Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Sep 23, 2014

China flash PMI signals steepening job losses amid near stagnation of activity

Another month of near stagnant business activity was reported at China's factories in September. Disappointingly weak growth of output and new orders caused firms to cut staff numbers at a faster rate than the prior month in an attempt to scale back capacity and cut costs. Prices meanwhile fell at an increased rate, in part due to more aggressive price discounting in the face of weak sales. More positively, export orders showed the largest monthly gain since early-2010.

Business activity continues to stagnate

The flash HSBC Manufacturing PMI, compiled by Markit, rose from 50.2 in August to 50.5 in September. With the index only marginally above the 50.0 no- change level, the survey pointed to another month of almost no growth of business activity in the goods-producing sector.

Output grew only modestly, expanding at a rate unchanged on August, reflecting another month of weak inflows of new orders. Although growth of new orders picked up slightly, largely driven by an upturn in foreign demand, the overall improvement in order inflows remained disappointingly weak as a result of lacklustre domestic demand.

Manufacturers consequently continued to focus on cost cutting, resulting in the largest monthly reduction in headcounts since February 2009, when employment was being slashed at the height of the financial crisis.

Manufacturing payrolls

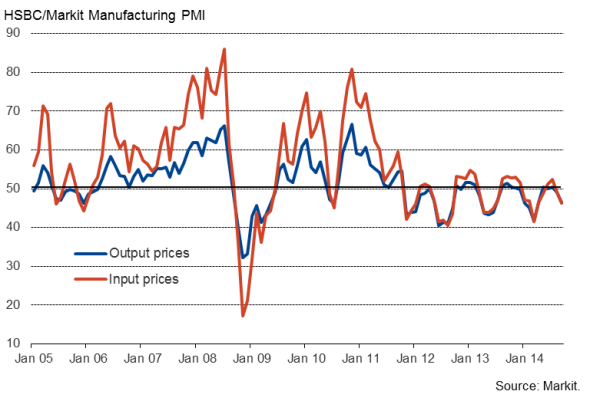

It's not just employment that's being cut: prices are also being reduced in an effort to boost flagging sales. Prices charged by factories for goods showed the steepest monthly fall since March.

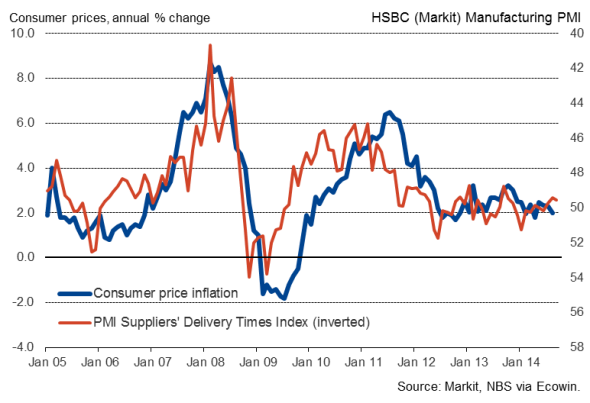

Consumer prices and capacity constraints

Input prices also fell, likewise dropping at the fastest rate since March, alleviating some of the squeeze on manufacturers' profit margins. Lower input prices were primarily linked to suppliers competing on price to win sales. Suppliers' delivery times - a key gauge of inflationary pressures in the supply chain - showed barely any change in September.

Factory prices

Weak price pressures, sluggish growth add to calls for more stimulus

The survey results therefore suggest that consumer price inflation, already down to 2.0% in August from 2.3% in July, may well fall further in coming months.

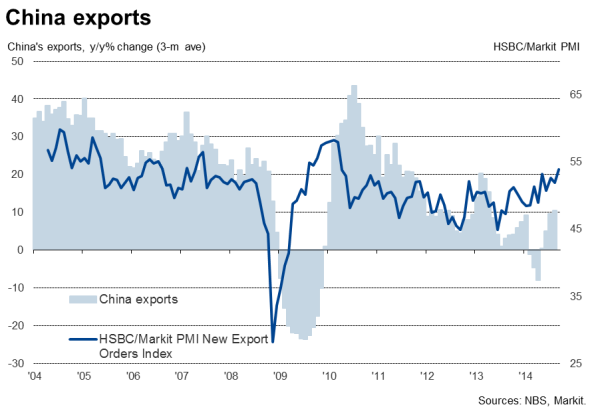

However, the survey brings slightly better news in respect of exports, suggesting that the steep improvement in export growth signalled by the official data in recent months (a 10.2% annual increase on average in the three months to August - the largest increase for over a year) has continued into September.

The survey also suggests that growth of industrial production should pick up after the surprise weakening to an annual pace of just 6.9% in August.

The underlying sluggish pace of factory output growth and lacklustre domestic demand signalled by the survey, as well as the worrying downward trend in employment, will nevertheless continue to put pressure on the authorities to do more to boost economic growth and meet the government's 7.5% growth target for the year.

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092014-Economics-China-flash-PMI-signals-steepening-job-losses-amid-near-stagnation-of-activity.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092014-Economics-China-flash-PMI-signals-steepening-job-losses-amid-near-stagnation-of-activity.html&text=China+flash+PMI+signals+steepening+job+losses+amid+near+stagnation+of+activity","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092014-Economics-China-flash-PMI-signals-steepening-job-losses-amid-near-stagnation-of-activity.html","enabled":true},{"name":"email","url":"?subject=China flash PMI signals steepening job losses amid near stagnation of activity&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092014-Economics-China-flash-PMI-signals-steepening-job-losses-amid-near-stagnation-of-activity.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=China+flash+PMI+signals+steepening+job+losses+amid+near+stagnation+of+activity http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f23092014-Economics-China-flash-PMI-signals-steepening-job-losses-amid-near-stagnation-of-activity.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}