Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 15, 2023

Weekly Pricing Pulse: Commodity prices edge slightly higher

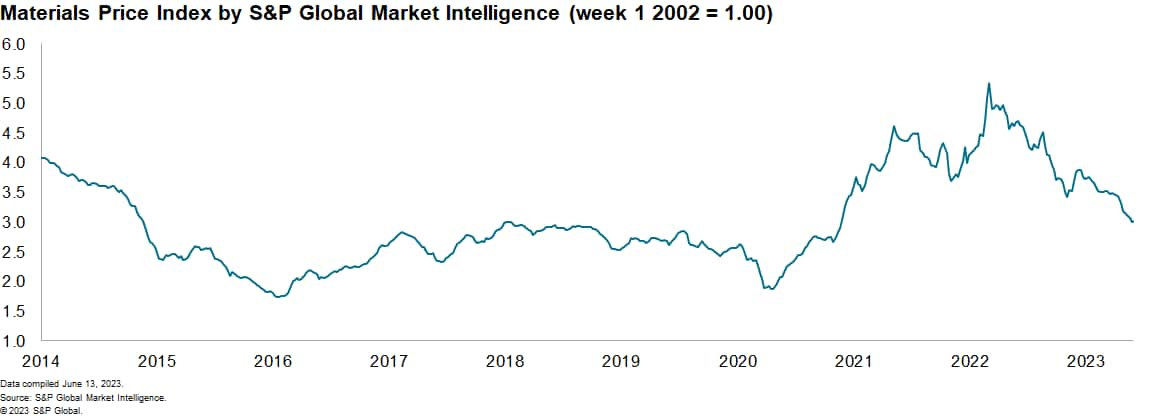

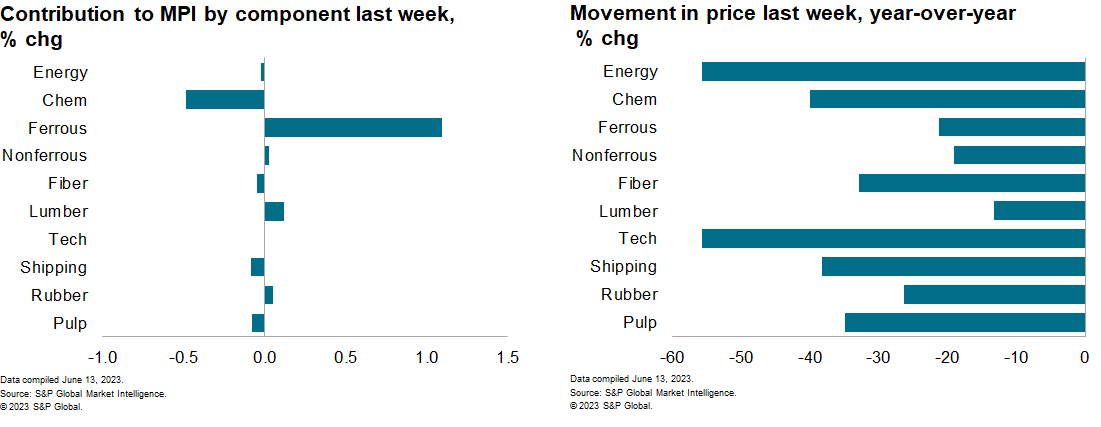

The Materials Price Index (MPI) by S&P Global Market Intelligence turned up 0.6% last week, after nine consecutive weekly declines. The increase was mixed with exactly half of the ten subcomponents rising. Despite last week's price rise the story so far in 2023 remains one of falling commodity prices with the MPI decreasing in 17 out of the last 22 weeks. The index also sits 36% below its year-ago level.

Rising iron ore prices were the major driver of last week's increase in the MPI. The ferrous sub-index climbed 3.1% as 62% fe iron ore prices in mainland China rose to $113/metric ton, from a low of $105/metric ton the previous week. The main reason for this increase was news that the six state-owned banks in mainland China planned to cut deposit rates which was expected to boost construction activity. This news also led traders to speculate that further stimulus measures would be implemented creating optimism on near-term demand conditions. Macroeconomic data remains weak, however, so last week's positive sentiment is likely to be short-lived. Optimism on Chinese growth prospects was not shared in chemical markets with the sub-index dropping 2.7% last week, the eighth consecutive weekly decline. Global chemical prices have now fallen 20% since mid-April due to oversupplied markets, low feedstock costs and weak demand in mainland China.

Markets continue to grapple with mixed signals on global economic growth, with trading notably muted last week. Strong consumer credit data in the US added some optimism but also suggested that inflation remains stubbornly high. Consumer credit outstanding increased at an annual rate of 5.7% in April, the month following the failure of Silicon Valley Bank (SVB). This indicates the Federal Reserve (Fed) may continue to tighten monetary policy and traders chose to wait for this week's meeting of the central bank (14th June) before making any big moves. Higher interest rates, uninspiring Chinese output, and globally weak demand will ultimately lead to lower commodity prices through this year.

Subscribe to our supply chain newsletter

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-edge-slightly-higher.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-edge-slightly-higher.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+edge+slightly+higher+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-edge-slightly-higher.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices edge slightly higher | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-edge-slightly-higher.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+edge+slightly+higher+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-edge-slightly-higher.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}