Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 12, 2023

Weekly Pricing Pulse: Commodity prices ease at start of 2023

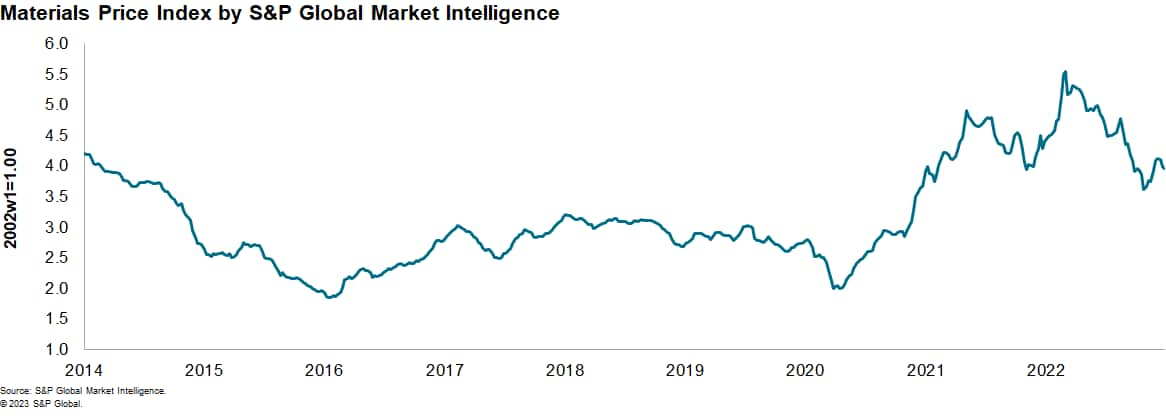

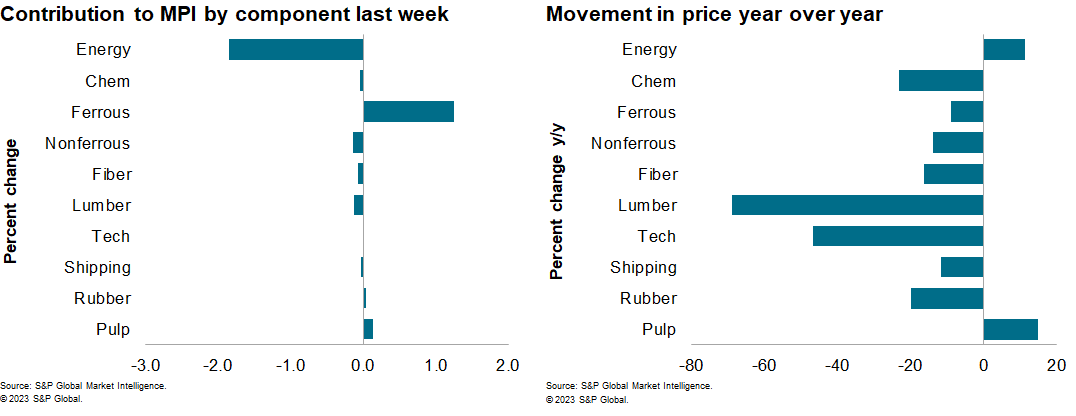

Our Material Price Index (MPI) decreased 0.8% last week as markets resumed trading after the holiday period. The decrease was mixed with six out of the ten subcomponents falling. The MPI starts the year down 6.1% year on year (y/y), led by a 15.6% decline in nonenergy prices. That said, prices remain far higher (46%) than the pre-pandemic levels of the fourth quarter 2019.

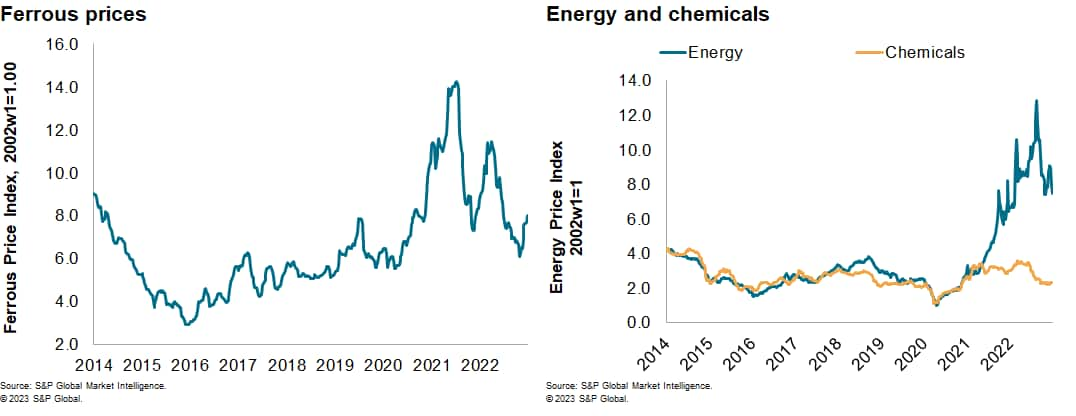

Energy and chemical prices were notable drops last week. The energy sub-index posted a 6.1% decline, following an 11.4% decrease the previous week. Spot landed prices of Liquefied Natural Gas in Europe dipped below $20/MMBTu for the first time since June 2022, having been as high as $70/MMBTu in August 2022. In addition, Asian prices fell by $6/MMBTu on average last week. Meanwhile, in the United States, average spot Henry Hub natural gas prices settled at $3.70/MMBtu, a 12-month low. Global prices were reacting to generally milder weather conditions which reduced heating demand. In Europe, supply remains healthy with storage facilities around 84 per cent full, which is more than 10 per cent higher than the average over the last five years. In the US a major export facility (Freeport LNG) remains offline which has boosted supply levels in North America and created additional downward pressure on Henry Hub prices. Oil markets displayed similar weakness with Brent Crude, the international benchmark, settling below $80/barrel. Falling oil prices translated to lower feedstock costs for chemicals and nudged the sub-index down 0.3%. There were elements of price strength last week with iron ore prices jumping 4.7% as mills began to restock ahead of the Chinese Lunar New Year which begins on the 21st January.

Markets remain nervous about global economic prospects but are turning more positive on the inflation outlook. Consumer price inflation slowed more than expected in the Eurozone which boosted market sentiment. Eurozone Harmonized Index of Consumer Prices (HICP) inflation plunged from 10.1% to 9.2%, well below the initial market consensus expectation (9.7%) for the second straight month. In the US, average hourly earnings rose less than expected in December indicating easing wages and salaries pressure heading into the first quarter. This better news on inflation underpinned the view that central banks will ease their aggressive interest rate stances in 2023. That is not a view shared by S&P Global Market Intelligence. For commodities, weaker growth signals in mainland China will continue to prove a headwind for prices in the near term. While better news on inflation may spark some price surges, slowing economic growth will lead to lower commodity prices overall this year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-ease-at-start-of-2023.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-ease-at-start-of-2023.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+ease+at+start+of+2023+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-ease-at-start-of-2023.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices ease at start of 2023 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-ease-at-start-of-2023.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+ease+at+start+of+2023+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-ease-at-start-of-2023.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}