Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 25, 2021

World real GDP will reach new peaks in the second quarter of 2021

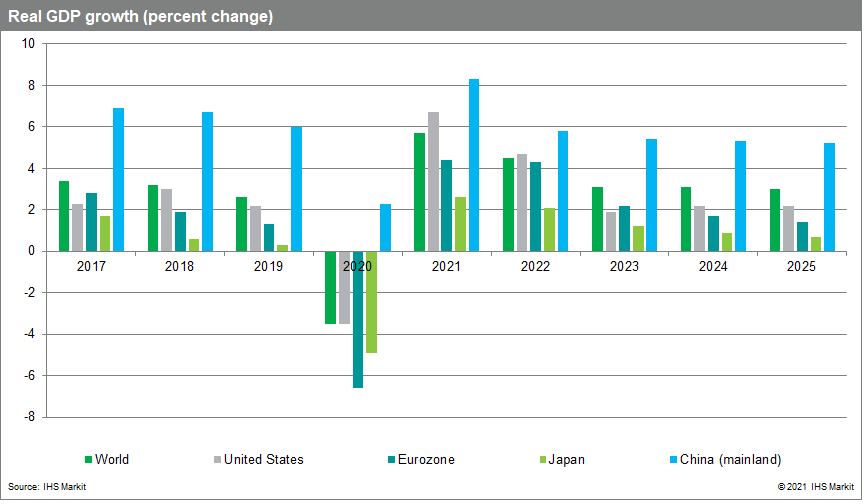

After a 3.5% contraction in 2020, global real GDP is projected to surge 5.7% in 2021, its strongest advance since 1973. Growth will continue at a robust 4.5% pace in 2022 before settling to 3.1% in 2023. The growth forecast for May is revised up by 0.4 percentage point in 2021 and 0.2 percentage point in 2022, reflecting stronger performances in North America, Europe, and mainland China but significantly weaker growth in India, where the COVID-19 pandemic is raging.

The progress of vaccination campaigns will be pivotal to economic outcomes. Evidence from the United States and the United Kingdom, two countries achieving high vaccination rates, is encouraging. Since early January, the seven-day average of new COVID-19 cases has plunged 88% in the United States and 97% in the United Kingdom. Consumer spending is proving more resilient than expected as economies reopen, travel picks up, and social activities resume. The IHS Markit PMI™ surveys show service sectors are quickly gaining momentum (while manufacturing performance remains strong) in countries where the pandemic is subsiding.

The United States

The US economy remains at the forefront of the global economic recovery. After a 3.5% contraction in 2020, the US economy will likely expand 6.7% in 2021, led by rapid growth in consumer spending, residential investment, and business equipment investment. The economy will regain its previous peak of employment in mid-2022, and the unemployment rate should fall to 3.5% by mid-2023. Real GDP growth will moderate to 4.7% in 2022 and 1.9% in 2023 as the economy reaches full employment. This forecast does not include any of the approximately USD4 trillion in spending and taxes in President Biden's proposed American Jobs Plan and American Families Plan.

The Eurozone

Following a double-dip recession, the eurozone outlook is improving. After setbacks in the fourth quarter of 2020 and the first quarter of 2021, eurozone real GDP is starting to rebound in the second quarter as COVID-19 vaccinations rise, new infections decline, and containment measures ease. Consumer spending, which was almost 8% below its pre-pandemic level in the fourth quarter of 2020 (and likely declined in the first quarter of 2021), will lead the rebound. As in the United States, on average, household finances are in good shape after lockdowns caused a surge in "forced" saving in 2020. Eurozone real GDP will likely increase 4.4% in 2021 and 4.3% in 2022, regaining its pre-pandemic peak early in 2022.

Mainland China

Mainland China's economic expansion is supply-led, but domestic demand will catch up. In the first quarter of 2021, real GDP increased 18.3% from its year-earlier level and 10.3% from its level in the first quarter of 2019. Growth rates of industrial production and services output are outpacing gains in fixed investment and retail sales. Consumer demand has been slow to recover, and precautionary savings remains higher than normal. On the positive side, the rapid recovery in supply is restraining consumer price inflation. With COVID-19 vaccination rates rising, IHS Markit analysts expect an acceleration in consumer spending on services in the months ahead. After a 2.3% increase in 2020, real GDP should advance 8.3% in 2021 and 5.8% in 2022.

India

A tidal wave of COVID-19 virus infections has darkened India's economic outlook. A second wave of the pandemic was previously in the India forecast, but it is proving more virulent and deadly than anticipated. Meanwhile, vaccine shortages have stalled progress on vaccinations and prompted the government to temporarily halt vaccine exports. The May forecast incorporates a national lockdown that will lead to a 10% quarter-on-quarter drop in India's real GDP during the April-June quarter. Another round of fiscal stimulus is likely, but it will take away from previously announced measures to increase capital investment. Amid inflationary pressures, the central bank will not have room to cut interest rates. Although the economy should recover in the second half of 2021, the virus will take a toll on the labor market and household finances after the second wave eases. After falling 8.2% in fiscal year (FY) 2020, real GDP is projected to increase 7.7% in FY 2021 and 6.7% in FY 2022.

The bottom line

The global economy will achieve solid growth of 5.7% in 2021 and 4.5% in 2022 as the COVID-19 pandemic subsides. Performances will vary across regions, with North America and Asia-Pacific leading but Africa and Latin America lagging.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworld-real-gdp-peaks-in-the-second-quarter-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworld-real-gdp-peaks-in-the-second-quarter-2021.html&text=World+real+GDP+will+reach+new+peaks+in+the+second+quarter+of+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworld-real-gdp-peaks-in-the-second-quarter-2021.html","enabled":true},{"name":"email","url":"?subject=World real GDP will reach new peaks in the second quarter of 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworld-real-gdp-peaks-in-the-second-quarter-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=World+real+GDP+will+reach+new+peaks+in+the+second+quarter+of+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fworld-real-gdp-peaks-in-the-second-quarter-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}