Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 23, 2014

Japan flash manufacturing PMI hits seven-month high in October

Japan's manufacturing sector is showing further signs of recovering after the hike in the country's sales tax caused the economy to weaken.

At 52.8 in October, up from 51.7 in September, the flash Markit/JMMA Japan Manufacturing PMI signalled the largest monthly improvement in business conditions since March.

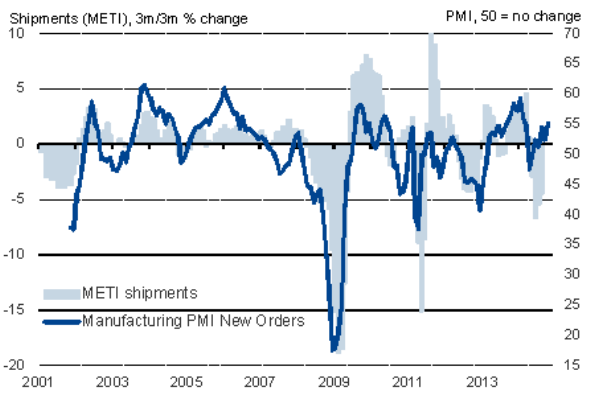

New orders to drive production upturn

Output growth was slightly weaker than in each of the prior two months, but inflows of new orders rose at the fastest rate since February, boding well for an acceleration in growth of production in coming months.

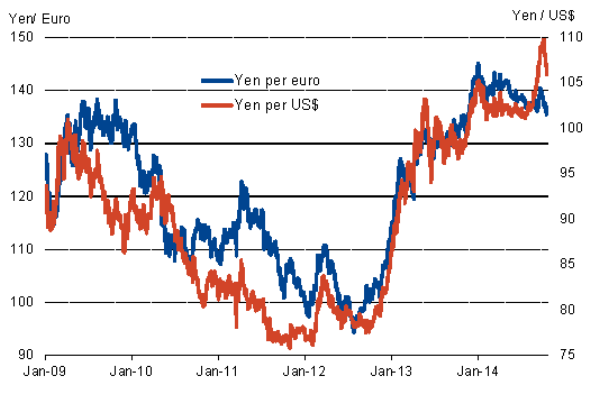

The upturn in new orders was driven by a combination of rising domestic demand as well as faster growth of exports. New export orders showed the second-largest rise since January. Exports have been buoyed in part by the yen remaining some 10% weaker than a year ago, despite appreciating slightly in recent weeks.

In a further sign that production will rise in coming months, the amount of inputs bought by manufacturers showed the biggest monthly increase since February. Supply chain delays were the worst since February as a result of the upturn in demand for inputs, highlighting how the sector has become busier in the face of rising demand.

The survey therefore provides some welcome news that growth of manufacturing output should start to improve after official data showed a 1.9% decline in August, leaving production 2.0% lower than a year ago.

The order book data suggest that manufacturing shipments should likewise pick up, after official data showed a 2.1% decline in August.

Goods exports

Order books

Recession avoided?

It remains uncertain, however, as to whether Japan avoided a slide back into recession in the third quarter. GDP fell 1.8% in the second quarter as demand slumped in response to a hike in the country's sales tax from 5% to 8%. PMI data point to a mere 0.3% rise in GDP in the third quarter, but the official data have so far come in somewhat weaker than the PMI in July and August. Manufacturing output, for example, is running 2.5% lower on average than in the second quarter. A second successive quarterly decline in GDP should not be ruled out.

More data will of course be required before any decision should be made as to whether the government should go ahead with a planned hike in the sales tax to 10% in October 2015, but the flash manufacturing PMI raises hopes that the underlying trend in the goods-producing sector is picking up.

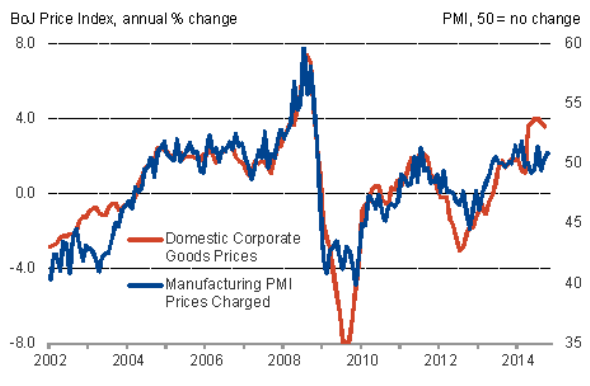

Prices rise at faster rate

The survey also brought good news on prices. A combination of the weakened yen and rising demand for raw materials meant manufacturers' input prices rose at the fastest rate since February. Factory gate, or selling, prices rose as a result, albeit only marginally. The rise in charges nevertheless adds further evidence to suggest that Japan is succeeding in beating deflation.

However, the rate of growth of output prices remains only very slight, and the strengthening of the yen against the US dollar and the euro in recent sessions suggests the currency could start to have less of a positive impact on both export growth and prices. The yen dropped over 5% against the US dollar in September but has since recouped almost half of that loss in October.

Corporate goods prices

Exchange rate

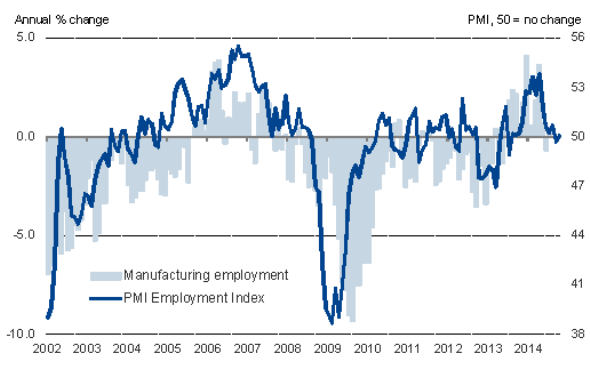

Employment stagnates

A key concern is that, despite the upturn in new orders, companies left their payroll numbers largely unchanged again in October. A strengthening labour market feeding through to higher wages is a pre-requisite for deflation to be truly beaten.

Manufacturing employment

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-economics-japan-flash-manufacturing-pmi-hits-seven-month-high-in-october.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-economics-japan-flash-manufacturing-pmi-hits-seven-month-high-in-october.html&text=Japan+flash+manufacturing+PMI+hits+seven-month+high+in+October","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-economics-japan-flash-manufacturing-pmi-hits-seven-month-high-in-october.html","enabled":true},{"name":"email","url":"?subject=Japan flash manufacturing PMI hits seven-month high in October&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-economics-japan-flash-manufacturing-pmi-hits-seven-month-high-in-october.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Japan+flash+manufacturing+PMI+hits+seven-month+high+in+October http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-economics-japan-flash-manufacturing-pmi-hits-seven-month-high-in-october.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}