Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 25, 2020

Coronavirus (COVID-19) has triggered a heretofore unimaginable oil product demand decline

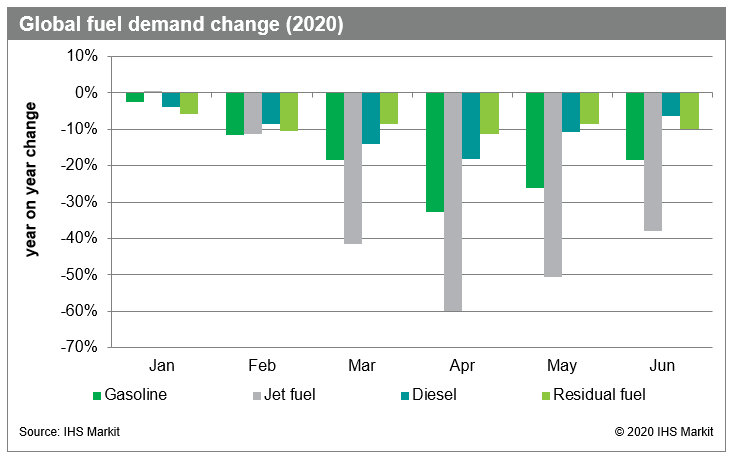

The term "unprecedented" has been utilized more than a few times during the past month. And while usage of this word is often hyperbolic, it is wholly deserved in the context of COVID-19's impact on the global oil sector. The extreme lockdown measures enacted by the world's largest oil product markets, coupled with voluntary "social distancing" and other secondary effects, have caused a heretofore unimaginable degree of demand destruction. IHS Markit is predicting that global March gasoline consumption is down 18% versus the year before and demand next month will decline a staggering 33% year on year. The impact on jet fuel demand is even more severe, falling 42% this month and 60% next month (again, year on year basis). Demand for diesel and residual fuel will hold up better but are still expected to experience double digit declines.

Figure 1: Global fuel demand change (2020)

It is not an exaggeration to say that demand declines of this scale have never occurred before. Nor would any reasonable industry watcher have expected them to occur for any reason short of the outbreak of World War III.

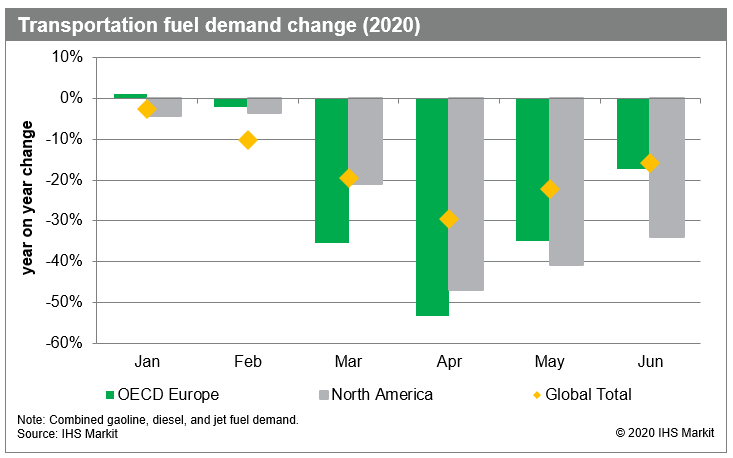

And while the impact on oil product consumption is decidedly global in nature, the demand destruction will be most severe in Europe and North America. These markets are now the epicenters of the global pandemic, with COVID-19 cases still rising exponentially. In response, respective governments have instituted harsh lockdown measures that have strangled commerce, mobility, and - by extension - oil product demand. Some of the leading indicators are truly remarkable. Most airlines are culling their flight schedule by upwards of 50%, with most European airlines cancelling better than 90% of their flights. And speaking of Europe, commuter vehicle traffic in heavily affected cities like Milan, Paris, and Madrid has fallen as much as 80% after lockdown measures took effect. Meanwhile, vehicle mileage in the US is "only" expected to contract by 55%.

Figure 2: Transportation fuel demand change (2020)

Given that this demand shock - and the timing of the eventual recovery - is entirely dependent on the progression of the COVID-19 pandemic, outlooks beyond the next couple of months are far more uncertain than usual. For now, IHS Markit's forecasts assume the outbreak is largely brought to heel by the end of the summer, though the economic impacts of the pandemic - not to mention continued voluntary social distancing - will linger for some time, with a corresponding effect on oil product demand.

Understand changing dynamics in the oil refining and marketing value chain around the world with IHS Markit energy refining and marketing outlooks, data and analysis: Learn more.

Rob Smith is a Director in IHS Markit's Refining and Marketing group.

Posted 25 March 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcoronavirus-covid19-has-triggered-a-heretofore-unimaginable.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcoronavirus-covid19-has-triggered-a-heretofore-unimaginable.html&text=Coronavirus+(COVID-19)+has+triggered+a+heretofore+unimaginable+oil+product+demand+decline+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcoronavirus-covid19-has-triggered-a-heretofore-unimaginable.html","enabled":true},{"name":"email","url":"?subject=Coronavirus (COVID-19) has triggered a heretofore unimaginable oil product demand decline | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcoronavirus-covid19-has-triggered-a-heretofore-unimaginable.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Coronavirus+(COVID-19)+has+triggered+a+heretofore+unimaginable+oil+product+demand+decline+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fcoronavirus-covid19-has-triggered-a-heretofore-unimaginable.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}