Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Jan 04, 2023

Weekly Pricing Pulse: A mixed week for commodity markets overshadowed by sharp decline in energy prices

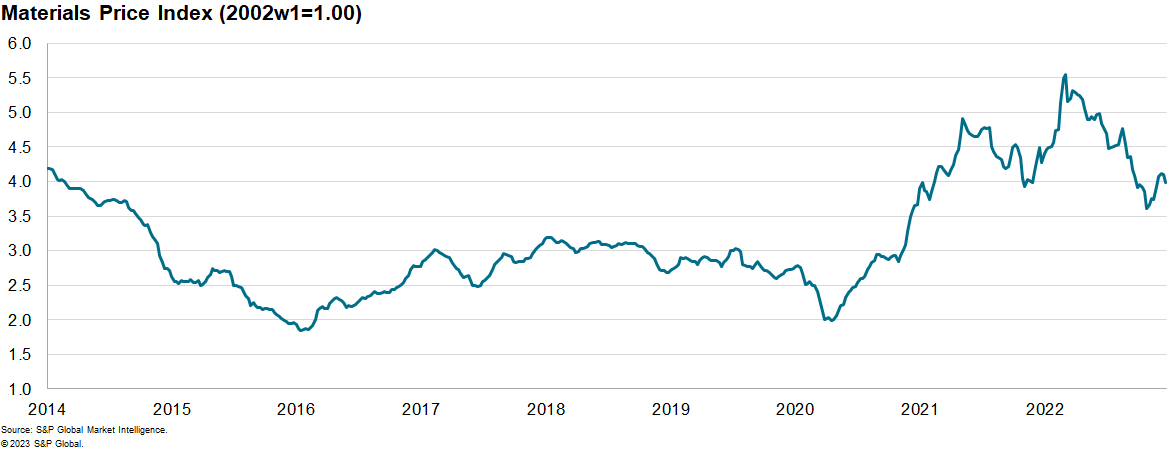

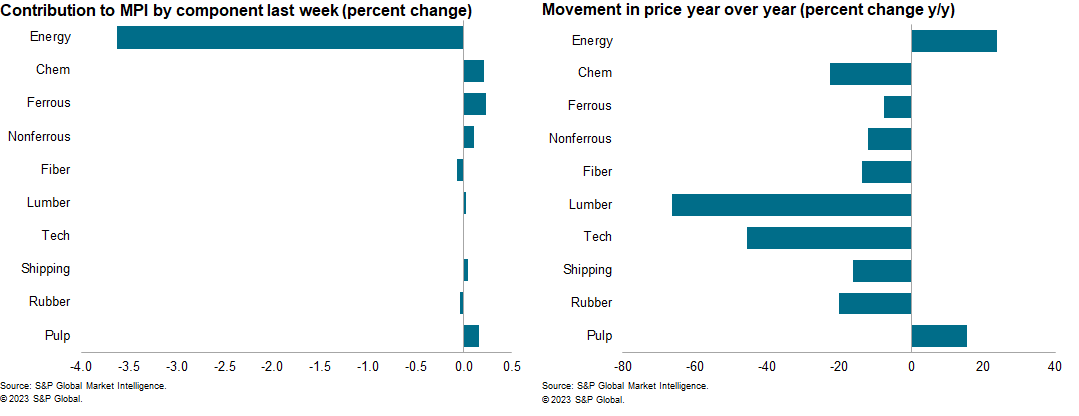

Our Material Price Index (MPI) decreased 2.8% in the last week of 2022, the second consecutive weekly decline. Despite the large decline, six of the ten subcomponents increased last week. The MPI is 6.1% lower than a year ago, and 30% lower than its all-time high established in early March.

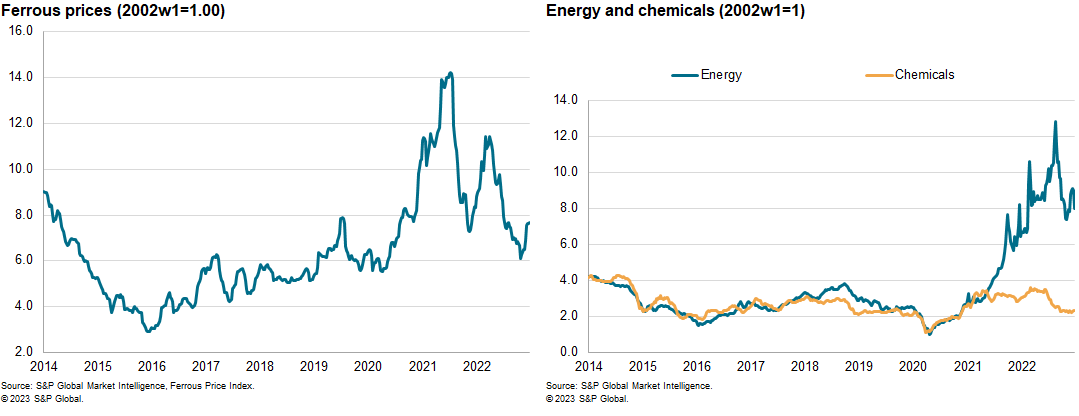

Energy prices were once again the biggest mover last week. A 32% decline in natural gas prices pulled the energy index 11.2% lower last week. The US saw a shift from a far below average weather pattern during the Christmas weekend to much milder weather to begin the new year while the European continent faces temperatures far above normal levels in early January. The bottom line is warm weather caused below average demand. The MPI-excluding energy commodities increased 1% last week, led by significant increases in pulp, chemicals, and nonferrous metals. The pulp index registered a 4% increase, though this followed a 3.2% decline in the previous week and is likely as much a factor of the quiet holiday week as anything else. Nonferrous metals likewise saw a bit of a rebound following the previous week's decline, plus a reflection of generally better than expected demand sentiment in Europe and the United States. In chemicals markets, the downward price correction seems to have run its course. The 1.4% increase last week leaves chemicals prices up 5% over the last three weeks. The efforts by producers to slash output in response to soft demand has led to a bounce in prices for now.

In Asia last week, three releases suggest slower economic activity for the November/December period. Retail sales in Japan cooled from 4.4% year-over-year growth in November to 2.6% in December. Industrial production in South Korea in November was 3.7% below year ago levels, a downturn from the 1.2% year-over-year growth as of October. The composite PMI for mainland China slid to 42.6 in December from 47.1 in November, indicating a more widespread downturn in economic activity. The rollback of China's containment policy and the disruptions stemming from labor shortages drove the retreat in economic activity. In the US, a build in wholesale inventories in November beat expectations and suggested a bit more strength in fourth quarter GDP than assumed. Commodity prices enter 2023 below year-ago levels, and far below the early March peak.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-a-mixed-week-overshadowed-energy-decline.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-a-mixed-week-overshadowed-energy-decline.html&text=Weekly+Pricing+Pulse%3a+A+mixed+week+for+commodity+markets+overshadowed+by+sharp+decline+in+energy+prices+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-a-mixed-week-overshadowed-energy-decline.html","enabled":true},{"name":"email","url":"?subject=Weekly Pricing Pulse: A mixed week for commodity markets overshadowed by sharp decline in energy prices | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-a-mixed-week-overshadowed-energy-decline.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Pricing+Pulse%3a+A+mixed+week+for+commodity+markets+overshadowed+by+sharp+decline+in+energy+prices+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-pricing-pulse-a-mixed-week-overshadowed-energy-decline.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}