Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

ECONOMICS COMMENTARY

Feb 09, 2024

Week Ahead Economic Preview: Week of 12 February 2024

The following is an extract from S&P Global Market Intelligence's latest Week Ahead Economic Preview. For the full report, please click on the 'Download Full Report' link.

US and UK inflation updates accompanied by UK GDP

Key inflation and GDP data will be due from several Western economies in the coming week as various North Asian markets remain closed for the Lunar New Year holidays at the start of the week. Of particular focus will be US CPI figures, with retail sales and industrial production data also eagerly anticipated. The UK updates a slew of economic releases such GDP, inflation and labour market statistics. Growth conditions in Japan will also be assessed with preliminary Q4 GDP data.

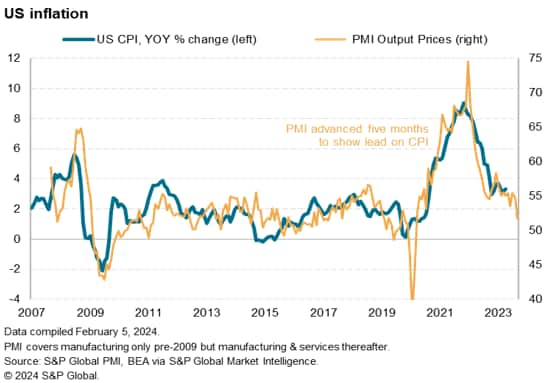

January US inflation data will be the key release in the coming week as the market remains focused on speculating the number of Fed cuts this year. According to the CME FedWatch tool, expectations for the Fed to make six 25 basis point cuts this year have been checked after Fed chair Powell hinted at just three cuts and after better-than-expected US labour market performance at the start of the year. As far as PMI data have shown, a further easing of price pressures is expected and will have US CPI to help further assess the inflation trend. Additionally, the S&P Global Investment Manager Index will also offer deeper insights into the key driver for the US market according to major money managers. Any changes in views surrounding central bank policy as a driver for near-term returns will be sought with the February update.

The UK is meanwhile also in focus thanks to a large number of key economic data releases through the week. These notably include fourth quarter GDP numbers, which could indicate a recession, as well as January inflation figures and also labour market statistics, the latter including wage data that could sway rate opinions at the Bank of England. A flat fourth quarter GDP reading is expected after weak official monthly data early in the quarter have been followed by services-led improvements towards the end of the year and into January. Official CPI figures will also be watched for confirmation of relatively sticky inflation that should keep the Bank of England in much less of a hurry to lower rates compared to other major central banks.

Outside of the UK, the eurozone releases end-2023 employment and industrial production figures, which could hint at fourth quarter GDP revisions after the flash reading of no change.

UK recession risk and US inflation update

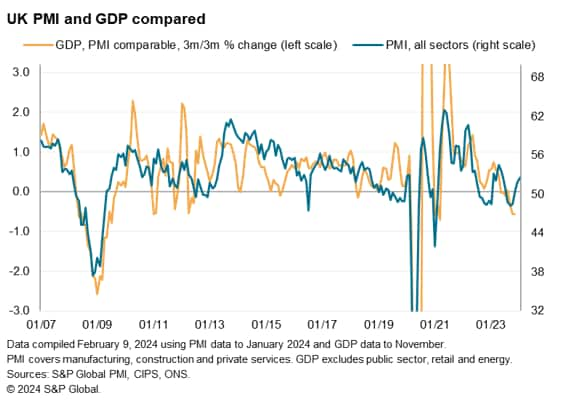

After the eurozone narrowly avoided recession with a flat fourth quarter GDP reading, the attention now turns to the UK, where preliminary fourth quarter GDP data are updated in the coming week. After a 0.1% decline in the third quarter, any further fall would represent a technical recession. Prior data showed GDP falling 0.3% in October then rising a similar amount in November, leaving the December data as all-important in determining whether the UK fell into recession. PMI data hint at some upside risks.

Meanwhile US inflation data are also eagerly awaited as the Fed seeks further insights into when it can start cutting interest rates. PMI data have been encouraging, signaling a fall in CPI below target in the coming months.

Key diary events

Monday 12 Feb

China (mainland), Hong Kong SAR, South Korea, Taiwan and

Singapore Market Holiday

India Industrial Production (Dec)

India Inflation (Jan)

United States Consumer Inflation Expectations (Jan)

United Kingdom Natwest Regional PMI* (Jan)

Germany HCOB Export Conditions Index* (Jan)

Tuesday 13 Feb

China (mainland), Hong Kong SAR, Taiwan Market

Holiday

Australia Westpac Consumer Confidence (Feb)

Japan PPI (Jan)

Singapore GDP (Q4, final)

Australia NAB Business Confidence (Jan)

France Unemployment (Q4)

United Kingdom Labour Market Report (Dec)

Switzerland Inflation (Jan)

Germany ZEW Economic Sentiment Index (Feb)

United States CPI (Jan)

GEP Global Supply Chain Volatility Index* (Jan)

S&P Global Investment Manager Index* (Feb)

Wednesday 14 Feb

China (mainland), Taiwan Market Holiday

United Kingdom Inflation (Jan)

Eurozone Employment (Q4, prelim)

Eurozone Industrial Production (Dec)

Indonesia Presidential Election

Thursday 15 Feb

China (mainland) Market Holiday

Japan GDP (Q4, prelim)

Australia Employment Change (Jan)

Indonesia Trade (Jan)

Japan Industrial Production and Capacity Utilization (Dec)

United Kingdom GDP, incl. Manufacturing, Services and Construction

Output (Dec, Q4 prelim)

Eurozone Balance of Trade (Dec)

United States Retail Sales (Jan)

United States Industrial Production (Jan)

United States Business Inventories (Dec)

Friday 16 Feb

China (mainland) Market Holiday

South Korea Unemployment Rate (Jan)

Singapore Non-oil Domestic Exports (Jan)

Thailand GDP (Q4)

Malaysia GDP (Q4)

United Kingdom Retail Sales (Jan)

Switzerland Industrial Production (Q4)

France Inflation (Jan, final)

United States Building Permits (Jan, prelim)

United States PPI (Jan)

United States Housing Starts (Jan)

United States UoM Sentiment (Feb, prelim)

* Access press releases of indices produced by S&P Global and relevant sponsors here.

What to watch in the coming week

Americas: US CPI, retail sales, industrial production

The highlight next week will be US CPI data due Tuesday. According to consensus, the headline US CPI is expected to fall at the start of the year from the 0.3% month-on-month print in December, though the core inflation rate may stay unchanged from December. This is in line with recent indications from PMI data, which hinted at the likelihood for a further easing of inflation in the coming months.

Separately, we will be looking to January's activity data out of the US, notably retail sales and industrial production figures. Latest S&P Global US Sector PMI showed output returned to growth for the consumer goods sector in January, boding well for retail sales performance, though most other manufacturing sectors remained under pressure at the start of the year to signal soft production performance.

EMEA: UK employment, inflation and GDP reports, Eurozone employment and industrial production

The key releases out of Europe in the coming week will be from the United Kingdom where a preliminary Q4 GDP report is accompanied by January inflation and retail sales data, as well as fresh labour market statistics. After GDP fell 0.1% in the third quarter, any further GDP decline at the end of the year would push the UK into a technical recession.

Meanwhile PMI price data showed UK inflation remaining sticky and signalled that we may see prices stuck at a level consistent with the CPI running above 3%. Finally, UK labour market data will provide important wage growth insights to Bank of England rate setters.

APAC: Japan GDP, Australian employment data

In APAC, Japan releases preliminary Q4 GDP data on Thursday with the consensus pointing to stronger growth conditions in the final quarter of the year. That said, the bias may be for a reading lower than that seen in Q3 as PMI data pointed to subdued manufacturing sector conditions dampening growth into the end of 2023. GDP data are also released for Malaysia, Thailand and Singapore.

Additionally, Australia's employment data will be due Thursday. Jobs growth continued at the start of 2024 according to the Judo Bank Australia PMI, albeit at a slightly softer pace compared to December.

S&P Global Investment Manager Index and GEP Supply Chain Volatility Index updates

The February 2024 edition of the S&P Global Investment Manager Index will be released Tuesday for insights into risk sentiment and market drivers. Central bank policy, linked to expectations for central banks including the Fed, was viewed as the most supportive factor for equities at the start of the year and any changes in views will be closely observed after the Fed dashed hopes for a March cut.

Supply chain developments on the back of recent Red Sea related issues will meanwhile be closely watched with the release of the GEP Supply Chain Volatility Index.

© 2024, S&P Global. All rights reserved. Reproduction in whole

or in part without permission is prohibited.

Purchasing Managers' Index™ (PMI®) data are compiled by S&P Global for more than 40 economies worldwide. The monthly data are derived from surveys of senior executives at private sector companies, and are available only via subscription. The PMI dataset features a headline number, which indicates the overall health of an economy, and sub-indices, which provide insights into other key economic drivers such as GDP, inflation, exports, capacity utilization, employment and inventories. The PMI data are used by financial and corporate professionals to better understand where economies and markets are headed, and to uncover opportunities.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-february-2024.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-february-2024.html&text=Week+Ahead+Economic+Preview%3a+Week+of+12+February+2024+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-february-2024.html","enabled":true},{"name":"email","url":"?subject=Week Ahead Economic Preview: Week of 12 February 2024 | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-february-2024.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Week+Ahead+Economic+Preview%3a+Week+of+12+February+2024+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fweek-ahead-economic-preview-week-of-12-february-2024.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}