Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Dec 13, 2021

Weekly Global Market Summary Highlights: December 6-10, 2021

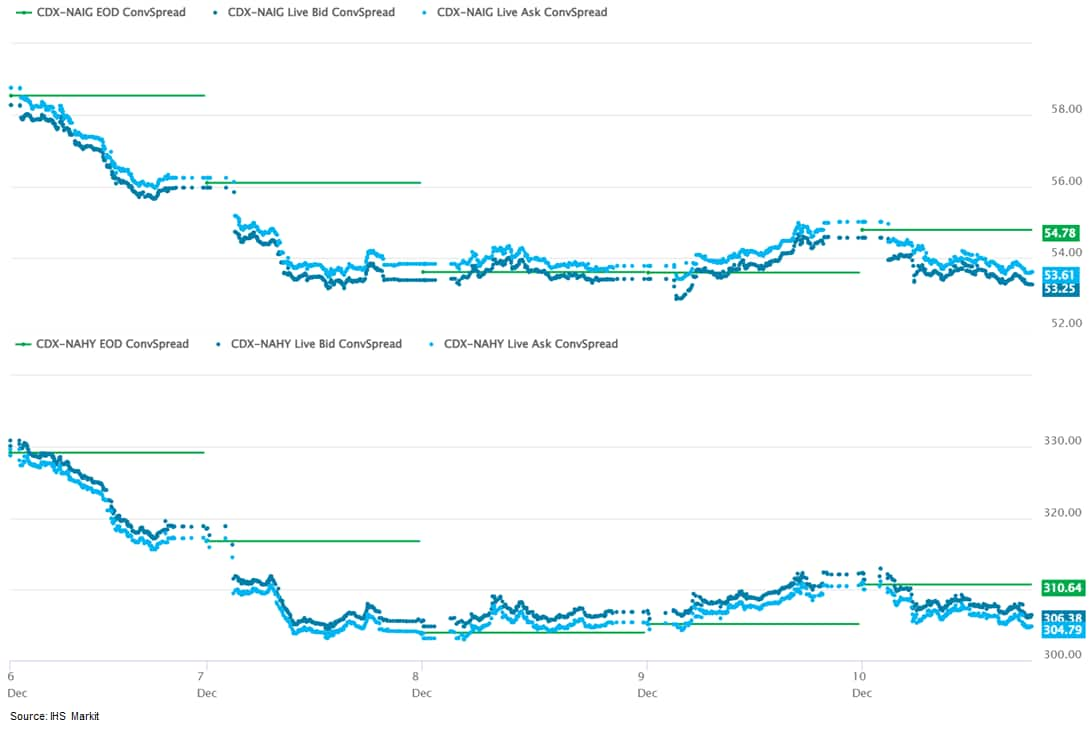

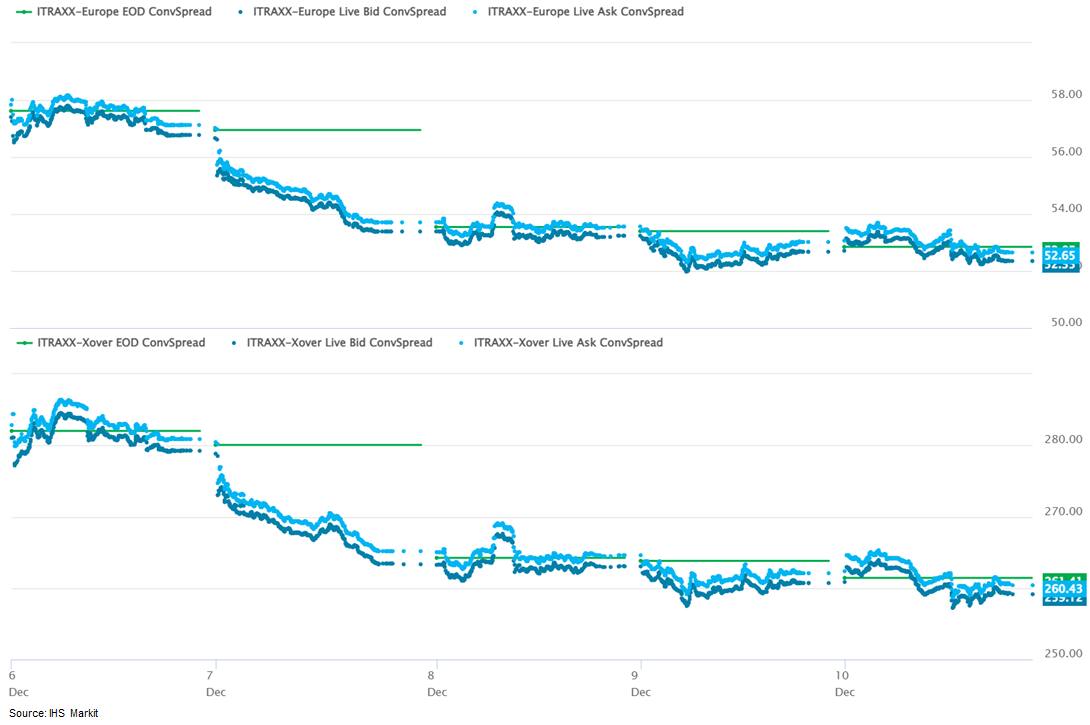

All major US, European, and APAC equity indices closed higher on the week. US government bonds closed sharply lower on the week, while benchmark European bonds were mixed. European iTraxx and CDX-NA closed much tighter on the week across IG and high yield. Oil, gold, and copper closed higher on the week, the US dollar was flat, and natural gas and silver were lower week-over-week.

Americas

All major US equity markets closed higher on the week; DJIA +4.0%, S&P 500 +3.8%, Nasdaq +3.6%, and Russell 2000 +2.4% week-over-week.

10yr US govt bonds closed 1.49% yield and 30yr bonds 1.89% yield, which is +13bps and +20bps week-over-week, respectively.

DXY US dollar index closed 96.1 (flat WoW).

Gold closed $1,785 per troy oz (+0.1% WoW), silver closed $22.20 per troy oz (-1.3% WoW), and copper closed $4.29 per pound (+0.5% WoW).

Crude Oil closed $71.67 per barrel (+8.2% WoW) and natural gas closed $3.93 per mmbtu (-5.0% WoW).

CDX-NAIG closed 53bps and CDX-NAHY 306bps, which is -5bps and

-23bps week-over-week, respectively.

EMEA

All major European equity indices closed higher; France +3.3%, Italy +3.0%, Germany +3.0%, UK +2.4%, and Spain +1.4% week-over-week.

10yr European government bonds closed mixed on the week; Spain closed -2bps, UK -1bps, France +2bps, Italy +3bps, and Germany +4bps week-over-week.

Brent Crude closed $75.15 per barrel (+7.5% WoW).

iTraxx-Europe closed 53bps and iTraxx-Xover 260bps, which is

-5bps and -22bps week-over-week, respectively.

APAC

All major APAC equity indices closed higher; India +1.9%, Mainland China +1.6%, Australia +1.6%, Japan +1.5%, South Korea +1.4%, and Hong Kong +1.0% week-over-week.

Monday, December 6, 2021

- Turkish annual inflation - both headline and core - continued

to rise in November, exacerbating the disruption of the current

rate cutting cycle to market stability. With inflationary pressures

still building, although we still expect another rate cut on 16

December, it may be moderated from our previous expectation. Sharp

lira losses and high inflation will continue through early 2022,

particularly following the recent resignation of a trusted economic

minister. (IHS Markit Economist Andrew

Birch)

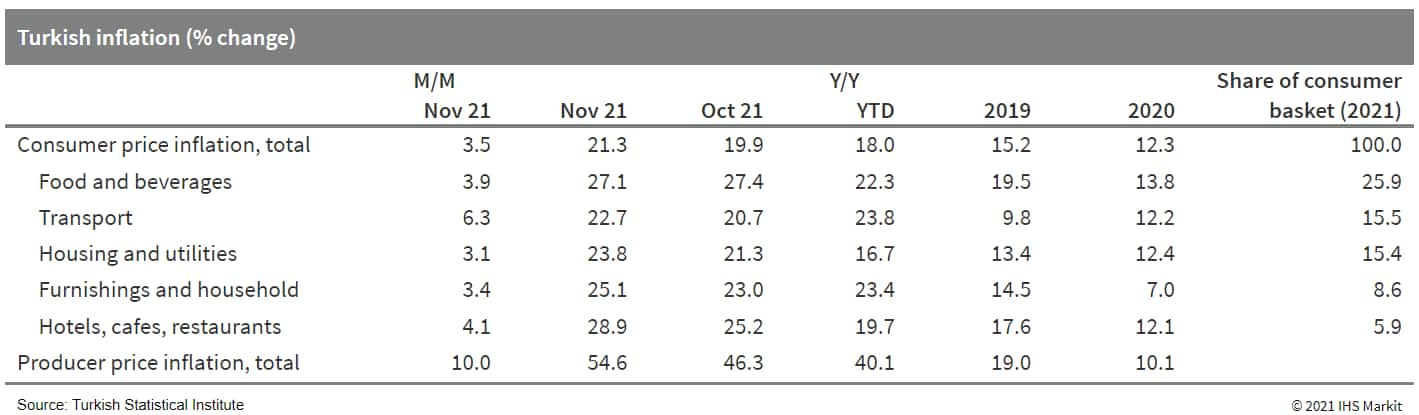

- In November 2021, annual consumer price inflation continued to rise, to 21.3% according to data from the Turkish Statistical Institute (TurkStat). Inflation has steadily risen for over a year, standing more than seven percentage points higher than it had been a year earlier.

- President Recep Tayyip Erdoǧan and Central Bank of the Republic of Turkey (TCMB) Governor Şahap Kavcıoğlu had pointed to a modest month-on-month (m/m) decline of inflation from September to October as justification for the last cut of the one-week repo rate. After that modest m/m decline from 17.0% to 16.8%, annual core inflation re-rose in November, to 17.6%.

- TurkStat also reported annual producer price inflation of 54.6% in November 2021, surging upwards from 46.3% the previous month. The impact of high global commodity prices, the sharp lira losses, and supply-chain problems has been particularly substantial on producer price inflation, more than doubling its level over the past 12 months.

- Sharp lira losses were extremely inflationary through the first 11 months of 2021. Through 23 September, the lira had already depreciated by nearly 23% against the US dollar, pushing import prices higher.

- The beginning of the current rate cutting cycle at the

September TCMB policy meeting, the lira losses were enflamed. As of

3 December, the lira had depreciated by 95.8% against the US

dollar.

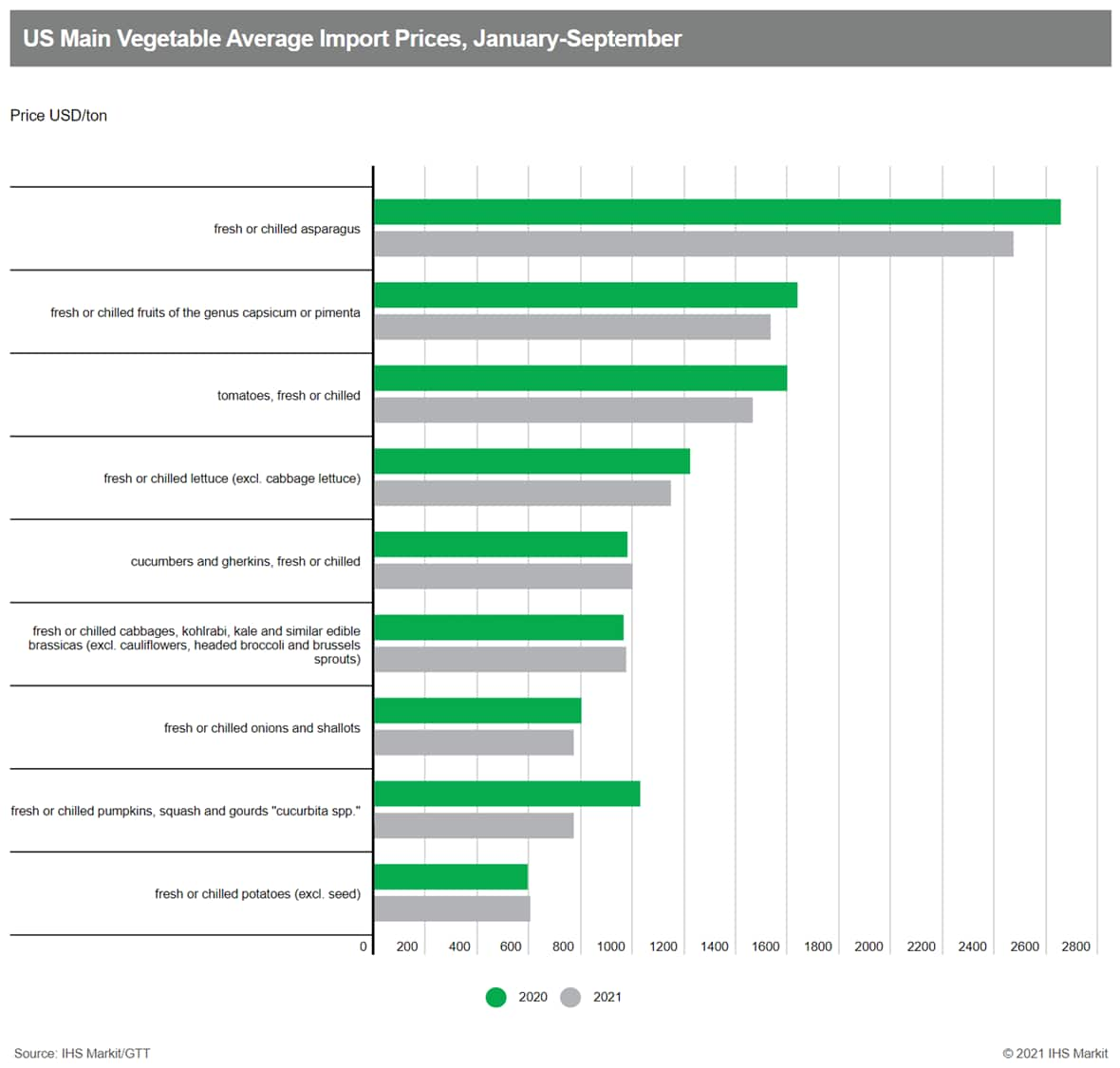

- The US recorded strong increases in main fresh vegetable

imports in January-September 2021 while the average import prices

went down from last year. Mexico and Canada are the main suppliers

in this period. (IHS Markit Food and Agricultural Commodities' Hope Lee)

- Fresh tomatoes were the most imported vegetable in the first nine months of 2021, with 1.5 million tons imported, 8% up y/y. Tomatoes are also the most valuable imported vegetables. Mexico accounted for over 90% of total shipments, followed by Canada. Canada increased its shipments to the US by 13% y/y, at an average price of $2,260 per ton, 14% down y/y. Mexico's prices were also reduced by 8% y/y to $1,370/ton. The USDA report (June 2021) estimated Mexico's 2021 calendar year production is 3.3 million tons, 2% up from 2020.

- US pepper imports climbed by 14% y/y to breach one million tons, of which chili peppers grew by 19% y/y to 371,000 tons. Among top 10 vegetables, peppers ranked second in both volume and value. Mexico accounted for about 86% of total volumes. Greenhouse-grown organic bell peppers saw an import price fall of 18% y/y to $2,950/ton, but, still the highest among all varieties. Greenhouse-grown conventional bell peppers were priced at $2,400/ton, 12% down y/y. Open-field grown organic bell pepper's prices went up by 10% y/y to $2,880/ton.

- Lettuces imports outpaced main vegetables at +29% y/y to 232,000 tons in January-September 2021. Mexico made up over 94% of total imports, followed by Canada; prices from both suppliers fell 5% y/y and 11% y/y, respectively.

- Fresh asparagus ranked fourth by import value to $573 million, 5% up y/y. The import volume increased by 12% y/y to 231,000 tons. Mexico (70%) and Peru (29%) are the main suppliers. The average import price was $2,470/ton, 7% down y/y; asparagus has the highest import price among main vegetables. Mexico's average price was $2,000/ton compared to Peru's $3,370/ton.

- Pumpkins and squash noted a sharp fall of 22% y/y in import value to $294 million, despite a 4% y/y increase in volumes. The category's import price decreased by 25% y/y to $770/ton, the biggest fall among main vegetables. Most varieties saw price decreases; organic squash registered the biggest fall of 25% y/y to $950/ton.

- For a reference point, the US imported over 10 million tons of

fruits and nuts (fresh, dried and frozen) from January-September

2021, 4% up y/y. The average price of the products under one HS

code 08 was $1,440 per ton, 9% up y/y.

- The EU has vowed to spend billions on international development

finance with a move it compared to China's Belt and Road, but with

"the highest environmental standards." China's Belt and Road

initiative has invested in projects such as roads, power stations,

railways, airports, and ports across Eastern, Southern, and Central

Asia. (IHS Markit Net-Zero Business Daily's Cristina Brooks)

- On 1 December, the European Commission (EC) announced the new strategy, dubbed Global Gateway, through which it will facilitate foreign investments of up to $339 billion (€300 billion) by 2027.

- While China's environmental standards under Belt and Road have been criticized, it recently published green standards for overseas construction.

- The EC responded to the comparison with China by saying it is "offering an innovative choice" and filling an infrastructure finance gap for low- and middle-income countries estimated at over $2.7 trillion in 2019 and worsened by the COVID-19 crisis.

- In particular, the Global Gateway will use the EU's existing European Fund for Sustainable Development+ to offer up to $152.83 (€135 billion) of guaranteed investments for infrastructure in countries in the EU's region and in Africa.

- It will not only provide grants, loans, and budgetary guarantees to de-risk projects like renewables and smart grids, but it will also support what it termed "soft infrastructure" such as health projects, education, and research.

- Its energy investments will include growing hydrogen production through state partnerships, to "promote the creation of competitive markets to enable such hydrogen produced outside the EU to be traded internationally without export restrictions or price distortions."

- It aims these projects in countries where it has existing development partnerships and strategic interests. For example, China's rivals include India and Japan, with which it recently signed pacts to cooperate on cleantech and connectivity.

- The EU will pour funds into its neighbors to the east, including Albania, Bosnia and Herzegovina, North Macedonia, Montenegro, Serbia, Kosovo Armenia, Azerbaijan, Belarus, Georgia, the Republic of Moldova, and Ukraine.

- Israel and Jordan in November signed what the countries'

governments called "the largest-ever cooperation agreement" between

the nations, which could result in a new solar PV power plant in

Jordan that will generate electricity for Israel, while Israel will

sell Jordan additional clean water from desalination plants. (IHS

Markit Net-Zero Business Daily's Keiron Greenhalgh)

- The solar PV plant will have a capacity of 600 MW. Israel will supply up to 200 million cubic meters of desalinated water per year to Jordan under the deal, doubling the amount of water it currently has promised to sell to Jordan.

- For both countries, the deal helps solve climate change problems: energy in Israel, and water in Jordan.

- Climate change is exacerbating an immense water resources problem in Jordan, said Minister of Water and Irrigation, Mohammad Al-Najjar at the signing event at the Dubai Expo in the United Arab Emirates (UAE). "Climate change and the influx of refugees have further exacerbated Jordan's water challenges, however, there are many opportunities for regional cooperation to help increase sustainability in the sector," he said.

- Energy ministries of both countries could not be reached by Net-Zero Business Daily for further information on how the power-for-water swap might work, nor any further details on a timetable.

- "The benefit of this agreement is not only in the form of green electricity or desalinated water, but also the strengthening of relations with the neighbor that has the longest border with Israel," Israel's Energy Minister Karine Elharrar said at the signing ceremony.

- The agreement was brokered by the UAE, and a UAE firm will build the PV plant in Jordan, she added.

- Japan's Suntory Group has successfully prototyped a

polyethylene terephthalate (PET) bottle made from 100% plant-based

chemicals, the company announced last Friday. (IHS Markit Chemical

Market Advisory Service's Chuan Ong)

- The company said that the prototype PET bottle uses plant-based terephthalic acid (PTA) and monoethylene glycol (MEG), and is fully recyclable. The PTA is produced from plant-based paraxylene (PX) derived from wood chips, utilizing new techniques from technology company Anellotech. Suntory used MEG derived from molasses.

- Suntory believes its prototype PET bottle is a crucial step towards its aim of producing 100% sustainable PET bottles by 2030, and net-zero greenhouse gas emissions across its entire value chain by 2050. The company said the new PET technology is significant as its PTA is produced using non-food biomass, which avoids competition with the food chain, while its MEG is derived from non-food grade feedstock.

- The beverage maker believes Anellotech's PX technology enjoys process efficiency, using a single-step thermal catalytic process by going directly from biomass to aromatics benzene, toluene and xylene. This process generates required energy from the biomass feedstock itself, and may allow significant reductions in greenhouse gas emissions compared to fossil-derived PX, according to a Suntory source.

- Electric vehicle (EV) startup Lucid Motors says reservations for the Air sedan have surpassed 17,000 units, although these are not guaranteed sales, reports Automotive News. According to the report, Lucid's senior director of sales and services, Zak Edson, said, "Demand is in great shape, so a lot of what we're doing is executing our plan and ensuring that cars are coming out in sufficient volumes and quality to satisfy that demand." The company is building first the limited-run USD169,000 Dream Edition of the Air sedan and then a USD139,000 Grand Touring version. In 2022, the company plans to add a USD95,000 Touring version and a USD77,400 Pure version. Edson said that the reservations so far are for a mix of trim levels, saying, "We see a strong demand for the Grand Touring. It's definitely not a case where everyone is coming in at the low end." The report highlighted earlier remarks from Lucid CEO Peter Rawlinson, who suggested the company potentially could create a smaller model, given the Air Grand Touring has range of 516 miles with a 112-kilowatt-hour battery pack. Lucid is planning the Gravity sport utility vehicle (SUV) in 2023, production of which is to be at the company's plant in Arizona, United States. According to reports, Lucid says its production capacity will be 34,000 vehicles per year in the current phase and it plans to expand this to 90,000 units when phase two of the plant is completed in 2023. Eventually, Lucid plans a production capacity of 365,000 units per annum at the Arizona plant. (IHS Markit AutoIntelligence's Stephanie Brinley)

Tuesday, December 7, 2021

- On December 7, Equinor announced the opening of its New York

offshore wind project office, located in Sunset Park's Industry

City neighborhood adjacent to the South Brooklyn Marine Terminal.

(IHS Markit PointLogic's Barry Cassell)

- This office will serve as the hub for Equinor and bp's large-scale offshore wind operations in the region, including Empire Wind and Beacon Wind. Together, Empire Wind 1 and 2 and Beacon Wind 1 are poised to provide 3.3 GW to New York. Empire Wind and Beacon Wind are being developed by Equinor and bp through their 50/50 strategic partnership in the US.

- The opening of the project office was attended by officials including Doreen Harris, President and CEO of the New York State Energy Research and Development Authority (NYSERDA), Elizabeth Yeampierre.

- Said Equinor Wind US President, Siri Espedal Kindem, who presided over the ribbon-cutting ceremony: "The office is the cornerstone for our vision of developing an exciting new industry in New York, in the United States, and beyond."

- Harris added: "As New York solidifies its place as the nation's leader in offshore wind, we are pleased to see Equinor affirming its commitment to our state and its workforce. Equinor's investments and partnership are critical vehicles for advancing our climate and clean energy goals, and we look forward to continuing our shared efforts to seize this once in a generation opportunity to truly change the energy system and create thousands of family-sustaining jobs."

- The office will be built out by a local New York contractor and is set to open for day-to-day operations in 2022.

- Australia's Woodside Energy has proposed its first overseas

clean hydrogen plant as the natural gas producer seeks to add

low-carbon products to its business mix. Woodside, which expects a

hydrogen business to play a major role in its path to net zero,

announced 7 December its third project in the space this quarter to

underscore its decarbonization ambitions. (IHS Markit Net-Zero

Business Daily's Max Lin)

- The ASX-listed company said it had secured a lease and purchase option for 38 hectares of vacant land to develop the H2OK facility at the Westport Industrial Park in Ardmore, Oklahoma, targeting the heavy transportation sector.

- Initially, the plant will produce up to 90 metric tons (mt) of hydrogen per day based on a 290-MW electrolysis capacity. Woodside said the location allows the plant to expand its production to 180 mt per day with a 550-MW electrolysis capacity.

- "H2OK would be located in a highly prospective part of the US market, close to national highways and the supply chain infrastructure of major companies that have signaled their interest in securing reliable, affordable, and lower carbon energy," she added.

- Woodside plans to source power for the project from Oklahoma's existing grid, a large portion of which is wind powered, and acquire Renewable Energy Certificates to abate any remaining emissions.

- Wind power accounted for more than one-third of the state's net electricity generation of 82.3 million TWh in 2020, according to the US Energy Information Administration. Overall, 40% of Oklahoma's electricity came from renewable sources last year.

- Woodside has completed the preliminary design for the modular, scalable production facility for H2OK and may issue tenders for front-end engineering design before the end of this year. The project is due for a final investment decision (FID) in the second half of 2022 and would begin production in 2025.

- The facility will aim to meet hydrogen demand from heavy-duty trucks and equipment, warehouse forklifts, ground-handling equipment, and fuel-cell microgrids for warehouses and data centers, according to Woodside.

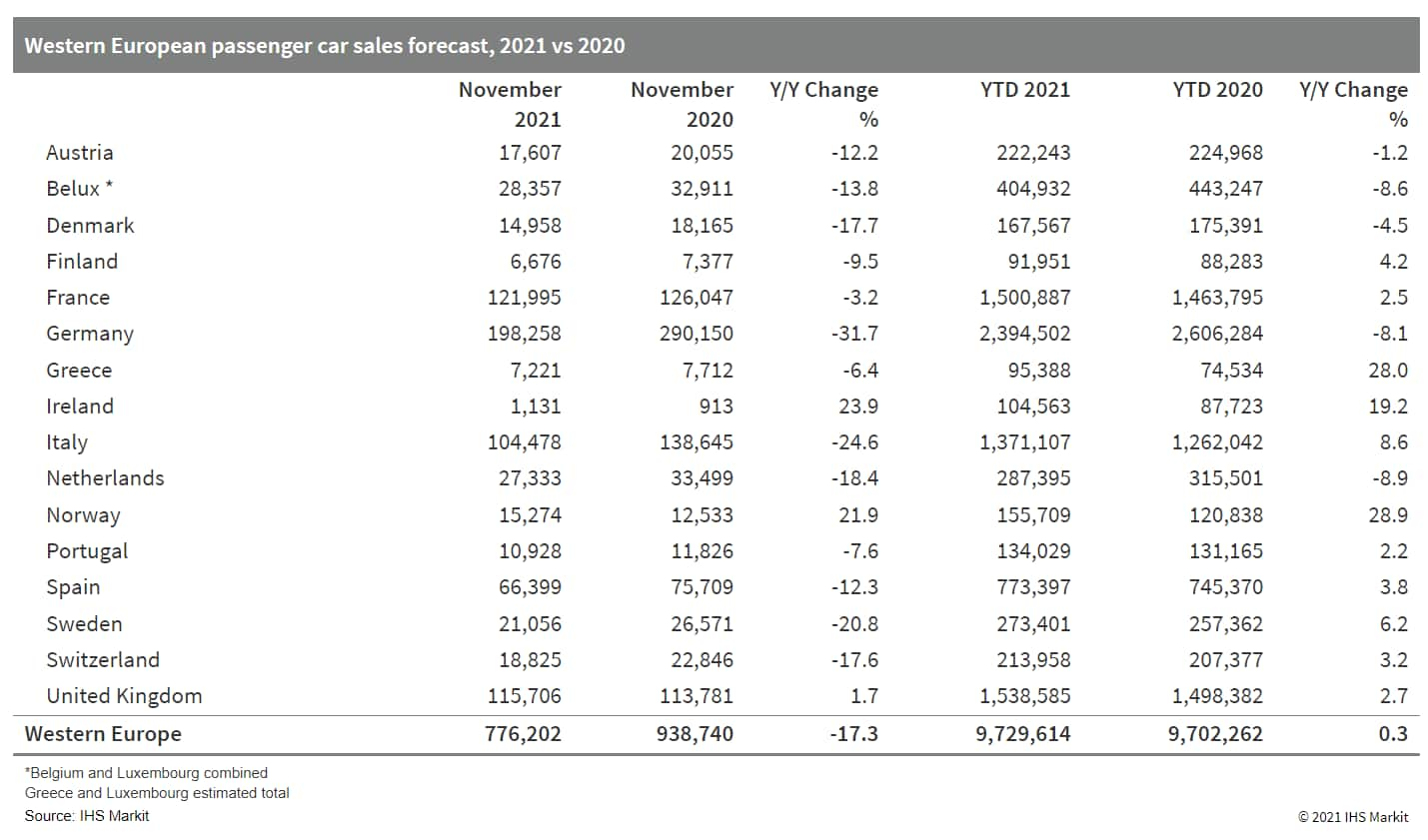

- Western European passenger car registrations have retreated

again during November. According to IHS Markit's latest forecast,

registrations in the region dropped by 17.3% year on year (y/y) to

776,202 units. Nevertheless, substantial earlier gains due to the

low base caused by coronavirus disease 2019 (COVID-19) virus

pandemic measures during the first half of 2020 have helped to keep

volumes just about in positive territory in the year to date (YTD).

For the first 11 months of 2021, registrations are up 0.3% y/y at

around 9.7230 million units. The fall this month was despite an

already low base of comparison as some markets in the region

reintroduced COVID-19-related restrictions during the final quarter

of 2020. The drag was caused by a shortage of vehicles as OEMs and

suppliers have struggled to source enough semiconductors. IHS

Markit currently expects 2021 volumes to be below 2020's, but there

should be some improvement in 2022. (IHS Markit AutoIntelligence's

Ian Fletcher)

- The triennial Forum on China-Africa Cooperation (FOCAC) took

place in Dakar, Senegal, on 29-30 November. At the summit, China

pledged to facilitate USD40 billion in overall funding and

investment for African countries over the next three years. (IHS

Markit Country Risk's William Farmer, David Li, Nezo Sobekwa, and

Chris

Suckling)

- The Chinese government pledges do not represent direct state investment and instead prioritize channels involving the International Monetary Fund (IMF), the African Development Bank (AfDB), and private Chinese firms. None of the total USD40 billion pledged is projected to take the form of direct government investment. Rather, USD10 billion each is to be provided through trade financing, credit to African official institutions, and the reallocation of part of China's Special Drawing Rights (SDRs) allocation of SDR29.22 billion from the IMF in August 2021, with the remainder to come from private Chinese investment into Africa. As yet, there has been no announcement on how the commitment from China's SDR new allocation is to be distributed among the African continent's 55 states.

- The reduction in China's financial pledges versus 2018, and their narrower scope, indicate increased caution in committing financial resources to African development. China reduced its three-year pledge to USD40 billion in 2021, from a headline USD60 billion between 2018 and 2021, and narrowed its scope (we have not identified an official statement on the actual amount previously disbursed). The absence of large-scale infrastructure projects and the reduction in development finance pledges were expected, aligning with indications given by Chinese policymakers prior to the FOCAC ministerial meeting.

- Private-sector development has replaced infrastructure investment as the cornerstone of China's African strategy. Half of China's USD40-billion pledge is designated as trade credit for African exports or to encourage Chinese companies to invest in Africa. This approach is a clear move away from the prior focus on large projects carried out by Chinese state-owned enterprises in areas such as power generation and transport infrastructure, generally without a BOT or PPP contract. Areas of focus now include agriculture, the digital economy, and healthcare, including the provision of Chinese-made vaccines. For the first time, China and African countries jointly signed the Declaration on Climate Change Cooperation, highlighting Chinese support for environmental initiatives, biodiversity protection, and climate-sensitive development in the region.

- US productivity (output per hour in the nonfarm business

sector) declined at a 5.2% annual rate in the third quarter,

revised down 0.2 percentage point. The third-quarter decline more

than reversed a 2.4% increase in the second quarter. (IHS Markit

Economists Ken

Matheny and Lawrence Nelson)

- Compensation per hour rose at a 3.9% annual rate in the third quarter, revised up 1.0 percentage point. This followed an 8.4% increase in the second quarter that was revised up 4.9 percentage points. Growth in compensation per hour has been elevated, on average, during the pandemic: since the fourth quarter of 2019, compensation per hour has risen at a 6.8% annual rate. Employment in lower-wage sectors has declined relative to employment in higher-wage sectors. Wage gains have increased in some lower-wage sectors.

- Unit labor costs surged in the early stages of the pandemic, as compensation per hour rose much more than productivity. The rise in unit labor costs then slowed on average after the initial surge but quickened over the second and third quarters of 2021. Over the last two quarters, unit labor costs rose at an average annual rate of 7.7%, comprising rapid growth in compensation per hour (6.2%) alongside falling productivity (-1.5%). Upward revisions to unit labor costs in the second and third quarters were largely accounted for by revisions to compensation.

- Hours rose at a 7.4% rate in the third quarter, continuing a strong recovery that began in the third quarter of 2020. Over the last five quarters, hours have risen 15.8% (not annualized), leaving them just 1.0% below the fourth-quarter 2019 level.

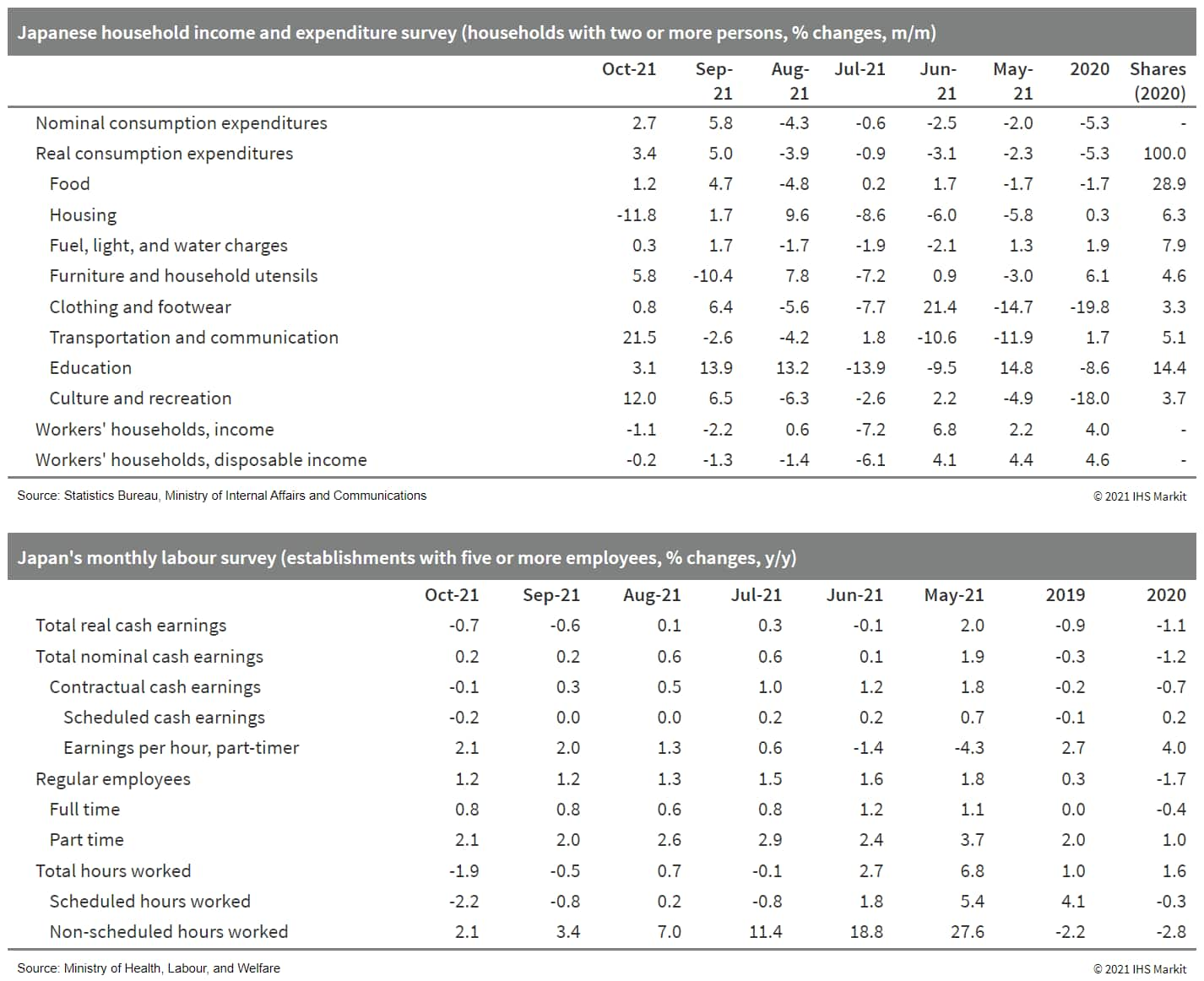

- Japan's real household expenditure increased by 3.4% month on

month (m/m) in October following a 5.8% rise in the previous month,

but the year-on-year (y/y) figure continued to fall, decreasing by

0.6%. (IHS Markit Economist Harumi

Taguchi)

- The continued month-on-month improvement largely reflected solid increases in spending on transportation and communication and culture and recreation; this is as a result of increased mobility caused by the easing of COVID-19-related containment measures. Improvements in auto supply led to a rise in auto purchases. However, the increases were partially offset by weaker spending in housing and medical care.

- According to the monthly labor survey for October, year-on-year

growth for nominal cash earnings remained at 0.2%, but real cash

earnings fell by 0.7% y/y following a 0.6% y/y decline in

September. The year-on-year rise was caused by fast increases in

special and non-scheduled earnings. The rise was largely offset by

weak scheduled cash earnings (down by 0.2% y/y), mainly because of

declines in part-timers' cash earnings as a result of fewer

workdays.

Wednesday, December 8, 2021

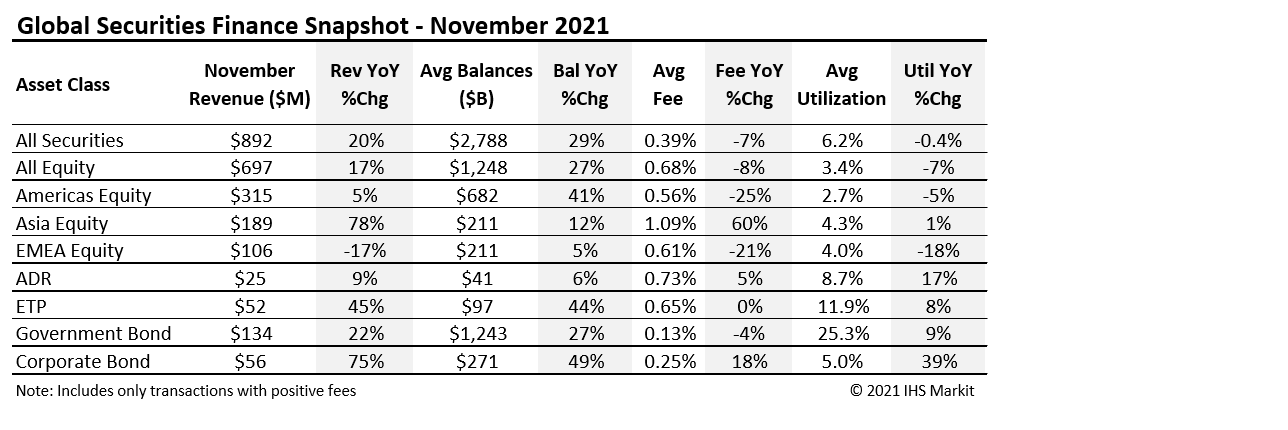

- Global securities finance revenues totaled $892 million in

November, a 20% YoY increase. ETPs saw YoY increases in revenues

and loan balances. All asset classes showed YoY increases, except

for European equities where a lack of new specials dented revenue

opportunities. In this note we'll discuss some of the highlights of

the November equity finance revenue. (IHS Markit Securities

Finance's Paul

Wilson)

- In the wake of surging oil and gas prices this year, reports

are emerging that say that further high prices and volatility will

continue for the rest of the decade if investments in new

production do not increase. (IHS Markit PointLogic's Kevin Adler)

- The current situation reflects six years of low prices that discouraged investment, plus the uncertainty generated by rising environmental restrictions on fossil fuel development and use, said the reports. But if fossil fuels are to be a significant, perhaps the majority, source of energy for 10 to 30 more years, then investment must be increased quickly. Oil and gas accounted for about 84% of the world's energy needs in 2020, according to the International Energy Agency.

- "The next two years (2022-2023) are critical for sanctioning and allocating capital toward new projects to ensure adequate oil and gas supply comes online within the next 5-6 years," said a report released by the International Energy Forum (IEF), based on Saudi Arabia.

- The report, co-authored by IHS Markit, pegs the needs globally at $525 billion in those years, compared to $341 billion invested in 2021. "Oil and gas investment will need to return to pre-COVID levels and stay there through 2030 to restore market balance," the report states.

- Moody's this fall issued a similar recommendation, saying that global investment needs to be about $540 billion per year through 2025 to replace reserves and maintain production.

- The IEF-IHS Markit report does not project oil or gas prices going forward. But other sources, such as Goldman Sachs, have issued forecasts of high oil prices next year. In November, Goldman Sach said West Texas Intermediate, one of the global benchmarks, could be $90/bbl in 2022, as the economic recovery from COVID continues to outpace the ability of oil producers to expand production, given their investments. In October, Morgan Stanley and BNP Paribas forecast high prices as well for 2022, though less aggressively placing them at $70-80/bbl.

- On December 7, AES Corp. announced a completed purchase of Valcour Wind Energy, which controls wind farms in New York, from global investment firm Carlyle. Valcour's six wind farms represent the largest operating wind platform in New York and play an important role in helping the state meet its commitment to have 70% of its electricity come from renewable resources by 2030, AES said. The Valcour portfolio currently produces roughly 25% of the State of New York's wind power and includes three wind parks in Clinton County totaling 279 MW, two wind parks in Wyoming County totaling 227 MW, and one wind park in Franklin County totaling 106 MW. (IHS Markit PointLogic's Barry Cassell)

- Lab-grown meat companies have created a new coalition to defend

their interests in the EU policy-making circle. 'Cellular

Agriculture Europe' was formally launched on 3 December and

consists of 13 companies - including Bluu Biosciences, Vital Meat,

Mosa Meat, SuperMeat, Aleph Farms and Higher Steaks. (IHS Markit

Food and Agricultural Policy's Pieter Devuyst)

- The companies will start lobbying EU policymakers in early 2022 and said they are "making the same food Europeans love in a new way", using just a small sample of animal cells to grow meat, fish, and oils.

- The coalition argued that their industry can therefore be a "powerful new tool" to help realize the EU's environmental ambitions of the Farm to Fork (F2F) strategy because it can "trigger a shift away from intensive animal agriculture".

- They added that a transition towards alternative protein sources is needed to achieve the bloc's climate targets and highlighted that the EU's research program Horizon Europe recognized this by allocating millions in funding to the development of more sustainable proteins, including cultivated meat.

- Robert Jones, President of the Board of Cellular Agriculture Europe and Head of Public Affairs at Mosa Meat, said: "We believe in a future where cellular agriculture, in combination with sustainability reforms to conventional agricultural practices, helps Europe meet its growing demand for protein while giving consumers the opportunity to choose delicious and safe meat and seafood products".

- The new coalition could nevertheless face some competition from other groups that also promote cultivated and plant-based meat alternatives in Europe, such as the Good Food Institute and ProVeg. At the same time, cooperation between these groups could see them achieve their joint goals of realizing more favorable EU legislation for lab-grown meat and their widespread consumption in the bloc.

- Currently, food produced with cells derived from animals falls under the bloc's Novel Foods Regulation and requires pre-market authorization as well as approval by the European Food Safety Authority (EFSA). These stringent steps have effectively blocked the sales of lab-grown meat in the bloc.

- Japan's real GDP growth for the third quarter of 2021 was

revised down to -0.9% quarter on quarter (q/q), or -3.6% q/q

annualized, from -0.8% q/q, or -3.0% q/q annualized, following a

0.1% q/q rise (revised down from a 0.5% q/q increase) in the second

quarter. Reflecting annual revision, full-year real GDP figures

were revised down to a 0.2% year on year (y/y) decline from 0% for

2019, and up from a 4.6% y/y drop to a 4.5% y/y drop in 2020. (IHS

Markit Economist Harumi

Taguchi)

- The downward revision largely reflects weaker external demand, highlighting a narrower decline in imports (revised up from a 2.7% q/q decline to a 1.0% q/q decline), relative to exports (revised up from a 2.1% q/q drop to 0.9% q/q drop). While domestic demand remained weak, declining by 0.9% q/q, upward revisions to private capital expenditure (capex) and residential investment were offset by a downward revision in private consumption and changes in private inventory.

- The third-quarter revision reflects the review of seasonal adjustments in addition to regular revisions factoring in additional information after the release of preliminary figures. According to the source, non-seasonally adjusted capex was revised down, just as expected by IHS Markit. However, the revision to seasonal adjustments led to an upward revision of the quarter-on-quarter figure, from a 3.8% q/q decline to a 2.3% q/q decline.

- Despite the upward revision to capex, sluggish business conditions under states of emergency and supply chain disruption led to declines in all types of capex. Investment in transport equipment fell by 8.4% q/q for a third consecutive quarter while investment in other buildings and structures fell by 1.8% q/q for the fourth consecutive quarter. Investment in other machinery and equipment fell by 1.2% q/q, marking the first decline in five quarters. Investment in intellectual properties slid by 0.3% q/q.

- South Africa's real GDP contracted by 1.5% q/q during the third

quarter, reports Statistics South Africa (StatsSA), more than the

market consensus of closer to -1.2% q/q but better than the 2.0 q/q

fall expected by IHS Markit. The third-quarter GDP slowdown leaves

GDP up by 5.8% year on year (y/y) during the first three quarters

of 2021. (IHS Markit Economist Thea

Fourie)

- Sectors showing the largest contribution to third-quarter output included the financial sector (adding 0.3 percentage point), followed by personal services (0.1 percentage point). Negative contributions during the third quarter were made by the trade sector (-0.7 percentage point), followed by manufacturing (-0.5% percentage point) and agricultural production (-0.4 percentage point). A fall in production of field crops and animal products was primarily responsible for the slowdown in overall agricultural output. StatsSA reported that eight of the 10 manufacturing divisions reported negative output in the third quarter, of which motor vehicles, parts and accessories, and other transport equipment division made the largest contribution to the overall manufacturing slowdown.

- A fall in durable and non-durable consumer spending left overall household spending down by 2.4% q/q during the third quarter. Total fixed investment spending was flat between the second and third quarter, while government consumption expenditure increased marginally by 0.1% q/q as compensation of employees accelerated. Net trade made a positive contribution to overall economic output during the third quarter. A 5.9% q/q fall in exports of goods and services was matched by a 2.8% q/q slowdown in imports of goods and services. A drawdown in inventories, to the amount of ZAR915 million (USD58 million), was recorded during the third quarter.

Thursday, December 9, 2021

- US farmers are urging the Biden administration to investigate

record high fertilizer prices and whether the highly-consolidated

industry is manipulating the market. (IHS Markit Food and

Agricultural Policy's JR Pegg)

- "The economic conditions of the fertilizer sector suggest market abuses are likely, and farmers are experiencing a price squeeze that is highly suspicious in its timing," the Family Farm Action Alliance said in a December 8 letter to the Department of Justice's Antitrust Division.

- "These corporations are using their monopoly power to raise and lower the price charged to farmers not based on basic supply and demand, but rather on the price the farmer is paid for their commodity crops," according to the ag group.

- The letter from the alliance—a non-profit advocacy organization with more than 6,000 members—comes as farmers are wrestling with prices for several fertilizers have risen more than 100% in the past year. Fertilizer companies blame the price increases on rising natural gas costs, export delays and production disruptions caused by severe weather in the US.

- But the alliance is unconvinced and contends the "alarming spike in prices … suspiciously coincides with an increase in income farmers are earning from commodity crops like soybeans and corn."

- The ag group points to industry consolidation, noting that since the 1980s the US fertilizer industry has shrunk from 46 companies to 13. The North American supply of potash is controlled by two companies—Nutrien Limited and the Mosaic Company—and four firms control 75% of the production and sale of nitrogen-based fertilizer in the US.

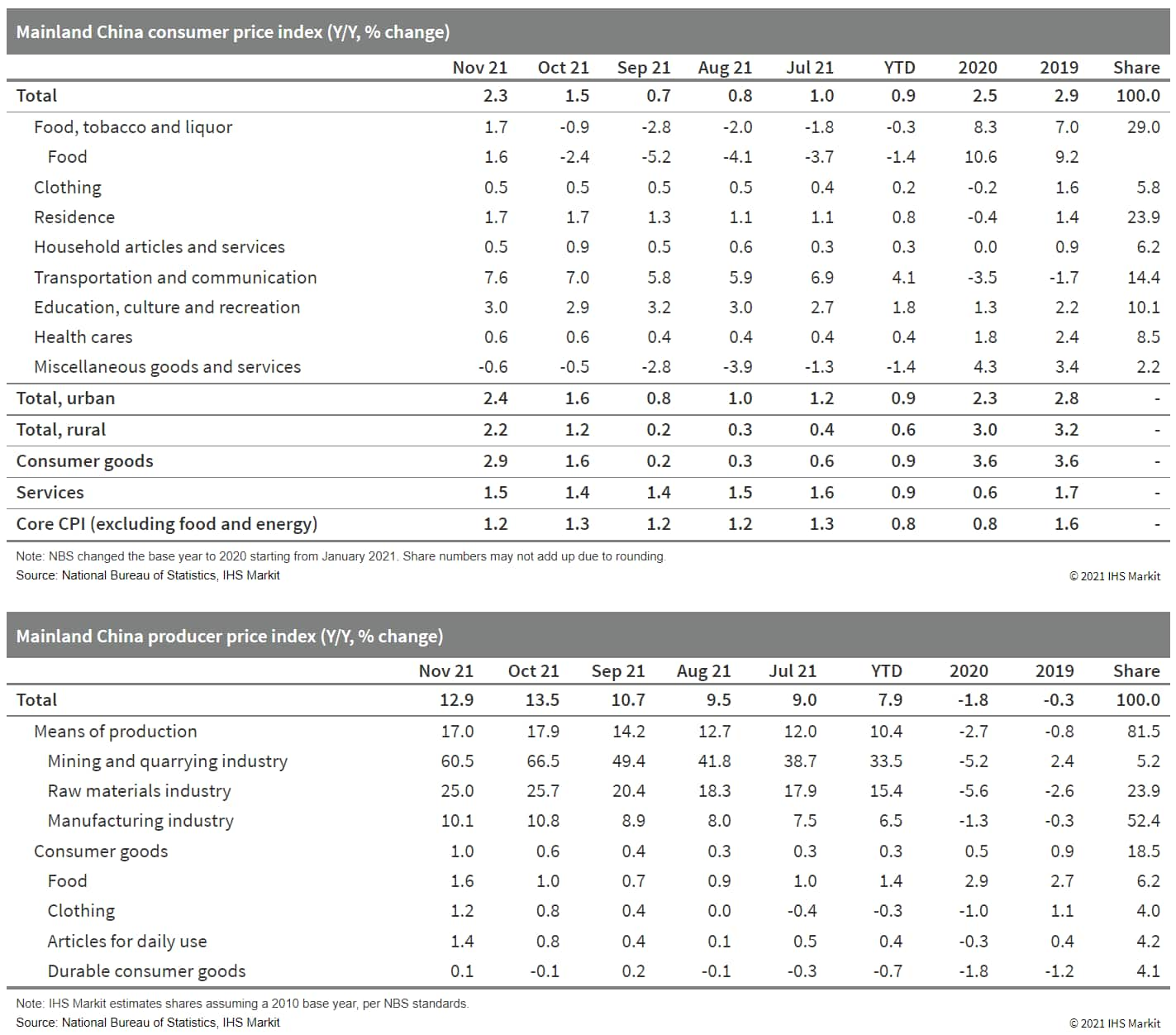

- The divergence in Mainland China's year-on-year and

month-on-month CPI inflation change was largely to do with the

November pandemic impact outweighed by the year-ago low-base effect

(Headline CPI recorded 0.5% y/y deflation in November 2020).

Widespread outbreak affecting two-thirds of mainland China

provinces notably hampered services demand in November on top of

the seasonal effect, which resulted in a 0.3% m/m decrease in

service price, compared with a 0.1% m/m increase in October. Prices

of air tickets and hotel accommodation fell by 14.8% m/m and 3.7%

m/m, respectively in November. Excluding the volatile food and

energy components, core CPI slid into deflation territory of 0.2%

m/m, the lowest so far in 2021. (IHS Markit Economist Lei Yi)

- On a year-on-year basis, recovering food prices again became the main driver for the uptick in November headline CPI inflation. Owing to the further narrowed pork price deflation from 44.0% y/y to 32.7% y/y and widened fresh vegetable price inflation from 15.9% y/y to 30.6% y/y, food price inflation came in at 1.6% y/y in November, higher by 4.0 percentage points from October and ending the five-month-long deflation since June. As vehicle fuel price inflation expanded by 4.3 percentage points to 35.7% y/y in November, non-food price inflation inched up by 0.1 percentage point to 2.5% y/y. Core CPI came in at 1.2% y/y, lower by 0.1 percentage point from the month before.

- The producer price index (PPI) continued to report year-on-year gains of 12.9% y/y in November. Still, this has come down from the October high by 0.6 percentage point thanks to authorities' interventions to tame commodity rally and tackle power crunch. Month-on-month PPI inflation moved in the same direction, down by 2.5 percentage points to reach 0.0% m/m in November.

- With the ramped-up coal production and imports, prices of coal

mining and dressing registered a 4.9% m/m drop in November compared

with a 20.1% m/m gain in October; energy-intensive sectors like

non-ferrous and ferrous metal smelting and pressing also saw output

prices falling month on month. However, oil and gas-related sectors

continued to log price increases due to persistent rally in the

global market.

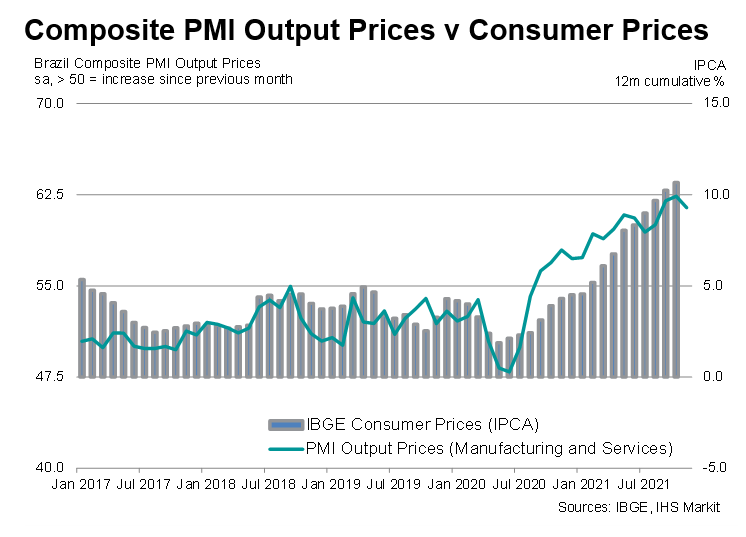

- Brazil dipped back into recession in the third quarter of 2021

as a severe drought hugely impacted farmers. PMI data for the

fourth quarter so far showed a resilient service sector, but

factory production contracted to a greater extent as demand was

stymied by rising interest rates and price pressures. With

inflation mounting, the central bank hiked the policy rate for the

seventh time running, a factor that could hurt consumption and

investment in coming months. (IHS Markit Economist Pollyanna

DeLima)

- Official statistics data for the third quarter of 2021 highlighted another quarterly contraction in GDP as the agriculture and livestock sector posted its worst performance (-8.0%) in nine-and-a-half years due to a severe drought. Industrial production stabilized (0.0%), with companies in this segment negatively impacted by supply-side issues and mounting inflationary pressures. Services activity expanded (+1.1%) in what appears to be a shift in demand from goods to services as COVID-19 restrictions recede. Encouragingly, domestic consumption rose (+0.9%), but exports decreased sharply (-9.8%).

- Industrial production figures from IBGE showed another monthly reduction in output during October, the fifth in successive months. Timely PMI data indicated that the manufacturing sector remained stuck in contraction, with the downturn gathering pace during November. Companies indicated that order book volumes were down markedly, owing to higher interest rates and inflationary pressures. Elevated prices for inputs also restricted input buying and job creation as companies focused on cost-reduction measures.

- Price pressures in Brazil remained elevated, as global shortages of inputs and supply-chain disruptions were exacerbated by an unprecedented drought and associated increases in energy prices. Official inflation climbed to 10.7% in October, the highest since January 2016 and more than double the central bank's upper-limit goal (5.25%) for 2021.

- PMI data showed that input costs continued to rise at a stronger rate in manufacturing than in services midway through the final quarter of 2021, the latter registered a survey record increase (data collection started in March 2007). Subsequently, the aggregate rate of input cost inflation climbed to a series peak.

- Indeed, a large proportion of purchases in Brazil are attained

on credit and indebtedness is on the rise. Preliminary data from

the central bank showed an increase in household debt to 59.9% of

national income. Excluding mortgages, household debt amounted to

37.0% of GDP. This is particularly concerning as the cost of

borrowing is rising. In August, the annual interest rate on a

credit card for households averaged 63.8% and that for overdrafts

stood at 125.1%.

- By the end of 2022, the nameplate nominal capacity of operating

US LNG facilities is expected to increase to processing 11.4 Bcf/d

of natural gas, and peak capacity will increase to 13.9 Bcf/d,

according to the US EIA. The peak capacity is greater than the

capacities of the two largest LNG exporting nations today,

Australia (peak 11.4 Bcf/d) and Qatar (10.4 Bcf/d). (IHS Markit

PointLogic's Kevin Adler)

- At 11.4 Bcf/d of gas intake, US LNG production capacity is about 77 million metric tons/annum (Mtpa). At the peak of 13.9 Bcf/d of gs, that's about 90 Mtpa of LNG.

- The move to being possibly become the largest LNG producer and exporter in the world has been rapid, as the first global-scale train began service at Cheniere's Sabine Pass LNG in May 2016.

- US capacity this year has been increased with the startup of Train 3 at Corpus Christi LNG, and Train 6 at Sabine Pass could be at full commercial service this month. For 2022, the big impact is that Calcasieu Pass LNG will reach in-service. Its 18 liquefaction trains will have a total processing capacity of 1.6 Bcf/d of gas; commissioning at Calcasieu Pass has started, and the company has said all trains will be operating by the end of 2022.

- While the US could reach No. 1 status next year, Qatar is on target to become the world's largest producer by 2026, when new projects will be completed to bring the country to a total capacity of 110 Mtpa and possibly as high as 127 Mtpa, according to announcements it made in June.

- The UK government this week announced a design for a

hydrogen-fueled airplane, lining up with its plans to subsidize

both zero-carbon flight and hydrogen production. The proposed

plane, which uses hydrogen from renewable energy rather than the

fossil fuels from which 96% of hydrogen is currently sourced, was

designed by the FlyZero project, part of the government-funded

public-private £3.9 billion Aerospace Technology Institute Program.

(IHS Markit Net-Zero Business Daily's Cristina Brooks)

- The research program works with NATEP, an industry-led incubator on zero-carbon aviation, and H2GEAR, an industry project aiming to create liquid hydrogen fuel cells for planes. The government said the projects could bring a £114 billion boost to the UK economy by 2035.

- UK Prime Minister Boris Johnson flew back to London from the Glasgow COP26 climate summit last month, provoking tough questions from the media. At the summit, the UK had joined over 20 countries in making tentative plans to reduce aviation emissions.

- The UK is eager to carve out a path to low-carbon aviation. The government-backed HyFlyer project completed the first hydrogen fuel cell passenger flight in September 2020, although the first liquid hydrogen aircraft, the Soviet Tu-155, flew in 1988.

- Meanwhile, the UK is also investigating other types of low-carbon aviation fuel, known as sustainable aviation fuel (SAF), created for example from waste cooking oil.

- Ford has reportedly stopped taking reservations for the upcoming F-150 Lightning, having confirmed in November that reservations were approaching 200,000. According to Automotive News, Ford is preparing to open its actual order banks in January 2022. Automotive News cites a Ford spokesperson as saying that the company is planning a "waved invitation approach" for converting the reservations to orders. "The number of waves will be adjusted throughout the process based on available commodities and customer order rates from each previous wave. Invitations to order a 22MY will continue to be sent to reservation holders until 22MY production is fulfilled. Remaining reservationists will be invited to order in subsequent model years," the Ford contact is quoted as saying via email. Given that Ford suggests the potential orders are approaching 200,000 units, it is likely that many will not get 2022 model year vehicles. Ford has not said how many it will produce in 2022 or 2023, although it has said it plans to ramp up to an annual run rate of 80,000 units in 2024. (IHS Markit AutoIntelligence's Stephanie Brinley)

- Autonomous vehicle (AV) technology startup Robotic Research has raised USD228 million in a Series A funding round, reports TechCrunch. The financing round was led by SoftBank Vision Fund 2 and Enlightenment Capital and included the participation of Crescent Cove Advisors, Henry Crown and Company, and Luminar. The company plans to use the infused capital to scale up its commercial division RR.AI's solutions for trucks, buses, and logistics vehicles. Alberto Lacaze, CEO of Robotic Research, said, "Most people think robotics is some magic piece of software. The reality is that robotics is more like a stamp collection. You have to collect all these different edge cases where you need to be able to run on slippery roads and with dust and without being able to see the lines and so forth. We have collected lots and lots of stamps. To a certain degree, a common day for a military application is the edge case for a commercial application." Robotics Research is an engineering and technology company, founded in 2002 to offer autonomy software and robotic technology. The company has a history of automating trucks for the US army and navy, operating in areas with no GPS, good communications, or lined roads. (IHS Markit Automotive Mobility's Surabhi Rajpal)

Friday, December 10, 2021

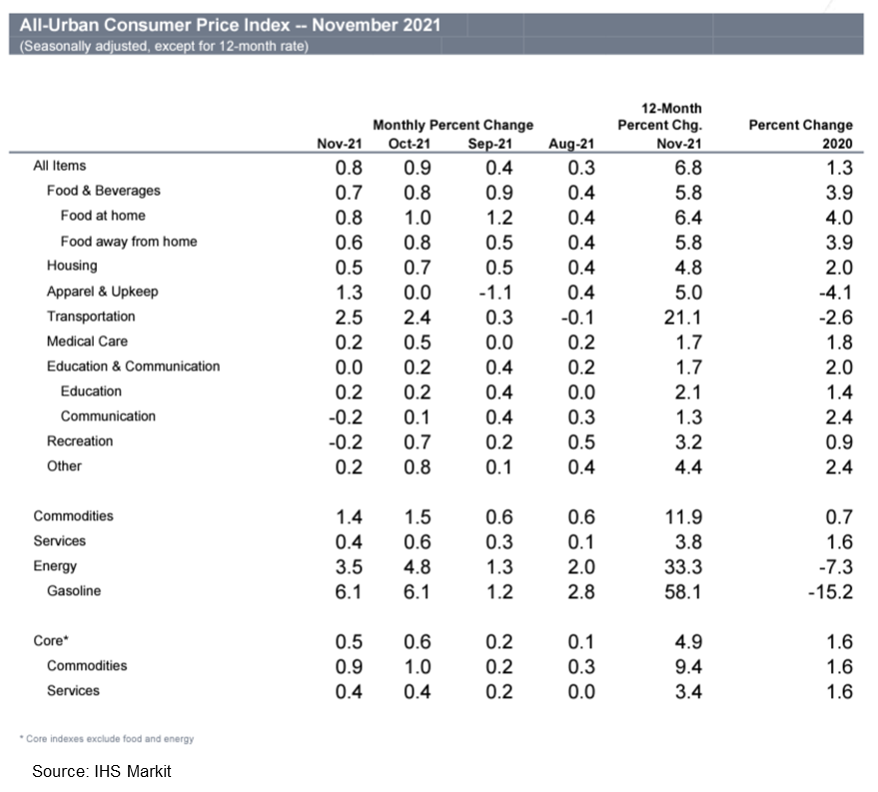

- The US consumer price index (CPI) rose 0.8% in November

following a 0.9% increase in October. The core CPI, which excludes

the direct effects of moves in food and energy prices, rose 0.5% in

November after a 0.6% increase in October. The CPI for food rose

0.7% and the energy CPI rose 3.5%. (IHS Markit Economist Ken

Matheny and Juan

Turcios)

- As in October, the rise in consumer prices in November was broadly based. Notable increases occurred for apparel (1.3%), airline fares (4.7%), used vehicles (2.5%), new vehicles (1.1%), and shelter (0.5%). The price of new vehicles rose for the eighth consecutive month and is up 11.3% since March. Severe supply chain bottlenecks have hampered new vehicle production, resulting in extraordinarily lean inventories and firming prices. Used-car prices rose in November and are up 34.3% since March. The ongoing supply issues in new vehicles continue to shift demand to used vehicles, resulting in ongoing upward pressure on used-car prices.

- Rent inflation rose robustly for a third consecutive month. The surge in house prices following the onset of the pandemic is translating into higher rents. Owners' equivalent rent (OER) and rent of primary residence (RPR) both rose 0.4% in November. Monthly increases in OER and RPR have averaged 0.4% over the last three months. At 3.5% for OER and 3.0% for RPR, annual (12-month) rent inflation readings in November were close to or below average readings in a broad historical context but have moved up briskly from 2.4% and 1.9% since July, respectively.

- The 12-month change in the overall CPI increased to 6.8%, the highest reading since June 1982, while the 12-month change in the core CPI increased to 4.9%, the highest reading since June 1991. We anticipate that 12-month inflation readings will moderate over the course of 2022 as supply chain issues are addressed.

- We estimate that the core price index for personal consumption

expenditures (PCE) rose 0.4% in November, revised up from our

previous estimate of 0.2%. We estimate that the 12-month change in

the core PCE price index rose from 4.1% in October to 4.5% in

November.

- The US University of Michigan Consumer Sentiment Index rose 3.0

points to 70.4 in the preliminary December reading, recovering from

the decade low in November. The increase was driven by an

improvement in views on both the present situation and the future.

The present situation index rose 1.0 point to 74.6, and the

expectations index jumped 4.3 points to 67.8. (IHS Markit

Economists Akshat Goel and William Magee)

- Elevated inflation remains the foremost drag on sentiment. At 6.8%, the 12-month increase in the consumer price index (CPI) in November was the fastest since 1982, with energy prices up a stunning 33.3%. The median expected one-year inflation rate in the University of Michigan survey remained at 4.9%, its highest level since 2008.

- There was a large disparity in the monthly change in sentiment between households in the bottom and the top halves of income distribution. The index of sentiment for households earning over $100,000 per year declined 4.9 points, while that for households earning below $100,000 per year jumped 7.8 points. According to the report, the uptick in sentiment among the bottom half was the result of an expectation of a substantial increase in income in the year ahead.

- The indexes of buying conditions for large household durable goods, automobiles, and homes improved in December but continue to be held back by high prices and limited inventories.

- Despite an improvement this month, consumer sentiment remains low and underscores the downside risks related to a prolonged period of above-trend inflation. Nevertheless, inflation risks are balanced by our expectation for strong job and wage growth in the coming months, which should continue to support solid consumer spending growth. Sentiment will track spending more closely as inflation subsides, although these might not align until next year.

- The People's Bank of China (PBoC) announced on 9 December that

it will lower the reserve requirement ratio (RRR) for foreign

currencies from 7% to 9%. The announcement noted that the move is

to improve and strengthen foreign currency liquidity management.

The higher RRR will be in effect from 15 December, the same day as

the cut for banks' RRR, as announced on 6 December. (IHS Markit

Banking Risk's Angus

Lam)

- According to annual statistics from PBoC, as of 2020, foreign-exchange loans account for 3.2% of total loans by banks. PBoC did not mention the liquidity reduction due to the RRR increase, however, given the small proportion, the impact on overall loan growth is expected to be minimal.

- Together with the general RRR cut for banks, this latest move is expected to slightly improve the amount of lending granted to local companies. In recent days, the authorities have eased liquidity pressure by also reducing the relending rates to boost lending to MSMEs.

- IHS Markit expects that while the general RRR cuts will boost longer-term lending by 0.6%, the foreign exchange RRR increase will have limited impact. Overall, credit growth is expected to be 11.7% in 2021 and 11.4% in 2022, somewhat dragged down by the recent issues faced by the real-estate sector, despite easing of the three red lines for real estate companies and also the relaxation in property loans by local authorities.

- Final November German inflation data based on national

methodology from the Federal Statistical Office (FSO) confirm the

'flash' data release of 29 November, showing rates of -0.2% month

on month (m/m) and 5.2% y/y. The latter is up from October's 4.5%

y/y and at a level last seen this high in mid-1992, then related to

reunification. It contrasts starkly with average inflation of 1.5%

in 2019 and 0.5% in 2020. (IHS Markit Economist Timo

Klein)

- The EU-harmonised consumer price index (CPI) measure even increased by 0.3% m/m, raising its annual rate from 4.6% to 6.0%. This markedly exceeds the eurozone average of 4.1%. The renewed divergence between the harmonized and the national measure, owing to very different weights for package tours and this component's extreme seasonality, will narrow sharply in December already.

- The national core CPI (excluding food and energy) rate increased from October's 2.9% to 3.3% y/y in November, more than twice as high as the 1.4% average during January-April, not to mention the December 2020 level of 0.4%. Although this partly owes to the temporarily lower value-added tax (VAT) rate during July-December 2020, an effect that will unwind in January 2022, recent upward pressures have come not only from energy (including not just oil but also natural gas and electricity) but also from rising prices for other commodities and intermediate goods owing to global supply chain bottlenecks.

- In November, more expensive durable goods and a smaller seasonal decline than usual for package tours also contributed. This was enabled by consumers having both the funds and the urge to satisfy their pent-up demand accumulated during previous lockdown periods. Thus, companies were able to pass on their higher costs fairly easily.

- Specifically, energy prices increased by 1.8% m/m in November, boosting their annual rate from 18.6% to 22.1%. Along with higher inflation for food, clothing/shoes, and household goods, this raised the y/y rate for goods in general from 7.0% to 7.9%. Its service-sector counterpart increased from 2.4% to 2.9%, which largely owes to the influence of package-tour prices.

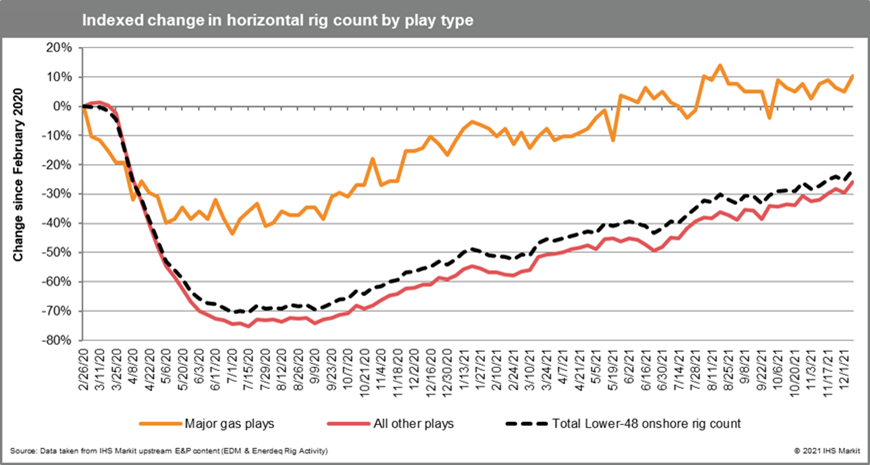

- Operators continued to add rigs back to the field following the

Thanksgiving holiday, with the Lower-48 onshore horizontal rig

count reaching 507 on 8 December; this represents the highest

horizontal-directed activity level since February 2020. The

SCOOP/STACK and Wolfcamp Midland led in terms of net rig additions

over the past two weeks, while the greatest declines were observed

in the Delaware Basin and the Eagle Ford. (IHS Markit Energy

Advisory's Raoul

LeBlanc, Plays and Basins' Imre

Kugler and Prescott Roach)

- Gas-directed drilling activity stagnated in recent weeks, with virtually all incremental gains in Lower-48 onshore rig counts being driven by activity in liquids plays. Although drilling in Appalachia and the Haynesville initially drove a substantial share of the recovery in rig activity during late 2020, the gas-directed rig count in these major gas plays has plateaued since late summer of 2021.

- This marks a particularly notable departure for the

Haynesville, where rig counts rose by more than 50% between

mid-2020 and mid-2021. Despite this stagnation, gas-directed

activity remains slightly above pre-pandemic levels, while

oil-directed rig counts remain a full quarter below February 2020

levels despite their continued (and ongoing) recovery.

- South Korean steelmakers are forming partnerships with

international miners in their initial decarbonization phase,

focusing on potential value-chain emissions cuts before the

government can secure domestic supplies of what's required to

produce low-emissions steel: renewable power. (IHS Markit Net-Zero

Business Daily's Max Lin)

- POSCO and Hyundai Steel, which together account for over 90% of the South Korean steelmaking sector's GHG emissions and crude steel output, both signed memorandums of understanding (MOUs) with Vale to develop low-carbon iron in November.

- Earlier this year, POSCO-the No. 1 player at home and No. 6 globally-also teamed up with BHP and Rio Tinto to explore technologies to reduce emissions across the steelmaking value chain, some of which could be used to optimize coke quality.

- Those initiatives came after POSCO and Hyundai Steel committed to carbon neutrality by 2050 last December and February, respectively. The two companies also have interim targets of a 20% cut in CO2 emissions by 2030.

- Joojin Kim, managing director of Seoul-based non-profit Solutions for Our Climate (SFOC), said international cooperation is an important way to exchange experiences and knowledge in cutting emissions.

- But he expressed concern that the partnerships focus on indirect reduction activities rather than decarbonizing the steelmaking process. "POSCO may opt out of investing in proper infrastructure and technologies to meet their net-zero goal by signing these MOUs," Kim told Net-Zero Business Daily.

- When establishing national decarbonization roadmaps earlier this year, the government said South Korean steelmakers will achieve emission cuts mainly via replacing blast furnaces with electric arc furnaces (EAFs) and swapping out coking coal for clean hydrogen as a reducing agent.

- China's Ningbo Zhongjin Petrochemical has slashed its

paraxylene (PX) production ahead of an urgent shutdown due to an

emergency COVID-19 lockdown, three sources told OPIS late-Thursday.

A local trader in Ningbo said that Zhongjin Petrochemical was

cutting production due to COVID-19 issues. (IHS Markit Chemical

Market Advisory Service)

- Zhongjin's current production rate remains unclear but it was expected to shut its 1.6 million mt/yr PX plant Thursday night or Friday morning, said an industry source in Shandong.

- "Zhongjin is facing a conundrum, its logistics are bottlenecked by transportation vehicles that will no longer have entry and exit permits from the Zhenhai district," according to a Zhejiang polyester producer. The producer said that the access permits to Zhenhai will expire "Friday or Saturday". "There will be no further processing of these permits," he said.

- Zhongjin is hence neither able to receive its procurements, nor deliver its finished goods to customers, meaning its supply chain has been completely severed, the polyester source said.

- OPIS previously reported that Zhenhai commenced lockdown at 0200 hrs on Dec. 7, while the wider Ningbo city declared a "Level 1" emergency at the same time. Zhenhai District then set up multiple testing points by 0500 hrs Dec. 7, including one at Zhongjin Petrochemical.

- The only unit affected initially was Yisheng Petrochemical's 3.6 million mt/yr purified terephthalic acid (PTA) unit, which lowered its production rates to an undisclosed level.

- Talks had been underway to clear logistical bottlenecks at factories and docks since the lockdown began.

- Besides Zhongjin Petrochemical, Zhenhai district is also home to Sinopec Zhenhai with its 750,000 mt/yr PX capacity.

- Port sources had estimated Zhenhai's lockdown to last 14 days, meaning that Zhongjin's logistics might be equally gridlocked.

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-december-13-2021.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-december-13-2021.html&text=Weekly+Global+Market+Summary+Highlights%3a+December+6-10%2c+2021+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-december-13-2021.html","enabled":true},{"name":"email","url":"?subject=Weekly Global Market Summary Highlights: December 6-10, 2021 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-december-13-2021.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Weekly+Global+Market+Summary+Highlights%3a+December+6-10%2c+2021+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweekly-global-market-summary-highlights-december-13-2021.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}