Customer Logins

Obtain the data you need to make the most informed decisions by accessing our extensive portfolio of information, analytics, and expertise. Sign in to the product or service center of your choice.

Customer Logins

EQUITIES COMMENTARY

Apr 06, 2021

Value gains traction amid rising interest rates

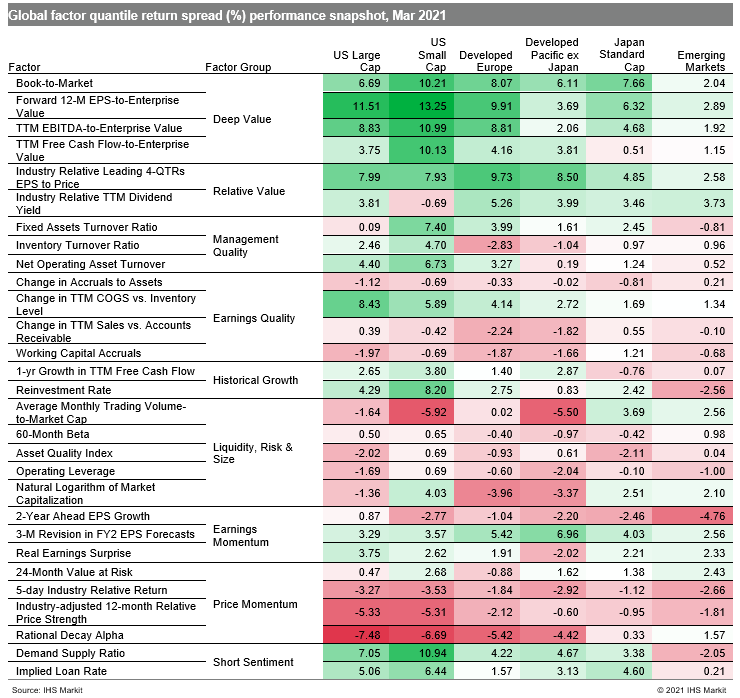

Investors remain optimistic given an improved economic outlook amid accelerating vaccinations, supported by fiscal and monetary stimulus as well as a 10-year high in the J.P.Morgan Global Manufacturing PMI. However, rising inflation expectations and US Treasury yields, which logged their highest quarterly gain since December 2016, put pressure on growth stocks, reinforcing the value trade (Table 1).

- US: Forward 12-M EPS-to-Enterprise Value posted double-digit spreads across large and small caps, with the former group's performance unsurpassed since April 2002

- Developed Europe: Rational Decay Alpha remained the weakest performing Price Momentum measure for a second consecutive month

- Developed Pacific: 2-Year Ahead EPS Growth was an underperforming signal across the region

Emerging markets: Industry Relative TTM Dividend Yield recorded its first positive spread since May 2020

Table 1

S&P Global provides industry-leading data, software and technology platforms and managed services to tackle some of the most difficult challenges in financial markets. We help our customers better understand complicated markets, reduce risk, operate more efficiently and comply with financial regulation.

This article was published by S&P Global Market Intelligence and not by S&P Global Ratings, which is a separately managed division of S&P Global.

{"items" : [

{"name":"share","enabled":true,"desc":"<strong>Share</strong>","mobdesc":"Share","options":[ {"name":"facebook","url":"https://www.facebook.com/sharer.php?u=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalue-gains-traction-amid-rising-interest-rates.html","enabled":true},{"name":"twitter","url":"https://twitter.com/intent/tweet?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalue-gains-traction-amid-rising-interest-rates.html&text=Value+gains+traction+amid+rising+interest+rates+%7c+S%26P+Global+","enabled":true},{"name":"linkedin","url":"https://www.linkedin.com/sharing/share-offsite/?url=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalue-gains-traction-amid-rising-interest-rates.html","enabled":true},{"name":"email","url":"?subject=Value gains traction amid rising interest rates | S&P Global &body=http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalue-gains-traction-amid-rising-interest-rates.html","enabled":true},{"name":"whatsapp","url":"https://api.whatsapp.com/send?text=Value+gains+traction+amid+rising+interest+rates+%7c+S%26P+Global+ http%3a%2f%2fssl.ihsmarkit.com%2fmarketintelligence%2fen%2fmi%2fresearch-analysis%2fvalue-gains-traction-amid-rising-interest-rates.html","enabled":true}]}, {"name":"rtt","enabled":true,"mobdesc":"Top"}

]}