Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 28, 2021

Weekly Pricing Pulse: Constrained supply causes further rise in commodity prices

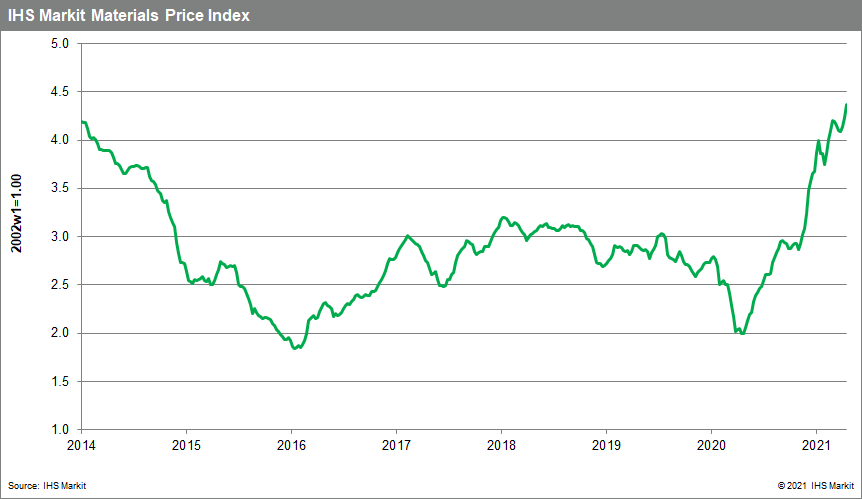

Our Markit Materials Price Index (MPI) climbed 3.2% last week, following a 2.2% increase the previous week. The volatility in the MPI witnessed at the start of the year, when weekly prices were changing by more than 2%, has returned with the index is now at its highest point since February 2013. Prices, as measured by the MPI, have more than doubled since late April 2020.

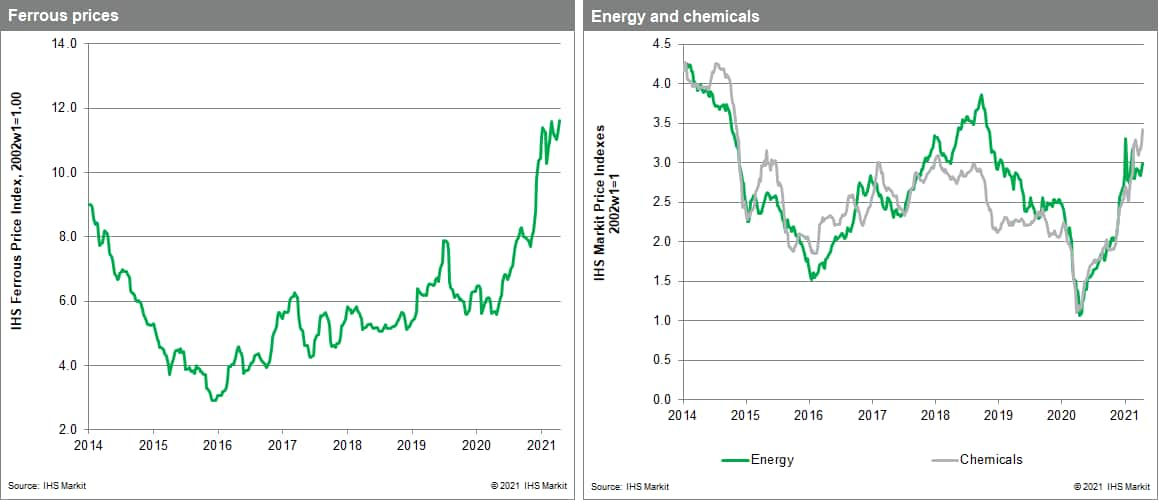

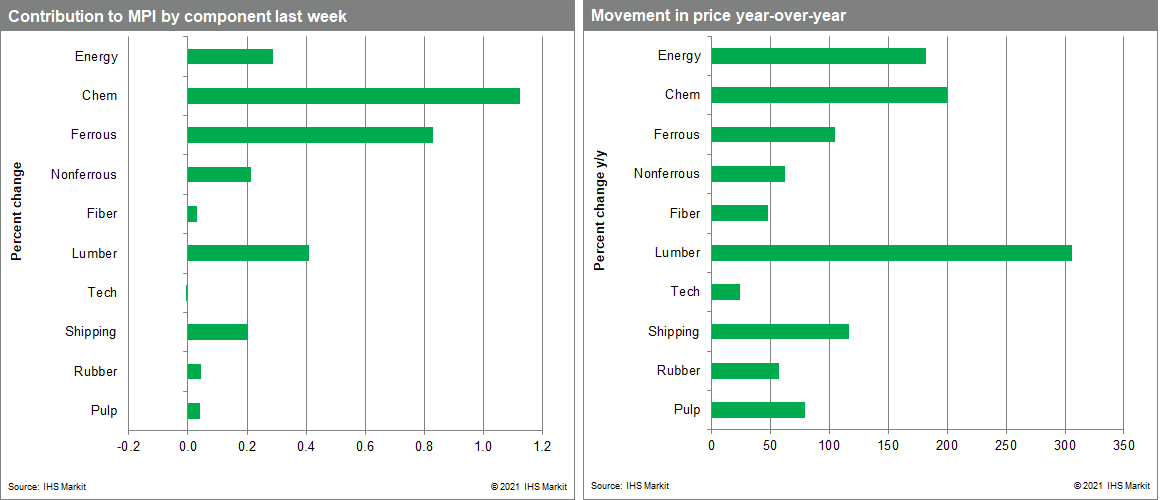

All but one of the MPI's ten sub-components posted increases last week with lumber once again recording the largest gain. The lumber index jumped 8% as demand continues to outstrip supply with housebuilders and DIY stores competing for scarce materials. Daily lumber futures reached $1,372 per 1000 board feet length, nearly 40% higher than their September 2020 peak, which was then a record. The North American lumber market is experiencing a perfect storm with US housing starts at their highest level since December 2006 while low inventory at domestic sawmills and constrained imports from Canada limit supply. New capacity is due to come onstream this year and alleviate the shortage, but prices will remain high in the near term. The chemicals industry was also beset by supply issues with our index increasing by 5.6% last week. Spot benzene prices in Europe reached a record high of $1,560 per metric ton while in the United States they were at the highest level since 2014. Both regions suffered unplanned domestic outages that tightened supply. Lower imports from Asia due to freight issues are also a problem and are unlikely to be resolved until July. Freight problems continue to plague manufacturing globally. Ships or containers are either unavailable or positioned in the wrong location. Conditions are reflected in our shipping index, which rose another 7.4% last week, its eighth consecutive increase. Carriers expect that the Suez Canal blockage will worsen the existing container shortage into May and pressure prices as shippers rush to get their orders in amid the supply uncertainty.

It was a quiet week for equity markets with global stock indices broadly flat. The US dollar did ease slightly, which helped to provide some support to commodity prices. Despite the alarming surge in COVID-19 cases in India, markets remain upbeat about a near-term recovery in demand, highlighted by last week's IHS Markit flash Purchasing Manager Index reports, which showed a near-uniform improvement in the advanced economies. However, for commodities, it is the continuing disruptions in supply chains that are keeping markets off-balance. The only solace in looking toward the summer is that absent some new shock, IHS Markit believes supply-chain conditions during the second quarter are as bad as they will get.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-constrained-supply-causes-further-rise-in.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-constrained-supply-causes-further-rise-in.html&text=Weekly+Pricing+Pulse%3a+Constrained+supply+causes+further+rise+in+commodity+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-constrained-supply-causes-further-rise-in.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Constrained supply causes further rise in commodity prices | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-constrained-supply-causes-further-rise-in.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Constrained+supply+causes+further+rise+in+commodity+prices+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-constrained-supply-causes-further-rise-in.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}