Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Jun 06, 2022

Value’s jubilee

Research Signals - May 2022

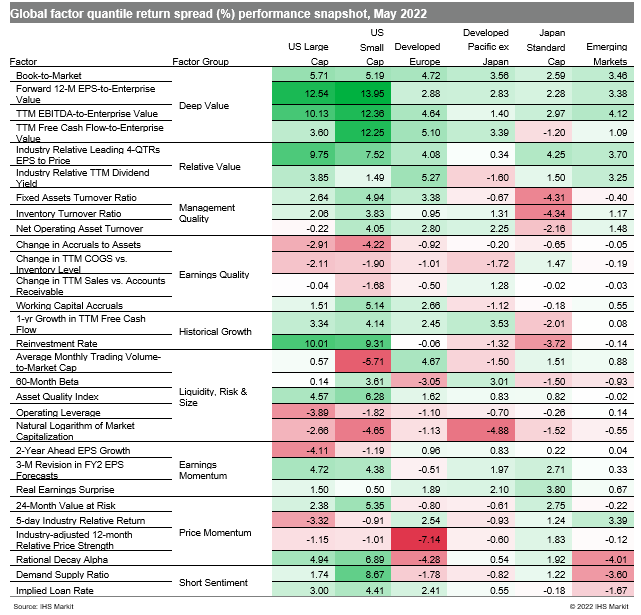

As admirers across Britain and around the world awaited Queen Elizabeth's Platinum Jubilee celebrations, equity investors reveled in value factors' good cheers throughout the month of May (Table 1). However, markets are still trying to recover from the built-up pressures that have reigned in 2022 including supply chain issues, elevated inflation, the war in Ukraine and the recent downturn in China from renewed COVID restrictions.

- US: Robust double-digit spreads were recorded by value measures including Forward 12-M EPS-to-Enterprise Value

- Developed Europe: Price Momentum measures moved to the opposite end of the performance spectrum, with Industry-adjusted 12-month Relative Price Strength the weakest performing factor last month

- Developed Pacific: In Japan, investors rewarded both value and momentum measures, as represented by Industry Relative Leading 4-QTRs EPS to Price and Rational Decay Alpha, respectively

- Emerging markets: Deep Value and Relative Value themes were favored in May, as captured respectively by TTM EBITDA-to-Enterprise Value and Industry Relative TTM Dividend Yield

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalues-jubilee.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalues-jubilee.html&text=Value%e2%80%99s+jubilee+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalues-jubilee.html","enabled":true},{"name":"email","url":"?subject=Value’s jubilee | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalues-jubilee.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Value%e2%80%99s+jubilee+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalues-jubilee.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}