Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 02, 2021

Banking risk monthly outlook: June 2021

Our banking risk experts provide insight into events impacting the financial sector in emerging markets in June.

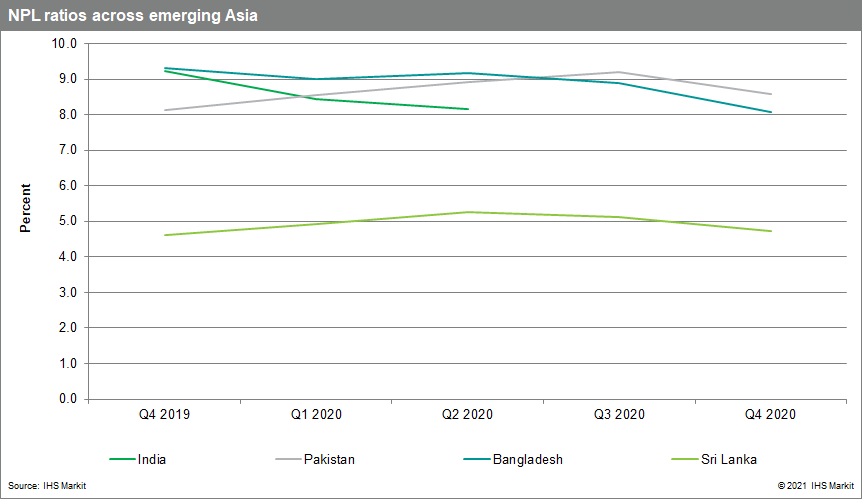

- The effects of renewed COVID-19 waves in South Asia on banks' asset quality

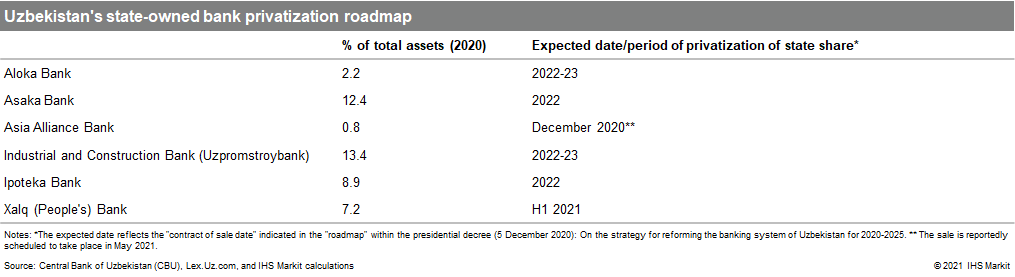

- Banking sector privatization developments in Uzbekistan

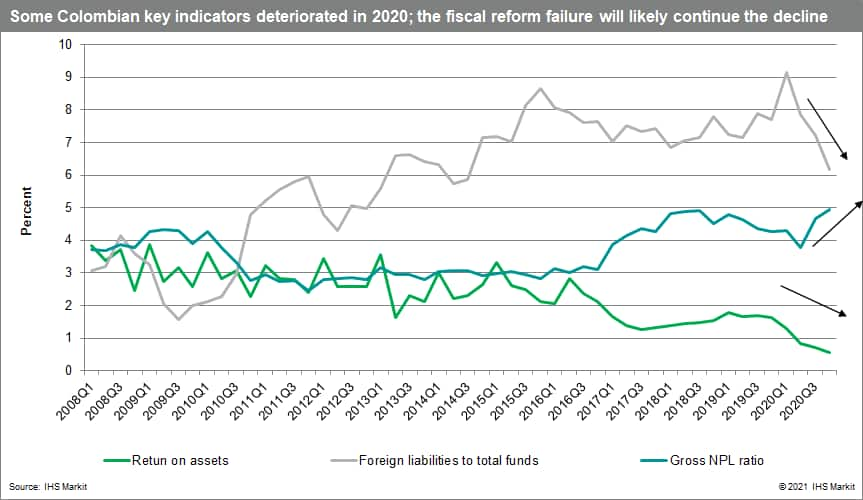

- Impact of Colombia's fiscal instability on banks' key indicators

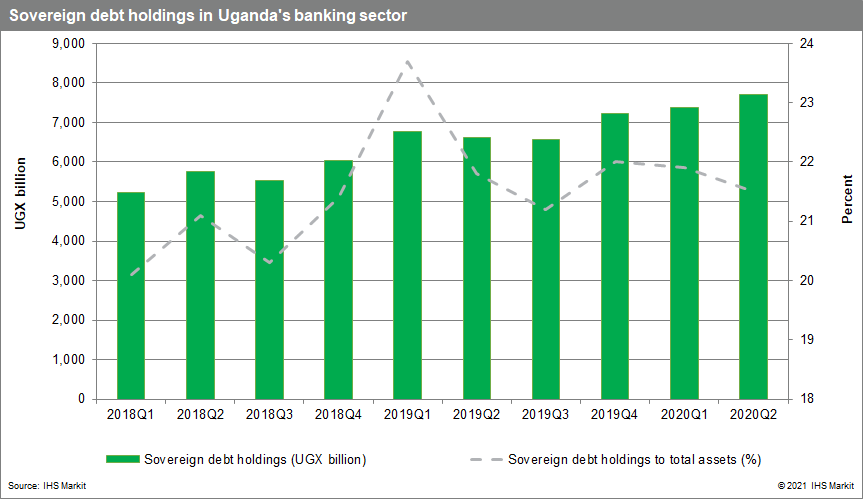

- Ugandan government's increased lending requirements and crowding-out effects on private-sector lending

Banks' asset quality amid renewed COVID-19 waves in South Asia. The new waves of COVID-19 in Bangladesh, India, Pakistan, and Sri Lanka will likely impact banks' asset quality because of regional and national lockdowns affecting borrowers' payment abilities. Some of these have ongoing loan-support schemes (moratoriums or restructuring schemes), but some are due to expire (Bangladesh and Sri Lanka) and the latest situation will push for more loan support and hide more bad loans.

Privatization developments in Uzbekistan's banking sector. Privatization developments have been limited since early 2020, likely as a result of the pandemic, with limited progress made on improving banking sector risk. This is reflected by the sector's weaker deposit reliance. Yet, it appears that state-owned bank sales plans are going ahead, as signaled in May when Uzbekistan's State Assets Agency invited interested parties to submit an application for a 100% stake in either Poytaxt Bank or Uzagroexportbank by end-June.

Colombia's fiscal instability impacting banks' key indicators. After large protests complaining about the tax reform bill in Colombia, the amendment was rejected by President Iván Duque. The derogation of fiscal reform in Colombia has multiple implications from a sovereign debt perspective, which IHS Markit is currently assessing at 40 (BBB- under the generic rating scale) over the medium term with a Negative outlook. This change is likely to affect the banking sector over the coming months, such as sudden changes in the sector's funding and even deleveraging if instability increases.

Ugandan government's increased lending requirements likely to further crowd out private-sector lending. In its last sitting, the Ugandan parliament passed a supplementary budget of UGX695 billion (USD196.7 million) to fund the supplementary budget expenditure. Some of these funds are likely to be sourced from the domestic market, which will likely overcrowd credit to the private sector at a time when banks in Uganda are tightening credit to the private sector ahead of a likely rise in impairments.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-june-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-june-2021.html&text=Banking+risk+monthly+outlook%3a+June+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-june-2021.html","enabled":true},{"name":"email","url":"?subject=Banking risk monthly outlook: June 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-june-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Banking+risk+monthly+outlook%3a+June+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fbanking-risk-monthly-outlook-june-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}