Published November 2021

Synthetic lubricants (synlubes)—formulated products consisting of synthetic base stocks plus additives—have physical and chemical properties that are generally superior to those of conventional mineral oil–based lubricants. As a result, synlubes are the lubricants of choice in applications with especially demanding performance requirements. Since synlube base stocks are generally far more expensive than conventional mineral oils, their use has traditionally been restricted to those applications that demand the very high performance characteristics that only synlubes can provide. Increasingly, however, industrial customers in some segments are taking a broader and longer view of their total costs and are opting to use synlubes to reduce maintenance, minimize disposal problems, or satisfy health, safety, or environmental regulations.

The ongoing demand for higher fuel economy has pushed the use of high-quality motor and gear oils. Another important development was the growing use of synlubes as refrigerator oils to provide compatibility with the new refrigerants that have replaced chlorofluorocarbons (CFCs) and hydrochlorofluorocarbons (HCFCs).

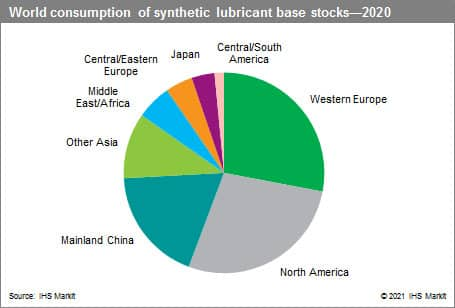

The following pie chart shows world consumption of synthetic lubricant base stocks on a volume basis:

The market for synthetic lubricant base stocks is dominated by three product groups—polyalphaolefins (PAO), esters, and polyalkylene glycols (PAG). Their combined market share in 2020 was almost 90%. PAO is the most important synthetic lubricant base stock, used largely in automotive and aviation applications and in industrial compressor oils and hydraulic fluids. Esters have a much broader application range than all other synlube base stocks, with use in refrigeration and air-conditioning, fire-resistant hydraulic fluids (FRHFs), and aviation turbines. The use of PAG in synlube applications represents only a minor share of total PAG production— between 5% and 10%, depending on the region. Industrial applications dominate usage of PAG as a lubricant, especially FRHFs, metalworking oils, and process oils.

The total share of synthetic lubricant base stocks in the global lubricant base oil business is only around 3.8%, but their importance is growing as more applications demand a level of performance that is borderline or beyond the capabilities of conventional lubricants. This is reflected by the fact that synlubes represent about 10% of the total value of the global lube oil market. Nearly all synlube base stocks enjoy growth rates that are higher than those of mineral oils, and many are growing faster than other specialty chemical product types.

The main market drivers are the growing demand for industrial lubricants in developing countries such as mainland China, the ASEAN countries, and India, as well as North America. Increasing automobile production has increased demand for gear oils and indirectly for use as rolling oil in steel production and as industrial hydraulic and metalworking fluids. The government-subsidized introduction of electric vehicles, in conjunction with new stricter exhaust emission rules, however, will reduce the future demand for crankcase lubricants, including synthetic ones.

The 2017–20 period was overshadowed by the COVID-19 pandemic in 2020, which reduced the global demand for synthetic lubricants by 5–6%. The impact in the different regions differed greatly—while Europe and the Americas suffered heavily, the effects in Asia were mild and mainland China even saw slight growth. The world market for synlube base stocks is projected to grow at an average annual rate of about 2% per year on a volume basis. Growth in synlube base stocks is expected to continue at a low rate in Europe and Japan, while demand in the Americas will grow at 2–3% per year. In contrast, high growth rates are expected in developing countries including mainland China, India, and Southeast Asia.

For more detailed information, see the table of contents, shown below.

S&P Global’s Specialty Chemicals Update Program – Synthetic Lubricants is the comprehensive and trusted guide for anyone seeking information on this industry. This latest report details global and regional information, including

Key benefits

S&P Global’s Specialty Chemicals Update Program – Synthetic Lubricants has been compiled using primary interviews with key suppliers and organizations, and leading representatives from the industry in combination with S&P Global’s unparalleled access to upstream and downstream market intelligence and expert insights into industry dynamics, trade, and economics.

This report can help you

- Identify the competitive environment and key players

- Assess key issues facing both suppliers and their end-use customers

- Understand industry integration strategies

- Keep abreast of industry structure changes, regulatory requirements, and other factors affecting profitability

- Identify new business opportunities and threats

- Follow important commercial developments

- Recognize trends and driving forces influencing specialty chemical markets