Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Aug 11, 2021

Weekly Pricing Pulse: Commodity prices slump on iron ore weakness

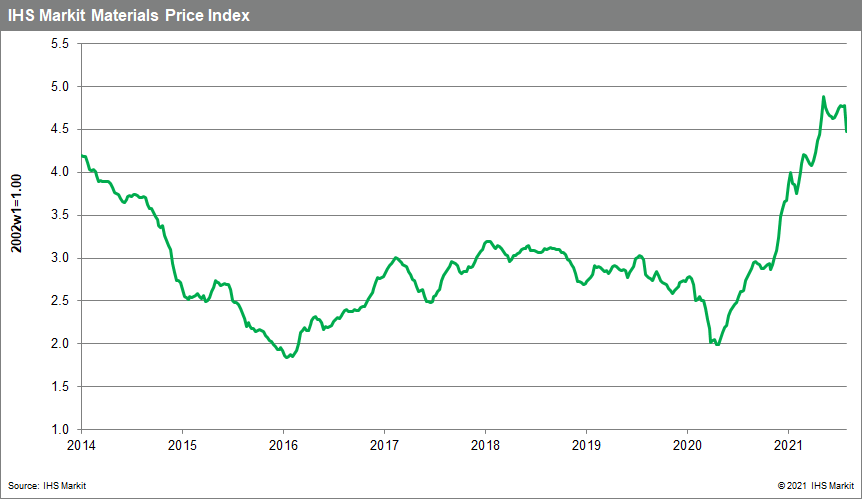

Our Materials Price Index (MPI) fell 6.4% last week, a significant reversal of the price increases recorded since mid-June. This is the largest weekly price decrease since March 2020, which was the height of the COVID-19 impact on commodity prices. This latest move takes commodity prices back to April 2021 levels eradicating the strong price rally recorded through May.

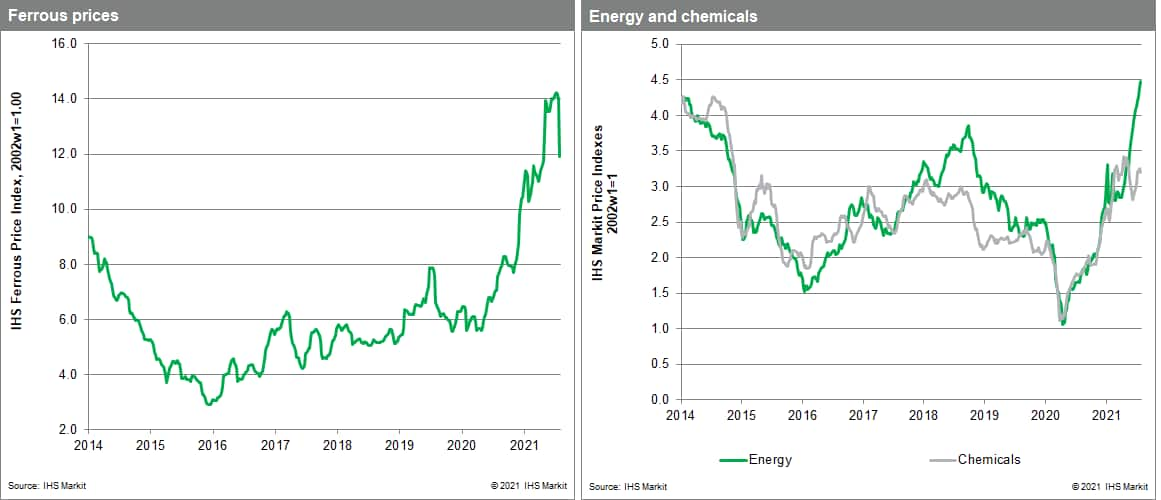

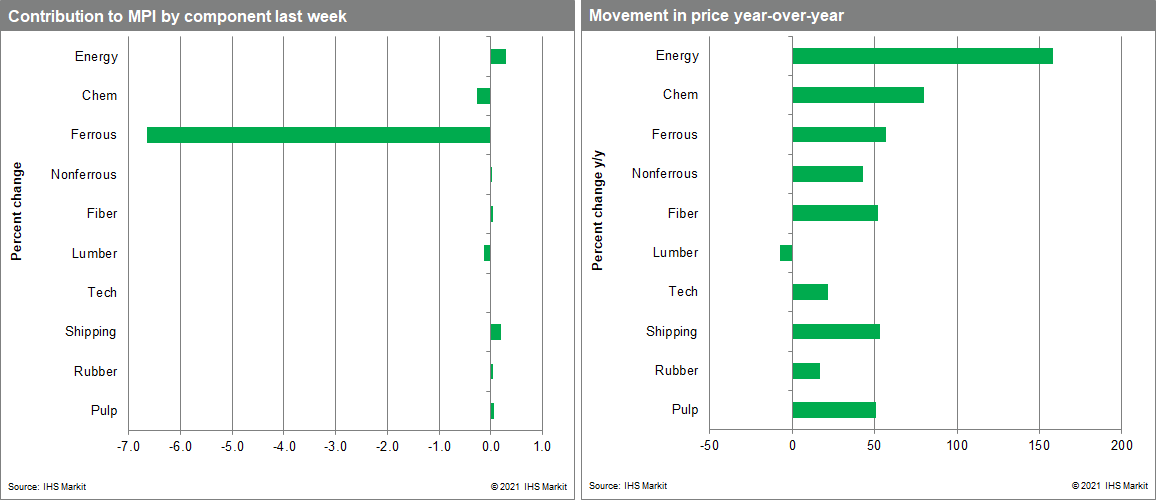

Steel making raw materials were the main contributor to the MPI's decline last week. Our ferrous sub-index was down 14.8% as both iron ore and scrap steel prices plummeted. This is the third biggest decline ever recorded in the sub-index, highlighting the scale of the drop. Iron ore prices fell to $172 a tonne last week, a four-month low, with scrap prices dropping to $459 a tonne, down from $518 in late May. The reason for the price drop is linked to uncertainty over future Chinese steel consumption. Authorities in mainland China have asked steel mills to limit production to help meet carbon emission targets and are threatening punishment for any noncompliance. This intervention has reduced demand for iron ore and scrap steel, sending prices lower. Further downward pressure on commodity prices was evident in chemical markets last week as global benzene prices dipped. Lower crude oil prices, a key benzene feedstock, was the reason for prices dropping 6.8% last week.

Last week's price correction provides further evidence that the year-long rally in commodity markets has run its course. Growth has begun to slow and oil markets were particularly roiled by the rise of the COVID-19 Delta variant in major economies last week. However, supply-chain disruptions and bottlenecks continue to plague markets with vendor performance poor with little sign that logistics services are becoming better. Moreover, service sectors are now experiencing the same kinds of problems manufacturing encountered last year, which means top-line inflation pressures may persist until year-end or even early 2022. This said last week's commodity price drops are a sign that the worst is over, at least in goods markets.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slump-iron-ore-weakness.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slump-iron-ore-weakness.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+slump+on+iron+ore+weakness+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slump-iron-ore-weakness.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices slump on iron ore weakness | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slump-iron-ore-weakness.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+slump+on+iron+ore+weakness+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-slump-iron-ore-weakness.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}