Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 28, 2023

Weekly Pricing Pulse: Commodity prices dip as oil demand weakens

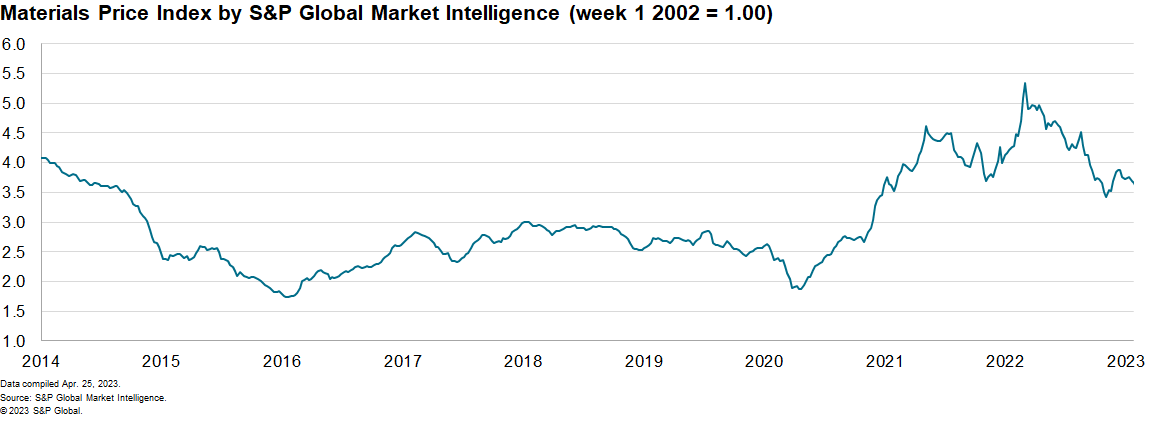

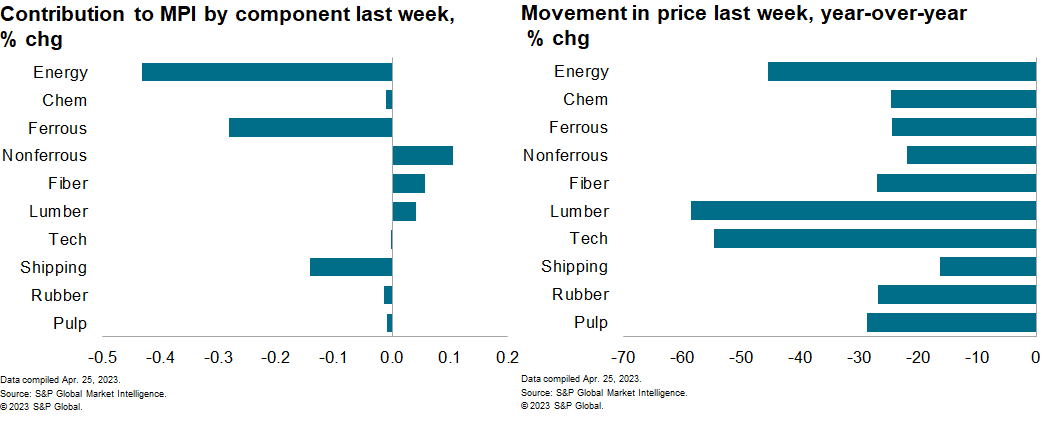

The Material Price Index (MPI) by S&P Global Market Intelligence decreased 0.7% last week, the third consecutive weekly decline. The decrease was widespread with seven of the ten subcomponents falling. The story of 2023 so far has been one of falling commodity prices with the MPI decreasing in 11 out of the last 15 weeks. The index also sits 31% below its year ago level which was near the all-time peak.

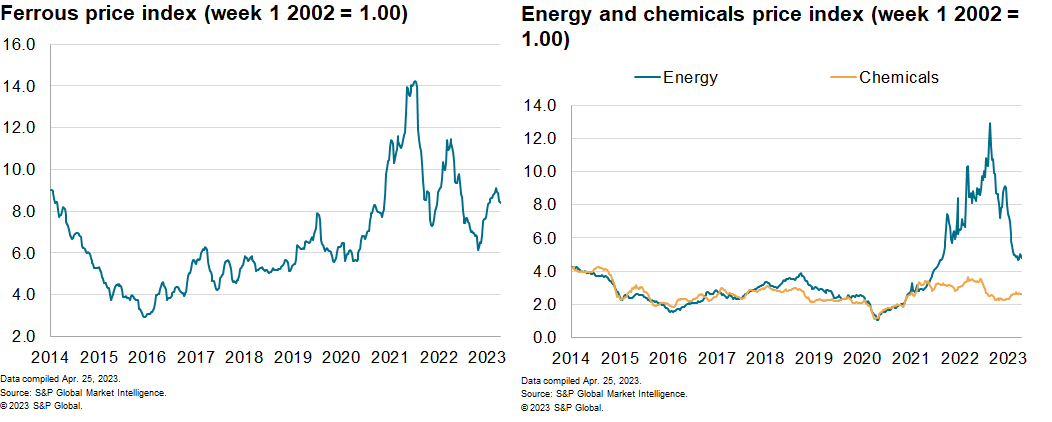

Declining energy prices were the major driver of last week's decrease in the MPI. The energy sub-index was down 3.8% with oil prices notably weak. Brent Crude Oil, the international benchmark, fell back to $80/barrel from $88/barrel the week before. Prices had been higher after the announcement by OPEC+ at the beginning of April to cut production amid strong non-OPEC output and soft demand. However, demand signals continue to weaken, and traders were particularly concerned by the poor European PMI manufacturing numbers released last week. The HCOB Flash Eurozone Composite PMI Output Index, compiled by S&P Global, showed that manufacturing output contracted at the sharpest rate since December, falling back into decline after two months of marginal growth. The fall in oil prices lowered feedstock costs for ethylene and this was enough to push our chemicals sub-index down 0.1% last week. Elements of price strength remain in commodity markets, however, with the nonferrous metal sub-index increasing 1.1%. The highest price growth was seen in tin which climbed to $26,097/tonne, having been at $22,000/tonne in the middle of March. Myanmar, mainland China's biggest single supplier, announced it would ban all tin mining from August to preserve resources. Indonesia is also considering the prospect of an export ban which added further concern that supply issues will surge this year.

A slower manufacturing sector continues to emerge from the data. Positive news came from the HCOB Flash Eurozone Composite PMI Output Index, compiled by S&P Global, which reached its highest level since May of last year. However, market bears focused on the uneven nature of growth with the service sector reporting its strongest expansion for a year whereas manufacturing output declined in all major developed economies bar the United States. US "flash" PMI signals indicated broad-based expansion in April, which suggests the Federal Reserve (Fed) will increase the federal funds rate target range by 25 basis points at its policy meeting in May. Higher interest rates, combined with falling natural gas costs for producers and weaker manufacturing growth, will ultimately contribute to lower commodity prices overall this year.

A slower manufacturing sector continues to emerge from the data. Positive news came from the HCOB Flash Eurozone Composite PMI Output Index, compiled by S&P Global, which reached its highest level since May of last year. However, market bears focused on the uneven nature of growth with the service sector reporting its strongest expansion for a year whereas manufacturing output declined in all major developed economies bar the United States. US "flash" PMI signals indicated broad-based expansion in April, which suggests the Federal Reserve (Fed) will increase the federal funds rate target range by 25 basis points at its policy meeting in May. Higher interest rates, combined with falling natural gas costs for producers and weaker manufacturing growth, will ultimately contribute to lower commodity prices overall this year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip-as-oil-demand-weakens.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip-as-oil-demand-weakens.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+dip+as+oil+demand+weakens+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip-as-oil-demand-weakens.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices dip as oil demand weakens | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip-as-oil-demand-weakens.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+dip+as+oil+demand+weakens+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-dip-as-oil-demand-weakens.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}