Published March 2021

Powder coatings are applied to metal substrates to form highly durable and attractive finishes. They are manufactured and applied without the use of organic solvents; thus, they are highly desirable from an ecological standpoint. The powder coatings industry has endured years of low profitability as the industry increased capacity while demand stagnated in developed regions. Prices have tended to decline as many producers were willing to sell quality powder coatings at low prices. Users have also become more educated and consider many powder coatings to be commodity-like. However, consumption of powder coatings in less industrialized regions has increased and is expected to continue to grow at a strong rate, with annual growth expected to be about 5% in mainland China and 4–5% in other developing nations.

The profitability of producing powder coatings varies significantly among products, companies, and regions. Barriers to entry are minimal because of the relatively low capital requirements; small producers can compete successfully with larger producers in many markets. The customers for powder coatings are quite diverse. A select few end-use applications require the resources of a large, multinational organization, a notable example being clear coats for automotive bodies.

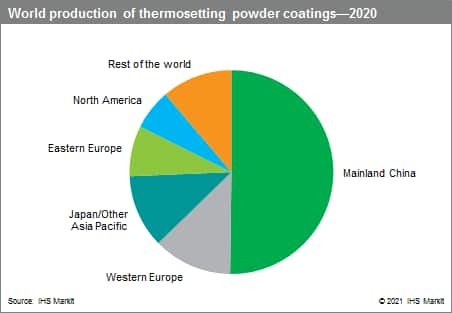

The following chart shows world production of thermosetting powder coatings:

In mainland China, there are over 500 producers, with many being small-scale operations that supply powder coatings for the local market only. There are three large international producers that account for about 22% of the global market. There has been some consolidation in the industry in recent years, mainly because powder coatings production has grown more rapidly in areas outside of North America, Western Europe, and Japan—in regions where manufacturers based in these more developed regions have much less of a presence. In mainland China, powder coatings production roughly doubled during 2004–13, with most of the production being by very small enterprises using unsophisticated equipment. Mainland China is currently the leading powder coatings producer by a wide margin. In Europe, there are at least 100 producers with more than 80 production sites. In North America, there are an estimated 70 producers.

Powder coatings are used primarily in the following five major markets:

- General metal finishing (e.g., furniture, shelving, and electrical equipment)

- Appliances (e.g., washing machine tops and lids, and dryer drums)

- Architectural (e.g., window and door frames)

- Automotive (e.g., wheels, oil filters, and engine blocks)

- Functional (e.g., oil and gas transmission pipes)

Powder coatings compete with other finishing technologies (such as waterborne and high-solids coatings) as pollutionabating alternatives to conventional low-solids, organic solvent–based coatings. Powders are especially attractive since they are made and applied without any solvent. However, powder coatings have certain technical limitations and thus, will never totally displace other technologies. Powder coatings currently account for 10% of the US industrial coatings market; the penetration of powder coating technology into its niche markets (e.g., metal furniture, appliances, and automotive underbody parts) is about 25% on an aggregate basis. In Western Europe, the figures are 18% and 30%, respectively, and in Japan, 6% and 15%. In mainland China, powder coatings account for about 10% of the industrial coatings market.

Some of the more important trends and opportunities foreseen for the powder coatings industry are the following:

Continued consolidation of producers.

- Continued rapid growth, especially in less-developed nations.

- Intense research efforts to provide powder coatings that can be used in more markets, including wood, plastics, and other nonmetallic substrates. UV-curable powders are being developed for medium-density fiberboard (MDF), which is used in interior kitchen construction, office furniture, roofing, and wall panels; to date, however, its use is limited.

As of early 2021, the major challenge of the global powder coatings industry is dealing with much higher raw material costs, especially for epoxy resins, one of the major binders used in powder coatings.

For more detailed information, see the table of contents, shown below.

S&P Global’s Specialty Chemicals Update Program –Coatings, Thermosetting Powder is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Specialty Chemicals Update Program –Coatings, Thermosetting Powder has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify the competitive environment and key players

- Assess key issues facing both suppliers and their end-use customers

- Understand industry integration strategies

- Keep abreast of industry structure changes, regulatory requirements, and other factors affecting profitability

- Identify new business opportunities and threats

- Follow important commercial developments

- Recognize trends and driving forces influencing specialty chemical markets