Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Mar 25, 2022

Weekly Pricing Pulse: Commodity markets see their first retreat of 2022

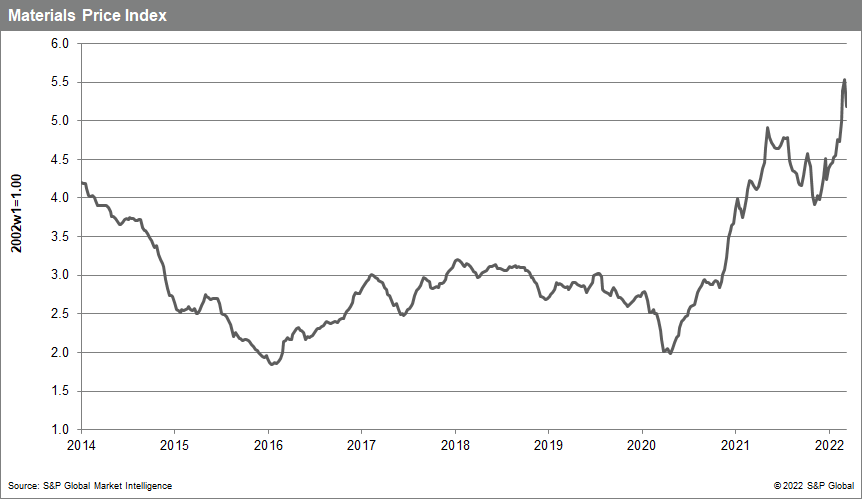

Our Materials Price Index (MPI) fell 6.3% last week, the index's first decline of 2022. Price declines were broad with nine out of ten sub-components in the index falling. Despite last week's drop, commodity prices still sit above the previous all-time high set in April 2011.

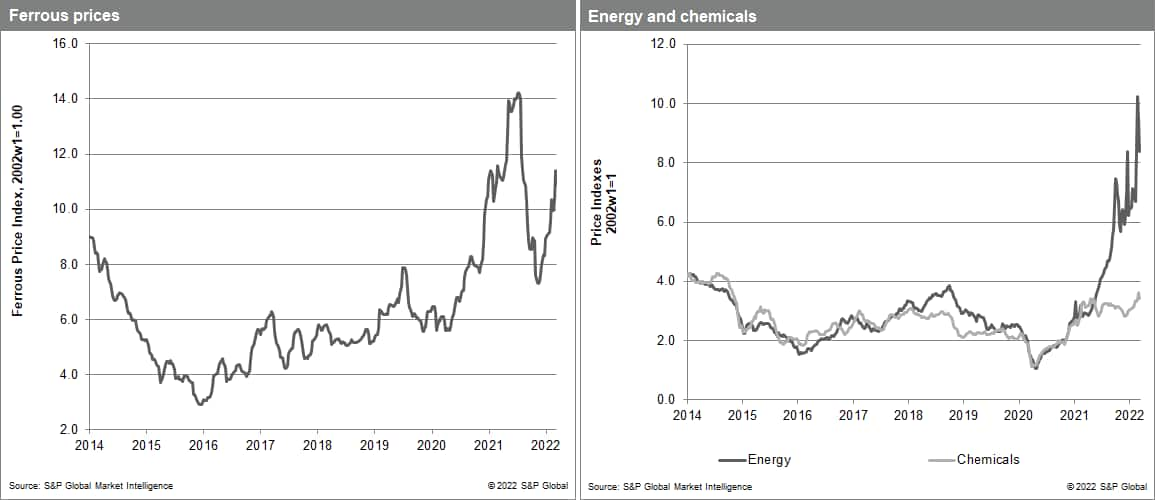

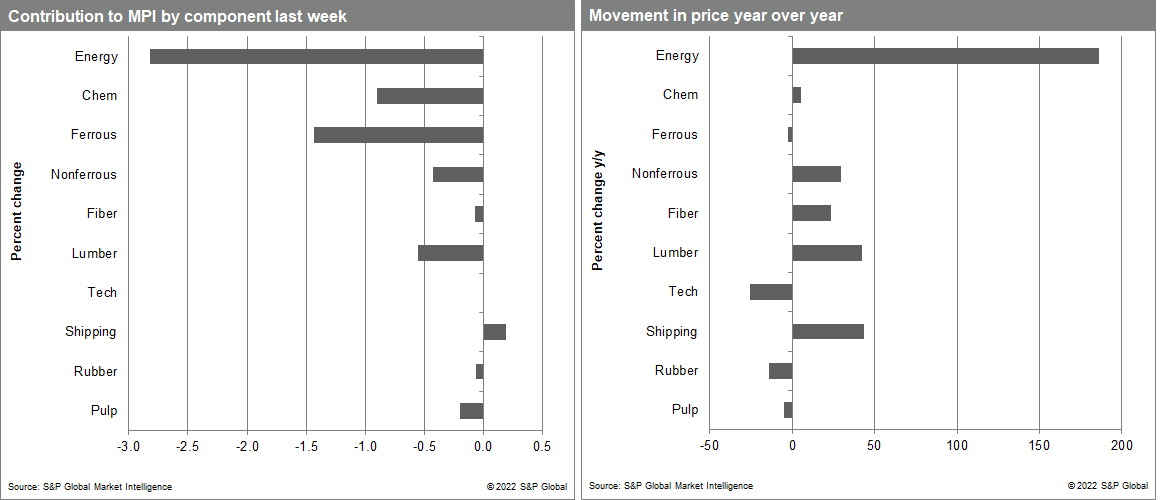

Falling energy prices were the principal reason for MPI's decline last week, with the subcomponent diving 11.4%, its second consecutive double-digit drop. Price declines last week were concentrated in Asian and European natural gas and oil in the United States, Asia, and Europe. Energy prices will be volatile for the immediate future as markets adjust assumptions about Russian oil and gas supply and how strong global demand will be. Energy prices remain high, however, despite their recent correction and are expected to remain strong for the rest of 2022. Limited spare capacity in oil markets, low natural gas inventories in Europe and Asia, and the general uncertainty surrounding sanctions and buyer boycotts will keep markets stretched. The invasion of Ukraine is uniquely enhancing energy demand transportation segments as air freight and oceangoing shipping use longer routes to avoid conflict zones. Freight rates climbed 7.7% last week, the sole subcomponent in the MPI to rise.

While commodity prices fell this week, prices remain high with markets far from calm. The tightening in trade finance reflects this heightened uncertainty. Higher initial margins on futures contracts and difficulties in securing letters of credit have pushed traders, investors, and even physical users to the sidelines. The net result has been a drop in open interest and, in turn, liquidity in many commodity markets, aggravating volatility, a condition that will continue into the second half of the year, compounding problems for supply chains.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-see-first-retreat-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-see-first-retreat-2022.html&text=Weekly+Pricing+Pulse%3a+Commodity+markets+see+their+first+retreat+of+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-see-first-retreat-2022.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodity markets see their first retreat of 2022 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-see-first-retreat-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodity+markets+see+their+first+retreat+of+2022+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodity-markets-see-first-retreat-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}