Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Sep 21, 2022

Weekly Pricing Pulse: Commodity prices rise in a calm week for energy markets

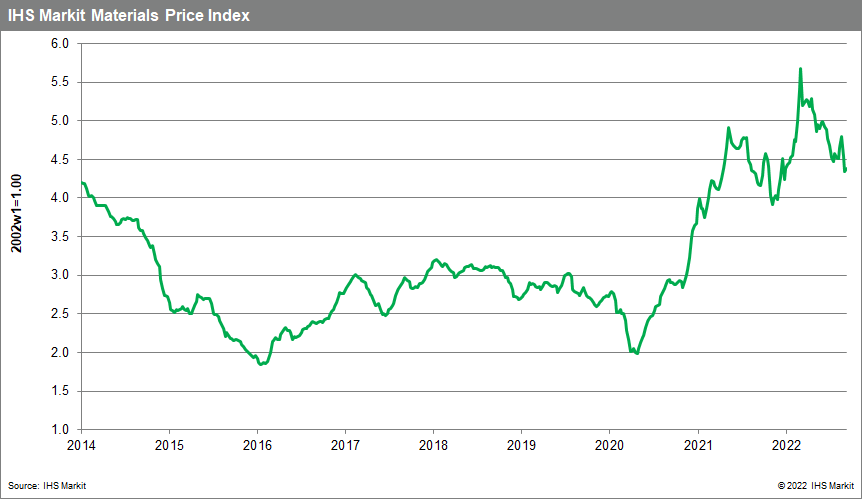

Our Materials Price Index (MPI) increased 0.8% last week, with six of the ten sub-components rising. The scale of week-to-week price changes was much smaller than 3.6% average change over the last four weeks. The lower volatility reflected a comparatively quiet week in energy, steel, and nonferrous metals markets.

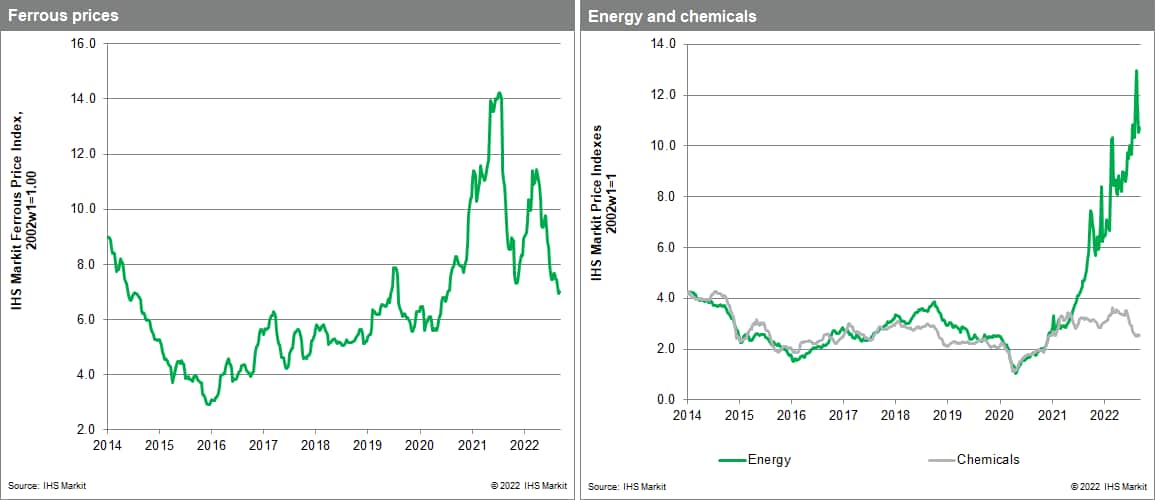

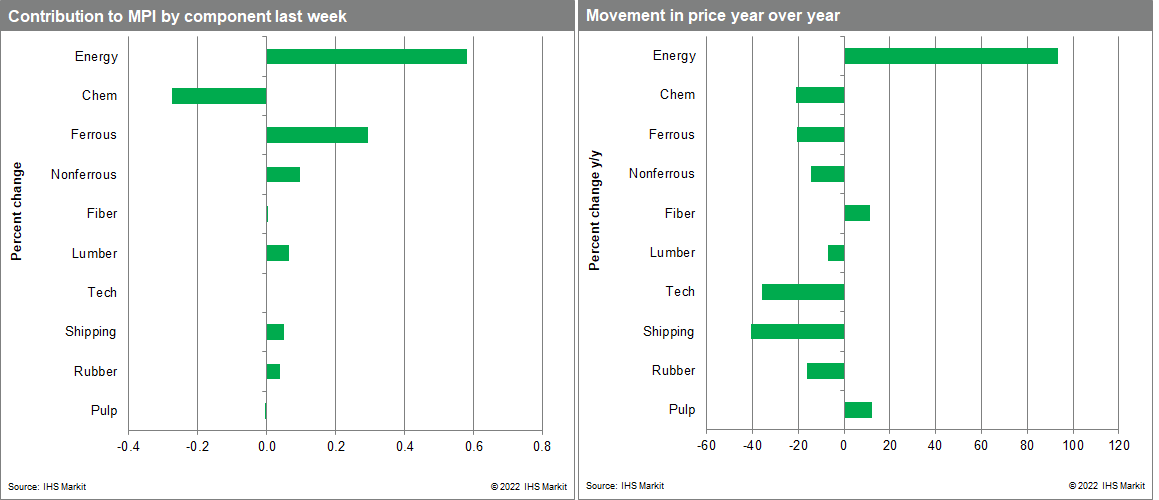

The MPI's energy subcomponent increased 1.6% last week, a far cry from the 9.8% average weekly change in the previous four weeks. Natural gas markets were the biggest energy mover, posting a 3.6% increase following two straight weeks of double digit declines. Lumber prices jumped 3% last week, though prices remain near their lowest level of 2022 as US homebuilding has cooled. The freight rate index also saw a noticeable 2% rebound following seven straight weeks of declines, though the reversal of the downward trend may be temporary as the iron ore market saw low volume last week amid soft demand in mainland China. The chemicals subcomponent stood out on the downside, posting a 1.8% weekly decline. A 4.4% drop in Asian ethylene prices pulled the sub index lower as concerns over global growth and specifically demand in mainland China weigh on the chemicals market. The weakness in chemicals -- the subcomponent is down 21% y/y -- is eye-opening given that energy products, major inputs in chemicals production, are 95% higher y/y as measured by the MPI's energy index.

Although the MPI notched an increase last week, there are clear signs of softening demand. Central banks around the world are aggressively tightening financial markets to reign in demand and thus tame inflation. Seven central banks will hold meetings this week, with most expected to raise interest rates again, including the US Federal Reserve and the Bank of England. Although commodity prices have been moving lower since March, they remain high. Moreover, the chance of energy shortages in Europe this winter presents significant upside price risk for energy-intensive commodities, including metals and chemicals. Notwithstanding these concerns, a softening macroeconomic outlook leads us to continue to project lower inflation over the next year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-calm-week-energy.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-calm-week-energy.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+rise+in+a+calm+week+for+energy+markets+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-calm-week-energy.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices rise in a calm week for energy markets | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-calm-week-energy.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+rise+in+a+calm+week+for+energy+markets+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-calm-week-energy.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}