Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 16, 2020

Cruise vessels forecast and COVID-19 impact on the industry

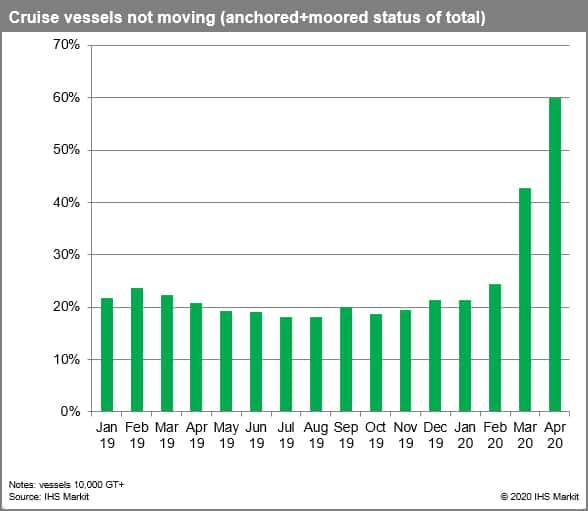

Pictures of stranded passengers on cruise vessels with the COVID-19 outbreak and port authorities refusing some of those vessels access to ports across the world is something that many people will remember the cruise industry by this year. The majority of cruise operators have ceased operations amid the coronavirus outbreak, and our AIS data suggests that a large number of vessels have spent the majority of their time moored or anchored. The percent of total time not moving has jumped from an average of 20% to more than 60% for vessels larger than 10,000 gross tonnes.

Similarly to other travel and leisure segments the operators laid off many of their people and seized their operations, as ships remain empty and idle. This is certainly something that the industry is trying to avoid, as idle vessels do not bring money in. There will be mounting pressure on the cruise companies, and many will probably look to get access to additional credit lines until the situation stabilizes.

This will be a difficult year for the cruise industry, certainly when safe more aggressive price cuts for cruise holidays are expected to follow which will hopefully encourage passengers back on board. Much will depend on the shape of the recovery curve for the major economies that are expected to be hit by recession this year. Particularly bad news for the industry is that the recession is expected to hit the two most important markets Europe and the US. The share price for cruise operators reflects the current situation, but the industry is expected to survive, although the margins will definitely suffer.

A large orderbook and intensification of competition on economies of scale expected to continue

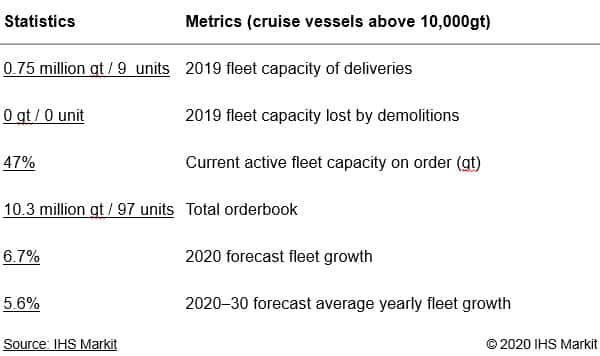

Following fleet expansion programmes set up during last few years, the newbuilding orderbook swelled to about half of the capacity of 22 million gross tonnes. This type of expansion seems to be almost unbelievable for any shipping segment, although the orderbook is going to be delivered over a longer period of time, compared with the traditional commodity fleet.

Intensification of competition on economies of scale seems to be a way to go for the cruise industry at the moment. This raises some concerns for the future and profit margins for the industry that competes on lowering prices and affordability of cruise package holidays. We downgraded the fleet forecast growth this year, as some deliveries seem to be pushed to next year. The industry is highly driven and highly sensitive to disposable income, and any looming recession, may be a potential threat for an industry that seems to be losing competition on economies of scale.

Long-term, incremental growth for the industry is expected to be coming mostly from emerging markets, namely China. US and Western/North European markets still remain a major source of demand for the cruise market industry, with the US being by far the largest. The major risk factor for fleet profitability and further growth remains the fleet orderbook, which stands at an incredible 47% of current fleet capacity. Recently growing bunker prices, started to cool off in the meantime, but risks of an escalating trade war added concerns to the health of the global economy.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvessel-forecast-and-covid19-impact-on-the-cruise-industry.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvessel-forecast-and-covid19-impact-on-the-cruise-industry.html&text=Cruise+vessels+forecast+and+COVID-19+impact+on+the+industry+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvessel-forecast-and-covid19-impact-on-the-cruise-industry.html","enabled":true},{"name":"email","url":"?subject=Cruise vessels forecast and COVID-19 impact on the industry | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvessel-forecast-and-covid19-impact-on-the-cruise-industry.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Cruise+vessels+forecast+and+COVID-19+impact+on+the+industry+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvessel-forecast-and-covid19-impact-on-the-cruise-industry.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}