Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jun 09, 2021

Weekly Pricing Pulse: Commodity prices continue their retreat

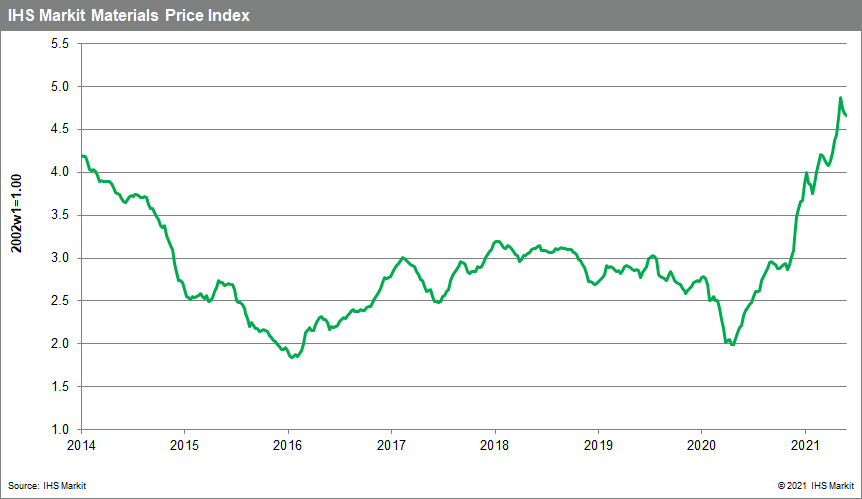

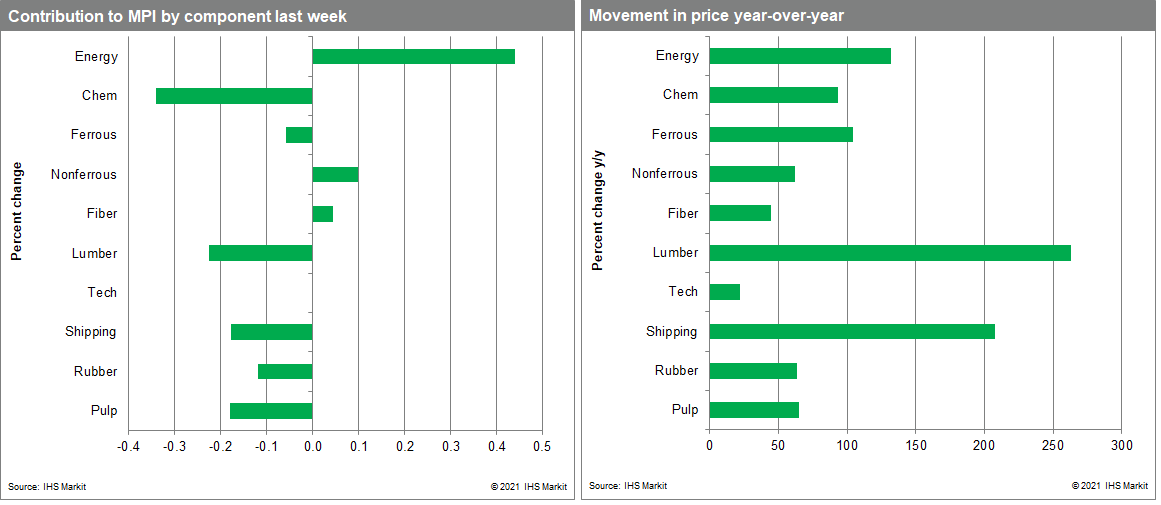

Our Markit Materials Price Index (MPI) fell 0.5% last week, following a 1.4% decrease the previous week. This was the third consecutive drop in the MPI; declines were also broad with seven of the MPI's ten subcomponents falling. Notwithstanding their recent consolidation, commodity prices as measured by the MPI are still up 21% since the beginning of 2021.

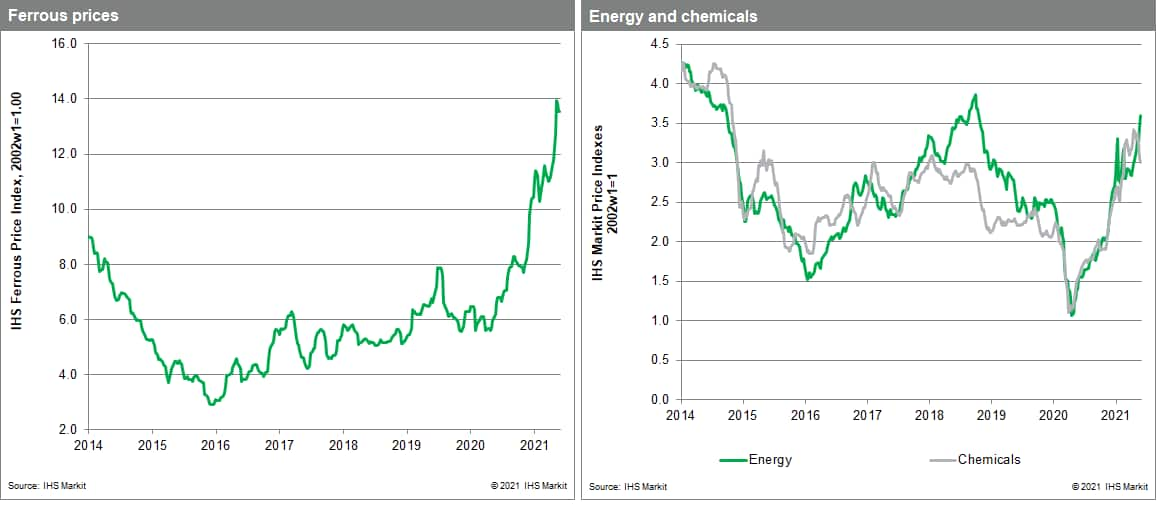

Chemicals prices were the largest contributor to last week's downward move. Global chemical prices fell 2%, after a 5% drop the previous week, as supply bottlenecks continue to ease. Ethylene markets globally witnessed the largest declines, with North American prices down 7%. This followed the resumption of activity at several production plants in the US Gulf Coast and the imminent startup of a new facility in Port Arthur, Texas. This continues the supply-side recovery in North American chemical markets with inventory levels returning to long-term averages after being severely depleted by winter storm Uri. Natural rubber markets were also weaker last week, with the sub-index down4.4%. Chinese tire producers have reduced operating rates, lowering demand for natural rubber and leading to softer pricing. Elements of the MPI showed strength last week including nonferrous metals, with our sub-index up 1.3% following broad based gains in the complex. Nickel, aluminum and tin prices all showed gains of more than 2.0%. Tin prices hit a ten-year high as demand from consumer electronics, including laptops and mobile phones, soared. Supply was also hit by droughts in Yunnan, south-west China, which caused a shortage of hydroelectric power and forced tin smelters to close. In addition, a volcano in DRC caused shipping delays creating further supply pressures in global tin markets.

Although commodity markets remain strong, overtly bullish sentiment has begun to ebb with prices having now seen a three-week correction. In physical markets, there are signs that high prices are encountering buyer resistance. But market optimism is also being tested by the appearance of higher inflation and growing nervousness that this may prompt central banks to begin reducing the amount of support they have been providing. The next few weeks will provide a more definitive answer to the question of whether the recent consolidation in prices is just a pause in commodities' one year uptrend or a sign that the rally may have run its course.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-their-retreat.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-their-retreat.html&text=Weekly+Pricing+Pulse%3a+Commodity+prices+continue+their+retreat+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-their-retreat.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity prices continue their retreat | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-their-retreat.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+prices+continue+their+retreat+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-prices-continue-their-retreat.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}