Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Dec 01, 2014

Global factories report slowest pace of expansion for 14 months

Global manufacturing grew at the slowest rate for 14 months in November, according to PMI survey data. The JPMorgan Global Manufacturing PMI", compiled by Markit from national surveys, edged down from 52.2 in October to 51.8, its lowest reading since September of last year.

Although the PMI remains above 50, thereby signalling expansion in the goods-producing sector, the average reading for the fourth quarter so far is the lowest since the third quarter of last year to indicate a waning in the rate of expansion. The survey data are running at a level consistent with worldwide factory output growing at an annual rate of approximately 3%, down from 4.5% at the start of the year.

The forward-looking new orders to inventory ratio fell to its lowest since December 2012, suggesting production growth is likely to weaken further in December.

Global factory output

Sources: Markit, JPMorgan, HSBC, Ecowin.

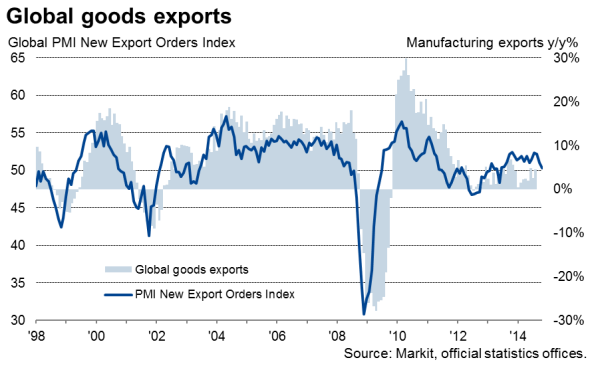

Stalling of global trade flows

The overall global weakness of manufacturing was driven by a near-stalling of global export growth, which showed only a marginal increase in November and the weakest in 17 months. Overall order book growth consequently fell to the slowest since July of last year.

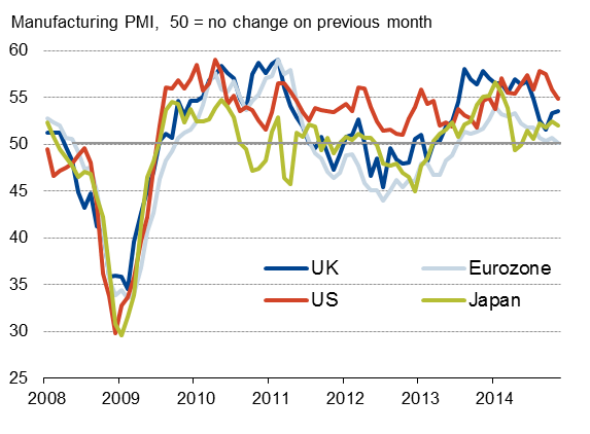

The weakness of global manufacturing primarily reflected stagnating factory activity in both the eurozone and China, while growth slowed in the US, which has been a key driver of global expansion.

Solid growth was again seen in the UK, little-changed on October, and Japan again saw modest growth of factory activity, continuing to revive from the downturn earlier in the year.

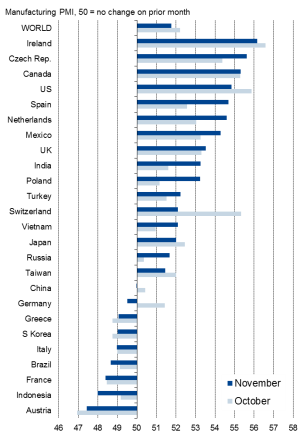

Countries ranked by manufacturing PMI"

Ireland remains top ranked manufacturer

Although the eurozone as a whole stagnated, disparate growth rates were again seen within the single-currency area. Ireland led the global manufacturing rankings for the second month running while Austria remained at the foot of the table. With Spain and the Netherlands also reporting strong expansions, three of the top six ranked countries were euro members. However, with France again contracting sharply, two of the bottom three performers were also eurozone nations.

US "decoupling' in doubt

North America continued to provide a major boost to global manufacturing, with Canada and the US in third and fourth places respectively in the ranking. However, with the US seeing the weakest expansion since January, linked largely to a renewed fall in export orders, the surveys raise a question mark over the extent to which the US may have "decoupled' from the global economy, appearing to remain vulnerable to weak demand in key markets such as Europe and the emerging markets.

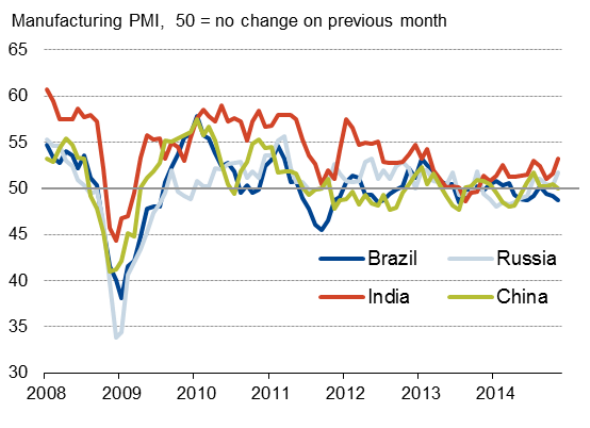

Emerging market malaise continues

A fall in the HSBC/Markit China PMI to the no-change level of 50.0, its lowest for six months, was not the only source of emerging market disappointment in November.

South Korea contracted for the sixth time in the past seven months, and growth slowed to the weakest in 15 months in Taiwan. Contraction was meanwhile seen in Indonesia for a third time in the past four months.

In Brazil, factories reported the steepest downturn since June, the sector having moved into reverse after briefly returning to expansion in August.

More positive signs were seen in India and Russia, with the PMIs hitting 21- and 13-month highs respectively.

Developed world PMI surveys

Emerging market PMI surveys

Chris Williamson | Chief Business Economist, IHS Markit

Tel: +44 20 7260 2329

chris.williamson@ihsmarkit.com

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122014-Economics-Global-factories-report-slowest-pace-of-expansion-for-14-months.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122014-Economics-Global-factories-report-slowest-pace-of-expansion-for-14-months.html&text=Global+factories+report+slowest+pace+of+expansion+for+14+months","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122014-Economics-Global-factories-report-slowest-pace-of-expansion-for-14-months.html","enabled":true},{"name":"email","url":"?subject=Global factories report slowest pace of expansion for 14 months&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122014-Economics-Global-factories-report-slowest-pace-of-expansion-for-14-months.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Global+factories+report+slowest+pace+of+expansion+for+14+months http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2f01122014-Economics-Global-factories-report-slowest-pace-of-expansion-for-14-months.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}