Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ARTICLES & REPORTS

Nov 14, 2022

Week Ahead Economic Preview: Week of 14 November 2022

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US, China retail sales, industrial output data, Japan Q3 GDP

An assortment of data releases packs the week ahead including US and China's retail sales and industrial production figures. GDP data from the eurozone and Japan will also be expected in addition to inflation data from Canada, the eurozone, and Japan. Meanwhile central banks in Indonesia and the Philippines will update their monetary policy decisions with further rate hikes expected. This is as Indonesia hosts the G20 meeting with various world leaders in attendance.

Political news dominated the headlines this week with the US midterm elections capturing the market's focus. That said, while we have yet to receive confirmation of the US Senate's control at the point of writing, our latest S&P Global Investment Manager Index indicated that US equity investors are seeing less of a drag from the political environment just ahead of the elections. Instead, monetary policy and the global macroeconomic environment remain the two biggest factors weighing on equity market performance in the near-term and it is not hard to see why that is so.

The latest JPMorgan Global Composite PMI, compiled by S&P Global, showed that worldwide economic activity contracted for a third successive month as demand shrank. Meanwhile inflationary pressures remained solid, even as rates of increase eased, to warrant persistent attention from central bankers.

Amid such a backdrop, official data including US and China industrial production and retail sales figures will shed light on the production and consumption picture in the two countries. Furthermore, Japan releases Q3 GDP to outline the effects of weaker external demand upon growth in the third quarter, while inflation data from Japan and India will also be expected.

Central bank meetings in the APAC region - Bank Indonesia and Bangko Sentral ng Pilipinas - will also be in focus after the Fed further hiked interest rates at the start of November. Bank Indonesia, in particular, may deliver another aggressive hike in bid to bring inflation under control.

Business confidence, where art thou?

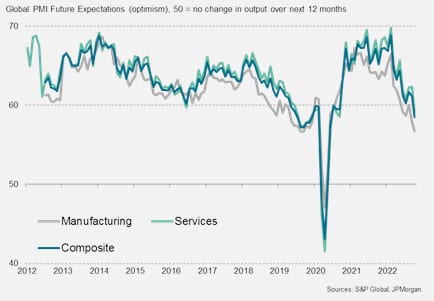

The latest JPMorgan Global Composite PMI showed business confidence in decline in October. Global private sector firms were the least upbeat in 28 months with confidence falling across both the manufacturing and service sectors, altogether alluding to further pressures for growth ahead.

JPMorgan Global PMI Future Expectations

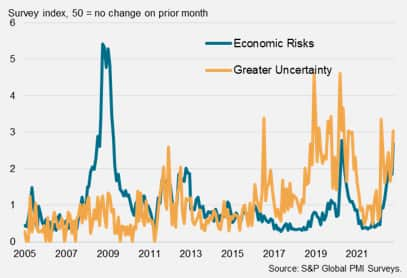

Specifically, the frequency of mentions for 'economic risks' in the PMI surveys was at the highest since the global financial crisis, barring the pandemic, while mentions of 'recession' had also risen markedly.

Reasons cited for weaker future outlook

Key diary events

Monday 14 November

Thailand Market Holiday

Eurozone Industrial Production (Sep)

India CPI, WPI (Oct)

Indonesia GDP (Q3)

Tuesday 15 November

Australia RBA Meeting Minutes (15 Nov)

Japan GDP (Q3)

South Korea Trade (Oct)

China (Mainland) Retail Sales, Industrial Output, FAI (Oct)

Indonesia Trade (Oct)

United Kingdom Labour Market Report (Oct)

Eurozone Trade (Sep)

Eurozone GDP (Q3, flash)

Germany ZEW Economic Sentiment (Nov)

United States NY Fed Manufacturing (Nov)

United States PPI (Oct)

Canada Manufacturing Sales (Sep)

Canada Wholesale Trade (Sep)

Wednesday 16 November

Japan Machinery Orders (Sep)

Australia Wage Price Index (Q3)

United Kingdom Inflation (Oct)

United States Retail Sales (Oct)

Canada CPI (Oct)

United States Industrial Production (Oct)

Thursday 17 November

New Zealand PPI (Q3)

Japan Trade Balance (Oct)

Australia Employment (Oct)

Australia Unemployment Rate (Oct)

Singapore Non-Oil Exports (Oct)

Malaysia Trade (Oct)

Philippines Policy Interest Rate (17 Nov)

Eurozone HICP (Oct, final)

United States Building Permits: Number (Oct)

United States Housing Starts Number (Oct)

United States Initial Jobless Claims

Indonesia 7-Day Reverse Repo (Nov)

Friday 18 November

Japan CPI (Oct)

United Kingdom Retail Sales (Oct)

Norway GDP (Q3)

Canada Producer Prices (Oct)

United States Existing Home Sales (Oct)

* Press releases of indices produced by S&P Global and relevant sponsors can be found here.

What to watch

Americas: US PPI, retail sales, industrial production figures and Canada inflation data

Official retail sales and industrial production data will be due from the US in the coming week. Consensus expectations currently point to faster retail sales growth though industrial production growth may moderate in October. The latest S&P Global US Manufacturing PMI indicated slower output growth amid a sharp fall in demand. Meanwhile PPI data will also be released following the CPI figures this week.

Europe: Eurozone Q3 GDP, inflation, German ZEW survey

Final Q3 GDP and October inflation data will be released in the eurozone next week to confirm the modest Q3 growth that was seen. German ZEW survey figures will also be released on Tuesday.

Asia-Pacific: Japan Q3 GDP, October CPI, China retail sales, industrial output, Australia employment data, India inflation and BI, BSP meetings

In APAC, Bank Indonesia will be updating their monetary policy decision on Thursday and we are expecting a 50 basis points expected for the third consecutive month in November to continue the aggressive monetary policy tightening. Despite inflation easing in October from the seven-year high prior, further attempts to nudge the elevated inflation rate down is expected to continue. Likewise, the Philippines central bank Bangko Sentral ng Pilipinas (BSP) may also further lift rates.

In Japan, Q3 GDP and October inflation figures will be due next week with the consensus pointing to a slowdown in Q3 growth to 0.3% quarter-on-quarter. Weaker external demand has weighed on Japan in the third quarter.

China's October retail sales and industrial output will also be released next week with the consensus pointing to a slowdown at the start of Q4.

Finally in India, inflation data will be due next week. According to PMI data, while goods producers saw mild inflationary pressures, services firms saw inflationary pressures gather pace which continued to be shared with consumers.

Special Report

APAC Electronics Industry Moderates as Consumer Demand Softens - Rajiv Biswas

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-november-2022.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-november-2022.html&text=Week+Ahead+Economic+Preview%3a+Week+of+14+November+2022+%7c+S%26P+Global","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-november-2022.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 14 November 2022 | S&P Global&body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-november-2022.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+14+November+2022+%7c+S%26P+Global http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-14-november-2022.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}