Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 28, 2022

Weekly Pricing Pulse: Commodity prices increases return

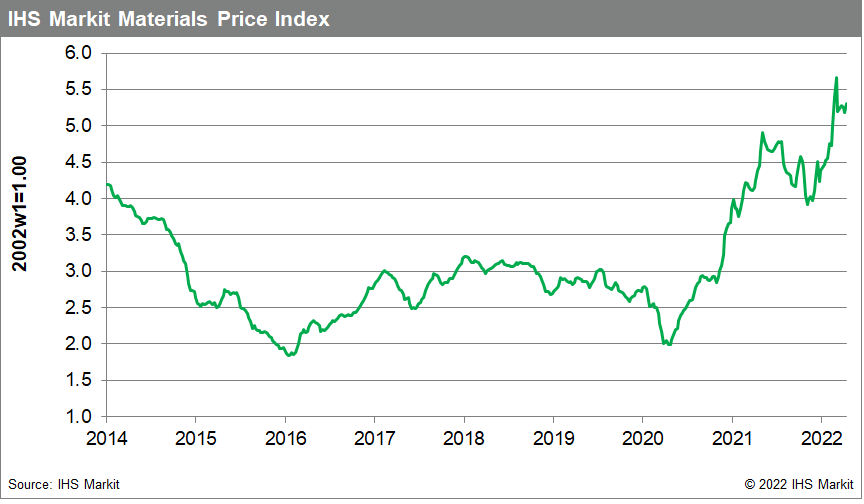

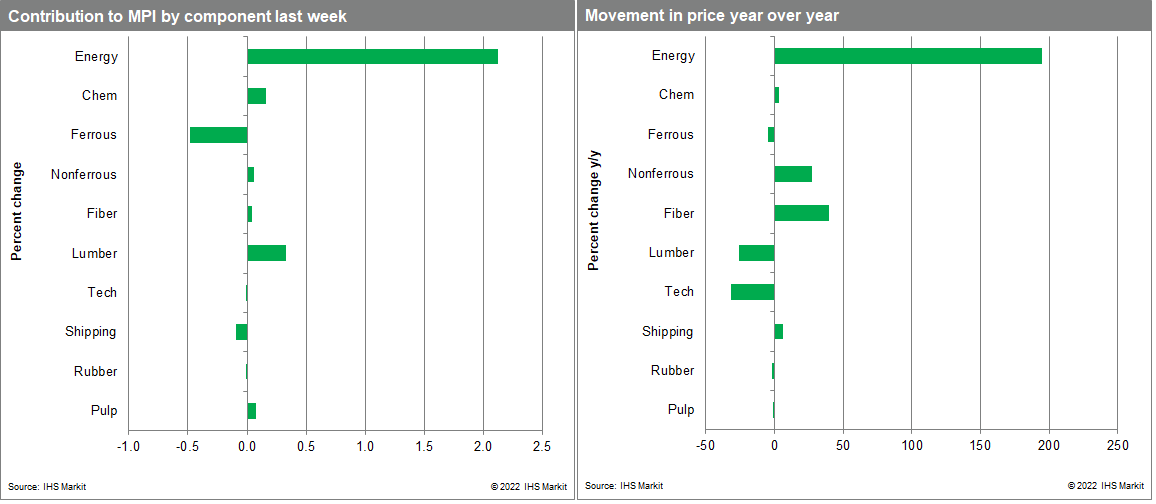

Our Materials Price Index (MPI) increased 2.2% last week, with six of the index's ten sub-components rising. Markets had been more settled in recent weeks, but the latest numbers demonstrate strong pricing pressure still exists and commodity prices remain near their all-time high established in early March.

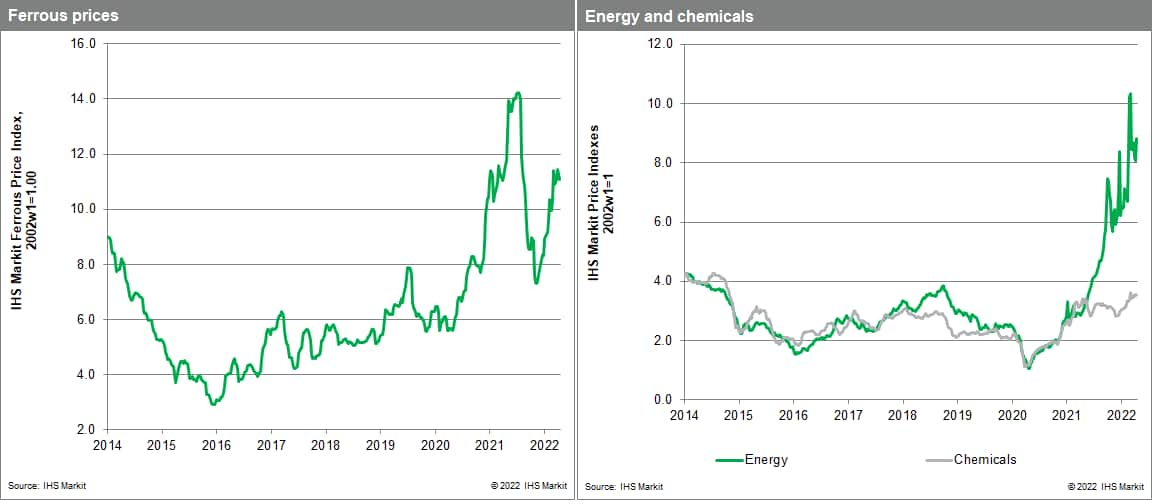

Rising energy prices were the main reason for the increase in the MPI last week. The energy sub-component soared 9.2% as coal, oil and natural gas prices all rose. Asian coal price increases were particularly strong as the benchmark Australian thermal 6000 Kilo calorie grade climbed to $364 per metric ton, up from $305 the previous week. The move was driven by low stockpiles of thermal coal at electricity plants in China and India, the two largest global importers. Indian plants were down to eight days stock based on current consumption levels and the federal government asked all states to increase imports, leading to the price hike last week. The rally in US natural gas prices continued last week as Henry Hub prices increased 6.5%, their fifth consecutive weekly rise. Increased exports to Europe and cooler temperatures in the Midwest and Northeast of the United States tightened the supply/demand balance and sent prices above $7 for the first time in a year. Lumber prices also jumped last week to reverse some of the declines in March. The onset of the spring/summer construction season created a spike in demand and sent prices 10.5% higher compared to the previous week. The number of homes under construction in the United States in March increased to a seasonally adjusted 1.622 million—the highest total since May 1973.

Another round of broad commodity price gains last week added to market nervousness over soaring inflation. US Federal Reserve Chair Powell strongly hinted at a 50-basis point interest rate increase in early May which hurt market sentiment at the end of the week. European rate increases are not likely until late this year though soaring consumer price inflation will continue to put pressure on the European Central Bank to act sooner. While the focus in commodity markets for the past month has been on real or potential disruptions to Russian exports, conditions in mainland China are also now drawing attention. Widening COVID lockdowns threaten to create yet another disruption in global supply chains while at the same time reducing demand. Tightening conditions in financial markets and softer Chinese demand could quickly check the recent upward momentum in commodity markets. Indeed, our growing sense is that commodity prices will now peak in the second quarter with a modest correction likely during the second half of the year. The caution in this sanguine view of commodity prices is that this was exactly our expectation last Spring. Prices did, in fact, fall in the second half of 2021 only to then recover and march to an all-time high in the first quarter of this year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-increases-return.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-increases-return.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+increases+return+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-increases-return.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices increases return | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-increases-return.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+increases+return+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-increases-return.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}