Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Jun 19, 2020

Week Ahead Economic Preview: Week of 22 June 2020

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report (including Special Reports) please click on the 'Download Full Report' link.

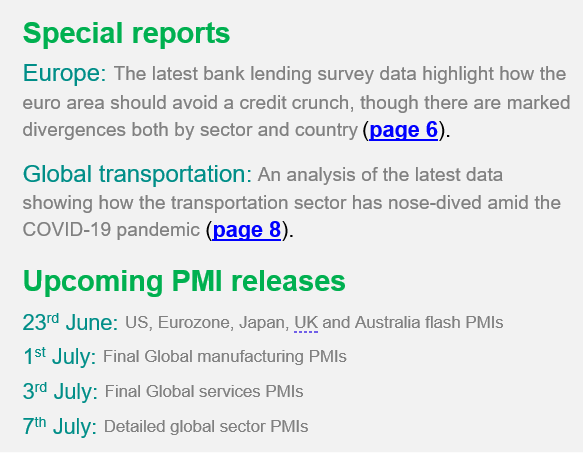

- Flash PMI surveys for June covering manufacturing and services for the US, Eurozone, UK, Japan and Australia

- US GDP and PCE updates, IMF forecasts

Data releases in the coming week will be scrutinised eagerly for clues as to the length and depth of recessions caused by the COVID-19 pandemic, most notably the flash PMI updates for the US, Europe and Japan, due out on Tuesday.

The week will also see updated forecasts from the IMF, while monetary policy decisions are due in New Zealand, the Philippines, Thailand, Hungary and the Czech Republic.

The PMI surveys provided an early indication that the worst of the economic impact from the virus outbreak appears to have hit in April, with the global PMI staging a record rise in May, albeit remaining worryingly weak by historical standards. With lockdowns having increasingly eased into June, further gains in the PMIs will be needed to corroborate growing expectations that economic recoveries are gaining traction.

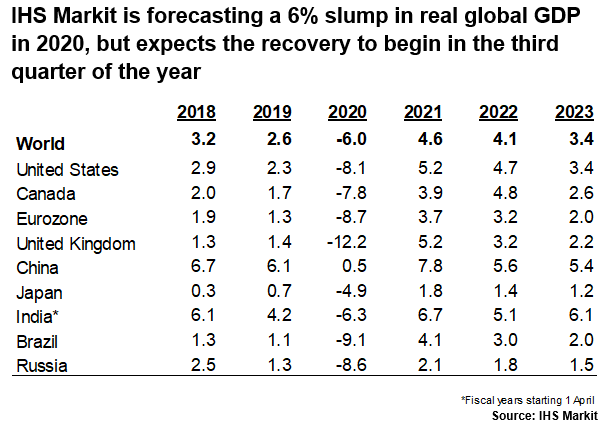

IHS Markit's latest forecasts anticipate that US and European economic growth will return in the third quarter, though these downturns will still be the worst since the end of World War II. For 2020 as whole, real GDP is projected to fall 8.1% in the US, 8.7% in the eurozone, and 12.2% in the UK. Mainland China's should eke out annual growth of 0.5%. All this means that global real GDP is projected to decrease by some 6.0% in 2020, more than three times the 1.7% contraction in 2009 during the global financial crisis.

In addition to the IHS Markit PMI surveys, US data releases include durable goods orders, home sales, house prices, personal spending, income and prices data, the University of Michigan consumer sentiment survey and regional manufacturing surveys.

In AsiaPac, flash PMI data for Japan and Australia are accompanied by some key official releases including China's industrial profits, Vietnam GDP, retail sales in Japan as well as industrial production numbers for Singapore, Thailand, Taiwan and Vietnam.

For Europe, the flash PMI data for the Eurozone, Germany, France and the UK are supplemented by sentiment surveys from the European Commission, which include the closely watched IFO survey for Germany.

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas and Bernard Aw

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-june-2020.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-june-2020.html&text=Week+Ahead+Economic+Preview%3a+Week+of+22+June+2020+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-june-2020.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 22 June 2020 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-june-2020.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+22+June+2020+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-22-june-2020.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}