Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 26, 2020

Renewables emerge as winner during China’s COVID-19 lockdown

The first nation to implement a COVID-19 lockdown, China, has experienced an unprecedented power demand drop during the first two months of the year as a result of the stagnation of industrial and commercial activities. Amidst this demand squeeze, renewables have emerged as a winner in the increasing competition among different power generation resources.

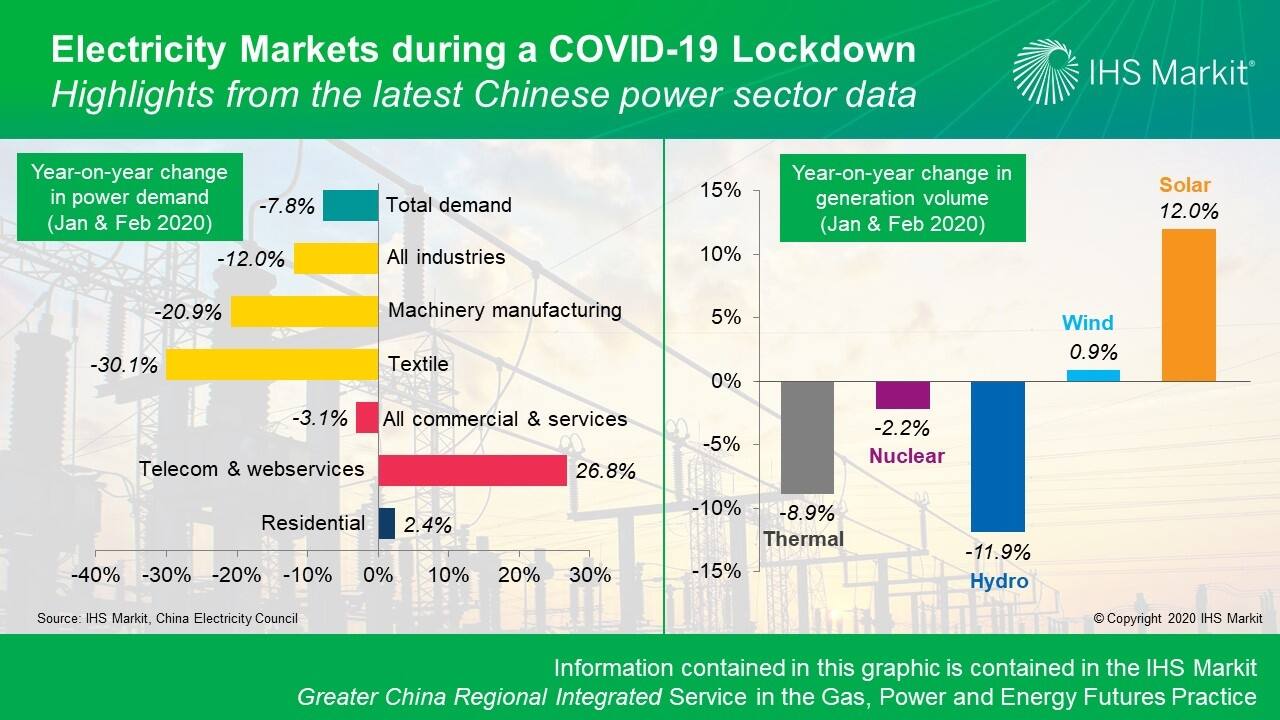

Electricity consumption declined 7.8% year on year during January and February, a sharper drop even compared to the 2008-09 Great Recession.

The industrial sector which accounts for two thirds of China's electricity consumption led the demand drop, recording a 12% decrease in power consumption. This is especially evident in sectors that are labor intensive as workers remained homebound for weeks; the textiles industry, for example, registered a 30% drop in electricity usage during the first two months.

The commercial and service sectors saw demand decrease by 3.1% during the first two months of the year. What's notable here is that while hotels and restaurants shuttered, home isolation policies drove an increase in technology usage - mobile applications, Internet TV - that led electricity demand from the telecom and webservice sector to increase by 27%, a similar trend that may repeat in other countries as lockdown policies expand globally.

Similarly, as people stayed home during this period, residential electricity demand also increased by 2.4%.

As China returns to work, IHS Markit expects demand growth to return to positive rest of the year, but as rest of the world head into recession, China will also be impacted negatively. As a result, we expect the Chinese economy to grow 3.9% (compared with our pre-COVID-19 outlook of 5.4%), leading to power demand to increase by only 2.8%; this compares with an average annual growth of 7% during the past decade.

On the power supply side, the lower demand is creating more competition among the different generation resources in the country. One notable difference in China's power system between the Great Recession in 2009 and the current COVID-19 downturn is the share of renewables; solar and wind accounted for less than 2% of China's power fleet a decade ago, but now they represent more than 20% of installed capacity.

Renewables have remained very resilient during the first two months of national lockdown and the power demand squeeze. While thermal power generation dropped 9% year-on-year in January and February, wind generation increased by 1% and solar generation increased by 12%.

Figure 1: Electricity Markets During a Coronavirus (COVID-19)

Lockdown

Renewables' non-dispatchability and preferential status in China's power system are allowing them to grow while power demand declined during the COVID-19 lockdown. We believe this trend will continue.

Learn more about our coverage of the Greater China energy market through our Greater China Gas, Power, and Energy Futures service.

Xizhou Zhou is a vice president at IHS Markit and leads the company's power and renewables practice globally.

Posted 26 March 2020.

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frenewables-emerge-as-winner-during-chinas-covid19-lockdown.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frenewables-emerge-as-winner-during-chinas-covid19-lockdown.html&text=Renewables+emerge+as+winner+during+China%e2%80%99s+COVID-19+lockdown+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frenewables-emerge-as-winner-during-chinas-covid19-lockdown.html","enabled":true},{"name":"email","url":"?subject=Renewables emerge as winner during China’s COVID-19 lockdown | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frenewables-emerge-as-winner-during-chinas-covid19-lockdown.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Renewables+emerge+as+winner+during+China%e2%80%99s+COVID-19+lockdown+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2frenewables-emerge-as-winner-during-chinas-covid19-lockdown.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}