Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Oct 18, 2022

Potential prolonged COVID-19 containment during the 20th National Congress of the Communist Party of China and slower-than-expected economic growth will continue to limit upside potential in the near-term

Freight Rate Forecast - Mainland China

Mainland China is pursuing COVID-19 outbreak control and a stable economic growth in the run-up to the 20th national congress of the Communist Party of China (CPC).

The once-in-a-five-years CPC national congress opened on October 16. The seventh plenary session convened in Beijing on October 9, which is set for the discussion of key topics in the coming national congress and lay the groundwork for CPC's roadmap for the next five years.

Mainland China's economy growth is projected to be way lower than the initial target of 5.5% set at the end of 2021. Our GDP forecast for mainland China has been periodically revised down throughout the year, with our forecast now expecting GDP for 2022 to achieve 3.3% and 4.5% in 2023. Although the stimulus measures from property market supported construction sector, the housing sector remains in deep recession, with sales, starts, and completions plummeting through August. Declining land sales are hurting local government finances according to S&P Global Economics and Country Risk team.

We may continue to see some support for rates in the near-term, especially Capesize freight rates that have rebounded from the low in August, however, our view has remained consistently bearish towards the end of 2022. The efforts to curb COVID-19 in mainland China have led to a drop in services activity in September and expected to limit the upside potential.

Mainland China's COVID-19 cases increased as people started travelling during the Golden Week holiday at the start of October, sparking fears of new lockdowns. Chinese newspaper People's Daily reported on October 10 that mainland China must stick with its 'zero-COVID' policy, pointing out that the policy is sustainable and lockdowns and centralized quarantines are necessary to protect people's life.

Looking ahead, concerns over potential new outbreaks of COVID-19 and related containment measures are the key for mainland China's economic recovery in the remainder of 2022 and early 2023. Also, declining global economy amid the Russia-Ukraine war and the disruption of downstream demand recovery from the pandemic weighed on the mainland China's economy and dry bulk freight market. Therefore, while seasonal demand will support rates for now, towards the end of the year it is likely we will see a softening in dry bulk freight rates.

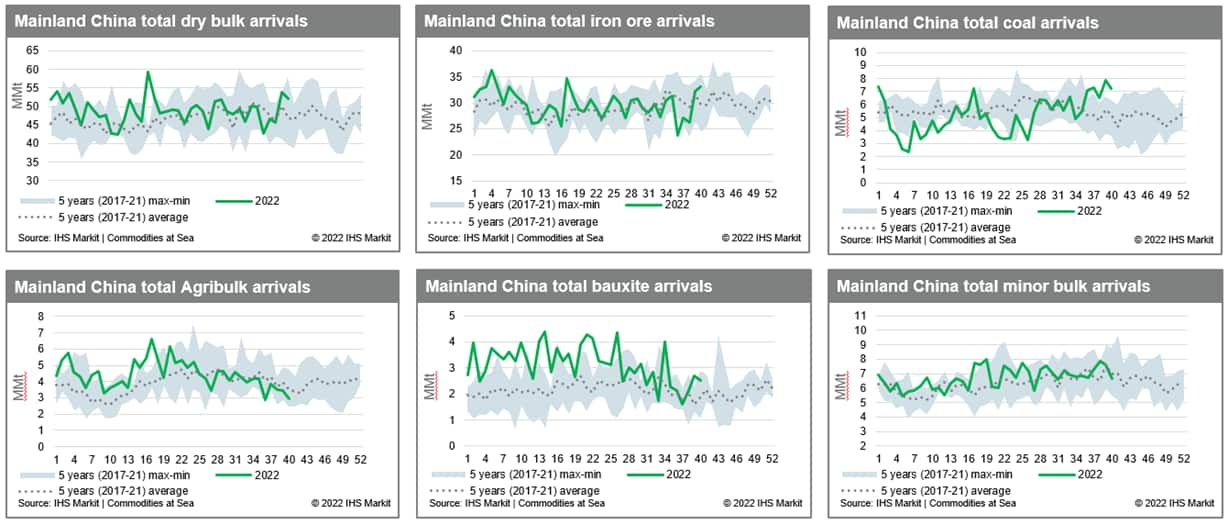

Mainland China's trade activity has softened in the first three quarters of 2022; models are bearish in the near-term as more downside risks are seen ahead

Mainland China's trading activity has softened in the first three quarters of 2022.

- According to S&P Global Commodities at Sea data, mainland China's total iron ore arrivals during January-September declined 2% year on year (y/y). Steel mills in Tangshan have been ordered to limit output to ensure blue sky during the congress, which means output cuts of around 50% is expected from October 14 (will be even earlier if pollution is heavy). Near-term iron ore demand will be under downside risk. During January-August, the sales area of commercial housing decreased 23% y/y, of which the residential sales area decreased 26.8% y/y, according to the National Bureau of Statistics of China. Downstream demand is still far from recovery.

- Apart from iron ore, this year so far a slowdown in coal imports has been seen compared with the same period last year. According to the S&P Global Commodities at Sea data, total seaborne coal discharges at mainland China during the first three quarters of the year stood at 172 million metric tons (MMt), down 20% y/y. Strong domestic output this year squeezed the demand from international market. Chinese domestic coal output reached 2,935 MMt in the first three quarters of this year, up 13.8% y/y.

- According to the S&P Global Commodities at Sea data, mainland China's total agricultural bulk seaborne arrivals in the first three quarters were down 13% y/y. Soybean seaborne arrivals to mainland China were down 6% y/y; arrivals from Brazil were down 3% y/y and arrivals and from the United States were down 14% y/y. The Russia-Ukraine war cut mainland China's major source for corn — Ukraine — to zero after March, where corn arrivals tumbled 28% y/y in the first three quarters.

- Bauxite arrivals to mainland China strengthened 18% y/y in the first three quarters with supply from domestic front tight, while domestic refineries' demand rose. Bauxite arrivals from mainland China's two major trade partners — Guinea and Australia — increased 18% y/y and 6% y/y, respectively.

- Nickel ore arrivals to mainland China during January-September fell 9% according to the S&P Global Commodities at Sea data. Arrivals from Philippines were down 14% y/y, while arrivals from Indonesia increased 16% y/y. Copper concentrate, which is highly correlated with urbanization of mainland China, has a increase of 7% from during January-September. Copper trade with Chile, the largest copper concentrate provider for mainland China, remained flat, but the second-largest provider, Peru, increased its supply to 15% y/y in the first three quarters of 2022.

The 20th CPC congress will be a key turning point for mainland China's economic growth as well as dry bulk demand. The decision to whether coexist with COVID-19 or switch to a new containment policy will determine the near-term — or even mid- and long-term — recovery of mainland China.

Construction, manufacturing, and service sectors are disrupted as a result of COVID-19 restrictions. The subdued demand recovery requires the return of investors and consumer's confidence. Currently, we assume strict containment measures will gradually soften in early next year, however, possibly persist over coming winter to maintain stability and security. Without significant change in the policy related with struggling property market and Zero Covid-19 policy in the congress, both of our weekly and monthly models hold bearish view for freight market.

In summary, although we expect some seasonal improvements in dry bulk market in the near-term, it is likely we will see a softening in dry bulk rates towards the end of the year and likely return to the level that we have seen in pre-pandemic period in the coming months in the absence of high congestion, softening container and dry backhaul rates, slower-than-expected economic growth with continued weakness in mainland China's real estate sector. However, gradual economic recovery in mainland China with inevitable change in mainland China's zero Covid policy towards more economic friendly containment measure may help to market to recover in the second half of 2023 and 2024.

Chart 1: Mainland Chinese total seaborne arrivals

For more insight subscribe to our complimentary commodity analytics newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpotential-prolonged-covid19-containment-during-the-20th-nation.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpotential-prolonged-covid19-containment-during-the-20th-nation.html&text=Potential+prolonged+COVID-19+containment+during+the+20th+National+Congress+of+the+Communist+Party+of+China+and+slower-than-expected+economic+growth+will+continue+to+limit+upside+potential+in+the+near-term+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpotential-prolonged-covid19-containment-during-the-20th-nation.html","enabled":true},{"name":"email","url":"?subject=Potential prolonged COVID-19 containment during the 20th National Congress of the Communist Party of China and slower-than-expected economic growth will continue to limit upside potential in the near-term | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpotential-prolonged-covid19-containment-during-the-20th-nation.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Potential+prolonged+COVID-19+containment+during+the+20th+National+Congress+of+the+Communist+Party+of+China+and+slower-than-expected+economic+growth+will+continue+to+limit+upside+potential+in+the+near-term+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fpotential-prolonged-covid19-containment-during-the-20th-nation.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}