Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 20, 2022

Weekly Pricing Pulse: Recession fears continue broad sell-off in commodity markets

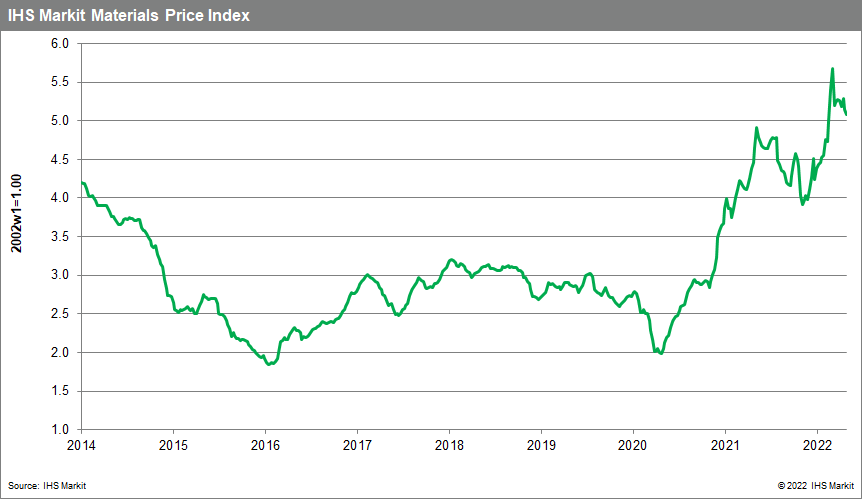

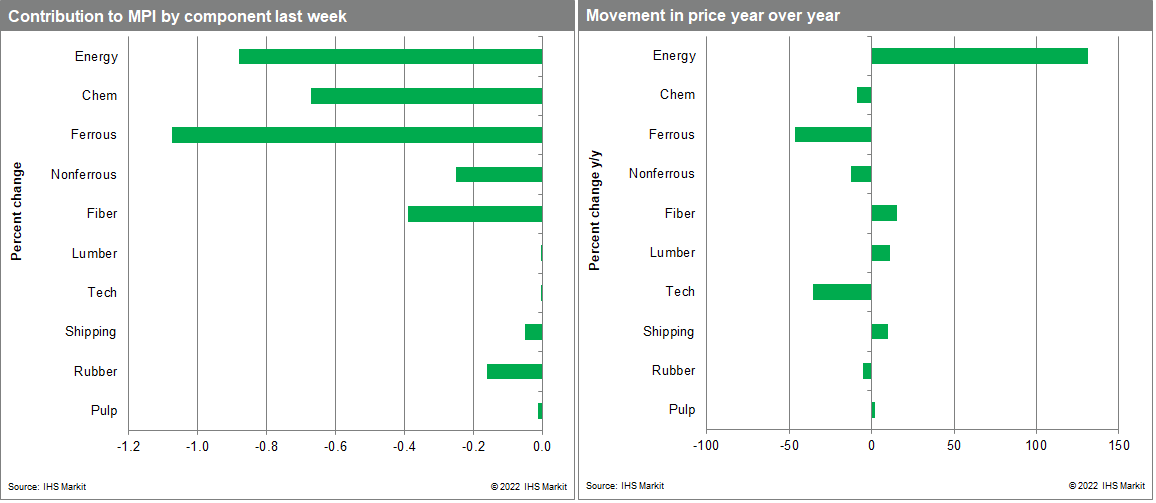

Our Materials Price Index (MPI) declined 3.5% last week, its fifth consecutive weekly decline. The sell-off was again broad with nine out of ten subcomponents falling, highlighting the downward momentum in commodity prices over the past four months -- the MPI is now 20% lower than its all-time high established back in early March. Significantly, commodity prices over the previous 12-months are declining for the first time since October 2020 with the MPI 5% lower than this time last year.

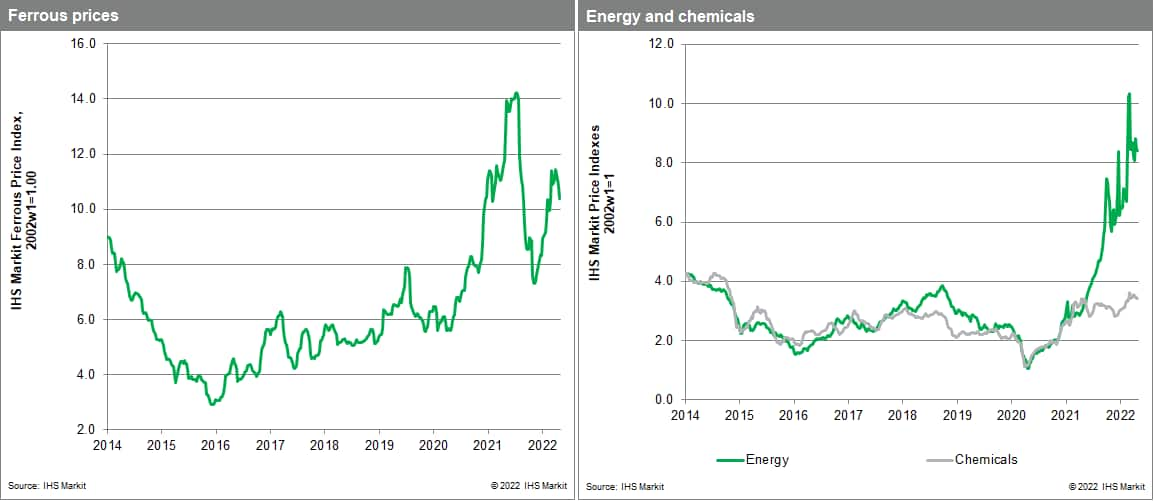

Price declines last week were most significant in industrial metals. The nonferrous metals sub-index declined 3.7% with all six base metals in the sub-index falling. Copper recorded the biggest drop with prices falling to $7,000/tonne for the first time since November 2020. Prices are now 24% lower than those recorded in early June and 34% lower than their record high established back in March. Nickel prices lost 5.5% for the week, dropping to $19,100/tonne, their lowest level since October 2021. Metals markets are facing several headwinds, but rising Covid cased in mainland China and the prospect of Russia shutting off European natural gas supply and thus threatening European manufacturing activity sparked the latest sell-off. The steel making raw material sub-index also dropped last week, falling 4.1%. Iron ore traded at $104/tonne from $115/tonne the previous week on news that several mainland Chinese producers were reducing output due to eroding profit margins and weaker demand.

Weaker demand expectations are weighing on commodity prices. The combination of mainland China's strict zero-COVID policy and tightening monetary policy has markets now pricing in at least a mild recession in global manufacturing. This easing in demand-side pressure does have a silver lining - the disruptions and bottlenecks that have plagued supply chains for the past two years are slowly being resolved. This is evident in the Purchasing Manager Index data for backlogs, delivery times and reported shortages, all of which are showing slow improvement. This does suggest an easing in cost pressures in goods markets in the coming months. Our one caution is that spare capacity in energy markets, and inventory in metal markets, remains low, exposing both to a potential rebound in prices should there be any loss in supply or better than expected demand.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-recession-fears-continue-broad-selloff.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-recession-fears-continue-broad-selloff.html&text=Weekly+Pricing+Pulse%3a+Recession+fears+continue+broad+sell-off+in+commodity+markets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-recession-fears-continue-broad-selloff.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Recession fears continue broad sell-off in commodity markets | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-recession-fears-continue-broad-selloff.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Recession+fears+continue+broad+sell-off+in+commodity+markets+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-recession-fears-continue-broad-selloff.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}