Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

May 20, 2021

Weekly Pricing Pulse: Animal Spirits

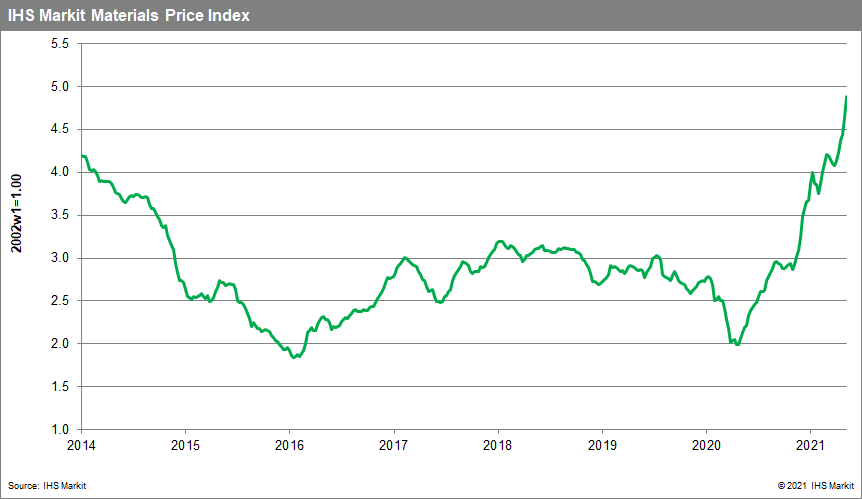

Our Materials Price Index (MPI) climbed 5.2% last week, following a 4.5% increase the previous week. This is the sixth consecutive weekly price increase and puts the index at its highest point since May 2011. Prices, as measured by the MPI, have increased 131% since mid-May 2020.

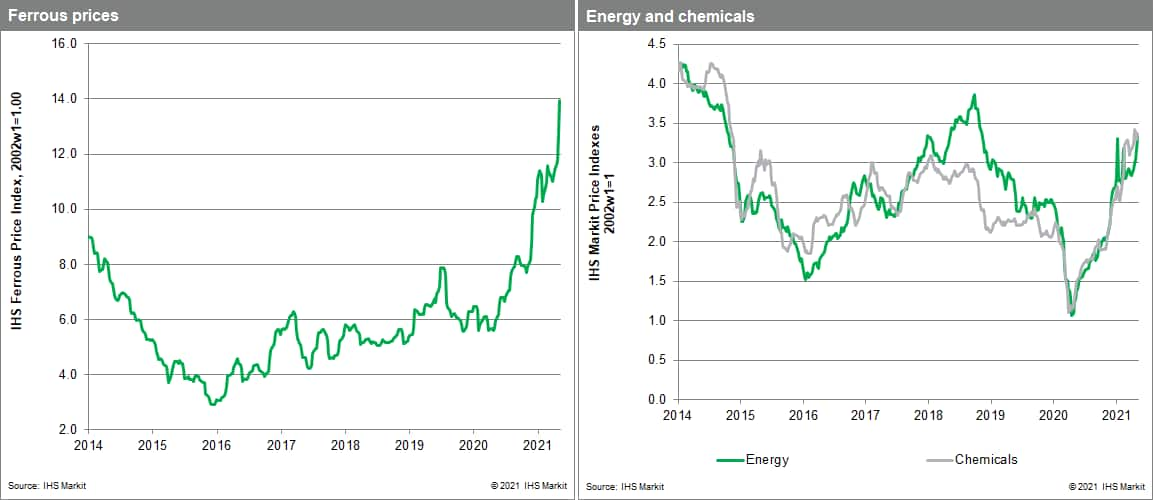

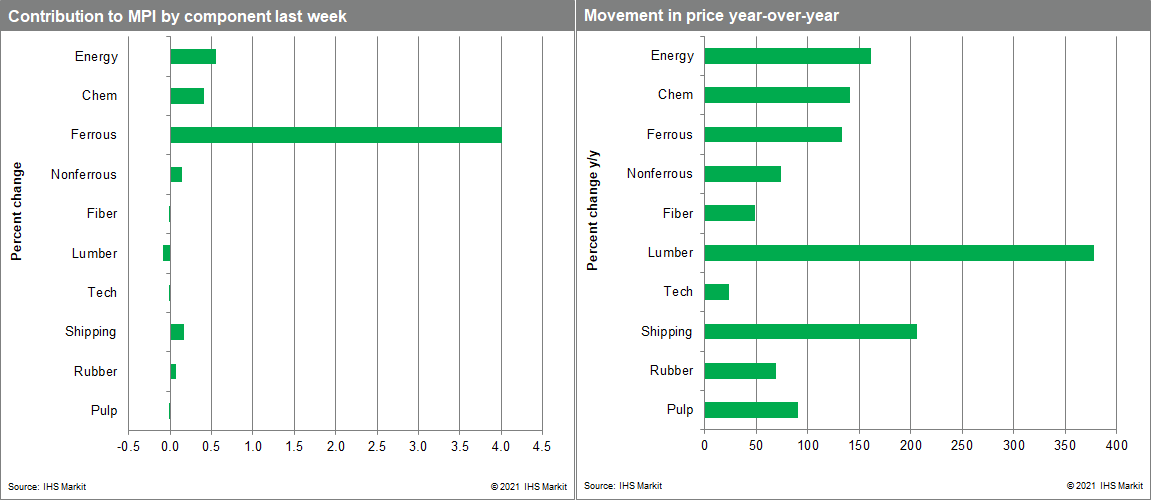

Six of the MPI's ten sub-components posted increases last week with ferrous metals and energy the largest reasons for the upward move. The steel-making raw materials index jumped 9.6% as iron ore spot prices touched $230 per metric ton on metal exchanges. There were signs of weakening sentiment towards the end of the week after the local government in Tangshan, mainland China's main city of production, announced its intention to intervene should any mills be found to be hoarding stock in order to push up prices. However, the key factor behind the recent price rally is strong Chinese demand so it is unclear how effective this government intervention will be in lowering prices in the near-term. The energy index was up 5% as natural gas and coal prices increased considerably. Coal prices saw broad-based gains as trade tensions between China and Australia curbed Australian imports into China. This sent thermal coal prices up to RMB900 per tonne with the MPI's global coal sub-index jumping 7.5% as a result. In contrast, lumber prices decreased after seven consecutive weeks of growth. The decline was only 1.4% but considering the lumber, sub-index has gained 90% since March, which provides a welcome change for buyers.

In contrast to commodities, equity markets pulled back last week with the FTSE All-World index down 1.5%, its biggest weekly drop in over three months. Markets were roiled by US inflation data, which showed the consumer price index was 4.2% higher in April 2021 than April 2020. This was above market expectations and was the largest monthly year-over-year increase in US inflation since 2008. As expected, the surge in commodity prices over the past year is now filtering downstream. This normal lagged transmission of upstream cost increases is being amplified to a degree by base effects, with the strong price declines of early 2020 now dropping out of the year over year calculations. Still, the overlying reason for the rise in commodity prices and now top-line inflation are the continuing disruptions in supply chains. What prices are signaling is a global economy struggling to adjust to the severe jolt of the pandemic. The only solace in looking forward is that absent some new shock, IHS Markit believes supply-chain conditions during the second quarter are as bad as they will get. Assuming some improvement this summer, inventories will begin to recover with delivery times starting to improve. Most importantly, this change should also be accompanied by some price relief in the second half of the year.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-animal-spirits.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-animal-spirits.html&text=Weekly+Pricing+Pulse%3a+Animal+Spirits+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-animal-spirits.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: Animal Spirits | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-animal-spirits.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+Animal+Spirits+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-animal-spirits.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}