Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 02, 2022

Weekly Pricing Pulse: Strength in energy offsets softness in broader commodity markets

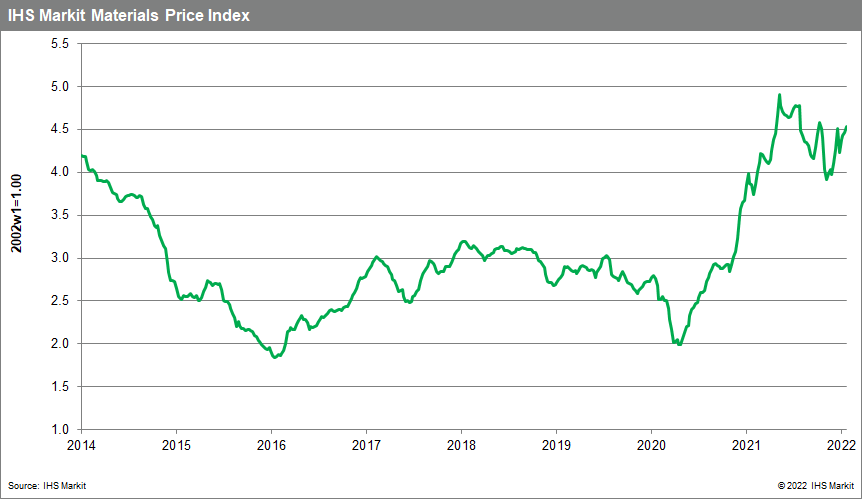

Our Materials Price Index (MPI) increased 1.4% last week, continuing a strong start to the year. The subcomponents paint a different picture, however, with the MPI excluding energy commodities falling 0.7%, its first decline since mid-November. Commodity markets have shown strength over the past eight weeks with the MPI rising 13.7%. Even so, the index is still 7.7% below its May 2021 peak.

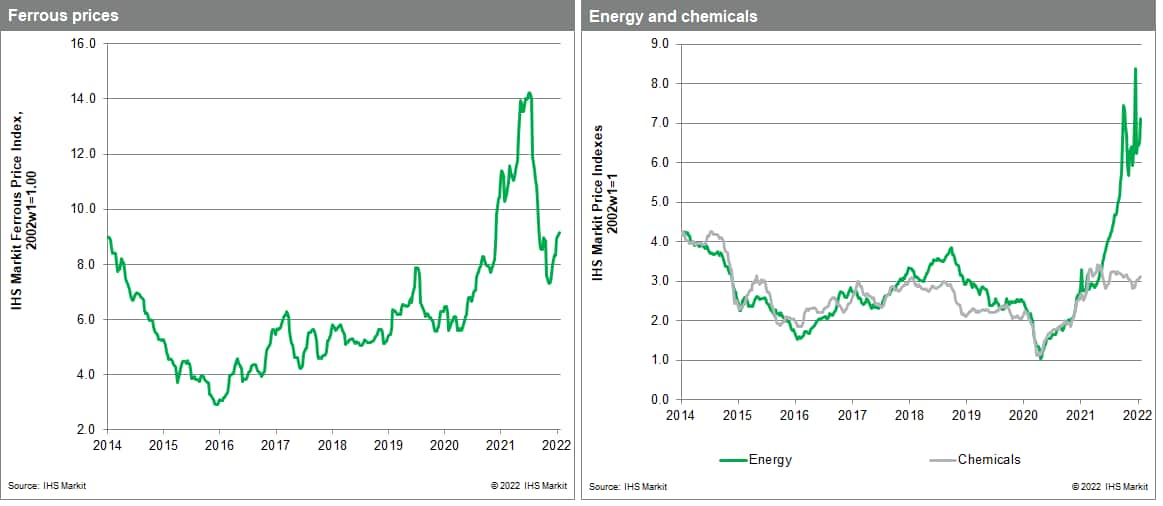

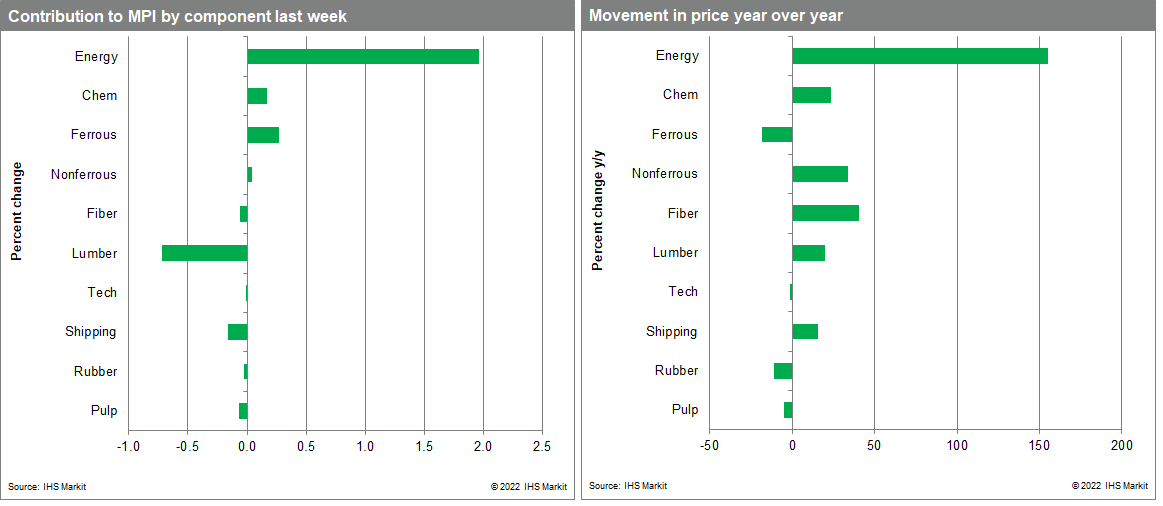

Six of the ten MPI subcomponents declined last week, but a 9.3% climb in the energy index drove the overall MPI into positive territory. Natural gas prices rebounded in another volatile week as the ongoing scramble to get more LNG imports into Europe was met with renewed urgency in northeast Asia where cold weather in Japan is lifting demand. Asian LNG prices jumped from $21.25/MMBtu to $27.50/MMBtu last week. Thermal coal prices increased for a fourth consecutive week and are now back to record levels in some regions; the Australian price reached $261 per metric ton, surpassing the previous all-time-high of $254 set in October 2021. Limited cargo availability and surging demand from India are behind the recent rise in coal prices. The supply outlook in Asia has improved in recent days as Indonesia ended its export ban three days early. Offset by the upward move in the heavy weight energy index, North American lumber prices declined 14.5% last week due to an improvement in market fundamentals. Infrastructure in British Columbia has been restored following disruptive mudslides, allowing supply from a major exporting region to recover. Demand is also back down to its usual weak winter seasonal levels, creating room for prices to fall.

The recent combination of the ongoing pandemic, related supply chain disruptions, inflation, and tightening monetary policy is creating volatility in markets, which is likely to continue into February. Energy markets, facing tight supply, will continue to see strong price moves driven by regional weather at least until the end of the Northern Hemisphere winter. With weekly oil prices nearing $90 per barrel, the market is perhaps just one more crisis away from the $100 per barrel threshold. Geopolitical tensions around Russia and Ukraine will likely continue to shake not just energy markets but a range of raw materials given the importance of both countries as large exporters of many hard and soft commodities. The bottom line is that commodity markets likely face heightened volatility until at least the middle of the second quarter.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-strength-energy-offsets-softness-market.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-strength-energy-offsets-softness-market.html&text=Weekly+Pricing+Pulse%3a+Strength+in+energy+offsets+softness+in+broader+commodity+markets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-strength-energy-offsets-softness-market.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Strength in energy offsets softness in broader commodity markets | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-strength-energy-offsets-softness-market.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Strength+in+energy+offsets+softness+in+broader+commodity+markets+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-strength-energy-offsets-softness-market.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}