Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Feb 07, 2022

Weekly Global Market Summary Highlights: January 31-February 4, 2022

All major APAC and US equity indices closed higher on the week, while most European markets closed lower. US and benchmark European government bonds closed sharply lower on the week. European iTraxx and CDX-NA closed on the week wider across IG and high yield. Oil, gold, silver, and copper closed higher on the week, while the US dollar and natural gas were lower week-over-week.

Americas

All major US equity indices closed higher on the week; DJIA +2.7%, Nasdaq +2.4%, Russell 2000 +1.7%, and S&P 500 +1.5% week-over-week.

10yr US govt bonds closed 1.92% yield and 30yr bonds 2.22% yield, which is +15bps and +16bps week-over-week, respectively

DXY US dollar index closed 95.49 (-1.8% WoW).

Gold closed $1,808 per troy oz (+1.2% WoW), silver closed $22.48 per troy oz (+0.8% WoW), and copper closed $4.49 per pound (+4.1% WoW).

Crude Oil closed $92.31 per barrel (+6.3% WoW) and natural gas closed $4.57 per mmbtu (-1.4% WoW).

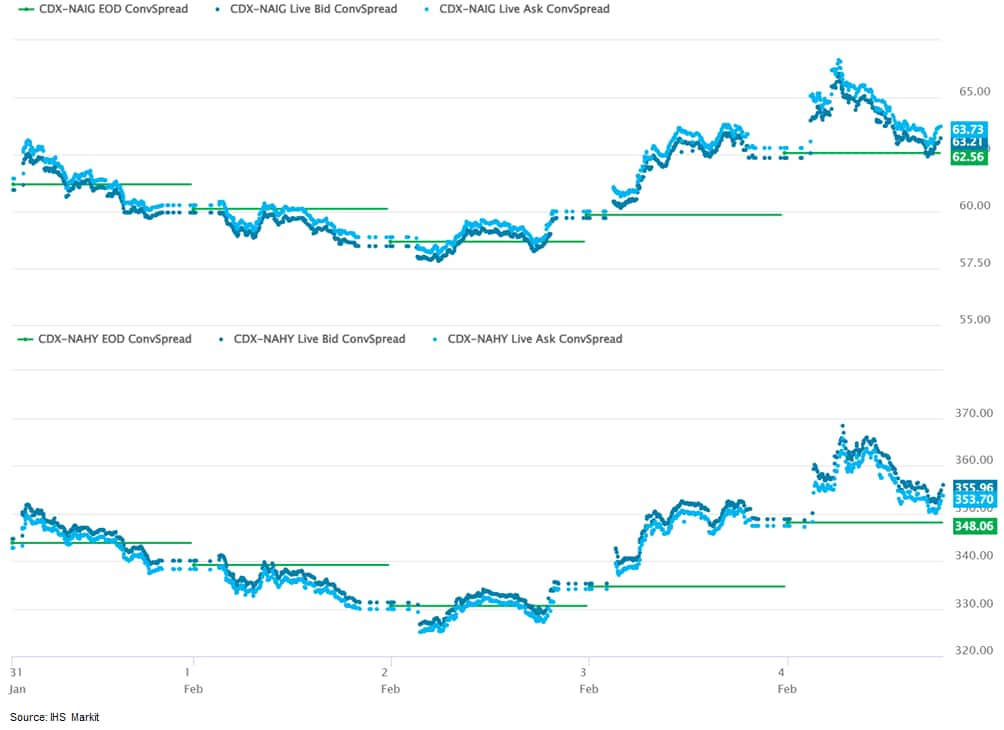

CDX-NAIG closed 64bps and CDX-NAHY 355bps, which is +2bps and

+11bps week-over-week, respectively.

EMEA

Most major European equity indices closed lower on the week except for Italy +0.1%; France -0.2%, Spain -0.2%, UK -0.5%, and Germany -1.4% week-over-week.

All major 10yr European government bonds closed sharply lower on the week; UK closed +17bps, Germany +25bps, France +28bps, Spain +34bps, and Italy +47bps week-over-week.

Brent Crude closed $93.27 per barrel (+5.4% WoW).

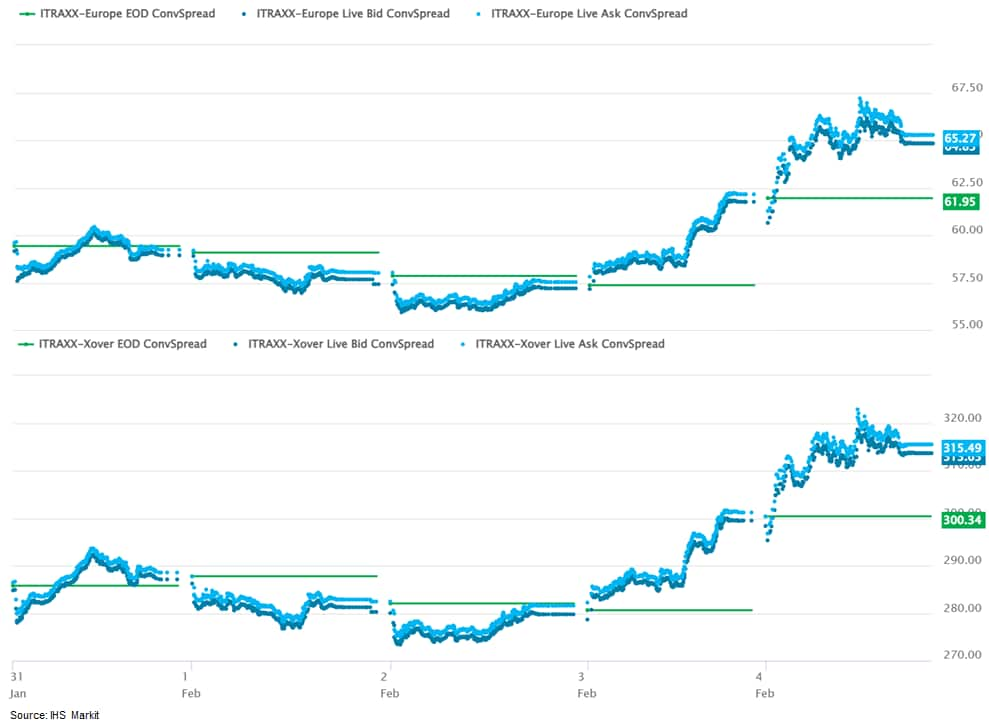

iTraxx-Europe closed 65bps and iTraxx-Xover 315bps, which is

+6bps and +29bps week-over-week, respectively.

APAC

All major APAC equity indices closed higher on the week; Hong Kong +4.3%, South Korea +3.3%, Japan +2.7%, India +2.5%, and Australia +1.9% week-over-week.

Monday, January 31, 2022

- Escalating tensions in Ukraine hit oil markets at a critical

juncture, after essentially a year and a half of stock draws that

have left storage thin, with recovery-born demand growth expected

by spring and the streaming of incremental OPEC and non-OPEC oil

yet to prove itself. Without firing a shot, armament along the

Ukrainian border raises risk of potential disruptions and along

with it, the price of oil. There is a rare $2/bbl premium at the

front of the Brent strip (expiring today), along with supersized

premiums over the next four months. While the range of possible

outcomes is wide, market risks can broadly be bracketed within

three distinct pathways in our view (IHS Markit Financial

Advisory's Roger

Diwan, Karim

Fawaz, Ian Stewart, and Sean Karst):

- Simmering tensions (Current base case price outlook). Tensions are contained but not resolved. There is no large-scale invasion of Ukraine. Yet modest progress on addressing core issues is limited, and relations between Russia and the West are frozen. An extended stand-off, even if unresolved, progressively allows market anxiety to eventually fade and prices to ease back into the sub-$85/bbl price range.

- Rupture - escalation. A Russian invasion of Ukraine triggers US sanctions on banking and energy sectors, and disruption of some trade flows pushes oil prices higher, though actual volumes lost on a sustained basis are relatively modest. Market anxieties are stoked, leading to a price spike above $100/bbl.

- Respite - de-escalation. Diplomatic efforts prove sufficient to push both sides to deescalate military presence along the Ukrainian border, even if falling short of resolving long-standing issues, easing oil's geopolitical risk premium and pushing prices swiftly back lower.

- Markets now currently find themselves straddled in no man's land somewhere between pathways simmering tensions and rupture - escalation, with escalating tensions showing little sign of reversal, although still falling short of material direct market impact.

- Private oil and gas explorer Maverick Natural Resources

announced January 28 it will acquire Permian producing properties

from ConocoPhillips for $440 million cash. The Houston-based

company said the assets span 144,500 net acres in the Permian in

the Texas counties of Andrews and Ector and the New Mexico counties

of Eddy and Lea. The assets produced more than 11,000 Boepd, of

which half was oil as of September 1 of last year and are largely

operated and held by production. (IHS Markit PointLogic's Annalisa

Kraft)

- The acquisition of the Central Basin Platform and Northwest Shelf assets has been approved by Maverick's Board of Directors and EIG Global Partners, its majority equity owner. The purchase will be paid for by a $500 million reserve-based loan funded by several banks including JPMorgan Chase Bank, N.A.; Royal Bank of Canada; Citizens Bank, N.A.; KeyBank National Association; and KeyBanc Capital Markets Inc.

- The deal is expected to close in the second quarter of 2022 and has an effective date of September 1, 2021.

- Maverick CEO Chris Heinson remarked: "This Permian acquisition expands the scale of Maverick's operations and provides high quality, oil-weighted drilling inventory. The transaction highlights our portfolio focus in Texas and Oklahoma, which follows our recent divestitures of assets in California and Michigan.

- "Pro forma for the acquisition, Maverick's production exceeded 78,000 boepd in September 2021. We are conservatively financed with pro forma leverage of approximately 0.5x at closing and expected pro forma 2022 EBITDA of approximately $450 million. We expect to utilize our enhanced scale, operational track record, and conservative balance sheet to access capital markets for funding future acquisitions, Heinson continued.

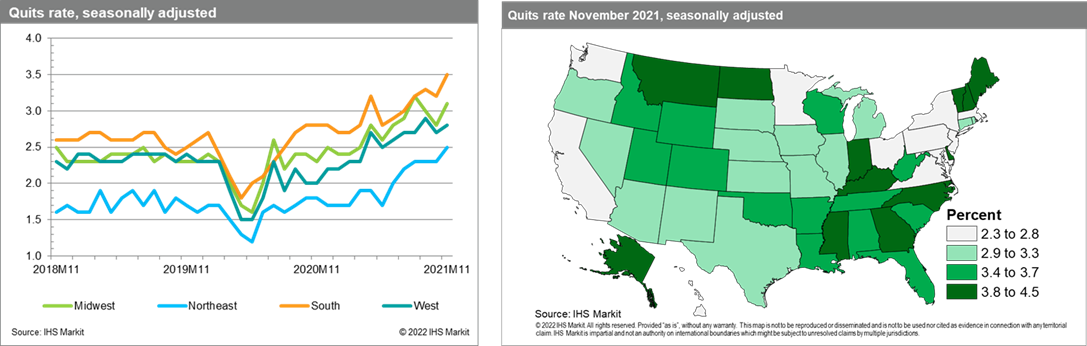

- The November data from the State Job Openings and Labor

Turnover Survey (JOLTS) revealed that the number of quits increased

in 22 states, with 19 states reaching a new series high, mostly in

the South and Northeast. The quits rate grew the most in the South

and Midwest, each adding 0.3 percentage point, to reach 3.5% and

3.1%, respectively. Except for Texas and South Carolina, every

state in the South faced a rise in quits, causing the region to

surpass its prior series peak from September. Georgia, Florida, and

North Carolina led the region in quits during November. The rise in

Florida's quits likely came from leisure and hospitality services,

which accounts for a significant share of the state's employment.

This sector was responsible for most of the month's total quits at

the US level (sector detail is not available for states). (IHS

Markit Economist Alexander Minelli)

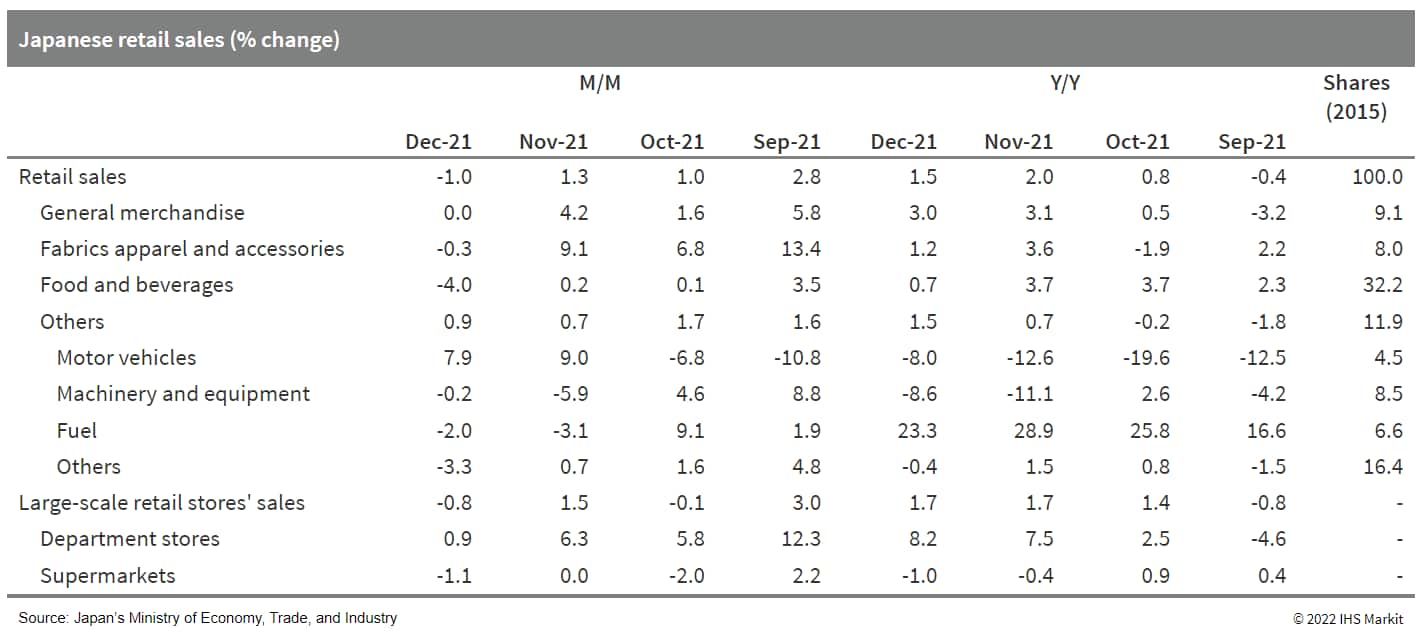

- Japan's retail sales fell by 1.0% month on month (m/m) on a

seasonally adjusted basis in December 2021 following three

consecutive months of increase. Despite the month-on-month

weakness, annual growth for 2021 turned positive, moving up by 1.9%

following a 3.2% drop in 2020. The month-on-month decline largely

reflected a 4.0% m/m decrease in sales of food and beverages and

continued declines in sales of machinery and equipment and fuel.

The weakness was partially offset by a 7.9 m/m increase in sales of

motor vehicles, reflecting improved auto production. (IHS Markit

Economist Harumi

Taguchi)

- The CCI fell by 2.4 points to 36.7 in January. While all component indices declined, the 4.8-point drop (to 36.7) in the employment index probably reflects concerns about the rapid spread of the Omicron variant and negative impacts from the expansion of the quasi-state of emergency in the country. Households' outlooks for higher prices a year ahead also weighed on the overall livelihood index, which moved down by 1.8 points to 36.8.

- The continued uptrend for department store and convenience

store sales reflects the resumption of operations, in line with low

daily infection cases. However, the weaker-than-expected December

results on retail sales were due, in part, to higher prices of food

and energy. Retail sales are likely to weaken over the near term

under the quasi-state of emergency, which covers about 80% of

prefectures.

- Ultium Cells LLC, the joint venture (JV) between General Motors (GM) and LG Energy Solutions, has expanded its agreement with Li-Cycle on recycling battery-material scrap created during battery-cell manufacturing to include lithium-ion battery recycling. The agreement will involve the construction of Li-Cycle's sixth and largest lithium-ion battery recycling facility, which is to be located at the Ultium Cells plant in Warren, Ohio (United States). Ultium Cells will construct a new building and Li-Cycle will install and operate its proprietary technology and equipment. Li-Cycle says this will provide on-site conversion of battery manufacturing scrap to intermediate products and operations are due to begin in early 2023. The facility's design is to be optimized for the particular types of battery manufactured at the Ultium Cells plant. Li-Cycle says that eventually the facility will have the capacity to process up to 15,000 tons of battery manufacturing scrap and battery materials per year. The company says this will mean its global capacity will reach 55,000 tons of lithium-ion battery input per year. Li-Cycle says the Ohio facility, which it calls a Spoke, will produce 'black mass', which it says is a powder-like substance consisting of a number of highly valuable materials, including lithium, cobalt, and nickel. This black mass will be converted into battery grade materials at Li-Cycle's Hub facility in Rochester, New York, also due to be operational in 2023. (IHS Markit AutoIntelligence's Stephanie Brinley)

- UK food and beverage merger and acquisitions (M&A) market

activity in 2021 was at its highest since 2010, the latest UK Food

and Beverage Sector M&A report from Oghma Partners shows. The

UK F&B market continued its strong performance into the last

four months of the year (T3 2021) with total deal volume amounting

to 29 transactions. (IHS Markit Food and Agricultural Commodities'

Julian

Gale)

- Compared with 2020, total deal volume for the year was up 50.8% to 89 transactions. The total deal value for T3 2021 was estimated at £722.1 million ($967.5 million). This boosted the 2021 annual deal value to an estimated £6.6 billion, which is the largest annual deal value recorded by Oghma Partners since 2010.

- The appetite from financial investors remained strong throughout 2021. In volume terms they accounted for 20.7% of total deal activity compared with 20.3% in 2020.

- When comparing deal activity from financial buyers in value terms there was a significant increase in both absolute value (2021: c. £2.6 billion versus 2020: c. £380.0 million) and the proportion of total deal value (2021: 39.3% vs 2020: 25.5%). "Driving this activity is the relative defensiveness of the sector's cashflows combined with loose monetary policy which has led to an inflow of funds into private equity companies as well as a low cost of debt," Oghma Partners observed.

- In addition, overseas buyers had another active year, accounting for 39.1% of total deal volume. This was the highest percentage of non-UK corporate buyers involved in UK food and beverage deals since 2010.

- In 2021, there was a wave of activity in the plant-based food and beverage M&A space. Notable activity during the period included Portuguese conglomerate, Sonae, acquiring Gosh Food, the UK producer of vegan sausages, burgers and falafels (EV: £67.0 million; EV/EBITDA: 16.1x).

- In addition, Canadian dairy giant, Saputo, acquired the dairy alternative cheese producer, Bute Island Foods for an undisclosed amount, "although market rumors suggest this was for yet another punchy valuation for a plant-based company," Oghma Partners noted.

- The firm suggested that whilst buyer demand for plant-based food and beverage companies remains high and so do valuations, the 2021 sell off in Oatly shares (IPO in May 2021 ) and Beyond Meat (IPO May 2019) following disappointing revenue numbers could impact valuations in the sector moving forward.

- Another subsector within the UK food and beverage industry that was particularly active was Direct-to-Consumer (D2C). Big food companies were keen to expand into this area as was seen with Nestle's acquisition of SimplyCook (advised by Oghma Partners - financial terms of the deal undisclosed). This deal followed on from its acquisition of the healthy meal kit provider, Mindful Chef at the end of 2020. Further activity in the space included Italian pasta giant, Barilla, acquiring a majority stake in D2C meal kit start-up Pasta Evangelists, an acquisition that represents a new step in Barilla's international growth strategy.

- The trading environment in 2022 is expected to be more challenging. "Cost pressures are appearing in most directions whether that be labor, energy, raw material or distribution costs," Oghma Partners observed. "The next 12 months will be a further test of the business models of many companies. Weaker businesses that struggle to get pricing through and/or reduce costs will find the prospect of a business exit more testing under these conditions."

Report was not published on Tuesday, February 1, 2021

Wednesday, February 2, 2022

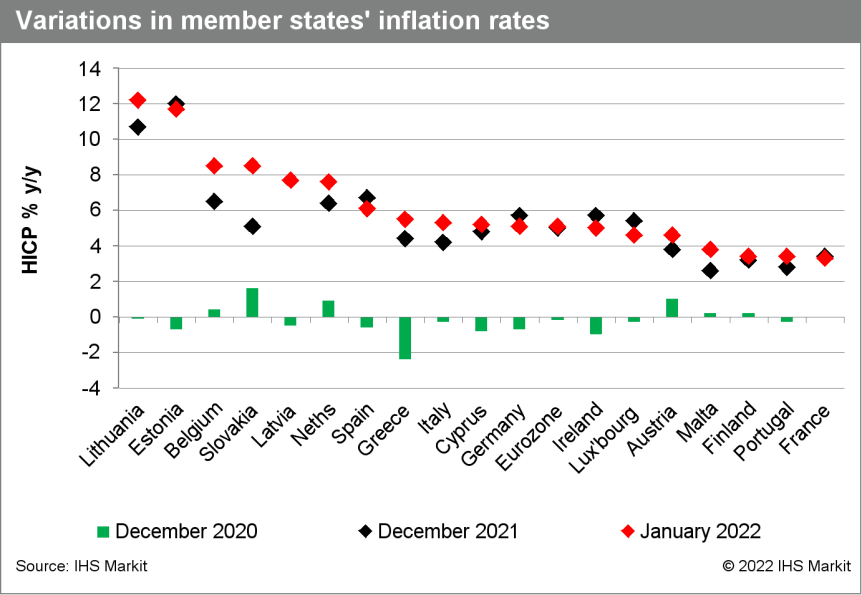

- 'Flash' estimates for eurozone headline and core inflation

rates in January again markedly exceeded expectations, although the

latter declined. Inflation will moderate during 2022 but is likely

to remain uncomfortably elevated for most of the year in the

absence of a reversal of the recent surge in energy prices. (IHS

Markit Economist Ken

Wattret)

- Contrary to expectations of a large, base-effect-driven decline, the flash estimate of January's eurozone Harmonised Index of Consumer Prices (HICP) shows the inflation rate ticking up to 5.1%, a new record high and well above the market consensus expectation (of 4.4%, according to Reuters' survey).

- Energy prices were again primarily responsible, rising by 6% month on month (m/m), the largest increase on record. Despite favorable base effects, therefore, the year-on-year (y/y) rate of increase in energy prices accelerated to a new record high of 28.6%. The contribution of energy to overall HICP inflation jumped to a new record high.

- A full breakdown of the HICP by item will not be available until the final January release on 23 February, but soaring gas and electricity prices remain key sources of upward pressure.

- Unprocessed food inflation also continued its recent run of

increases in January, rising to 5.2%, the highest rate since June

2020 and almost quadruple October 2021's rate.

- The IHS Markit manufacturing PMI for January showed output growth deteriorating markedly. The sub-index covering production fell to 50.5 from 53.8 in December, its lowest since the recovery form the first COVID-19 lockdowns began in July 2020. The news was followed by the ISM survey's output gauge also falling, down to its lowest since June 2020. However, at 57.8 compared to 59.4 in December, the ISM index is still indicative of production rising at a substantial rate whereas the IHS Markit index is signaling almost no growth. For both surveys, any index reading above 50 means more companies reported higher output during the month than reported lower output. (IHS Markit Economist Chris Williamson)

- The US homeowner vacancy rate—the proportion of residential

inventory vacant and for sale—remained at a record-low 0.9% in

the fourth quarter. Data-collecting procedures and response rates

are nearly back to normal—the data now appear to be more

reliable. The readings from the first quarter of 2020 to the first

quarter of 2021 were tainted by bad data related to low response

rates and Census workers' inability to make on-site visits. (IHS

Markit Economist Patrick

Newport)

- The rental vacancy rate—the proportion of rental inventory vacant and for rent—fell to 5.6%, from 6.5% a year earlier.

- The gross vacancy rate, the number of vacant units divided by the number of housing units, fell to 10.5%, down from 10.9% four quarters earlier and from 11.5% in the fourth quarter of 2019, the last pre-pandemic quarter.

- The homeownership rate came in at 65.5%, down from 65.8% four quarters earlier.

- Estimated housing inventory increased to 141.183 million, up 1.223 million from a year earlier.

- Markets are especially tight in the suburbs. Rental vacancy rates were highest outside of metropolitan statistical areas (MSAs; 7.7%), followed by principal cities (5.7%) and the suburbs (5.1%); the homeowner rate was lowest in the suburbs (0.7%), followed by places outside MSAs (1.0%) and principal cities (1.1%).

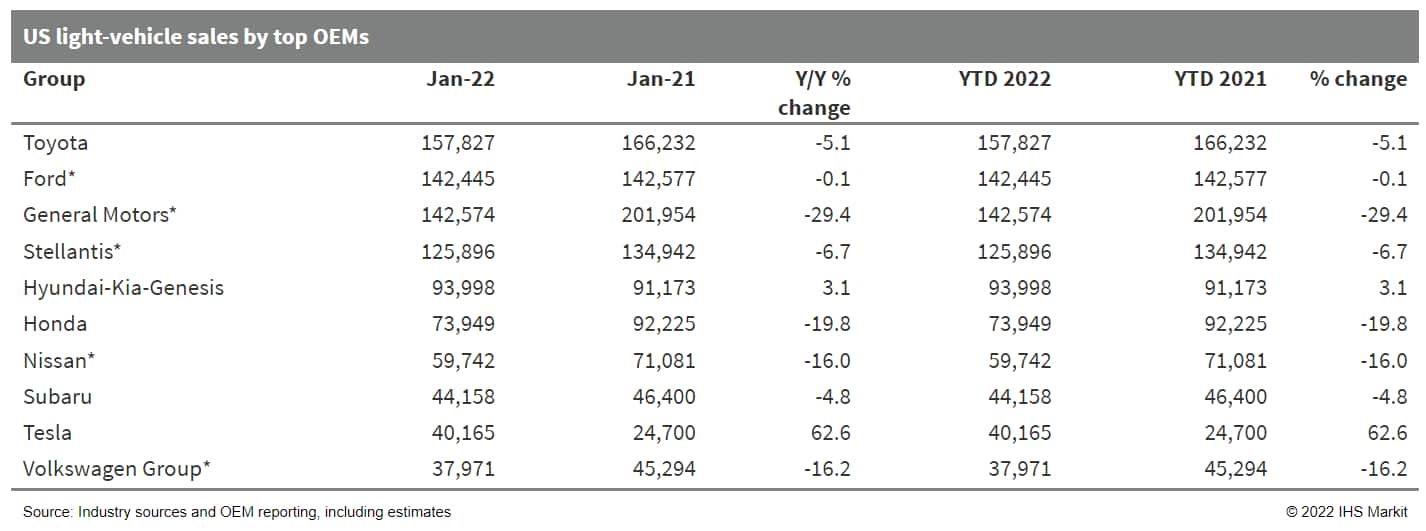

- A lack of inventory pushed US light-vehicle sales down by 9.8%

y/y in January. The estimated seasonally adjusted annual rate

(SAAR) of sales is 14.8-15.2 million units in January. The pace of

sales is expected to improve during the year, but low levels of

new-vehicle inventory are set to prevent a sharp change in sales

results. US light-vehicle sales in 2021 reflected the limited

demand growth given current inventory conditions. In the first half

of 2022, the market is expected to suffer much of the same

conditions and then sales quicken in the second half of the year.

Given current inventory conditions, it is difficult to project

significant demand recovery in the first half of 2022. However, by

the end of 2022, we expect the pace of sales to be more

recognizable in terms of pre-COVID-19 levels. Sales volume growth

is expected to be inventory-limited over the next 12 months and IHS

Markit projects US light-vehicle sales to reach approximately 15.6

million units in 2022. (IHS Markit AutoIntelligence's Stephanie

Brinley)

- HDFC Bank and the Spices Board of India have partnered to

launch an innovative digital platform Spice Xchange India. The

exchange is designed to strengthen the board's ability to provide

an international link between Indian exporters and importers

abroad. The newly created portal would support all B2B

transactions. HDFC bank is the only banking partner for the

exchange and would play a crucial role for all stakeholders in the

spice trade ecosystem. (IHS Markit Food and Agricultural

Commodities' Julian

Gale)

- The platform was launched by Som Parkash, minister of state for commerce and industry, government of India, in Kochi.

- The Spices Board, under the Ministry of Commerce and Industry, government of India, is the flagship organization for developing and promoting Indian spices worldwide. The Board has 6,000 members from across India.

- The bank has created a web portal with a unique Payment Gateway platform that would support all B2B transactions for the Board and its members. All members would be eligible to join. They can register themselves on the portal by paying a one-time/annual fee of INR44,000 ($588) with applicable taxes.

- Equinor and technology firm Battelle have signed a memorandum

of understanding to develop a decarbonized energy cluster in Ohio,

Pennsylvania, and West Virginia, the two announced February 1. (IHS

Markit PointLogic's Annalisa Kraft)

- Chris Golden, Equinor U.S. country manager, sees major low-carbon opportunity in Appalachia. "The Appalachian Basin is an important energy-producing region that also shows great promise in being a leader for the decarbonization of American industry.

- The partners agreed to undertake feasibility studies and work together on stakeholder outreach. According to the joint release the partners already have a presence in the tri-state region. "The partnership between Equinor, a global broad energy company, with offices in Hannibal, Ohio and Triadelphia, West Virginia and Columbus, Ohio-based Battelle, the world's largest independent research and development company, will enable the timely and progressive development of one of the first low-carbon industrial regions in the United States."

- The release detailed the companies' expertise in CCS. "Battelle is a leader in geologic carbon dioxide capture, use and storage with more than 100 projects worldwide over the past 20 years. Equinor has decades of experience with CCS projects of various sizes, from research and development to operations. Since 1996, Equinor has captured and safely stored more than 23 million tons of CO2."

Thursday, February 3, 2022

- Ford has partnered with Sunrun to advance home energy management by using the onboard battery capability of the F-150 Lightning electric vehicle (EV) pick-up. According to a company statement, Sunrun will facilitate installation of the 80-amp Ford charge station pro and home integration system, which will allow the truck to store and supply power to homes. The F-150 Lightning is equipped with Ford intelligent backup power, which enables customers to use bidirectional power technology to provide energy to their homes. The extended-range battery system for the F-150 Lightning can store 131 kWh and supply up to 9.6 kW of power. If the grid goes down, the truck uses Ford intelligent backup power and the home integration system to automatically power a home. Matt Stover, Ford charging and energy services director, said, "F-150 Lightning brings new innovations to customers, including the ability to power their homes when they need it most. Teaming up with Sunrun leverages their expertise to bring solar power to even more customers, giving them the chance to turn their truck into an incredible energy storage source —and future truck features can help accelerate the development of a less carbon-intensive grid". (IHS Markit AutoIntelligence's Surabhi Rajpal)

- Continental has unveiled a potentially key piece of technology in the acceleration of the electrification of the global vehicle parc in the form of a robotic battery electric vehicle (BEV) charging system, according to a company press statement. Continental is partnering on the new technology with startup Volterio; it became clear after discussions that they were both working on a similar solution simultaneously. Continental's development and production service provider Continental Engineering Services (CES) will combine its own know-how and proprietary technology with Volterio's; CES will also be able to meet all necessary certification criteria while developing the system to production maturity. The plan is for the first near production-ready system to be available this year. It will be demonstrated practically to OEMs and other potential customers before full series volume production begins in 2024, and Germany is planned as the production location. This robotized BEV charging system is potentially an exciting development for the speed of electrification in Europe and in other regions. As around half of the EU's residents do not have access to a garage or driveway in which they can home charge a BEV, compelling home charging solutions for those consumers are needed. While this solution does not necessarily help those potential BEV owners who live in houses with no off-street parking, it could be easily rolled out in city center parking garages and the kind of car parking spaces that are allocated to flat developments in Europe and elsewhere. There are also many potential benefits for the user. Unlike conventional charging stations, users no longer have to worry about handling heavy, potentially contaminated or rain-soaked charging cables in confined garages, while the system does not require very accurate parking - unlike aforementioned wireless charging infrastructure. (IHS Markit AutoIntelligence's Tim Urquhart)

- On February 2, the US Department of Energy (DOE) joined the US

Departments of Homeland Security (DHS) and Housing and Urban

Development (HUD), plus the Commonwealth of Puerto Rico, to launch

a new effort to accelerate work to strengthen the island's power

grid and advance new initiatives to enhance Puerto Rico's energy

future. (IHS Markit PointLogic's Barry Cassell)

- The parties executed a memorandum of understanding that enhances collaboration among federal agencies and the Commonwealth, and kickstarts the PR100 Study. This study is a community-driven and locally-tailored roadmap to help Puerto Rico meet its target of 100% renewable electricity, improve power sector resiliency, and increase access to more affordable energy and cleaner air.

- Dozens of grid modernization projects will start construction this year, and the government-owned Puerto Rico Electric Power Authority will sign contracts for at least 2 GW of renewable energy and 1 GW of energy storage projects.

- "The Biden-Harris Administration is helping Puerto Rico strengthen the island's resilience, and in the process unlock its potential for cheap and abundant renewable energy," said US Secretary of Energy Jennifer Granholm. "Today's commitments and the launch of the PR100 Study show that 2022 will be a year of action to modernize Puerto Rico's grid and increase energy resilience as we accelerate our work with Puerto Rico to execute data-driven, community-tailored pathways towards 100% clean electricity."

- FEMA Permanent Work Projects Will Begin Construction - FEMA, the Central Office for Recovery, Reconstruction and Resilience (COR3), the Puerto Rico Electric Power Authority (PREPA), and PREPA's contracted system manager, LUMA Energy, have established working groups and collaboration processes to reconstruct the island's electric grid. It is expected that at least 138 projects will be under construction bidding or have begun initial construction activities, including island-wide substation repairs, the replacement of thousands of streetlights across five municipalities, and the creation of an early warning system to improve dam safety.

- Clean Energy Projects Will Move Forward - Puerto Rico is procuring 3,750 MW of renewable energy and 1,500 MW of energy storage, enough clean energy to power over 1 million homes. Over the last year, DOE has provided technical assistance to the Government of Puerto Rico to align the procurement process with global best practices and ensure access to capital to ultimately lower electricity costs for ratepayers who currently pay twice the national average. PREPA is currently in final negotiations of the first tranche of proposed projects: 844 MW of renewable energy, 220 MW of energy storage, and two Virtual Power Plants.

- Implementation of $1.9 billion in HUD Grant Funding - In 2022, the Puerto Rico Department of Housing (PRDOH) will implement an action plan to enhance electrical system reliability and resilience. Puerto Rico's proposed plan includes the development of both small and large microgrids.

- Mexico's Alpek plans to acquire Oman-based polyethylene

terephthalate (PET) producer OCTAL, Alpek announced on Tuesday. The

Mexican petrochemical producer intends to purchase 100% of OCTAL's

shares for $620 million, subject to regulatory approval, by H1 this

year. (IHS Markit Chemical Market Advisory Service's Chuan Ong)

- Alpek sees value in OCTAL's PET sheet business, which has the potential to grow 6.4% annually through 2025, amid a demand for 100% recyclable packaging.

- OCTAL's proprietary "DPET" technology is also attractive to Alpek, and can be deployed across its existing plants to save costs, on top of synergy savings from asset integration.

- Alpek explained that OCTAL's DPET technology produces PET sheets with a carbon dioxide footprint that is 25% lower than industry standards, an improvement to Alpek's carbon intensity, helping Alpek reduce emissions in a transition to more sustainable packaging alternatives.

- The Mexican company added that the acquisition will allow Alpek to benefit from projected strong global demand for PET resin, and will expand Alpek's presence into the PET sheet and thermoforming industries.

- Alpek splits its business into two segments - the polyester segment encompasses purified terephthalic acid (PTA), PET, recycled PET (rPET), and polyester fibres, while its plastics and chemicals segment includes polypropylene (PP), expandable styrenics, and other specialty and industrial chemicals.

- According to Alpek, it is the largest rPET producer in the Americas, the third-largest expandable polystyrene (EPS) manufacturer worldwide, and the only producer of PP in Mexico.

- OCTAL said its operations span four plants in Saudi Arabia, the U.S., and Oman, with the world's largest single-location integrated PET producing site in Salalah, Oman.

- The ECB's press release following its February policy meeting

was very similar to the December 2021 version, which was relatively

dovish compared with those of other major central banks recently.

The key elements of the ECB's policy guidance remain unchanged, as

follows (IHS Markit Economist Ken

Wattret):

- Policy rates are expected to remain "at their present or lower levels" until the three inflation criteria introduced in July 2021's guidance are achieved.

- Net asset purchases under the Pandemic Emergency Purchase Programme (PEPP) are being conducted at a slower pace in the first quarter of 2022. They will cease at the end of March.

- The Governing Council intends to reinvest the principal payments from maturing securities purchased under the PEPP until at least the end of 2024.

- Monthly net purchases under the Asset Purchase Programme (APP) will amount to EUR40 billion (USD46 billion) in the second quarter of 2022 and EUR30 billion in the third quarter. From October onwards, they will be maintained at a monthly pace of EUR20 billion for as long as necessary. Net purchases are expected to end "shortly before" policy rates start to rise.

- Principal payments from maturing securities purchased under the APP will be reinvested for an extended period past the date when policy rates start to rise.

- Under stressed conditions, flexibility will remain an element of monetary policy whenever threats to monetary policy transmission jeopardize the attainment of price stability. Net purchases under the PEPP could be resumed, if necessary.

- The Governing Council stands ready to adjust all of its instruments, as appropriate, to ensure that inflation stabilizes at its 2% target over the medium term.

- There was one subtle but significant change to the latter element of the guidance above. While it was reiterated that the ECB stands ready to adjust all of its instruments, the prior reference to "in either direction" was removed, implying a tightening bias (although the easing bias for policy rates was retained). Furthermore, the press conference was littered with indications that the ECB's assessment of inflation prospects and risks had changed, potentially materially.

- Amid a surge in output, US productivity (output per hour in the

nonfarm business sector) rose at a 6.6% annual rate in the fourth

quarter, more than reversing a 5.0% decline in the third quarter.

During 2021, productivity rose 2.0% following a 2.5% increase

during 2020. Those increases exceeded the average annual increase

during the three years prior to the pandemic of 1.5%. (IHS Markit

Economists Ken

Matheny and Lawrence Nelson)

- Compensation per hour rose at a 6.9% annual rate in the fourth quarter following increases averaging 6.1% over the prior two quarters. Growth in compensation per hour has been elevated, on average, during the pandemic: since the fourth quarter of 2019, compensation per hour has risen at a 6.8% annual rate. Employment in lower-wage sectors has declined relative to employment in higher-wage sectors, while wage gains have risen particularly in lower-wage sectors such as leisure and hospitality.

- With productivity growth nearly matching growth in compensation per hour, unit labor costs edged up at a slight 0.3% annual rate in the fourth quarter. However, this follows much larger increases in previous quarters so that during 2021, unit labor costs rose 3.1%.

- Unit labor costs surged in the early stages of the pandemic, as compensation per hour rose much more than productivity. The rise in unit labor costs slowed on average after the initial surge but quickened again over the second and third quarters of 2021. Over those two quarters, unit labor costs rose at an average annual rate of 7.6%, as compensation per hour rose at a robust pace (6.1%) while productivity declined (down 1.3%).

- The rise in labor costs during the pandemic is contributing to inflationary pressures.

Friday, February 4, 2022

- US nonfarm payroll employment rose 467,000 in January,

considerably stronger than the consensus estimate. Meanwhile, the

unemployment rate rose 0.1 percentage point to 4.0%. (IHS Markit

Economists Ben

Herzon and Michael

Konidaris)

- The solid gain in payrolls was surprising, in light of (1) a substantial rise in initial claims through mid-January, (2) a previously reported surge in early January in the number of persons away from work because of COVID-19, (3) a widely reported private-sector estimate of a large decline in payrolls, and (4) general concern about the possible effect of Omicron on employment.

- Omicron did show up in this morning's report, but not in employment; it showed up in hours worked. In the payroll survey, a person is counted as employed if they worked or received pay for any portion of their pay period that includes the 12th of the month, even if it was for just one day.

- Roughly one-third of private-sector employees are on weekly payrolls, with the balance on pay periods at least two weeks in length, making it unlikely that, say, a five-day quarantine could register as a hit to payroll employment.

- A five-day quarantine would, however, show up as a reduced average workweek. Indeed, the private workweek showed a sharp decline in January. This likely will have some impact on private wages and salaries. As we get past the Omicron wave, we believe the private workweek will rebound.

- Average hourly earnings likely were also affected by Omicron. The 0.7% increase in January was the largest since December 2020. While tight labor markets generally are boosting wage gains, the unusually large increase in January likely reflected the effect of salaried employees, whose hours may have been reduced because of Omicron but whose pay was not.

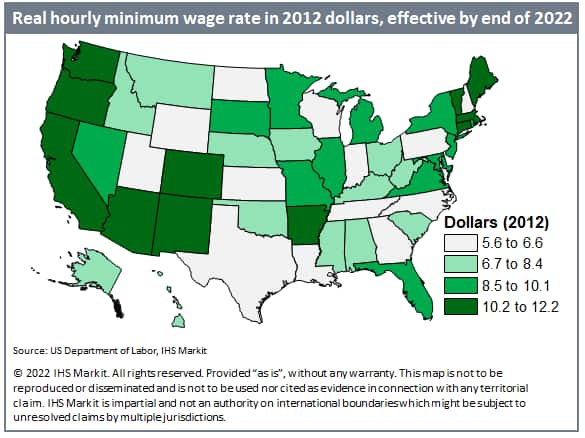

- By the end of 2022, 24 states plus the District of Columbia

will have increased their minimum wages, thanks to recently passed

laws, ballot measures, inflation indexing, or cost-of-living

adjustments. The District of Columbia will have the highest minimum

wage in the country by July 2022, increasing 20 cents to

$15.20/hour. Following the nation's capital, California

($15.00/hour), Washington ($14.49/hour), Massachusetts

($14.25/hour), Connecticut ($14.00/hour), Oregon ($13.50/hour), New

York ($13.20/hour) and New Jersey ($13.00/hour) will have the

highest minimum wage rates in the country by the end of 2022. On 1

May 2022, Virginia will enact the nation's largest minimum wage

increase, of $1.50, although that will still only raise its total

to $11/hour. California, Connecticut, Florida, Illinois, New

Jersey, and New Mexico are on a similar path, increasing their

minimum wage rates by $1 this year. Of the 26 states that will not

increase the minimum wage in 2022, 20 of them are still at the

federal minimum of $7.25/hour. Many of those states are in the

southern part of the US, but they also include Idaho, Utah, North

Dakota, Minnesota, Wisconsin, and Pennsylvania. (IHS Markit

Economist Steven

Frable)

- Looking at states' minimum wages in real terms (2012 dollars), the highest minimum wage rate will be Washington ($12.19/hour), followed by the District of Columbia ($11.46/hour). Connecticut, California, and Oregon round out the top five.

- By the end of 2021, there will be 15 states where the minimum wage is $10 or more in real terms.

- At the bottom of the list are Wisconsin ($5.64/hour), New Hampshire ($5.81/hour), Utah ($6.03/hour), Texas ($6.07/hour), and Pennsylvania ($6.21/hour), where higher costs of living mute the value of their federal minimum wage.

- Interestingly, it became clear in 2021 that even rising minimum

wages cannot always increase real incomes. Indeed, the 2021 minimum

wage increases in Colorado, the District of Columbia, Michigan, and

Minnesota amounted to essentially zero dollars in real terms,

indicating that in those states, wage increases were unable to

outpace the rising cost of living.

- The Bank of England (BoE) announced its first back-to-back

interest rate rise in 17 years at its February meeting. The BoE

expects an even higher inflation peak in early 2022, prompting its

Monetary Policy Committee (MPC) to embrace a more hawkish stance,

suggesting that it will accelerate the pace of interest rate

normalization. (IHS Markit Economist Raj

Badiani)

- The BoE's MPC voted 5-4 to increase the Bank Rate by 25 basis points (bp) to 0.5% at its meeting that ended on 2 February. This marked the first back-to-back interest rate rise since 2004 after the MPC raised the Bank Rate by 15 bp to 0.25% at its December 2021 meeting.

- The dissenting voices favored increasing the Bank Rate by 50 bp, to 0.75%. The four members wanting a larger rise were Dave Ramsden, one of the deputy governors, as well as Jonathan Haskel, Catherine Mann, and Michael Saunders.

- They pushed for a higher interest rate rise to provide some insurance should the BoE repeat its inflation forecasting errors in 2021. They also pointed to emerging signs that companies expect prices to rise significantly and that workers want larger pay rises, suggesting more persistent inflationary pressures.

- Meanwhile, the MPC voted unanimously for the BoE to begin quantitative tightening, or to reduce the stock of UK government and corporate bond purchases, namely ceasing to reinvest maturing assets (including a program of corporate bond sales).

- As of 2 February, the total stock of assets held in the Asset Purchase Facility (APF) was GBP895 billion (USD1.2 trillion), comprising GBP875 billion of UK government bond purchases and GBP20 billion of sterling non-financial investment-grade corporate bond purchases.

- Specifically, the BoE will not reinvest the proceeds of GBP70 billion of government bonds maturing during 2022 and 2023. The process begins as soon as March 2022, with the BoE not reinvesting the cash flow generated by the redemption of gilts totaling GBP27.9 billion.

- After plunging to 45.0, Canada's Ivey Purchasing Managers'

Index (PMI) jumped 5.7 points to 50.7 in January. Purchasing

managers' spending activity marginally increased in January after

showing a mild decrease in the previous month. The increase was

likely due to the higher spending on inventories. Given the

continued slower supplier deliveries, purchasing managers keep

investing in inventories to prevent a possible production

disruption caused by inventories' shortage. Combined with a

continued supply chain disruption and high raw material prices

including energy prices, the surge in the price index likely

indicates stronger upward pressure on inflation. (IHS Markit

Economist Chul-Woo

Hong)

- The employment index lowered to 49.1, which was the first contraction since January 2021, indicating a net job loss. This coincides with the steep 200,100 net employment plunge as reported by the Labour Force Survey in the month.

- While the supplier deliveries index dipped further to 24.1, the lowest level since April 2020, the inventories index rebounded to 54.2.

- The price index surged 14.6 points to 92.2, a record-high level.

- As regional restrictions are gradually eased, real GDP growth starting in February will be solid in the coming months.

- Grid-scale energy storage systems are unlikely to see any price

declines until 2024, when manufacturing of lithium-ion batteries

scales up to meet the increase in demand from automakers, according

to an IHS Markit analysis of clean technology trends. Released 3

February, the analysis finds that prices for lithium-ion batteries

rose 10%-20% to $110 per kWh in the latter half of 2021,

predominantly for LFP (lithium iron phosphate) cells, which is the

favored technology for grid-energy storage. (IHS Markit Net-Zero

Business Daily's Amena

Saiyid)

- However, IHS Markit analysts say these price hikes, which are driven by soaring raw material costs and demand from automakers, will be tempered by the anticipated rise in the global LFP cell production capacity.

- Announced expansion plans currently suggest that LFP cell capacity across the globe will reach 330 GWh annually in 2025, compared with less than 200 GWh in 2020.

- LFP batteries have been the choice of technology for the grid-scale energy storage industry in recent years due to their lower cost and better safety track record in comparison to the main alternative, NMC (lithium nickel manganese cobalt oxide) batteries, which automakers favored for EVs until 2020.

- As automakers seek to ramp up their EV fleets in response to the net-zero pledges made by countries where they have a large market presence, such as China, Europe, and the US, they are seeing the value of LFPs. Last year, Ford took a cue from Tesla and indicated it would consider LFP cells for EVs.

- Tesla announced in December it would begin offering its LFP-powered "standard range" models globally, rather than only in China as it had before. The EV giant already has positioned itself as the third largest energy storage integrator globally, holding 11% of the energy storage market.

- But with automakers getting into the demand mix, the ample supply of LFP batteries that the energy storage industry enjoyed until 2020 is no longer the case, Wilkinson wrote.

- The availability of LFP batteries depends on the pace at which automakers manufacture EVs using these cells as opposed other types of lithium-based batteries. In 2021, the automotive and transportation sector accounted for 80% of lithium-ion battery demand, a figure IHS Markit estimates is set to rise to 90% by the middle of the decade.

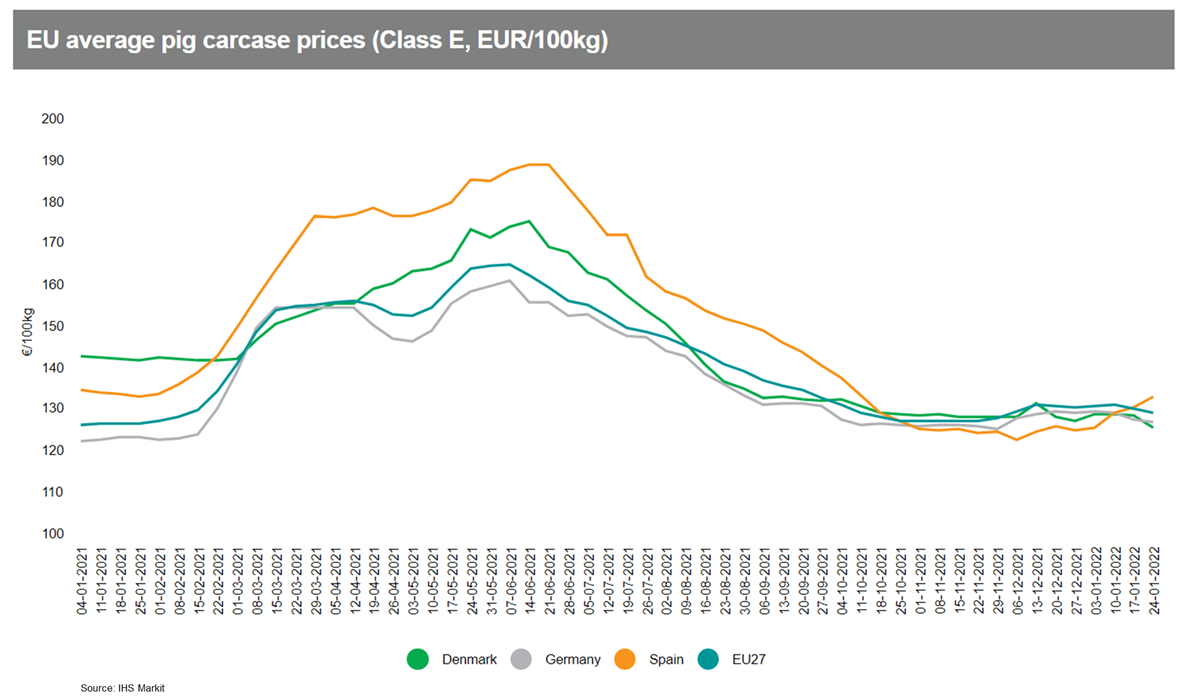

- European pig prices fell back once again over the past week,

with a slack market offering little in the way of encouragement to

under-pressure pig producers. Prices have in fact seen little real

change since October - but over that period, costs and expenses for

producers have continued to soar. (IHS Markit Food and Agricultural

Commodities' Chris Horseman)

- In December 2021, the Commission assessed the 'remainder' for EU pig producers - the nominal gross margin per animal after deduction of feed and replacer costs - at just EUR 10. This is the lowest figure recorded since at least 2013, and compares unfavorably with the long-term EU average of around EUR 48 per animal.

- It is also far short of remainders of upwards of EUR 70 which farmers were achieving for much of 2019.

- Markets signals are however offering little respite at present, with consumption still on the low side, and exports still constrained by weak demand from China, and by tight restrictions on exports from Germany and other countries affected by African Swine Fever.

- The EU average price for Class E pigs in the week ending 30 January was EUR130.36 per 100kg, down by 0.9% on the previous week.

- Spain is bucking the European trend with a pattern of strengthening prices. The average Spanish price was up by 1.9% week-on-week to EUR134.44 per 100kg, capping a rise of 6% over the past three weeks.

- But there were substantial week-on-week price reductions in Poland (-3.8%), Denmark (-2.2%), Belgium (-1.3%) and Germany (-0.5%).

- Italian prices are not routinely communicated to the

Commission, but they have fallen sharply since ASF was discovered

there several weeks ago.

- Amazon disclosed in a security filing that it holds 5.2% stake in Aurora Innovation, a company that specializes in autonomous vehicle (AV) technology for cars and trucks. In 2019, Aurora raised more than USD530 million in Series B funding round from multiple investors including Amazon. Amazon now owns 35,239,761 shares of Class B common stock of Aurora. Amazon is stepping up its efforts in the AV sector, as eliminating the cost of a human driver could make delivery services far cheaper. Last year, Amazon placed an order for 1,000 autonomous systems from technology startup Plus. In 2020, Amazon acquired AV technology startup Zoox, which plans to develop fleets of small, on-demand AVs that do not have a steering wheel or interior controls. In 2019, Amazon announced that it was using automated trucks developed by Embark to haul cargo on the I-10 highway in the United States. (IHS Markit Automotive Mobility's Surabhi Rajpal)

- Diesel's share of the passenger car market in the European Union fell below 20% for the first time in more than three decades last year, according to data from the ACEA. Given that diesel accounted for around half of the overall European market less than a decade ago, it shows how the popularity of this fuel type - which was once the darling of EU regulators because of its ability to lower carbon dioxide (CO2) emissions - has waned in the wake of the Volkswagen (VW) 'dieselgate' affair and as industry electrification accelerates. The fuel type's 19.6% share in 2021 was exactly matched by hybrid vehicles. Registrations of hybrid electric cars increased by a very robust 60.5% year on year (y/y) last year, marking the first time that hybrid electric vehicle sales (at 1,901,239 units) overtook those of diesel vehicles in the EU, by just 40 units. Combined sales of what ACEA refers to as electrically chargeable vehicles, which comprise PHEVs and pure BEVs, took an 18% share of the overall EU market in 2021. However, it should also be noted that gasoline (petrol) was still the dominant fuel type overall in the EU last year with a 40% overall market share. This meant that conventionally powered non-hybrid gasoline and diesel models still accounted for the majority of passenger car sales in the EU during the year with a combined share of 59.6%. (IHS Markit AutoIntelligence's Tim Urquhart)

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-february-7-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-february-7-2022.html&text=Weekly+Global+Market+Summary+Highlights%3a+January+31-February+4%2c+2022+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-february-7-2022.html","enabled":true},{"name":"email","url":"?subject=Weekly Global Market Summary Highlights: January 31-February 4, 2022 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-february-7-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Global+Market+Summary+Highlights%3a+January+31-February+4%2c+2022+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-february-7-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}