Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 08, 2022

Weekly Pricing Pulse: Commodity prices soar

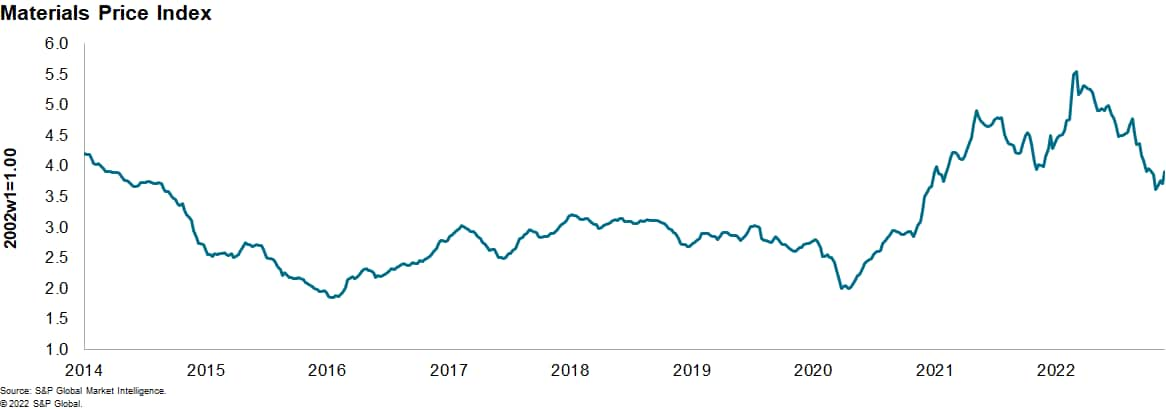

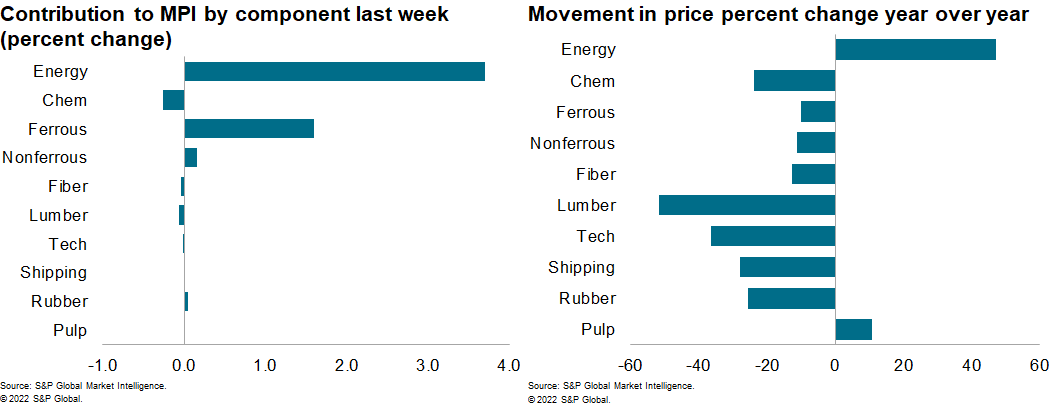

Our Material Price Index (MPI) increased 5.2% last week, the largest single weekly increase since late February. The increase was mixed with six out of ten subcomponents rising. Despite last week's price uptick, the longer-term trend of downward correction in commodity prices remains intact with the MPI 31% lower than its all-time high established back in early March. However, commodity prices remain far higher (45.9%) than the pre-pandemic levels of fourth quarter 2019.

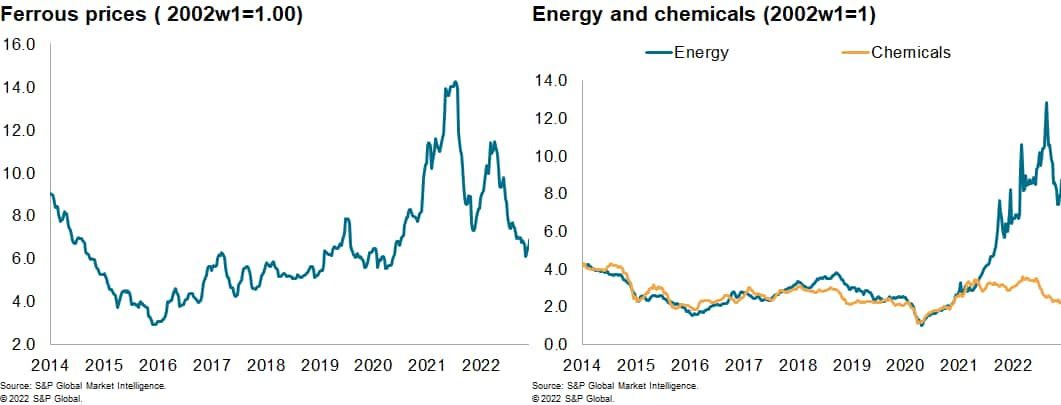

Jumps in energy and industrial metal prices were the main drivers of last week's rise in the MPI. The energy sub-index increased 11.8% the biggest rise in three months. Natural gas prices surged as colder temperatures arrived in Europe. Temperatures in the week commencing December 5 are set to plummet in northwestern Europe, taking them below seasonal norms for the first time this winter. This increased demand for natural gas and sent spot landed prices up to $31.22/MMBtu from $29.10/MMBtu the previous week. Fundamentals in the European gas market remain sound with storage levels healthy so near-term pricing will be determined by prevailing weather conditions. Elsewhere, industrial metal markets reacted positively to increasing evidence that the Chinese government is easing its approach to COVID-19 restrictions. Iron ore prices increased 6.6% last week and are back above $100/metric ton on the expectation that Chinese demand will now rebound. The lifting of restrictions in Guangzhuo, a major manufacturing center, was particularly well received and a major factor in driving the nonferrous metal sub-index up 1.9%.

The positive news on mainland China's COVID policy and growing belief that the Federal Reserve will slow the pace of interest rate rises buoyed markets last week. The S&P 500 closed November with its first consecutive monthly gain since 2021 after a speech from Federal Reserve chairman Jay Powell indicated a moderation of interest rate increases "as soon as the December meeting." We also expect a Fed rate hike of 50 basis points in December. If loosening restrictions in mainland China continue, there would be an additional impetus to markets in the coming weeks. However, with economic growth set to slow in 2023 lower commodity prices are expected, but temperature variations during the winter months may well result in further price spikes like last week.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-soar.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-soar.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+soar+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-soar.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices soar | S&P Global&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-soar.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+soar+%7c+S%26P+Global http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-soar.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}