Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Apr 13, 2017

Week Ahead Economic Overview

Flash PMI data for the US, the eurozone and Japan will provide early insights into the health of global economies at the start of the second quarter. Other key data highlights include China's GDP for Q1, UK retail sales as well as euro area inflation.

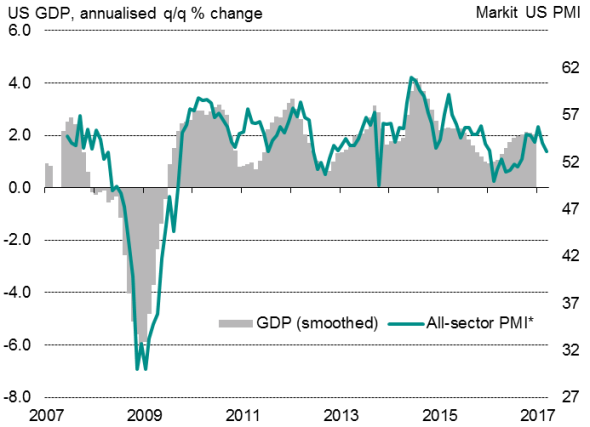

With March PMI data adding to the picture of a slowdown in US GDP growth from the 2.1% seen at the end of last year, focus now shifts to economic trends at the start of the second quarter. Alongside flash PMI results for April, data on the housing market and initial claims will provide analysts with clues as to the direction of growth and future monetary policy.

Markit US PMI and smoothed GDP

Sources: IHS Markit, Commerce Department

The eurozone economy gained momentum at the end of the first quarter, with March PMI data signalling a broad-based upturn among the euro's largest members, accompanied by the highest jobs growth for nearly a decade. The strong start to the year has raised expectations for the ECB to turn increasingly hawkish if the trend continues, although ECB president Mario Draghi is wary of the longevity of recent inflationary pressures, highlighting the need for further evidence to show that higher prices are sustainable. PMI data have already moved into territory that is historically consistent with a tightening bias at the ECB, thus increasing the focus on the release of flash PMI data for April.

China's GDP figures for the first quarter are released next week, where expectations are for an annual GDP growth rate of 6.8%, unchanged from Q4 2016. Recent PMI data showed that expansion in the three months to March was the second-fastest in four years and a significant improvement on the same period the year before, highlighting how China's economy has picked up momentum. Analysts will look to data on investment, retail sales and industrial production for signs of the key growth drivers.

China Composite PMI and GDP

Sources: IHS Markit, Caixin, NBS

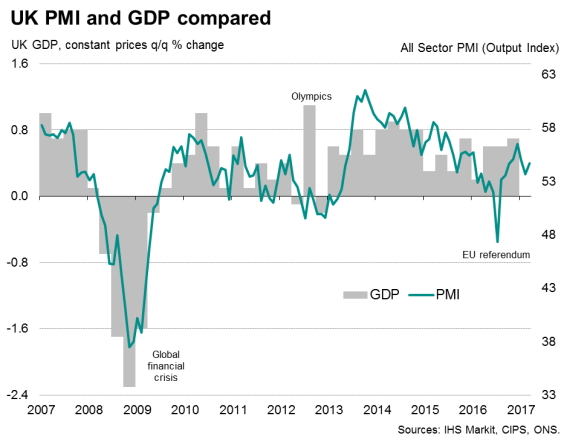

UK inflation surpassed the Bank of England's 2.0% target for the second month running in March and real wages grew at the slowest since 2014, underlying how consumer spending is being squeezed by higher prices. While the policymakers at the Bank of England may still look through the upturn in inflation and underlying wage trends, much will depend on the extent to which consumer spending will be dampened in 2017. Traders' focus will be on retail sales and the Markit HFI to gauge the health of household spending, which has provided the main engine of growth to the UK economy in recent years.

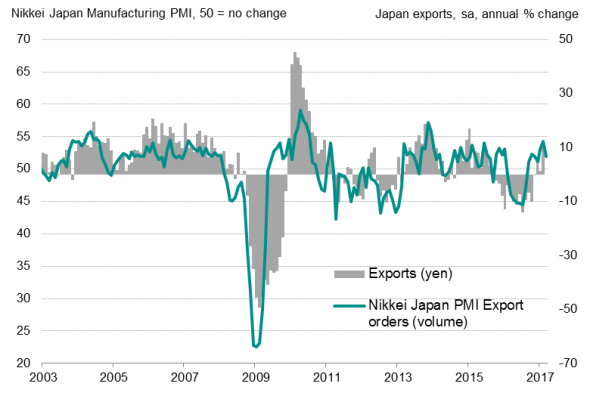

Japan's trade balance figures are updated and will be scoured for signs of export strength, as too will the flash PMI results for April. The latter offers an early insight to the performance of the economy at the start of the second quarter. Recent data indicated that the Japanese economy shifted to a higher gear in the first quarter, driven not only by an expanding manufacturing sector but also faster service sector growth.

Bank Indonesia will meet to set its latest key reverse repo rate, which currently stands at 4.75%. Forecasters are anticipating no change. Recent data showed an improvement in the manufacturing sector in the opening quarter of 2017 compared to Q4 last year, though strong input price increases point to the build-up of inflationary pressures.

Japan exports

Sources: IHS Markit, Nikkei, Japan Ministry of Finance

Bernard Aw, Principal Economist, IHS Markit

Tel: +65 6922 4226

Bernard.Aw@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042017-Economics-Week-Ahead-Economic-Overview.html&text=Week+Ahead+Economic+Overview","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Overview&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042017-Economics-Week-Ahead-Economic-Overview.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Overview http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f13042017-Economics-Week-Ahead-Economic-Overview.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}