Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Oct 23, 2014

German PMI suggests recession threat overplayed, but signs of slowdown evident

The flash PMI data for October allay fears that the German economy has slid back into recession. However, the data also highlight how growth may slow in coming months.

Third quarter rebound

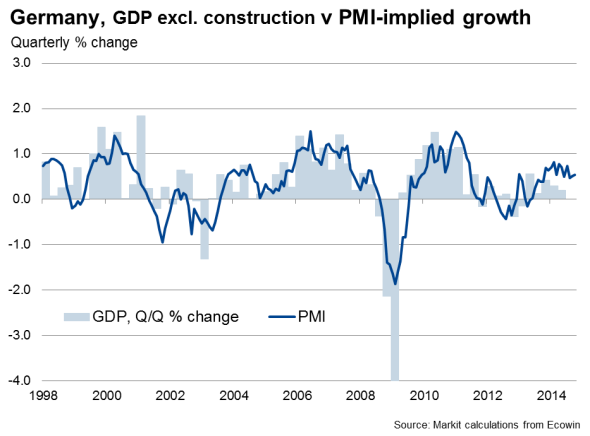

There's good reason to believe that the second quarter 0.2% decline in gross domestic product was caused by temporary factors, which in turn means some rebound should be evident in the third quarter. Strip out the volatile construction sector for example, the output of which jumped 4.1% in the first quarter before reversing that gain with a 4.2% decline in the second quarter, and the economy grew 0.2% in the second quarter. Bridging holidays and changes to school holidays are also thought to have contributed to a weakened economy in the second quarter (explored in more detail here).

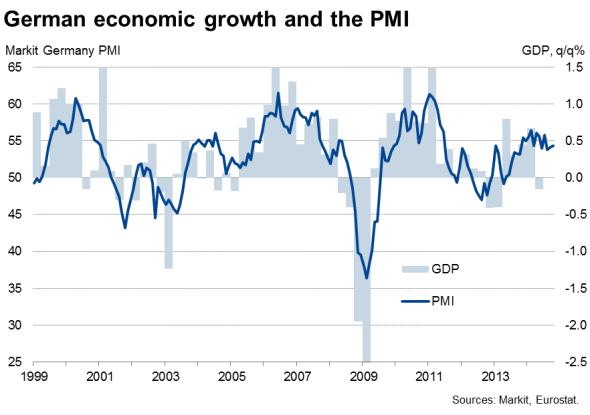

Viewed alongside robust PMI data, the distortions to the data earlier in the year mean we believe the economy to have been in better shape than the GDP data have signalled. The PMI has been pointing to GDP growth of 0.4-0.5% in the first two quarters of the year.

The sustained strength of the survey data in recent months also means we expect third quarter GDP to show growth of at least 0.3%. October's flash PMI data also suggest that this pace of expansion continued at the start of the fourth quarter. The PMI rose to a three-month high of 54.3, up from 54.1 in September but down slightly from the third quarter average of 54.5.

Slowdown imminent?

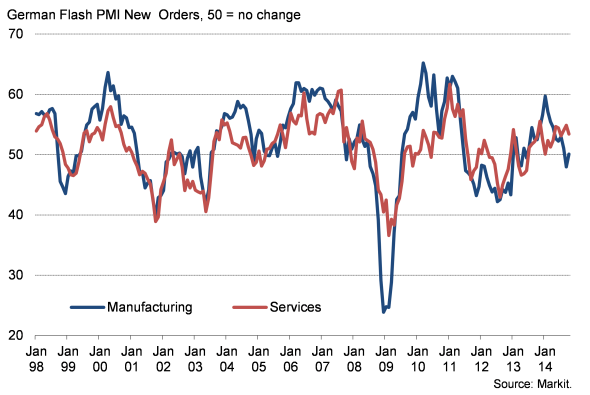

However, there are signs that the pace of growth could weaken in coming months, the most notable being an easing in the rate of growth of new orders signalled by October's flash PMI to the slowest for over a year.

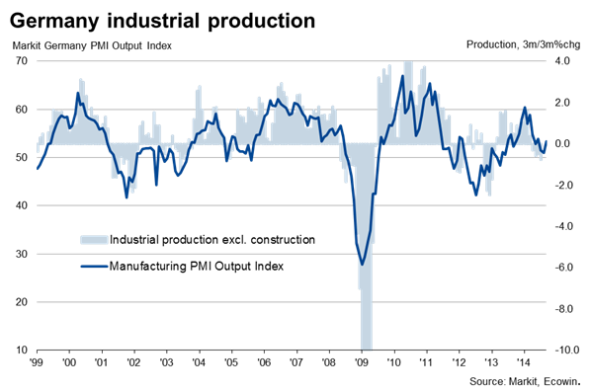

The recent pattern of growth is also worryingly uneven. Growth is being led by the services economy, according to the PMI, while manufacturing continues to struggle. The PMI survey showed manufacturing orders barely rising in October, though that was better than the decline seen in September. The survey's output index is broadly consistent with a near-stagnation of industrial production at the start of the fourth quarter.

Even in the service sector, where growth remained solid overall, the pace of expansion has eased. Business activity rose in October at the slowest rate since June, and expectations about the year ahead fell to their lowest since December 2012.

Multiple headwinds

It's easy to see why the German economy has slowed. Manufacturers in particular are facing several headwinds. First, trade is being hit by sanctions with Russia. Second, the Ukraine crisis is also causing unease and hitting business and consumer confidence in northern Europe especially. Third, slowing demand from China is weighing on demand for high quality investment goods, typical of the plant and machinery items that Germany specialises in. Fourth, lacklustre demand in neighbouring euro countries, especially to the south, remains a drag on growth.

Misleading rebound

While the PMI data therefore suggest that there is little chance of the economy contracting again in the third quarter, which would constitute a technical recession, the survey data suggest that any rebound in GDP should be treated with caution, as the underlying trend may in fact be one of a slowing economy.

PMI New Orders

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-German-PMI-suggests-recession-threat-overplayed-but-signs-of-slowdown-evident.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-German-PMI-suggests-recession-threat-overplayed-but-signs-of-slowdown-evident.html&text=German+PMI+suggests+recession+threat+overplayed%2c+but+signs+of+slowdown+evident","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-German-PMI-suggests-recession-threat-overplayed-but-signs-of-slowdown-evident.html","enabled":true},{"name":"email","url":"?subject=German PMI suggests recession threat overplayed, but signs of slowdown evident&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-German-PMI-suggests-recession-threat-overplayed-but-signs-of-slowdown-evident.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=German+PMI+suggests+recession+threat+overplayed%2c+but+signs+of+slowdown+evident http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23102014-Economics-German-PMI-suggests-recession-threat-overplayed-but-signs-of-slowdown-evident.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}