Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 16, 2021

Weekly Pricing Pulse: Risk-on optimism fuels markets

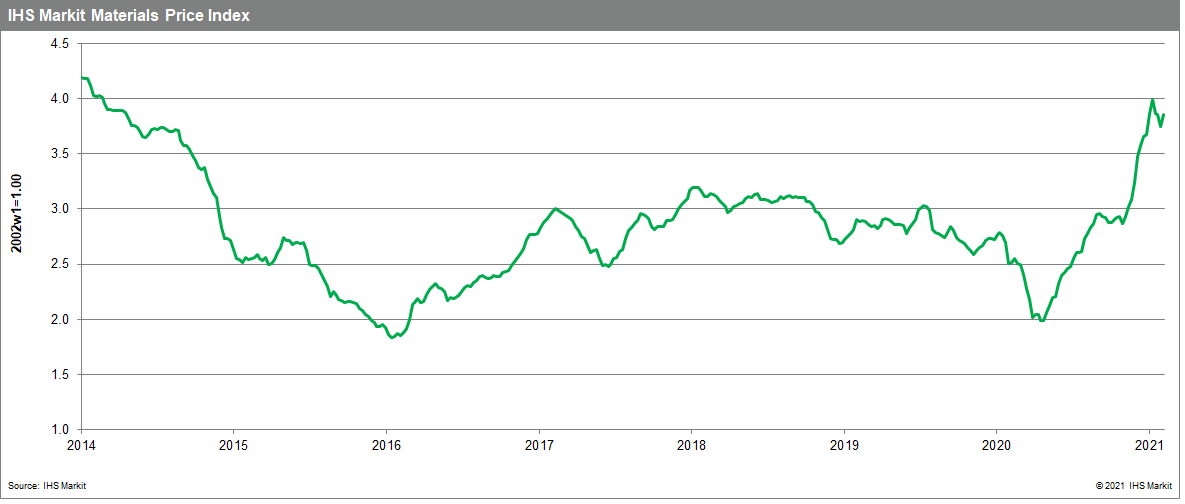

Our Materials Price Index (MPI) climbed 2.8% last week, its first increase in four weeks. In a return to the dominant pattern at the start of the year, prices collectively recorded a significant weekly gain. The MPI now stands 53% higher than in mid-February 2020.

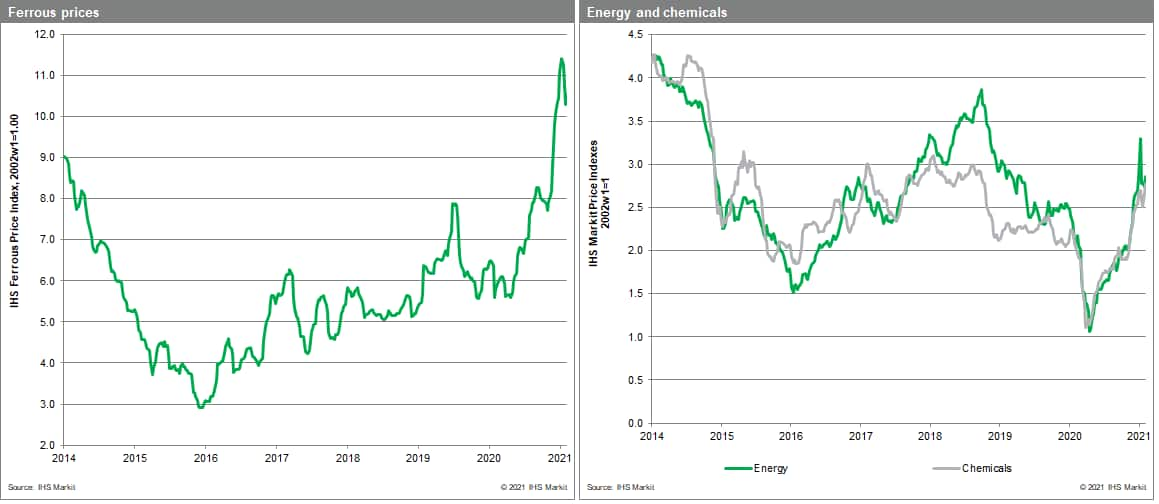

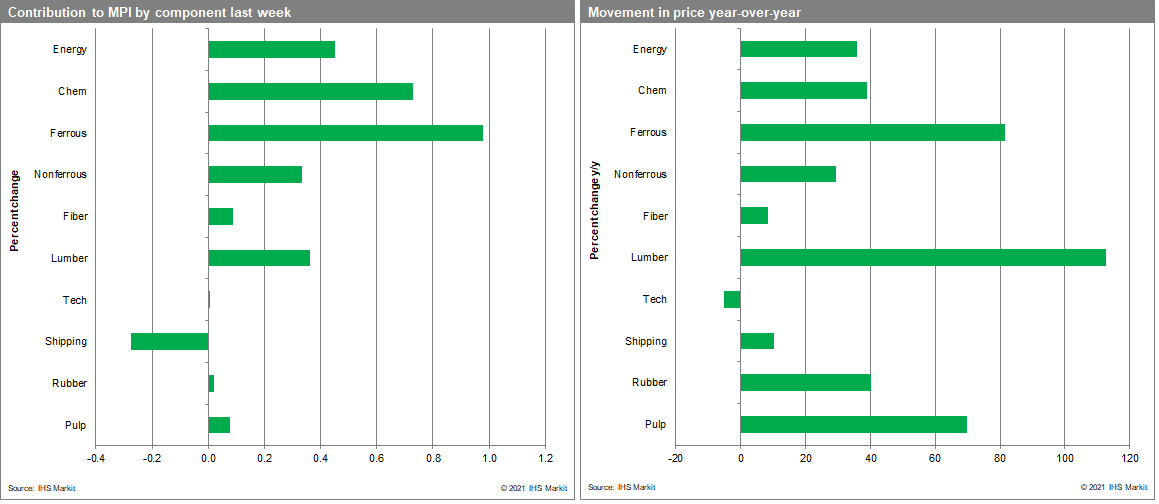

All but one of the MPI's ten sub-components posted increases last week with energy, chemical and metals the biggest movers. Our energy index was up 3.9% as crude oil prices breached $60 a barrel for the first time in over a year. Supply reductions implemented by the OPEC+ producers in January are the main reason for the price increase though the demand outlook has also improved. Rising oil prices lifted feedstock costs and had a knock-on effect on our chemical index, which ended last week up 4.1%. Global benzene prices were particularly impacted with poor weather in Texas creating logistic problems and adding further price pressure. It was also a busy week on metal exchanges with our nonferrous sub-index increasing 4.2%. Copper prices marched towards $8,300 a tonne as stock levels neared 15-year lows and the demand outlook grew stronger. The price of nickel also rallied amid optimism on prospects for the electric vehicle market. Nickel reached $18,600 per tonne last week, just shy of the $20,000 mark that analysts believe is crucial to stimulate new investment.

It was another strong week for markets as investors focused on the prospect of continued fiscal stimulus in global economies. A record-breaking $58bn was invested in global stocks with the success of the COVID-19 vaccine rollout adding to bullish sentiment. Commodity markets benefited despite quiet physical trading week due to the Chinese Lunar New Year. Markets collectively have taken on a glass half full view of the near future with real optimism for the second half of 2021 and now being priced into commodity and equity markets. Increases in the MPI over the past eight months guarantee a rise in goods price inflation through at least the second quarter. <span/>The question for markets is whether this burst of inflation is temporary, as policy makers believe, or the start of a more protracted bout of higher prices, which for commodity markets might mean the beginning of a new supercycle.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-riskon-optimism-fuels-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-riskon-optimism-fuels-markets.html&text=Weekly+Pricing+Pulse%3a+Risk-on+optimism+fuels+markets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-riskon-optimism-fuels-markets.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Risk-on optimism fuels markets | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-riskon-optimism-fuels-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Risk-on+optimism+fuels+markets+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-riskon-optimism-fuels-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}