Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 19, 2023

Weekly Pricing Pulse: Commodity prices down as bearish sentiment remains

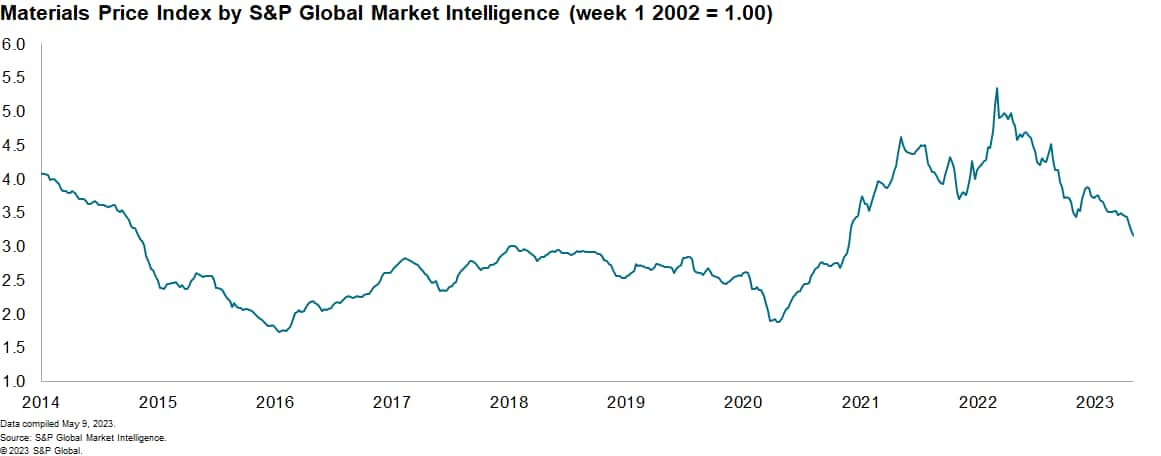

The Materials Price Index (MPI) by S&P Global Market Intelligence decreased 1.3% last week, the sixth consecutive weekly decline and eighth out of the last ten weeks. The decrease was widespread with eight of the 10 subcomponents falling. The story of the last few months has been one of falling commodity prices with the MPI decreasing in 14 out of the last 18 weeks. The index sits 32% below its year-ago level.

Declining industrial metal prices were the major driver of last week's decrease in the MPI. The nonferrous metal sub-index was down 1.7% with every metal from aluminum to zinc declining. Zinc prices fell to $2516/tonne on the London Metal Exchange (LME) last week. This is the lowest recorded price since October 2020. Markets continue to revise down Chinese demand expectations for this year, but an improving supply outlook also played a part in last week's price decline. The International Lead and Zinc Study Group (ILZSG) forecast zinc mine production to rise 3% in 2023, following a 2.5% decline in 2022. While the zinc market remains in deficit this year, the trade group believe the overall figure to be a modest 45,000 tonnes down from a figure of 150,000 tonnes in its previous update in October 2022. Lead markets exhibited similar characteristics with supply forecast to grow 2.8% while demand grows by 1.7%. Elsewhere, weak demand from mainland China continued to weigh on chemical prices with the sub-index down 1.5% last week, following a 4.5% decline the week before.

![]()

Markets remain concerned over global economic growth prospects, with fears over inflation and the US debt ceiling standoff dominating trading last week. The University of Michigan Consumer Sentiment Index decreased 5.8 points to 57.7 in the preliminary May reading driven by worsening views on expectations for future inflation. Outside of the US, both the European Central Bank and the Bank of England announced further interest rate rises to combat persistently high consumer prices. The debt ceiling crisis in the United States continues to create fear after a series of meetings between the four leaders of Congress and US President failed to reach a conclusion. Markets fear a repeat of the 2011 debt ceiling crisis which caused equity valuations to plummet. For commodity markets higher interest rates, combined with falling natural gas costs for producers and weaker manufacturing growth, will ultimately contribute to lower prices overall this year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-down-bearish-sentiment.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-down-bearish-sentiment.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+down+as+bearish+sentiment+remains+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-down-bearish-sentiment.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices down as bearish sentiment remains | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-down-bearish-sentiment.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+down+as+bearish+sentiment+remains+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-down-bearish-sentiment.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}