Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 23, 2014

PMI signals further waning of eurozone growth in September

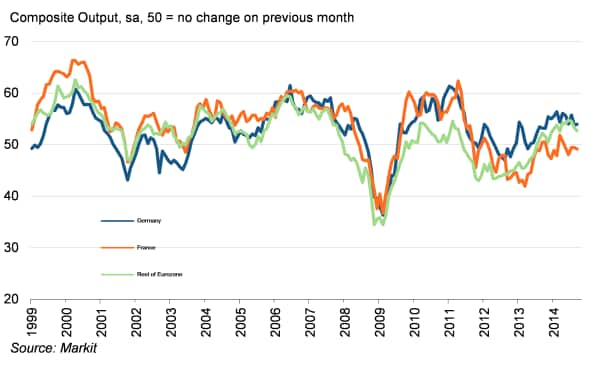

Euro area business activity grew in September at the lowest rate seen so far this year, according to the preliminary 'flash' PMI survey data.

At 52.3, down from 52.5 in August, the Markit Eurozone PMI" Composite Output Index fell for a second month running, dropping to its lowest since December of last year. At 52.9, the average quarterly reading for the three months to September was also the lowest so far this year.

Inflows of new orders rose only modestly, with the rate of increase waning for the third successive month to register the smallest monthly improvement since August of last year.

Employment was largely unchanged once again as companies held back from hiring extra staff due to the weak sales growth. Although payrolls have risen in each of the past six months, gains have been only marginal at best.

With backlogs of work falling in September at the steepest rate since July of last year, the survey suggests companies will continue to have little need to boost payroll numbers in October.

Inflationary pressures remained subdued in the face of weak demand. Companies' selling prices fell again, albeit only marginally, while input costs rose at the weakest rate since May.

By sector, growth of services activity slowed to a three-month low, while new business growth was the weakest since March. Employment in services barely rose as a result and prices charged fell slightly on average. Future expectations also nudged lower to the least optimistic since July of last year.

Manufacturing fared worse than the service sector with the headline PMI falling to 50.5, its lowest since July of last year and edging closer to the 50.0 mark that signals stagnation. Although factory output grew slightly, new orders fell for the first time since June of last year. Employment was unchanged and prices charged by factories fell for the first time since April.

By country, faster growth in Germany, led by the service sector, was offset by an ongoing downturn in France and slowing of growth elsewhere in the region.

Growth picked up slightly in Germany from the ten-month low seen in August, but a faster pace of expansion in the service sector was countered by growth grinding almost to a halt in factories. The manufacturing PMI for Germany signalling the weakest expansion since July of last year as new orders fell for the first time in over a year.

France meanwhile continued to contract, with the Composite Output Index down to a three-month low and signalling a fifth successive monthly decline. Service sector activity fell for the first time in three months but the manufacturing PMI, although still signalling decline, rose to a four-month high to suggest an easing in the rate of contraction.

A slight upturn in job creation in Germany contrasted with payrolls falling in France at the fastest rate since February.

Output growth outside of France and Germany slowed to a six-month low, with order inflows registering the weakest rise for ten months. Job creation almost stalled, down to the lowest since April, and prices charged continued to fall.

Commenting on the flash PMI data, Chris Williamson, Chief Economist at Markit said:

"The survey paints a picture of ongoing malaise in the eurozone economy. With growth of output and demand slowing, employment once again failed to show any meaningful increase. Such torpor meant prices continued to fall as firms fought for customers, which will inevitably heighten concerns that the region is facing deflation.

"For a central bank hoping the economic data flow will start to improve, the ECB will be disappointed by the ongoing weakness of the PMI. The survey data suggest GDP is on course to grow by 0.3% at best in the third quarter, buoyed by a 0.4% expansion in Germany but dragged down by stagnation in France and sluggish growth in the rest of the region.

"There are also worrying signs that growth could slow further in the fourth quarter. Inflows of new orders in the manufacturing sector are declining again, dropping for the first time in 15 months, and business expectations about the year ahead turned down in the services sector, led down by a slump in confidence in Germany.

"Concerns about the Ukraine crisis, related Russian sanctions and worries about the single currency area's general economic plight appear to be having an increased impact on the eurozone economy. The danger is that the ECB's efforts to stimulate the economy will prove ineffective in the face of such headwinds, which are exacerbating already-weak demand."

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092014-Economics-PMI-signals-further-waning-of-eurozone-growth-in-September.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092014-Economics-PMI-signals-further-waning-of-eurozone-growth-in-September.html&text=PMI+signals+further+waning+of+eurozone+growth+in+September","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092014-Economics-PMI-signals-further-waning-of-eurozone-growth-in-September.html","enabled":true},{"name":"email","url":"?subject=PMI signals further waning of eurozone growth in September&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092014-Economics-PMI-signals-further-waning-of-eurozone-growth-in-September.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=PMI+signals+further+waning+of+eurozone+growth+in+September http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092014-Economics-PMI-signals-further-waning-of-eurozone-growth-in-September.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}