Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 20, 2022

Confusion around ocean freight indexes limits their usefulness: shippers

A proliferation of ocean freight rate indexes in recent years is providing more confusion than clarity for capacity buyers, a signal that the tools may be more valuable as procurement guardrails than for assessing real-time rate movements.

A range of shippers have told JOC.com in recent weeks that they often don't understand what data goes into the publicly available spot rate indexes on the market, let alone how that data translates to the actual readings. That, in effect, has diluted the usefulness of the indexes to anything more than a broad indicator of which way the market is trending.

Although logistics managers have watched the movements of rate indexes for years, supply chain snarls and historically high ocean transportation costs during the COVID-19 pandemic have brought indexes into the market consciousness like never before. That means tools that have primarily been used by logistics procurement teams are now being scrutinized by executives.

What those executives sometimes fail to understand, shippers told JOC.com, is that each of the five major rate indexes offers a slightly different view of the market.

The Shanghai Containerized Freight Index (SCFI), for example, is based on spot rates provided by non-vessel-operating common carriers (NVOs) at origin in Asia. Drewry's World Container Index (WCI) and the Xeneta Shipping Index (XSI) are based on contract and spot rate data provided by shippers or forwarders as part of a benchmarking product. The data that goes into the Freightos Baltic Index (FBX) is derived from transactions made on the Freightos.com ocean freight booking marketplace. And the Container Market Data index from Platts, a sister company of JOC.com within S&P Global, is determined by gathering intelligence from capacity providers on all-inclusive rates on key trade lanes.

Although the producers of these rate indexes publish their methodology publicly, the actual calculations behind it remain their "secret sauce," a US importer who asked not to be identified told JOC.com. "I tell my execs that the direction of the index is more important than the actual number."

The idea that indexes can tell a shipper whether prices are rising or falling — and, in turn, whether vessel capacity is tightening or becoming more abundant — has been a common theme in conversations with logistics managers responsible for ocean freight procurement.

"From a macro perspective, indexes are helpful to identify directional trends in the market," a shipper that imports and exports vehicle products told JOC.com. "Spot market rates falling equals a softening in the market."

The shipper said she primarily uses data from Drewry and Freightos, partly to gauge the direction of the market and partly as a benchmark of how her company's ocean rates are performing relative to the market. The fact that the exact methodology of the indexes isn't clear doesn't negate their value as directional indicators, she added.

"This is essentially a 'pay no attention to that man behind the curtain' moment for me," the shipper said. "I have researched the source organizations and have confidence in the methodology. While I think the actual data collection and analysis and reporting details would be neat to know, it is not a deal breaker."

Although they all track ocean freight pricing, each of the five major rateindexes measures a different slice of the overall market.

Photo credit: Shutterstock.com

Dividing lines

Forwarders that spoke to JOC.com said rate indexes have limited value given their own direct knowledge of real-time rates in the market. That's exemplified by the fact that some forwarders, such as Shifl, have built their own indexes.

"When I see the rates in the indexes, I just don't see them applying to the business I'm doing," said the CEO of a mid-sized forwarder based in the US Midwest that handles both import and export shipments.

The forwarder, which is part of the World Cargo Alliance (WCA), a huge global network of NVOs, said the rates shared with her by other WCA members often bear little resemblance to what they see in indexes.

Forwarders at origin in Asia, for example, often offer spot rates that are below the current index readings and spot rates that forwarders based in destination markets such as the US can generally offer, she said. That pricing differential between the rate an export-focused forwarder in Asia can secure versus a destination-based forwarder is one of many dimensions that shippers must consider when comparing the relative value of the various indexes.

Other considerations include whether an index measures spot pricing, contract rates, or a mix of both; includes surcharges, such as loading premiums, terminal handling charges (THCs) or peak season surcharges (PSSs); and incorporates data from large-volume shippers, smaller or more transactional shippers, or both.

An index that is more oriented toward spot rates from smaller shippers, for example, would have trended far higher than average contract rates — and the other indexes — during fall 2021, at the peak of global shipping demand and port congestion. That same index will trend far lower today than contract rates and other indexes because of waning demand and capacity unlocked as port congestion unwinds and vessels get back on schedule. Indexes that mix contract and spot measure a balance between those sets of volumes but, as such, are potentially less comparable to both.

Publicly available index data also differs from data that's behind a paywall. Drewry and Xeneta clients, for example, can pay to get more granular data on their specific lanes, whereas those companies' public indexes provide a more general view of the market. Freightos offers free views of their various indexes dating back three months but requires a subscription to view historical data.

But mainstream reporting on ocean freight costs tend to focus on the broader, publicly available indexes, so those are the rates executives generally focus on in discussions with logistics managers about their own rates.

The vehicle products shipper said the increased prominence of rate indexes can make already difficult discussions with management about logistics costs even more strained.

"Executive management has access to numerous public indices, which leads to interesting discussions," the shipper said. The logistics team often must explain to leadership why the index rates don't match up with the rates on offer from carriers and forwarders, as well as the underlying relationship a shipper has with a carrier or forwarder that might result in rates that are above the market average.

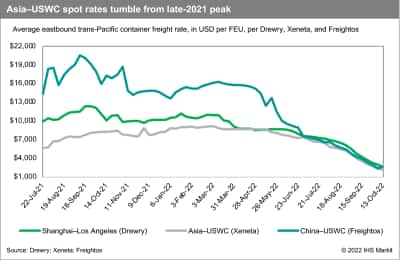

A comparison of peak readings for the various indexes bears out not only that they measure different parts of the market, but that they don't move in lockstep. The XSI's high point from Asia to the US West Coast over the last year came March 3 at $9,177 per FEU, while the WCI (which blends spot and contract rates) saw its high point coming nearly six months earlier on Sept. 23, 2021, at $12,424 per FEU. The FBX peaked two weeks earlier, at $20,586 per FEU on Sept. 9, 2021.

'Trends, not absolutes'

The question for logistics managers becomes whether those rates reflect what NVOs are quoting today, or the preferential spot carriers might be offering to shippers with existing contracts.

"The problem with freight indexes is that they do not compare real rates," Jon Monroe, a consultant to NVOs operating in the trans-Pacific trade, wrote in an Oct. 10 LinkedIn post. "Rates are so competitive right now, the best way to follow rates is to get on an NVO rate list. Why choose an index when you can get a real rate?"

Eytan Buchman, chief marketing officer at Freightos, told JOC.com the FBX is based on "solid, externally audited data sources and paired with transparent methodologies to give the absolute median price of the spot market, and not merely a directional indicator." But he acknowledged that indexes "rarely" reflect the actual rates a given shipper will pay.

"Many times, shippers will book as part of a bigger contract with volume commitments, with specific port pairs which differ from the average of the trade lane, or will require equipment other than the standard 40-foot dry container, and in all those cases, an adjustment will be required," Buchman explained. "Given market ranges and differences in buying power, a freight index will rarely provide the precise price that every shipper or forwarder will pay at any given moment. For these players, the directionality and magnitude of our index is key."

Of note, Freightos is the only rate index provider that also offers shippers the ability to get a quote and book an actual shipment directly on its platform. Drewry, Xeneta, the SCFI, and Platts, do not offer such capabilities.

This leads to another consideration: Are shippers better off merely surveying existing rate marketplaces or calling around to NVOs and carriers to get in-the-moment spot rates, as opposed to relying on indexes for real-time rate guidance?

Brian Nemeth, managing director at AlixPartners, a consulting firm that helps shippers with procurement strategy and annual ocean freight contracting, said that to understand actual rates at a particular moment, shippers are still better off surveying a group of ocean carriers or NVOs.

"For the real rate, the best way is word of mouth," Nemeth told JOC.com.

Nemeth said the indexes can help shippers understand how to leverage the pricing they receive against the market average.

"We'll say, 'You should be getting a percentage off the index based on your size," he said. "And we'll look historically to benchmark — for example, this shipper has always been at 80 to 85 percent of the Shanghai index the last five years."

Nemeth said the indexes are a valuable source of information, but the nature of the work he does means AlixPartners will always have data points that are more accurate and precise.

"I'll look at all of the indexes," he said. "But I Iook at them for trends, not absolutes. The more there are, the better it is. All this competition drives more attention and resources."

Subscribe now or sign up for a free trial to the Journal of Commerce and gain access to breaking industry news, in-depth analysis, and actionable data for container shipping and international supply chain professionals.

Sign-up to Maritime Trade & Supply Chain monthly newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fconfusion-around-ocean-freight-indexes-limits-their-usefulness.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fconfusion-around-ocean-freight-indexes-limits-their-usefulness.html&text=Confusion+around+ocean+freight+indexes+limits+their+usefulness%3a+shippers+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fconfusion-around-ocean-freight-indexes-limits-their-usefulness.html","enabled":true},{"name":"email","url":"?subject=Confusion around ocean freight indexes limits their usefulness: shippers | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fconfusion-around-ocean-freight-indexes-limits-their-usefulness.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Confusion+around+ocean+freight+indexes+limits+their+usefulness%3a+shippers+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fconfusion-around-ocean-freight-indexes-limits-their-usefulness.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}