Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 01, 2014

Italian manufacturing in renewed downturn

Italian manufacturing output continued to contract in November, adding to the likelihood of the sector acting as a drag on the wider economy in the final quarter of 2014 and extending the country's recession.

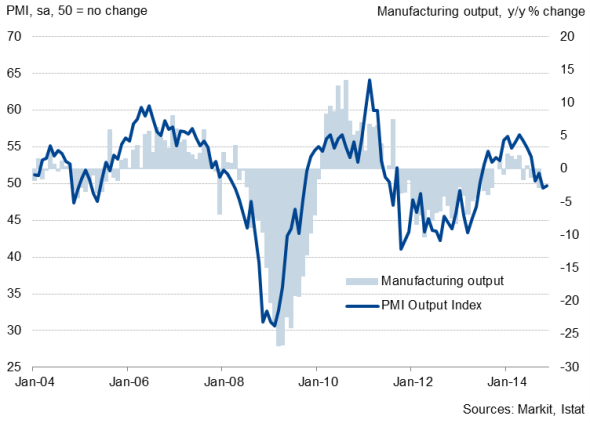

The latest Markit PMI" data showed factory output falling for the second straight month in November. Although the rate of contraction remained only modest, easing slightly on October, the sustained downturn nevertheless represents a marked turnaround from the strong performance seen in early 2014, when output growth reached the fastest for three years.

PMI data so far suggest that the manufacturing sector will weigh on final quarter gross domestic product. GDP fell slightly in both the second and third quarters, pushing the country back into recession. However, factories account for only a small proportion to total economic activity, and the picture will be made clearer by the release of latest PMI data for the vast service sector on 3 December.

Domestic weakness

The latest official numbers from Istat showed that manufacturing output fell 1.1% in September, and PMI data suggest this weak trend is set to continue through the final quarter of the year. Manufacturers reported that new orders fell in both October and November, and at notable rates. New export orders continued to grow, suggesting the domestic market is the main area of weakness.

Manufacturing output

Manufacturing employment falling

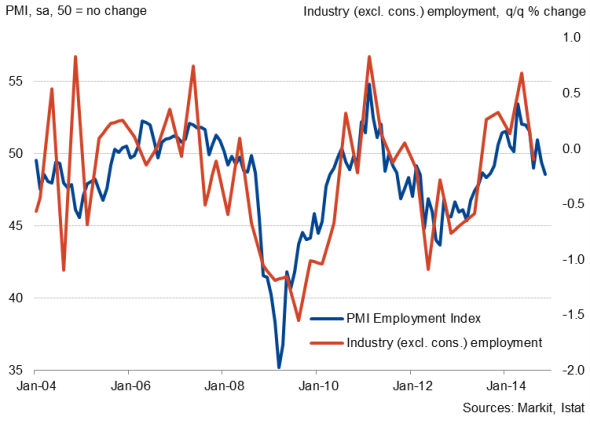

One of the key factors depressing domestic demand remains the high rate of unemployment, which ticked up again in October to a record high of 13.2%. With further job losses being reported at factories in the PMI survey responses in November, the unemployment rate looks set to remain worryingly high in coming months and could even increase again. November's fall in manufacturing employment was the sharpest since September of last year.

This renewed decline in employment at Italian factories represents another setback to the country's recovery, following growth in payrolls at the start of the year. Job creation peaked in April at the fastest for more than three years.

Last week's official numbers showed industry (excluding construction) employment fall to 4.571 million in the third quarter (from a revised 4.576 million in Q2), confirming the easing highlighted in advance by PMI data (see chart). The job losses shown by the survey data so far in the final quarter suggest that manufacturing employment may have peaked in Q2.

Factory employment

Some respite from low cost pressures

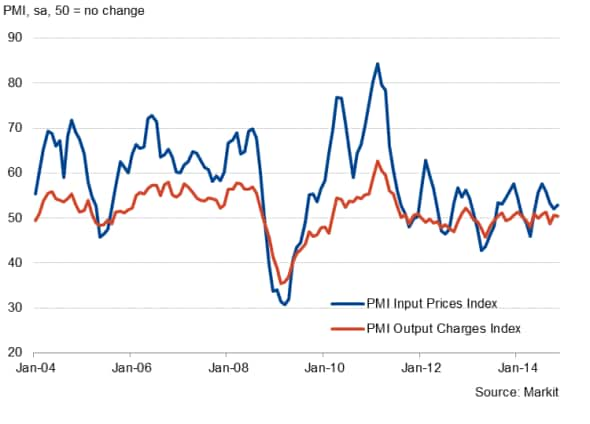

Manufacturers are cutting spare staffing capacity in order to limit the erosion of profitability. The situation therefore could have been much worse if it weren't for input cost pressures running at historically low levels. The survey's input prices index (charted) indicated only modest increases in average purchase prices faced by goods producers in the first two months of the final quarter, in some cases linked to the euro's depreciation.

If, therefore, the euro starts to hold its value - as has been the case in recent weeks - and oil and commodities prices continue to slide on world markets, we may see input costs even fall at manufacturers in months to come. As well as relieving some of the pressure on businesses to make further job cuts, this also leaves more room to manoeuvre in output price setting.

Input prices vs. charges

Phil Smith | Economist, Markit

Tel: +44 149 1461009

phil.smith@markit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122014-economics-italian-manufacturing-in-renewed-downturn.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122014-economics-italian-manufacturing-in-renewed-downturn.html&text=Italian+manufacturing+in+renewed+downturn","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122014-economics-italian-manufacturing-in-renewed-downturn.html","enabled":true},{"name":"email","url":"?subject=Italian manufacturing in renewed downturn&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122014-economics-italian-manufacturing-in-renewed-downturn.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Italian+manufacturing+in+renewed+downturn http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122014-economics-italian-manufacturing-in-renewed-downturn.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}