Week Ahead Economic Preview: Week of 18 May 2020

The following is an extract from IHS Markit's latest Week Ahead Economic Preview. For the full report (including Special Reports) please click on the 'Download Full Report' link.

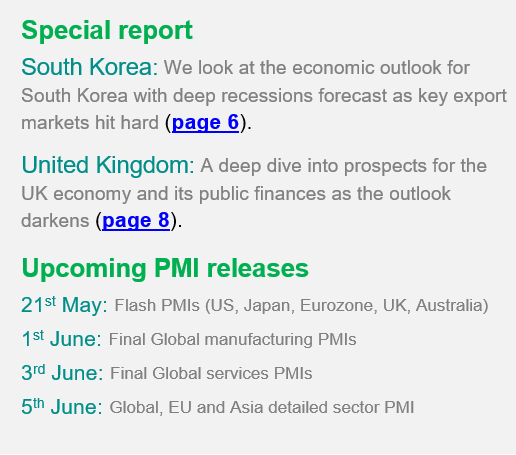

- Flash PMI surveys for the US, Eurozone, UK, Japan and Australia

- US claimant count, housing data and FOMC minutes

- Eurozone consumer confidence

- UK inflation, retail sales and jobs report

- Thai GDP and central bank meeting

The key data in the week ahead are likely to be the flash PMI surveys for May, which are released for the US, Eurozone, UK, Japan and Australia. Covering both manufacturing and services, the surveys will provide the first insights into whether these economies have bottomed out after many countries started to ease some of the restrictions designed to contain the COVID-19 outbreak.

April saw the US, Europe and Japan intensify their battles against the pandemic by extending lockdowns which commenced in late March, leading to record falls in business activity during the month. With some restrictions being lifted in May, and companies encouraged to restart work in many countries, there's hope that the PMIs will have started to pick up again, albeit likely remaining in contraction.

Analysts will meanwhile scrutinise the latest FOMC meeting minutes after US policymakers reassured that it will "use its tools and act as appropriate to support the economy". Since the meeting, Fed Chair Powell has sought to rebuff suggestions that the US could see negative rates, leaving many to view further QE and forward guidance as the most likely potential stimulus tools.

In Europe, the PMIs have shown especially deep downturns in both the UK and Eurozone, so May flash numbers will be particularly awaited for brighter news, as will consumer confidence data. On the other hand, official labour market and retail sales data for the UK will be more backward looking, and therefore likely to darken the overall picture.

In addition to the flash PMIs, Asia sees the release of Thailand's GDP, which is expected to show the first decline for six years and is likely to be accompanied by policy loosening from the central bank. A rate cut may also be in the cards in Indonesia. Various national trade reports are also eagerly awaited.

Contact us

PMI commentary: Chris Williamson

Europe commentary: Ken Wattret

APAC commentary: Rajiv Biswas and Bernard Aw

© 2020, IHS Markit Inc. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI™) data are compiled by IHS Markit for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.