Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 20, 2020

What is the outlook for the Chinese oil sector with COVID-19 on the wane domestically?

While COVID-19 continues to spread throughout the world, the number of active infections within China has been declining since mid-February. In fact, yesterday marked the first day since the outbreak began that China reported no new locally transmitted infections. As a result, the Chinese government has in recent weeks removed most restrictions on internal travel and is pushing for the resumption of "normal" economic activities.

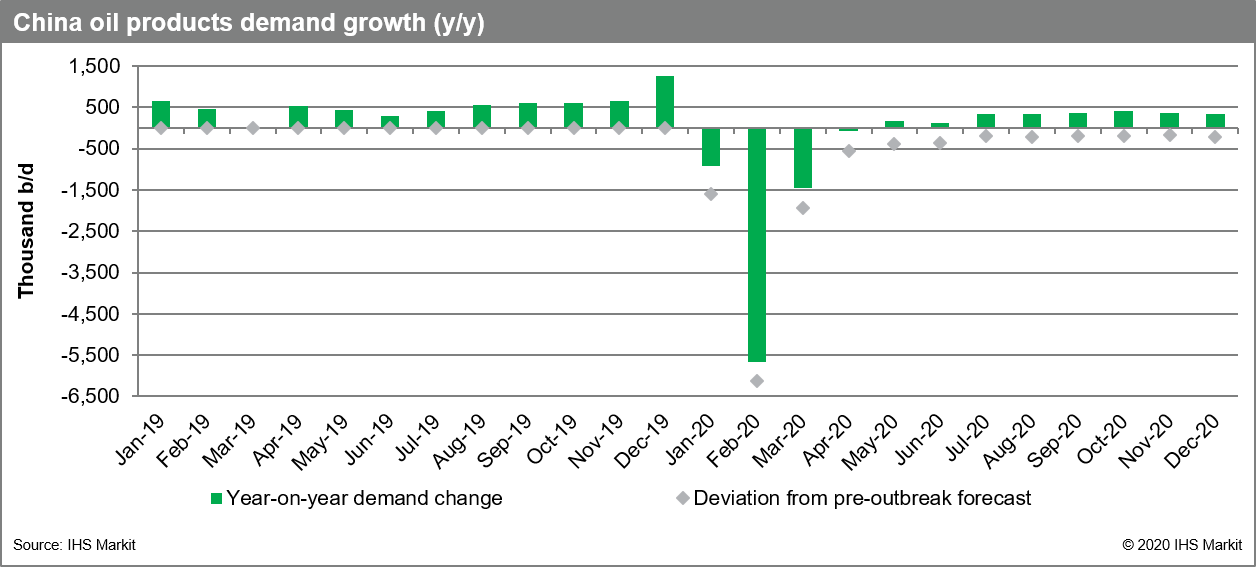

Consequently, while oil demand outside of China is still in the midst of an unprecedented decline, consumption within the country is now firmly on the upswing. Fuel sales by Chinese retail stations, for example, have recovered to more than 80% of their pre-outbreak level. However, as the Chinese saying goes, "the last leg of a journey merely marks the halfway point" and COVID-19 will continue to cast a shadow on the country's economy and consumer behavior. Most notably, cratering demand outside of China and the resultant slowdown in global GDP will certainly dent China's oil demand. Specifically, while IHS Markit expects Chinese demand will return to growth in the second half of this year, the scope of that growth is 200,000 b/d lower than our pre-outbreak forecast.

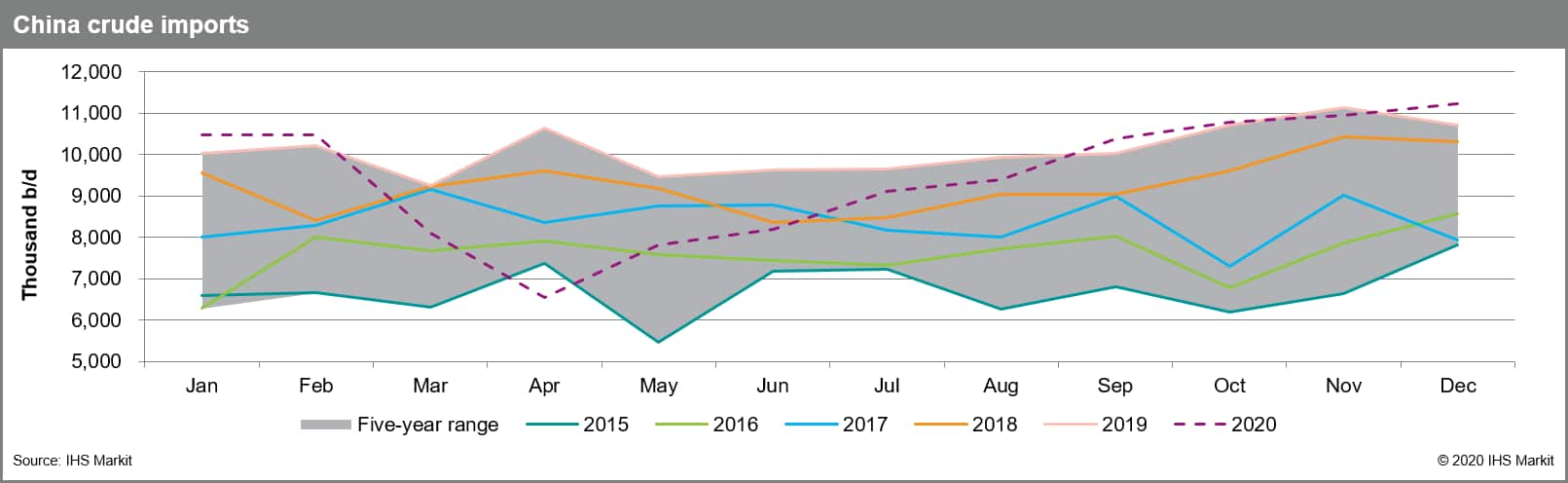

The global demand slowdown - and delayed effects from the 5.6 million b/d product demand drop within China last month - will have a major short-term impact on Chinese refiners. Domestic product storage tanks are already running close to full after a hefty build last month and export opportunities will obviously be limited. As such, even as domestic product demand rebounds, IHS Markit expects Chinese crude runs to average about 2.0 million b/d below last year during March and April. Chinese crude imports, meanwhile, will decline significantly from the typical 10+ million b/d level next month, even though oil prices are now well under $30 per barrel.

However, China has, unlike most countries, definitively passed the nadir of the COVID-19 pandemic. Crude runs and product demand have already begun to increase from their February low, while crude arrivals are expected to ramp up quickly after April. This is obviously welcome news for a global oil industry reeling from the recent price collapse, though China is just one piece of the puzzle. The world is still facing an unprecedented oil supply imbalance, the worst impacts of which are yet to come.

Understand changing dynamics in the oil refining and marketing value chain around the world with IHS Markit energy refining and marketing outlooks, data and analysis: Learn more

This article was published by S&P Global Commodity Insights and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhat-is-the-outlook-for-the-chinese-oil-sector-with-covid19.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhat-is-the-outlook-for-the-chinese-oil-sector-with-covid19.html&text=What+is+the+outlook+for+the+Chinese+oil+sector+with+COVID-19+on+the+wane+domestically%3f+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhat-is-the-outlook-for-the-chinese-oil-sector-with-covid19.html","enabled":true},{"name":"email","url":"?subject=What is the outlook for the Chinese oil sector with COVID-19 on the wane domestically? | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhat-is-the-outlook-for-the-chinese-oil-sector-with-covid19.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=What+is+the+outlook+for+the+Chinese+oil+sector+with+COVID-19+on+the+wane+domestically%3f+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fcommodityinsights%2fen%2fci%2fresearch-analysis%2fwhat-is-the-outlook-for-the-chinese-oil-sector-with-covid19.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}