Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 06, 2022

Weekly Pricing Pulse: Natural gas price decline outweighs broader price strength

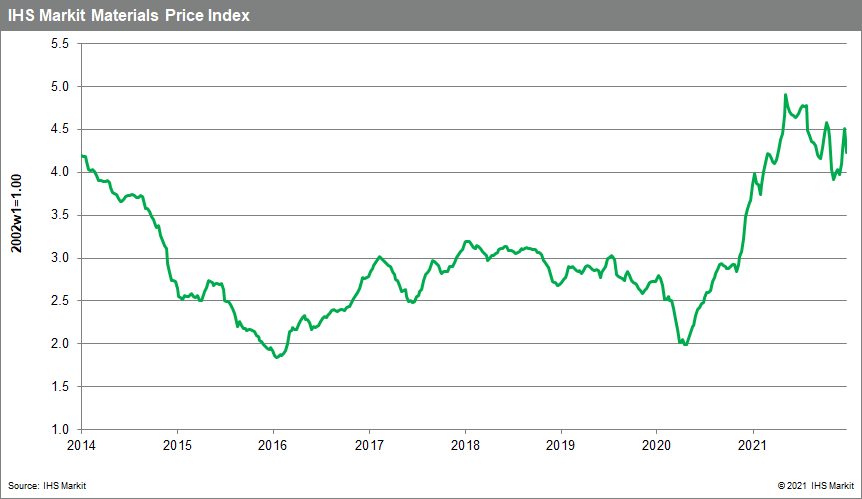

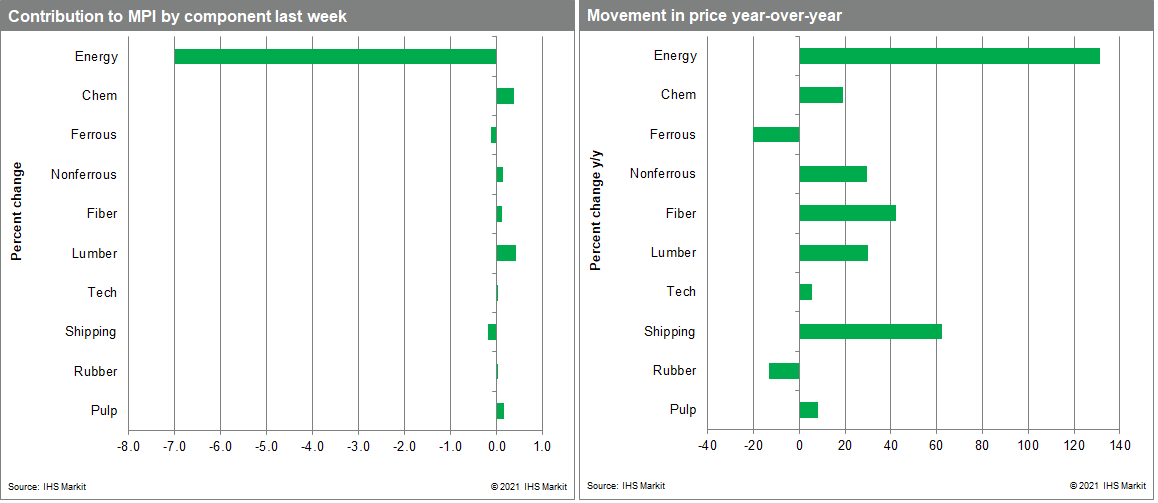

Our Materials Price Index (MPI) fell 6.1 % last week in light holiday trading, ending a string of strong December price increases. By subcomponent, price declines were outnumbered by increases, however, with seven of the MPI's ten sub-components increasing. The MPI ended 2021 15.6% higher than at the start of the year, though prices peaked back in May and have been trending lower in fits and starts since.

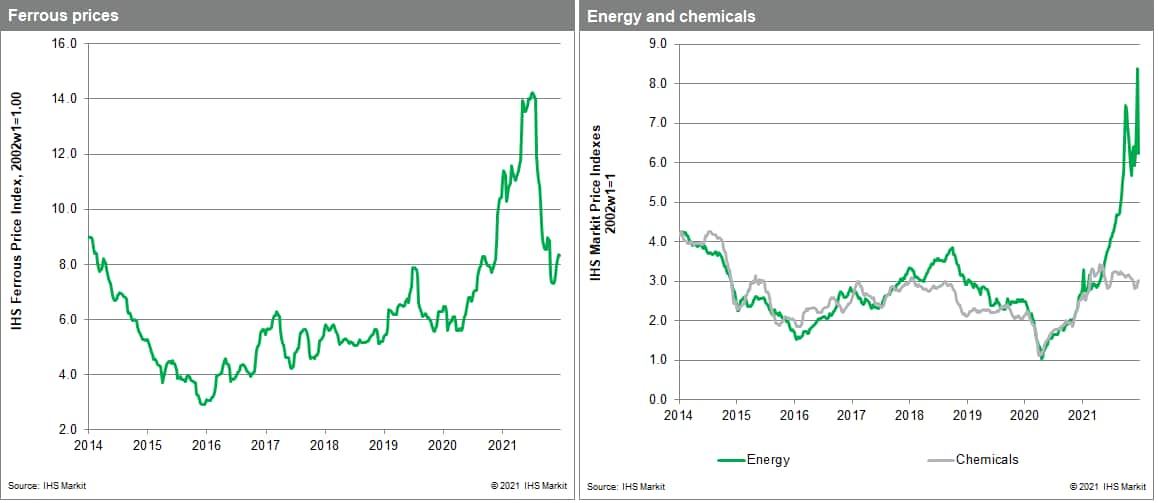

Energy commodities continued to drive the MPI last week. European liquefied natural gas (LNG) prices again demonstrated extreme volatility, declining from prices ranging in the $50s per MMBtu two weeks ago to the low $30s per MMBtu last week. Mild weather in Europe and increased deliveries to the region led to lower pricing. The movement in natural gas caused a 26% week-to-week decline in the energy subcomponent of the MPI, the largest decline in the 25-year history of the MPI. Natural gas markets will remain subject to strong price swings through the end of the 2021/2022 winter because of a tight global natural gas market. Excluding energy commodities, the MPI increased 1.3% last week, driven by sizable climbs in lumber, DRAMs, chemicals, and fiber prices. This was the sixth consecutive climb in the portion of the MPI excluding energy commodities.

Though natural gas prices took a step back, the energy crisis in Europe is ongoing and remains hostage to weather trends and political tensions between Russia and Ukraine, both of which create uncertainty and therefore potential market volatility through the first half of this year. More broadly, surging Omicron case counts in Europe, North America, and elsewhere threaten to delay an improvement in the poor supplier performance that has plagued supply chains for the past two years. It has been this weakness on the supply-side of markets that has contributed greatly to strong goods price inflation. Any continuing difficulties in reducing backlogs or speeding up delivery times will make the task of lowering inflation harder.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-natural-gas-price-decline.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-natural-gas-price-decline.html&text=Weekly+Pricing+Pulse%3a+Natural+gas+price+decline+outweighs+broader+price+strength+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-natural-gas-price-decline.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Natural gas price decline outweighs broader price strength | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-natural-gas-price-decline.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Natural+gas+price+decline+outweighs+broader+price+strength+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-natural-gas-price-decline.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}