Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jul 21, 2021

Weekly Pricing Pulse: Commodity prices rise but more slowly

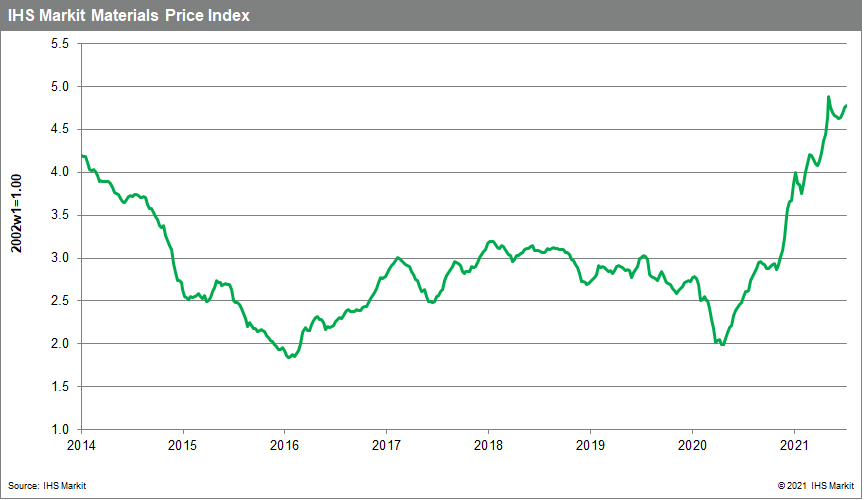

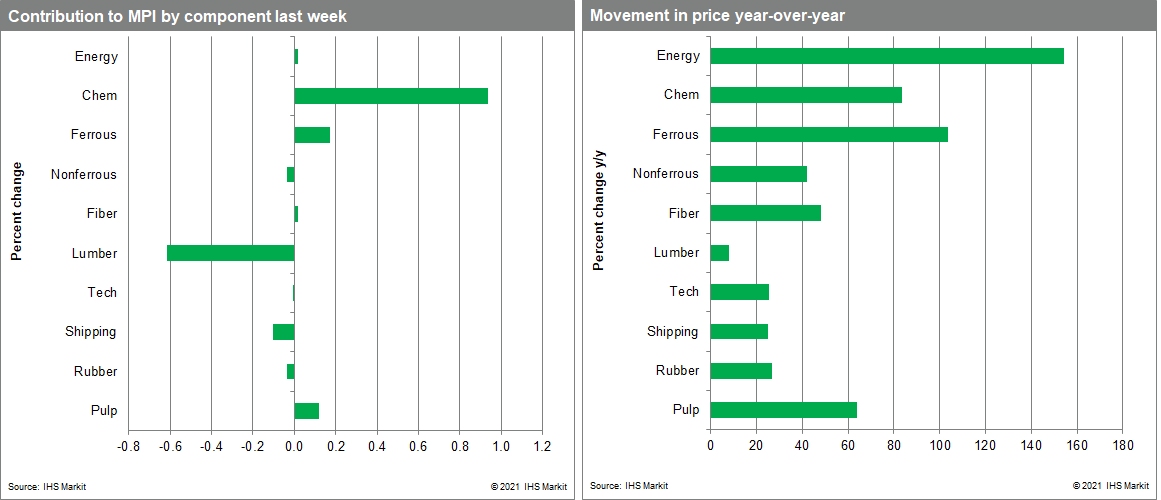

Our Materials Price Index (MPI) increased 0.5% last week, building on a 1.3% increase from the week before. Price movement was mixed with five of the ten MPI sub-components down last week. Commodity prices as measured by the MPI are up 86% compared to the same week in 2020, still a strong rate of increase but a slower rate of escalation than seen two months ago. More important, MPI is about 2% below its recent peak in early May.

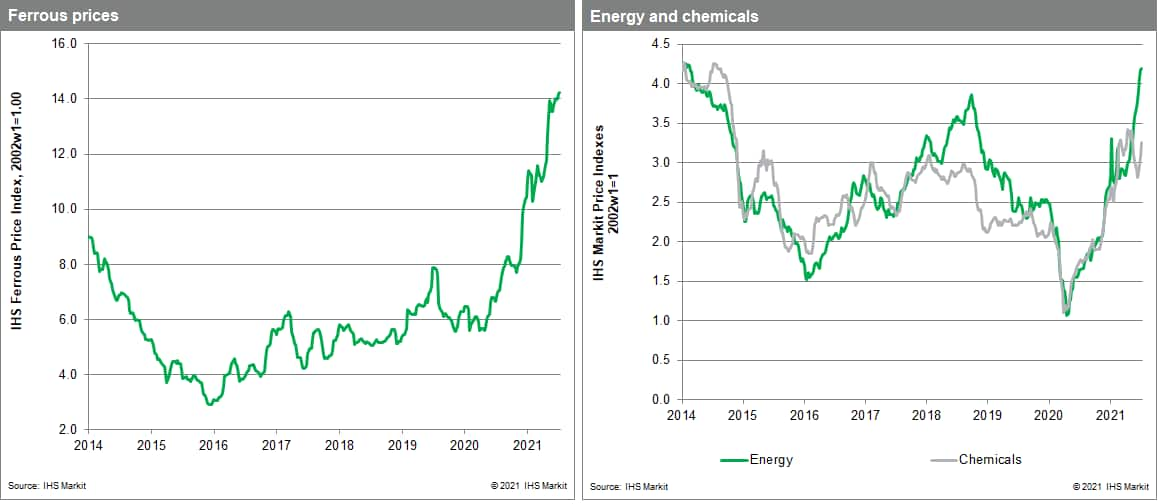

The largest gains in the MPI were seen in chemical and pulp. The MPI's chemicals sub-component was the larger driver pushing the overall index higher last week, posting a 5.5% gain. This increase marks an acceleration following the previous week's 3.6% gain. Global ethylene prices were once again the main reason for the recent strength in chemicals, recording an average increase of 13.7% across regions last week. Ethylene price increases are concentrated in North America due to unplanned outages in the US Gulf Coast. Pulp prices rose 3.5% last week, following average weekly increases of 1.2% in the two weeks prior. This recent strength marks a change from the softness in pulp markets in late May and June and is tied to firming market conditions in mainland China. On the downward side, rubber prices fell 1.6% last week. Rubber prices began declining seven weeks ago with recent weakness linked to a pullback in production by Chinese tire manufacturers. Lumber prices fell 22%, the largest drop since mid-May. Prices have reverted to November 2020 levels, driven by production catching up and buyers standing on the sidelines waiting for even lower prices. It is worth noting that certain steel finished prices, especially in North America, bear a resemblance to lumber in having reached record levels well above previous peaks. They are also likely to see a similarly rapid unwinding once the market breaks.

Data released this past week underscores a shift in consumption behavior that may reduce inflation in commodity prices. The United States Census Bureau released its monthly retail sales report and noted declining sales for segments specializing in household and recreational goods. At the same time, sales at food services and drinking places rose. As goods-based pandemic consumption makes way for service-oriented spending, pressure in durable goods markets and, in turn, upstream in commodity markets, will ease, a change the MPI is now beginning to hint at. The flip side to this improving picture of inflation in goods markets is the service sector. In the US rising airport traffic and hotel revenue nearing pre-pandemic levels are changes we expect to see replicated in other advanced economies as vaccinations become more widespread and containment measures are relaxed. As we saw in the manufacturing sector last year, however, service industries are likely to find it just as difficult to match supply with quick changes in demand with a corresponding rise in service cost inflation. There is also a general downside inflation risk in the outlook should second wave COVID-19 cases surge prior to achieving widespread global vaccination rates.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-but-more-slowly.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-but-more-slowly.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+rise+but+more+slowly+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-but-more-slowly.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices rise but more slowly | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-but-more-slowly.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+rise+but+more+slowly+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-rise-but-more-slowly.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}