Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 16, 2022

Weekly Pricing Pulse: Significant price rises for commodities

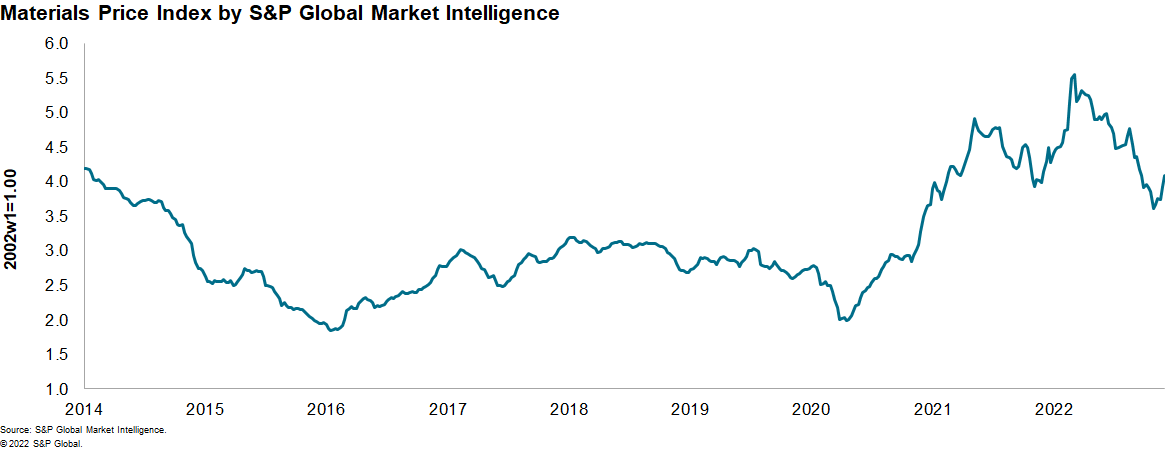

The Material Price Index (MPI) by S&P Global Market Intelligence increased 4% last week, building on the 5.2% rise the previous week (the largest single weekly increase since late February.) The increase was mixed with exactly half of the ten subcomponents rising. The significant price rises in the past two weeks demonstrate the excess volatility in commodity markets at present. However, the longer-term trend of downward correction in commodity prices remains intact with the MPI 28% lower than its all-time high established back in early March. That said, prices remain far higher (50%) than the pre-pandemic levels of fourth quarter 2019.

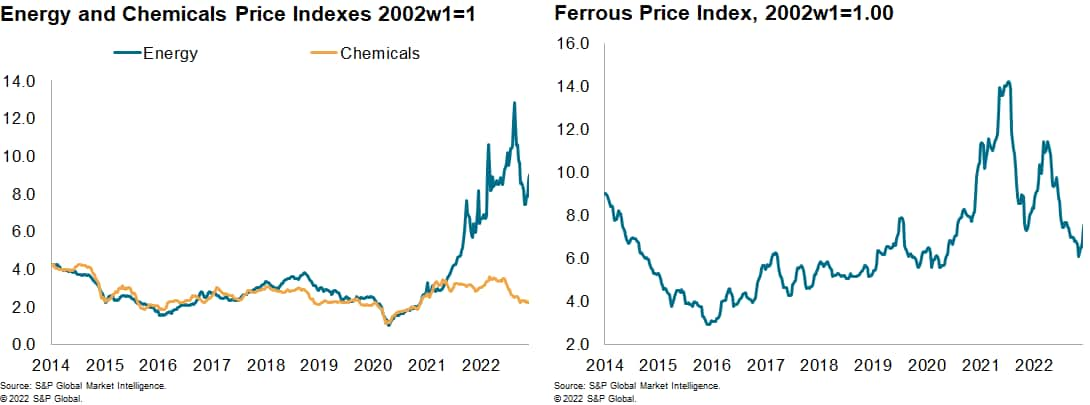

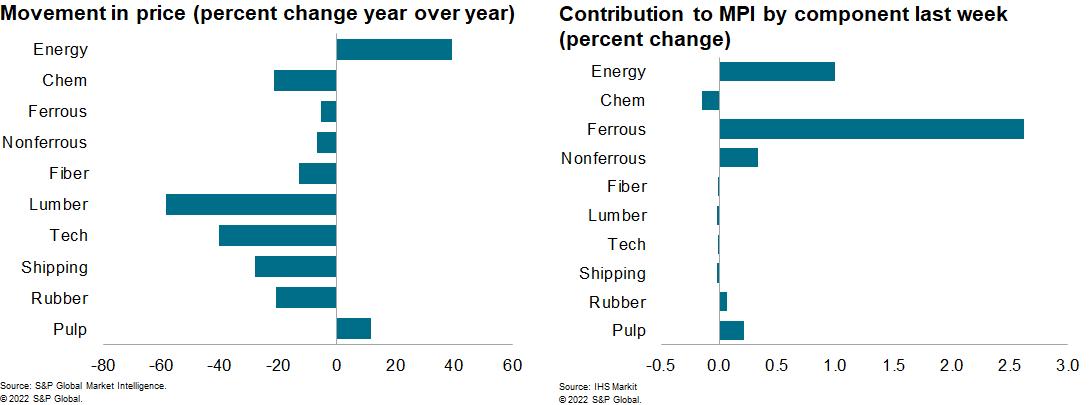

Industrial metals were the main driver of last week's rise in the MPI. The steel making raw materials sub-index increased 9.7% the biggest rise since March. Iron ore prices reached $110/metric ton last week, up from a low of $92/metric ton the week before with scrap steel prices also rising 5% on average. The nonferrous metal sub-index climbed 4% last week with every metal in the sub-index from aluminum to zinc registering an increase. Metals traders have turned more optimistic on mainland China's economic prospects in recent weeks which has supported pricing. Despite the overall increase in the MPI oil prices continue to decline and Brent Crude, the international oil benchmark, settled below $80/barrel last week. This had a knock-on effect on chemicals, since oil is the major feedstock, and the chemical sub-index dipped 1% as a result.

The expectation that the Central Economic Work Conference (starting December 15th) will boost the Chinese property sector buoyed commodities last week. However, markets were spooked by the stronger than expected producer price inflation data in the United States and consequent fears of higher interest rate rises. While unlikely to alter the Fed approach to rate hikes this time around it served as a reminder of the scale of the inflation challenge. With economic growth set to slow in 2023 lower commodity prices are expected, but metals market volatility may well result in further price spikes like last week.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-see-significant-price-rises.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-see-significant-price-rises.html&text=Weekly+Pricing+Pulse%3a+Significant+price+rises+for+commodities+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-see-significant-price-rises.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Significant price rises for commodities | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-see-significant-price-rises.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Significant+price+rises+for+commodities+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-see-significant-price-rises.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}