Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 20, 2023

Weekly Pricing Pulse: Commodities lower as inflation remains stubbornly high

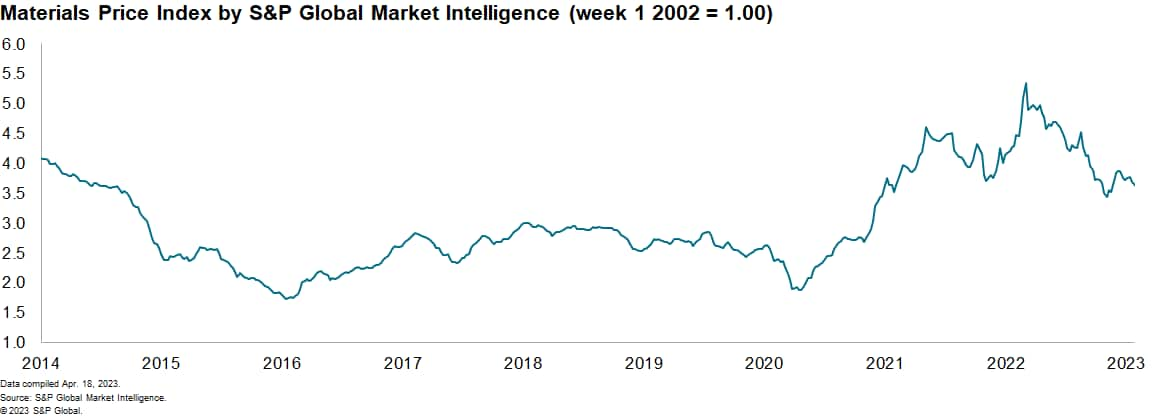

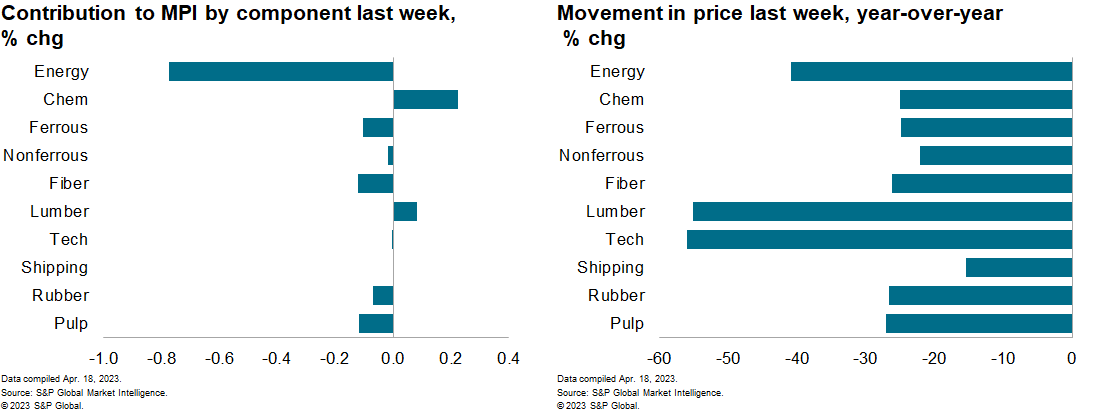

The Material Price Index (MPI) by S&P Global Market Intelligence decreased 0.9% last week, the second consecutive weekly decline. The decrease was widespread with seven of the ten subcomponents falling.

The story of 2023 so far has been one of falling commodity prices, with the MPI decreasing in 10 out of the last 14 weeks. The index also sits 30% below its year-ago level, which was near the all-time peak.

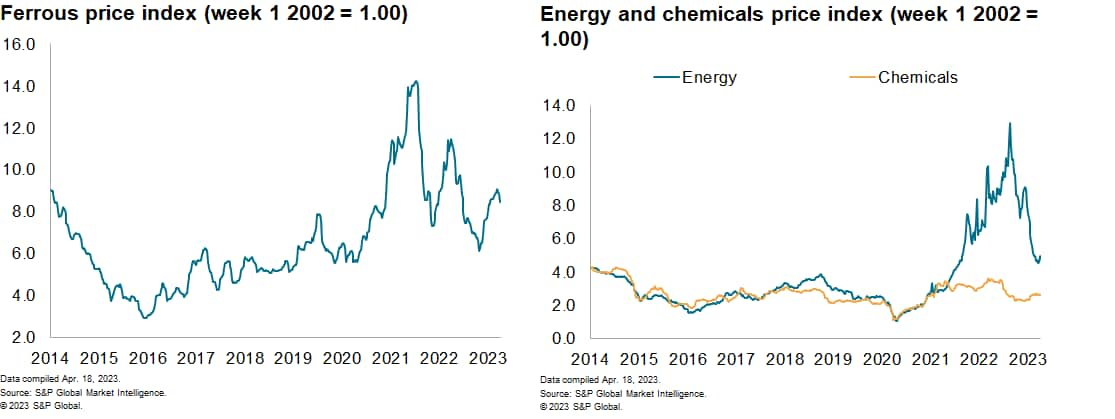

Declining energy prices were the major driver of last week's decrease in the MPI. The energy sub-index was down 3.8%, with global natural gas and coal prices both falling. Liquified Natural Gas (LNG) in Europe stood at $12.29/MMBTu last week, down from $13.65/MMBTu the week before and from a record peak of $70/MMBTu in August 2022. A combination of milder than average April temperatures and a strong inventory build have caused this slide. In addition, storm conditions in the UK last week increased wind power generation which drove demand for natural gas down and further weighed on prices.

Weaker natural rubber prices also contributed to the MPI's downward movement last week. Natural rubber prices on the Singapore Exchange dipped to 154 cents/pound, down from 160 cents/pound the week before. This was attributed to a weaker 2023/24 demand outlook for the automotive tire markets. Major tire manufacturers Bridgestone, Michelin and Continental have sounded notes of caution on sales figures for the year ahead which weighed on natural rubber prices.

Markets continue to grapple with mixed signals on global economic growth. Bank shares showed improvement last week with JP Morgan Chase reporting better than expected first-quarter results, raising hopes that any damage from the collapse of Silicon Valley Bank may be relatively contained.

US core inflation remained stubbornly high in March, with the 12-month increase edging up 0.1 percentage point to 5.6%. This, in combination with strength in employment, income, and consumer sentiment, suggests the Federal Reserve (Fed) will increase the federal funds rate target range by 25 basis points at its policy meeting in May. Higher interest rates, combined with falling natural gas costs for producers, will ultimately contribute to lower commodity prices overall this year.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-lower-as-inflation-stubborn.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-lower-as-inflation-stubborn.html&text=Weekly+Pricing+Pulse%3a+Commodities+lower+as+inflation+remains+stubbornly+high+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-lower-as-inflation-stubborn.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Commodities lower as inflation remains stubbornly high | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-lower-as-inflation-stubborn.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Commodities+lower+as+inflation+remains+stubbornly+high+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-commodities-lower-as-inflation-stubborn.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}