United States (US) Economic Forecasts

Medium- and Long-term Forecast

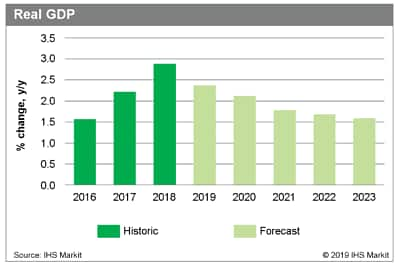

- S&P Global forecasts 2.0% GDP growth in 2019, followed by 2.1% growth in 2020 (fourth quarter over fourth quarter). Thereafter, a period of below-trend growth is assumed, balancing the risks between continued trend-like growth and a recession.

- The Fed is now expected to implement one more federal funds rate hike and wind down its balance-sheet run-off, bringing the top of the funds range to 2.75%, near the longer-run nominal neutral rate.

- The unemployment rate is forecast to decline to 3.5% by the second half of 2019 and core personal consumption expenditure inflation to rise to 2.2% by fourth quarter 2019.

- We view the recent drop in broad equity markets as only partly related to fundamentals and look for an 18.5% gain in the S&P 500 this year (end-2019 over end-2018).

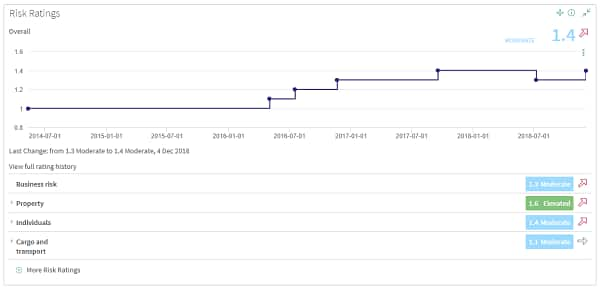

Country Risk Rating for the United States

- In mid-term elections held in November 2018, Democrats took a majority in the House of Representatives, while Republicans extended their majority in the Senate. Given the congressional composition, the likelihood of policy gridlock will almost certainly increase.

- Although organized attack risks remain, radicalized Islamist and domestic groups and individuals pose a more imminent threat. Issue-driven protests, including around immigration, gun control, or reproductive rights, are common, with an increasing likelihood of demonstrations by individuals associated with right-wing extremist organizations.

- We forecast 2.0% GDP growth (fourth quarter over fourth quarter) followed by 2.1% growth next year. After 2020, we assume a period of below-trend growth, balancing the risks between continued trend-like growth and a recession.

- Long-term interest rates are 10 to 20 basis points lower, reflecting a recent update to our “Fed call”, with just one more rate hike penciled in for December.

A note on our risk ratings: S&P Global derives country risk ratings for 206 countries, based on six separate ratings in each country: Political, economic, legal, tax, operational and security with 22 detailed sub-aggregate risks. These ratings allow you to quantify risk with greater specificity with a scoring system based on a 0.1-10 logarithmic scale. Seven risk bands, from low to extreme, allow you to compare and contrast risk between countries and regions.

{"items" : [

{"name":"facts","url":"","enabled":false,"desc":"","alt":"","mobdesc":"PDF","mobmsg":""},{"name":"login","url":"","enabled":false,"desc":"Product Login for existing customers","alt":"Login","large":true,"mobdesc":"Login","mobmsg":"Product Login for existing customers"},{"name":"sales","override":"","number":"[num]","enabled":true,"desc":"Call Sales [num]","proddesc":"[num]","alt":"Call Sales</br>[num]","mobdesc":"Sales","mobmsg":"Call Sales: [num]"}, {"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fsolutions%2fus-economic-forecasts-risk-ratings.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fsolutions%2fus-economic-forecasts-risk-ratings.html&text=United+States+(US)+Economic+Forecasts+and+Risk+Ratings+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fsolutions%2fus-economic-forecasts-risk-ratings.html","enabled":true},{"name":"email","url":"?subject=United States (US) Economic Forecasts and Risk Ratings | S&P Global&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fsolutions%2fus-economic-forecasts-risk-ratings.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=United+States+(US)+Economic+Forecasts+and+Risk+Ratings+%7c+S%26P+Global http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fsolutions%2fus-economic-forecasts-risk-ratings.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}