Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

BLOG

Apr 22, 2020

Tankers experiencing high congestion in North Western Europe

Several tankers heading for destinations across Europe have been facing huge delays due to high congestion during the last couple of weeks, with most of them carrying jet fuel and gasoline. Interest for clean floating storage has been increasing since mid-March, exactly as it happened with crude oil since late February. Many tankers haven't been able to discharge their cargoes as demand/consumption has been heavily affected by most countries remaining under general lockdowns.

Onshore storage capacity is almost fully occupied driven by the collapse in demand with the crisis expected to last at least for another month. More and more laden tankers currently positioned close to European coasts can't discharge according to original schedules. Amsterdam-Rotterdam-Antwerp (ARA) and hubs across the Mediterranean remain the busiest regions, as cargo owners face severe difficulties in finding buyers or storage tanks. This situation is expected to last for weeks, as the market cannot absorb volumes that typically get sent to the continent. This drives a shortage in available units for future loadings as well, pushing spot rates to new high records. There are severe and long delays on the horizon for most tanker terminals in the ARA area. Congestion will remain high.

Meanwhile, cargo flows on barges through rivers in central Europe have also been affected by low water levels in the Rhine which keeps on adding pressure. Major companies like BP have been fixing for storage of clean cargoes or still looking to fix more units.

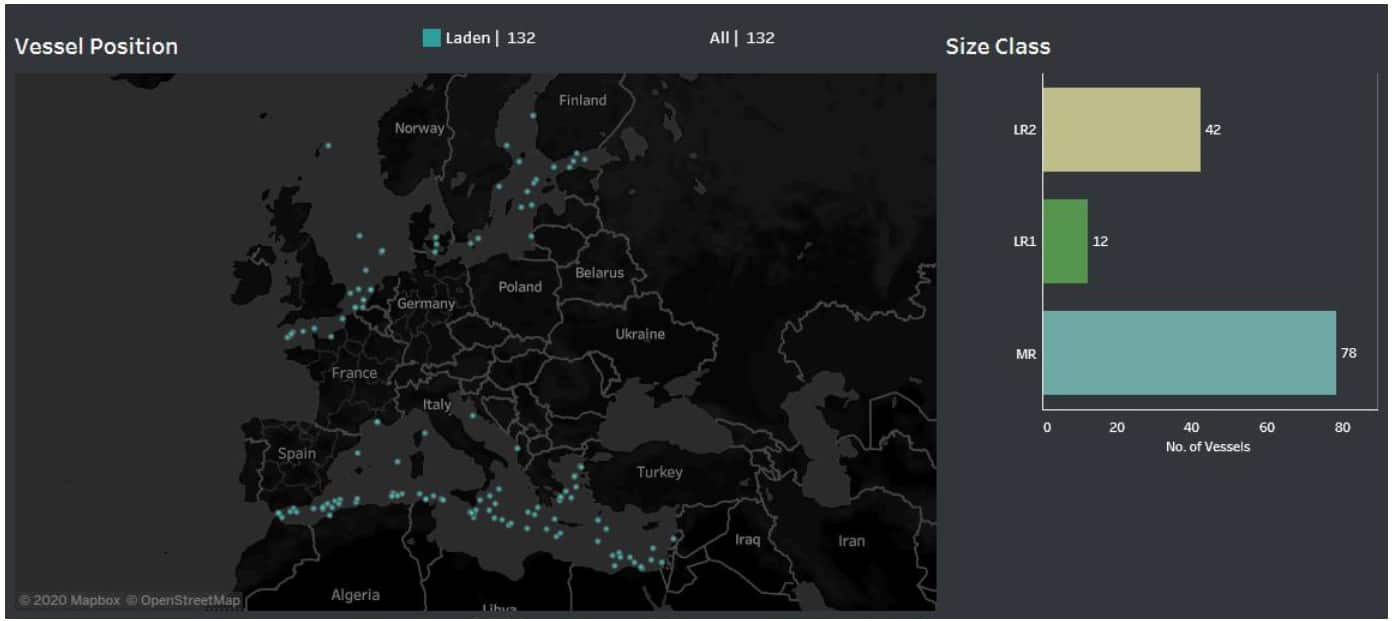

Clean tanker fleet (including MR, LR1 and LR2) currently positioned in North Western Europe and Mediterranean

Source: IHS Markit Commodities at Sea

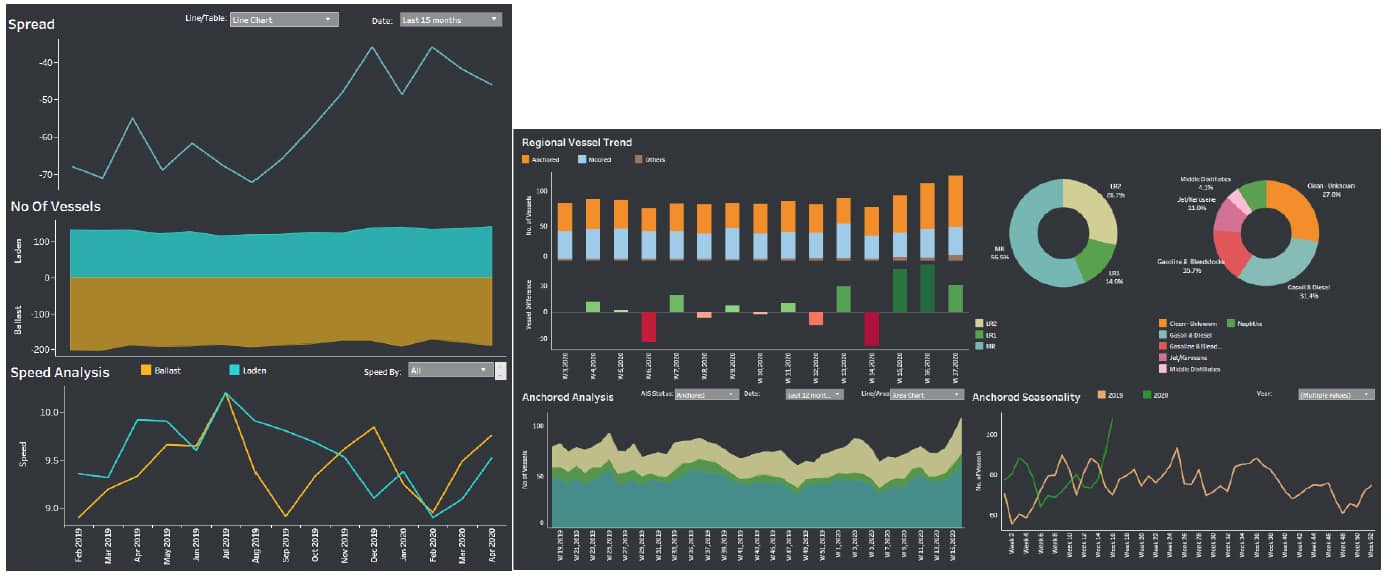

The spread of laden vs ballast clean tankers (MR, LR1 and LR2) in North Western Europe and Mediterranean suggests that employment has been quite strong lately. Meanwhile, average speed for both ballast and laden units has been increasing as well, excluding any ships moving with less than eight knots.

Spread between laden and ballast clean tankers in North Western Europe and Mediterranean and congestion analysis

Source: IHS Markit Commodities at Sea

Most recent data by IHS Markit Commodities at Sea on congestion suggest numbers of anchored clean ships in the region have reached a new record high.

Moving to tankers carrying Dirty Petroleum Products in the region, the interest for open Aframaxes to load fuel oil from North Western Europe has been increasing this week, shaping the availability of tonnage in the region, with rates pushed even higher since Thursday. But rates in the Mediterranean/Black Sea remain steady, as charterers have more options with plentiful units. There has been some activity for intra-continental movements as well, with Total having booked for loading in late April.

Rotterdam traffic hasn't been that strong, primarily due to the COVID-19 pandemic still disrupting trade. The fall in fuel oil trade (HSFO) between Russia and Singapore has been sharp so far in the last month, with many cargoes now skipping ARA and moving directly to the US Gulf instead. The US is now considered the major importer of European and Russian fuel oil that's not complying with IMO 2020, as US refiners import heavy products instead of heavy crudes from Venezuela.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftankers-experiencing-high-congestion-in-north-western-europe.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftankers-experiencing-high-congestion-in-north-western-europe.html&text=Tankers+experiencing+high+congestion+in+North+Western+Europe+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftankers-experiencing-high-congestion-in-north-western-europe.html","enabled":true},{"name":"email","url":"?subject=Tankers experiencing high congestion in North Western Europe | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftankers-experiencing-high-congestion-in-north-western-europe.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Tankers+experiencing+high+congestion+in+North+Western+Europe+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2ftankers-experiencing-high-congestion-in-north-western-europe.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}