Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 09, 2023

Why the best time to invest can be the most challenging time to fundraise

I recently took part in a webinar, How to Navigate 2023's M&A Headwinds: The Big Picture, Macro to Micro, in which we discussed the challenging environment for dealmakers this year. As with any market changes, where there are challenges, there are also opportunities, and many of these exist within the private debt markets. The recent dislocation in the public credit market has accelerated M&A financing activity for private debt lenders, with many industry participants bullish about its prospects in 2023. In this blog, I look at the headwinds facing the markets this year and identify reasons to be optimistic about private debt.

Dislocation in the public credit market is boosting private debt financing

During 2022, the syndicated loan market faced significant roadblocks. Notably, in the third quarter, the broadly syndicated loan market became very illiquid as the banks that underwrote deals earlier in the year took billions in write-downs. As the public credit market dried up, private equity firms no longer had access to the traditional source of capital that fueled the 2021 boom in M&A activity, leaving them with an increased reliance on direct lending to secure financing.

At the same time, particularly in the U.S., middle-market sponsored transactions remained active with 80% of these deals financed by private, direct loans. Our own experience bore out this trend with no noticeable slowdown in private debt activity for the middle-market managers that license our iLEVEL software for portfolio monitoring.

We're seeing this trend continue, with the latest Prequin data showing that private debt financing continues to outpace syndicated transaction volume, with average deal sizes for 2022 setting new highs by exceeding $1 billion, as the flexibility of private credit allows for it to react quickly to changing market conditions.

With the turmoil in the public credit markets, the regulated banks have increased their reserves to provision against losses, and from a risk management perspective, public financing for M&A activity will remain challenging with more restrictions on corporate lending; creating a continued reliance on private credit financing to meet demand through 2023 and beyond.

Risk-mitigating characteristics of private debt prove attractive during periods of economic uncertainty

As we remain in a lender-friendly environment, many private credit managers have the means to work out troubled investments and are generally willing to work with their sponsors to facilitate a path forward.

Historically, we've seen that the risk-mitigating characteristics of private debt, such as floating rate structures, short maturities, credit seniority and the relationship-based nature of transacting, are attractive in periods of economic uncertainty. In fact, some managers are gearing up for a recession because it is during these times when they opportunistically outperform.

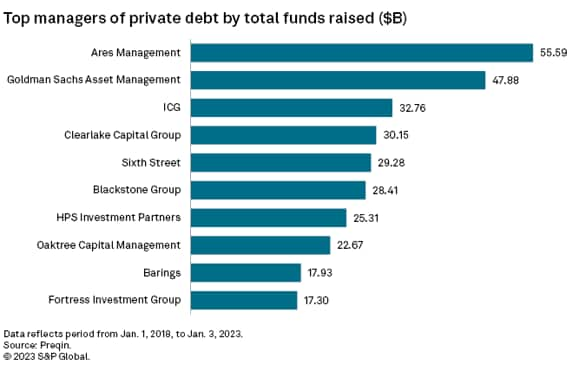

As the overall amount of debt available for M&A activity has decreased, the cost of financing is now more expensive. It's simply the law of supply and demand. Fundraising for private debt remains healthy, as shown in the graph below, and with the added benefits of higher rates, wider spreads and increased call protections, the risk-return profile of private credit may be at its prime.

The $226 billion of capital raised from investors in 2022 is a record amount, according to Prequin data, albeit by ~30% fewer funds, indicating that while investors remain positive on the asset class, they are becoming more discerning in their allocations, with larger commitments going to fewer managers.

Continued fundraising bodes well for private debt deal activity in 2023 and is evident of its anticipated resiliency with ~$210 billion of private debt dry powder outstanding, according to Prequin data. Despite private debt lenders being interested in putting this dry powder to work, they remain prudent in their underwriting terms, as they find themselves in a stronger position to negotiate lender-favorable terms, including noticeably higher spreads, which we are seeing through our WSO suite of products.

Compared to a year ago, rates are up 350-400bps, spreads have widened 100-200bps, fees to transact have also increased and leverage levels have reduced from a half turn to a full turn due to interest coverage considerations and recession fears.

During times of economic stress, private equity funds are more likely to pay attention to downside risk and the potential for earnings erosion to trip covenants which might cause restructurings that dilute their equity positions. As more attention is placed on mitigating downside risk, factors such as selecting financing partners become more paramount, specifically as sponsors prefer credit counterparties with a reputation for being thoughtful solution providers, as a risk mitigant if the portfolio company's performance deteriorates and the parties need to negotiate a revised path forward.

Flexible private credit arrangements can help mitigate default risk

It's no surprise that in a time of economic uncertainty, default rates are expected to rise. The following graphs show the anticipated increase in default rates for both public and private credit:

The prospect of a recession in 2023 contributed to S&P Global Ratings' projection that the U.S. trailing 12-month speculative-grade corporate default rate will reach 3.75% by September, up from 1.6% a year earlier. And accordingly, Proskauer's Private Credit Default Index reported an increase in its default rate to 2.06% in the fourth quarter 2022, up from 1.56% in the third quarter and 1.18% in the second quarter.

In the middle market, the prospect of recession and rising costs, related to interest rate increases, threatens to squeeze borrowers' bottom lines, particularly in cyclical businesses, potentially leading to a higher default risk coupled with the larger number of covenants when compared to the cov-lite large cap credit facilities.

Default risk can be mitigated though, through disciplined investment selection and tighter deal structuring, which is easier with more flexible private credit arrangements and the relationship-based nature of transacting.

The rise of opportunistic private debt strategies

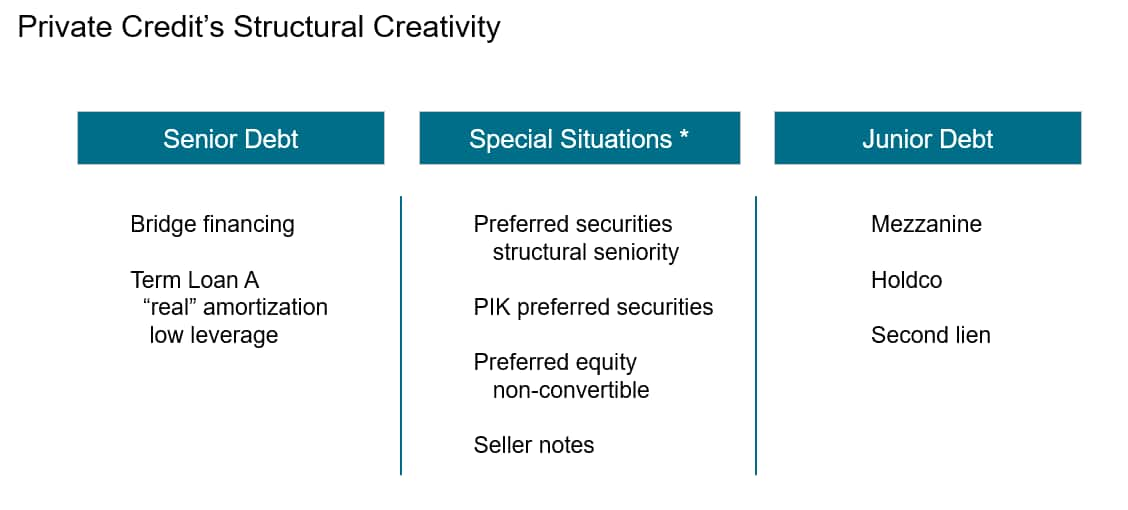

While direct lending remains the largest type of private debt capital raised, credit special situations strategies and junior debt strategies attracted more interest in 2022. The below chart shows some of the more creative debt structures that are gaining momentum:

The more opportunistic strategies provide both a significant return premium and differentiation within private credit, where investors can extract equity upside participation, juicing their returns, when sponsors are averse to raising dilutive rounds of equity. Creative private credit structures can facilitate M&A transactions by providing unique financing terms with both debt and equity characteristics.

Structural risk mitigants fell out of fashion when rates remained low and financing options were bountiful. These structures are starting to creep back into deals and, for the most part, are designed to increase leverage while maintaining acceptable interest coverage ratios, without increasing the cash interest burden.

Private debt holds a unique competitive advantage

In the first quarter of 2023, the confluence of recession fears, uncertainty and rising interest rates has led to an attractive investment environment for top private debt managers that have adequate diversification, scale, unique competitive advantages, a proven track record and are sufficiently disciplined. The chart below shows the top private debt managers by funds raised over the past five years. Notably many, if not all, of these top managers have teams dedicated to various private debt strategies, utilizing the types of debt shown above.

With lots of dry powder, firms that can provide a one-stop capital solution for private equity firms are positioned to grow this year through selective expansion. As we move further away from the comparably frothy M&A market in 2021, the reality of today's environment will set in, valuations will adjust accordingly, and M&A activity will pick up in 2023 with buyer and seller expectations converging, further increasing the overall demand for private credit financing.

Growing digitalization

We see increased digitalization across the private markets with growing adoption of our software solutions. Digital solutions can help managers make wiser decisions by reducing operating costs, increasing transaction speed, and reducing the risk of human error by digitalizing data ingestion from various sources and providing dashboards for performance tracking and analytics.

Digitalization provides increased transparency across internal teams through software integration. It reduces the redundancy of duplicative data input and maintains data consistency and integrity. In today's world of economic uncertainty, digitization can also help minimize the redemption risk by providing increased transparency that can calm investors during periods of increased illiquidity.

The digitization of portfolio administration, portfolio management, agent functions, cash reconciliation, and data management are all growing within private credit.

As we anticipate M&A activity to pick up during 2023, particularly in the second half of the year when base rates are projected to stabilize, private debt is positioned to continue to grow due to many factors, including:

(1) its relative stability compared to the volatile leveraged loan market,

(2) its consistent availability providing for certainty of deals to close despite volatility,

(3) the record levels of dry powder that private debt managers are interested in putting to work

(4) its flexible financing solutions, and

(5) its solution oriented and relationship-based nature of transacting.

Sometimes, the best time to invest is also the most challenging time to fundraise.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwhy-the-best-time-to-invest-can-be-the-most-challenging-time-t.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwhy-the-best-time-to-invest-can-be-the-most-challenging-time-t.html&text=Why+the+best+time+to+invest+can+be+the+most+challenging+time+to+fundraise+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwhy-the-best-time-to-invest-can-be-the-most-challenging-time-t.html","enabled":true},{"name":"email","url":"?subject=Why the best time to invest can be the most challenging time to fundraise | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwhy-the-best-time-to-invest-can-be-the-most-challenging-time-t.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Why+the+best+time+to+invest+can+be+the+most+challenging+time+to+fundraise+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwhy-the-best-time-to-invest-can-be-the-most-challenging-time-t.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}