Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 02, 2022

What Europe’s gas curtailment plan will do to industries and regions

The EU agreement to voluntarily reduce natural gas demand during the coming winter is likely to exacerbate symptoms of weakness in the European economy, as illustrated by S&P Global's Eurozone Composite PMI for June contracting for the first time since early 2021.

EU member states are expected to embark on national campaigns to reduce gas consumption in the household and commercial sectors, to mitigate the impact on industry. Weather developments will also be key, and seasonally cold temperatures would indicate larger adjustments hurting industrial sector.

Member states are also expected to use energy from non-gas sources, such as renewables but also coal and nuclear. These are also likely to make up at least part of the supply gap driven by lower inflows of gas. The expansion of non-gas power generation from such sources would be a positive indicator of greater gas availability for industry.

Industry implications

European gas demand curtailment would have major adverse impacts for the industrial sector, particularly the refining, chemicals, plastic, glass, ceramic, and metal industries.

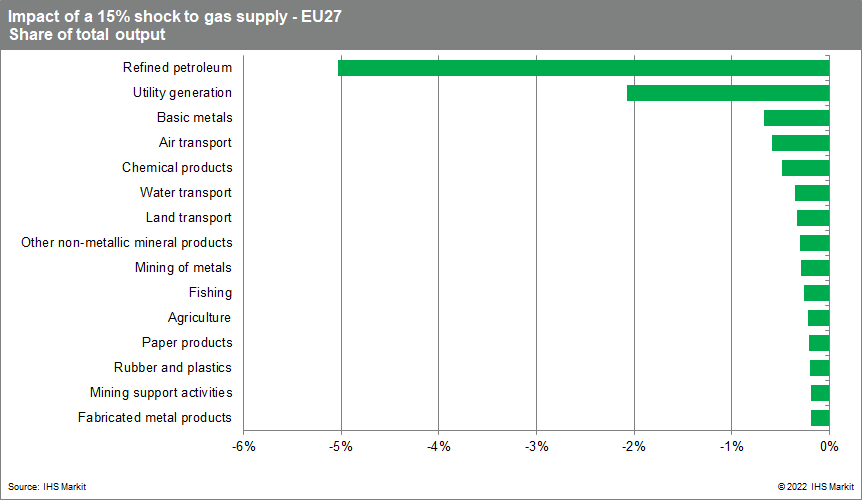

Results from a simulation of a 15% reduction in gas consumption based on supply multipliers show the projected curtailment of output from this supply side shock. Sectors particularly affected include utility generation (-2.1% of total output), basic metals (-0.7%), air transport (-0.6%) and the chemicals sector (-0.5%).

This simulation assumes that all sectors are equally affected by the limited availability of gas: if governments prioritize supply to certain segments this would amplify the damage caused to the remaining sectors. The analysis only captures the direct effect of the limited availability of gas and does not account for factors including price changes, complementarity, substitution or second-round effects after demand destruction or demand shift.

Industries heavily reliant on power and feedstock generally produce lower value added to their energy intensity, even with their overall importance in supply chains. Plastics are one such example. European chemical manufacturers making heavy use of ethane feedstock, derived from natural gas, are particularly vulnerable. Hydrocarbons undergo a "cracking" process to become the plastics used in food packaging, furniture, electronics, machinery, and construction, among many others. Shortages in plastic components would have impacts both up and down the value chain, hurting production in areas such as automobile components or agricultural packaging.

Country and regional impact

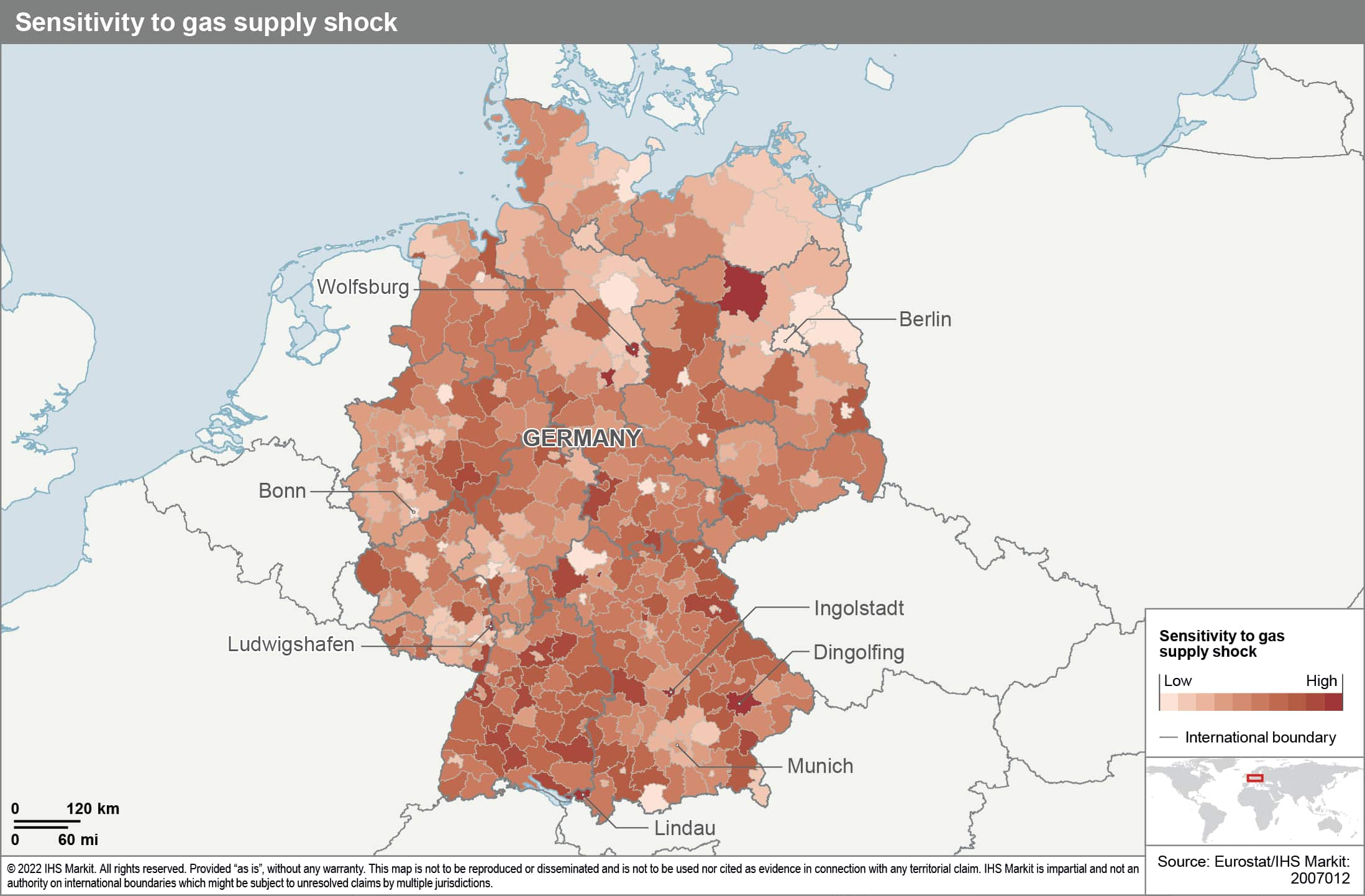

A combination of high share of gas consumption in industry, the large size of its industrial sector, and reliance on Russian gas supplies makes the German economy particularly exposed to the reduction in gas.

The impact of a gas supply shock varies across German regions and cities. Regions where manufacturing contributes a high share to GDP such as Volkswagen's car-manufacturing hub Wolfsburg are most sensitive. Other cities with a high sensitivity include Ingolstadt (the location for the second-largest Audi production plant), Lindau (with a cluster of automotive suppliers), Dingolfing (a major BMW production plant), and Ludwigshafen (headquarters of chemicals company BASF). Cities with well diversified economies and focusing on services such as Berlin or Bonn are likely to be affected less strongly.

To mitigate the impact on key industries, Germany's Federal Network Agency and the Economic Ministry are giving very high focus to designing rationing plans to prioritize sectors that represent critical infrastructure or are near the start of the value-added chain. Plans to shift more of the cost burden from gas providers to consumers would provide a large price incentive to consumers to save gas, leaving greater availability for industrial users.

One fifth of German GDP is directly tied to manufacturing activity, and chemicals constitute 7.5% of total manufacturing output. Comparatively, French manufacturing is slightly more reliant on chemicals with an 8.4% share of output. Consequently, French chemical production may be more exposed to a reduction in gas-derived feedstock. However, aggregate manufacturing only makes up 10% of the French GDP, and thus economic activity is more insulated than in Germany in a low gas supply scenario.

The Italian and Austrian economies are also heavily exposed as gas, mainly from Russia, is used for around 20% of their energy generation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwhat-europes-gas-curtailment-plan-industries-and-regions.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwhat-europes-gas-curtailment-plan-industries-and-regions.html&text=What+Europe%e2%80%99s+gas+curtailment+plan+will+do+to+industries+and+regions+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwhat-europes-gas-curtailment-plan-industries-and-regions.html","enabled":true},{"name":"email","url":"?subject=What Europe’s gas curtailment plan will do to industries and regions | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwhat-europes-gas-curtailment-plan-industries-and-regions.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=What+Europe%e2%80%99s+gas+curtailment+plan+will+do+to+industries+and+regions+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fwhat-europes-gas-curtailment-plan-industries-and-regions.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}