Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 05, 2021

Weekly Pricing Pulse: No relief yet for supply-short commodity markets

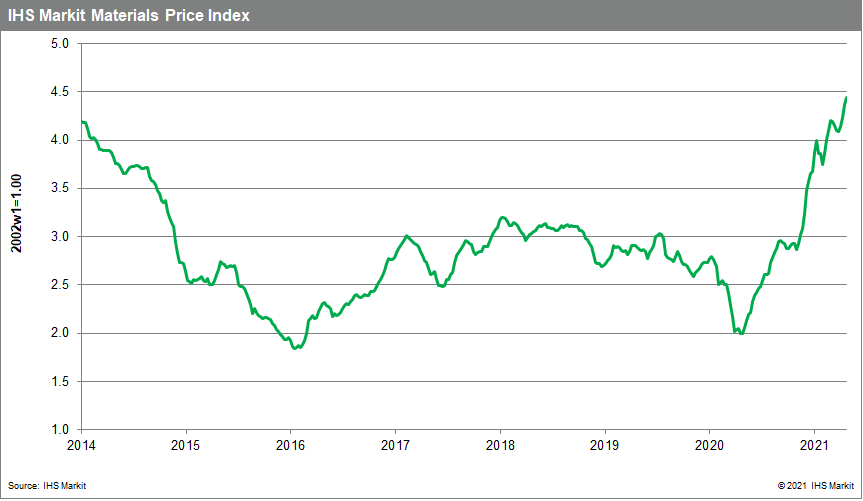

Our Materials Price Index (MPI) climbed 1.6% last week, following a 3.2% increase in the previous week. The MPI is up 21% year-to-date and is at its highest level in eight years.

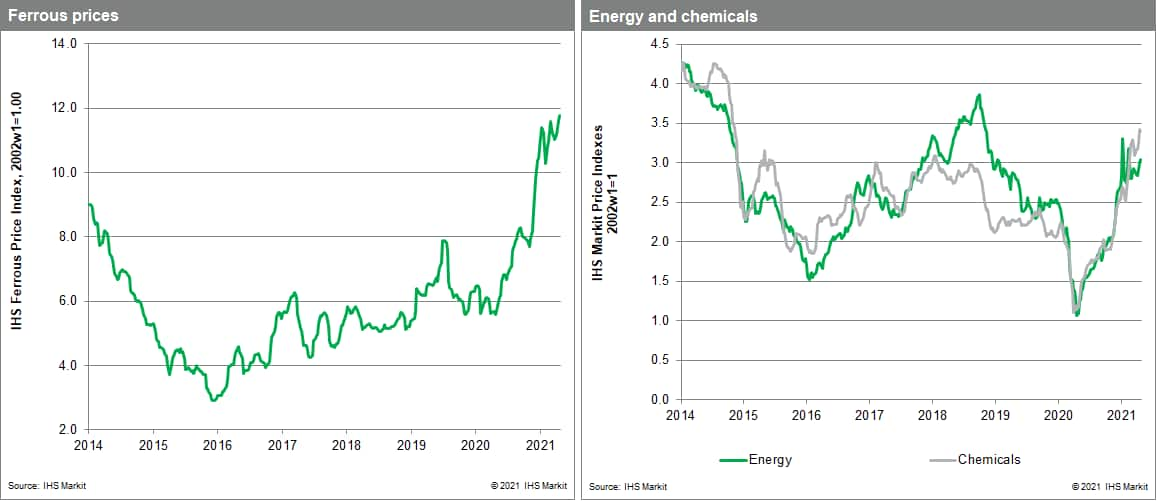

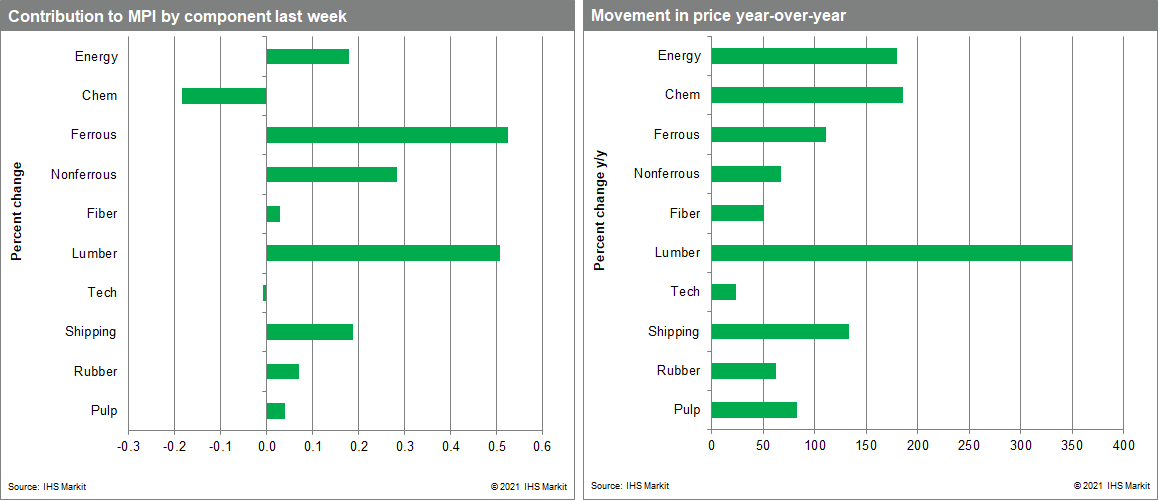

Eight of the MPI's ten sub-components posted week-to-week increases. Lumber and freight prices again led the pack. North American lumber prices, now up 64% since the beginning of the year, jumped 9.4% last week. Despite record highs, demand for lumber remains upbeat as new home building and home improvement continue to outpace supply. Sawmills are back to pre-pandemic capacity and thus are unable to catch up to new orders. The market for ocean-going freight faces similar fundamentals to the lumber market where robust demand has led to tight supply. Freight prices increased 6.5% last week and are up 69% year-to-date, the strongest performance among the MPI's ten subcomponents. The third stand was the nonferrous metals index, which jumped 3.7% last week. Tin was the major culprit, with prices rising 7.1% in response to news of supply disruptions in Malaysia as the market already faces short supply. Nickel and copper also contributed with increases of 6.3% and 4.7%, respectively. A weaker trade-weighted US dollar and investor bullishness supported higher pricing for the two base metals.

Last week's market drivers are a continuation of the main themes of the last couple of months. Robust demand at a time of several supply disruptions has pushed commodity prices to record levels. The worsening spread of COVID-19 in India and several other countries has not yet offset upbeat demand expectations at this point. However, supply chains remain fragile and maintain an uncomfortable position for market participants. We expect the second quarter will prove the low point for supply chain conditions as producers work through current backlogs. As the rollout of vaccines enables most countries to ease containment measures, consumers will be able to shift spending from goods back to services as the service industry returns to a more normal form.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-no-relief-supplyshort-commodity-markets.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-no-relief-supplyshort-commodity-markets.html&text=Weekly+Pricing+Pulse%3a+No+relief+yet+for+supply-short+commodity+markets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-no-relief-supplyshort-commodity-markets.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: No relief yet for supply-short commodity markets | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-no-relief-supplyshort-commodity-markets.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+No+relief+yet+for+supply-short+commodity+markets+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-no-relief-supplyshort-commodity-markets.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}